Grounds for withholding alimony from earnings

Alimony is payments made from the income of able-bodied adults to their relatives or other close persons who are unable to provide for themselves, in order to provide them with material support.

Payments of this kind can be voluntary or made compulsorily (by court decision). A court decision can be made in situations in which there is an obligation to pay alimony.

The Family Code includes in the list of persons obliged to make such payments:

- parents - in relation to: their children who have not reached the age of majority (clause 1 of article 80);

- adult children who are unable to work and need financial support (clause 1, article 85);

- their parents (clause 1, article 87);

Thus, almost any working person can become an alimony payer. Although in reality they are most often paid for children. If the withholding of alimony is carried out by a court decision, then the basis for this becomes such a decision or a decision of the bailiff, if the court decision is not carried out voluntarily.

For alimony paid by agreement of the parties or on the payer’s own initiative, the employee only needs to submit an application to the accounting department containing all the necessary information about such deductions: frequency, volume, full name. recipient, information about him and payment details.

Regardless of whether such payments are made compulsorily or voluntarily, the entry for withholding alimony from wages will be the same: Dt 70 Kt 76.

Alimony in accounting

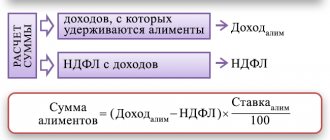

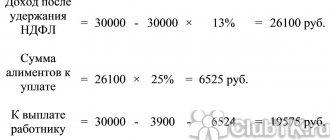

One of the most common deductions under writs of execution from an employee is alimony in favor of minor children. When calculating salaries, you need to take into account their payment after tax.

Alimony must be withheld from all income the employee receives each month. They must be transferred to their destination no later than 3 days after payment of wages. The organization's costs for transferring alimony (bank commission, cost of postage) are also deducted from the employee's salary.

The amount of alimony is usually indicated in the writ of execution. There are two options:

- Fixed amount of monthly deductions

- Share of wages: ¼ for one minor, 1/3 for two and ½ for three children or more

The amount of alimony is indexed in proportion to the minimum wage. The maximum amount of alimony should not exceed 50% of salary. There are two exceptions to this rule: for children, child support can be collected in the amount of up to 70% of income, if there are several enforcement documents, the requirements of all are satisfied, regardless of the amount of income of the employee.

The accrual of alimony is reflected in debit 70 of the account and credit 76. To deduct alimony from other employee income, an entry is made Debit 73 Credit 76. Payment of alimony can be made:

- Through the cash register: Debit 76 Credit 50

- Via mail: Debit 76 Credit 57

- Via transfer to current account: Debit 76 Credit

The bank commission or postal fee withheld from the employee is reflected by posting Debit Credit 76.

Example:

An employee of the organization receives a monthly salary of 47,000 rubles. According to the writ of execution, alimony must be withheld from him in favor of two minor children in the amount of 1/3 of his total income. The money is transferred to the current account. The bank commission is 0.2% of the transfer amount.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | Employee salary accrued | 47 000 | Payroll statement | |

| 68 personal income tax | Personal income tax withheld | 6110 | Payroll statement | |

| 76 | Child support withheld according to writ of execution | 13 630 | Performance list | |

| 68 personal income tax | Personal income tax transferred to the budget | 6110 | Payment order ref. | |

| 76 | Alimony payments listed | 13 630 | Payment order ref. | |

| 91.2 | Bank commission for transfer of alimony is withheld | 27, | Payment order for debiting funds | |

| 91.2 | Bank commission deducted from employee's salary | 27.06 | Accounting information | |

| 50 | Salary paid to employee via cash register | 27 232,74 | Account cash warrant |

Methods of paying alimony that are calculated from wages

Alimony can be set as a percentage of income (as, for example, it is provided for in paragraph 1 of Article 81 of the Family Code in relation to deductions for minor children) or in a fixed amount. The amount determined through the percentage must first be calculated. However, the calculation itself will not be shown in the accounting transaction. It will only reflect the total amount of deductions. Therefore, the posting of withholding alimony can be considered equivalent to the posting - alimony has been accrued.

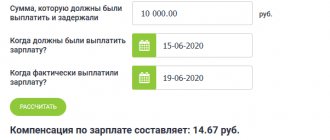

If there is arrears in alimony payments, the amount to be transferred may regularly be inflated until the debt is fully repaid. The calculation of the amounts subject to withholding, control over the balance of the existing debt and the maximum permissible share of withholdings is carried out by the accounting department.

Since alimony is withheld from the income received by the employee (i.e., from his salary), they are calculated monthly at the time of calculating the next earnings. Accordingly, entries for accounting for alimony in the accounting department appear on the last day of the month for which wages are calculated.

Is it necessary to withhold alimony from advance wages? You can find the answer to this question from a specialist from the Ministry of Labor in ConsultantPlus. Trial access to the system can be obtained for free.

The employer must pay the withheld funds to their recipient no later than the third day from the date of issue to the employee of the income from which the deductions were made (Article 109 of the Family Code).

Payment methods available are through a cash register (cash), a bank (including to a card account) and by postal transfer.

As of September 10, 2021, significant amendments to the rules for filling out a payment order for the payment of alimony came into force. To fill out the payment form correctly, get a trial demo access to the K+ system. It's free.

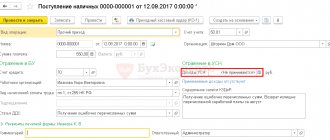

How to withhold alimony in 1C 8.3 Accounting

It is not difficult to calculate and withhold alimony in the 1C Accounting program. Retention is made on the basis of documents:

- according to the writ of execution;

- by agreement of the parties.

Appointed alimony is withheld from wages in a specified share or percentage of the employee’s income or is paid in a fixed amount.

In 1C Accounting 8.3 the salary block is limited. The calculation and deduction of alimony is implemented in two ways:

- manually - for organizations with more than 60 employees;

- automatically for others.

Which entries reflect alimony payments (including when they are paid by postal order)

Amounts in entries for alimony from wages, reflecting the accrual of deductions, to account 76 are always broken down by analytics corresponding to the list of persons to whom transfers will be made. This allows you to track the timeliness of payments to each recipient and the status of settlements.

Postings recording the payment of alimony will always have an account 76 in the debit part with analytics corresponding to the recipient of the payment, and the corresponding account (in the credit part) will depend on the payment method:

- count 50 - when issuing cash;

- account 51 - when paying by bank transfer;

- account 71 - for a postal transfer, since the money will be sent by mail by a person who has specifically received funds for reporting for this purpose.

Thus, the entry for the payment of alimony will look like Dt 76 Kt 50 (51, 71).

However, operations for the payment of alimony are not limited to this, since the Family Code (Article 109) prescribes that expenses arising during their transfer should be carried out at the expense of the alimony payer. That is, to the postings for payment of alimony, postings will also be added to withhold transfer costs from the payer. In particular, such deductions will always occur when postal orders are used for payments. When reporting on the costs of translation, the accountable person will attach a payment document to the advance report, according to which the entry Dt 76 Kt 71 will be made.

When paying alimony by postal order, what kind of entries will have to be made to withhold payments for postal services? Such deduction can be made from the income accrued to the employee (i.e., from the salary), and then the posting will have the same form as when deducting alimony: Dt 70 Kt 76. But it is also possible to deposit funds in cash at the cash desk. This will be reflected in accounting as Dt 50 Kt 76.

Calculation and deduction of alimony in 1C Accounting 8.3 manually

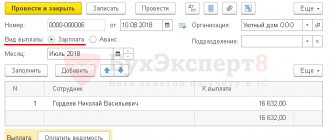

Withholding of alimony is carried out in the Payroll document (Salaries and personnel - All accruals - Create button).

Click the Hold Executive Order from the list .

Enter the amount of alimony in the writ of execution , calculating manually. The amount of alimony is calculated from the amount to be paid ( Accrued minus personal income tax ).

In the Recipient , select from the list or create a new counterparty.

Click the Hold to enter the amount of Remuneration for the paying agent and the Recipient , as in the example with the automatic calculation of alimony.

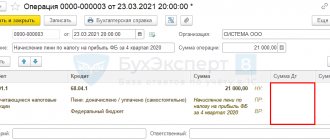

Post the document and check the postings. When manually entering deductions in the Payroll , the 1C 8.3 Accounting program does not generate postings for deductions.

Payroll document does not generate entries for withholding alimony in 1C 8.3, but withholding should be entered to automatically calculate the amounts payable in payroll statements (Salaries and Personnel - Payroll Reports).

To display deductions in accounting, create an Operation document (Operations – Operations entered manually).

a payment order , debit from a current account and a payslip , as with the automatic method of reflecting alimony in 1C.

We looked at step-by-step examples of calculating alimony in 1C 8.3 Accounting, as well as postings in accounting.

Results

There are several situations for deducting alimony from employee income.

The payments themselves can be either forced or voluntary. However, the fact of their deduction in any case will be reflected by the posting Dt 70 Kt 76. Alimony can be paid to the recipient in different ways: in cash (Dt 76 Kt 50), through a bank (Dt 76 Kt 51), by postal order (Dt 76 Kt 71). Expenses incurred during payment are repaid at the expense of the alimony payer (Dt 76 Kt 71). Payment can be made either from income (Dt 70 Kt 76) or in cash (Dt 50 Kt 76). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

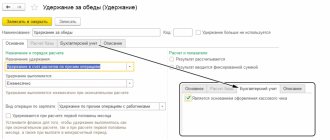

Manual withholding of alimony

In this case, alimony is not automatically deducted in the “Payroll” document.

After filling out the document, select the employee, click the “Hold” button and select the “Writ of Execution” item.

A window will open to enter the amount of the writ of execution and select the recipient of alimony.

Enter the required data and click “OK”.

The withholding amount will appear in the document.