The SZV-KORR form is filled out in order to correct the data recorded on an individual personal account based on the reporting (SZV-STAZH) previously submitted by policyholders for periods starting from 1996. For example, if in the 2015 report for an employee the length of service or length of service code was incorrectly indicated, then you need to submit a SZV-KORR.

The deadline for submitting the SZV-KORR form is immediately as soon as errors are discovered.

The SZV-KORR form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2022 No. 507P “On approval of the form SZV-STAZH, ODV-1, SZV-KORR, SZV-ISH of the procedure for filling them out and the format of information and on recognition as invalid by the Resolution of the Board of the Pension Fund of the Russian Federation dated 01/11/2017 No. 3P.”

The procedure for filling out sections of SZV-KORR depending on the type

Depending on the type of the SZV-KORR form, certain sections indicated in the table are filled out:

| Form type | Sections to fill out in the form |

| Form SZV-KORR with type " KORR " | Sections 1-3 and at least one of sections 4-6 of the form. Only the data specified in sections 3-6 of the form are corrected: Section 4, columns 1-6 - data on earnings (remuneration), income, amount of payments and other remunerations of the insured person REPLACE the data recorded on the ILS ZL Section 4, columns 7-13 - data on accrued and paid insurance premiums SUPPLEMENTS the data recorded on the ILS AP Sections 5 - 6 - REPLACE the data recorded on the ILS ZL |

| Form SZV-KORR with type “ OTMN ” | Section 1 and Section 2 must be completed - the data recorded on the ILS for the reporting period, which is being adjusted, is CANCELED |

| Form SZV-KORR with type “ OSOB ” | Sections 1-3 must be completed - data on “forgotten” employees is included |

Territorial conditions (code), Special working conditions (code), Calculation of the insurance period, Conditions for the early assignment of a labor pension - Filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (appendix to the Resolution of the Pension Fund of the Russian Federation Board dated 11 January 2017 No. 3p ).

SZV-STAZH: examples of filling

Let's look at examples of filling out information in the SZV-STAZH .

Example 1. The employee had no absences during the year

During the year, employee V.V. Chernichkin had no absences. It was adopted in mid-2022 and continued to operate throughout 2021.

In this case, in SZV-STAZH for 2022 there will be only one line for the employee:

- with the start date of the period - 01/01/2021;

- with the end date of the period being December 31, 2021.

Example 2. An employee had no-shows

Employee Yablokov Ya. Ya. was sick from April 12 to April 16, 2022.

In this case, in SZV-STAZH for 2022 there will be several lines where the period of absence will be highlighted with a special code.

In our example, the period from April 12 to April 16 will be indicated by the code VRNETRUD (Period of temporary incapacity for work) .

Example 3. An employee has annual leave

The Procedure for filling out the SZV-STAZH (clause 2.3.13 of the Resolution of the Board of the Pension Fund of Russia dated December 6, 2018 N 507p) says:

“The code “DLOTPUSK” is filled in only for periods of work of the insured person in special working conditions, for which there is no data on the calculation of insurance premiums at an additional rate.”

Thus, the DLOTPUSK is entered only if two conditions are met simultaneously :

- an employee with preferential seniority is on vacation;

- During the month you are on vacation, insurance premiums at the additional rate are not charged.

This is possible when an employee’s vacation is accrued in one month, but actually “walks” in another.

Therefore, when an employee is on regular annual leave, this period is not allocated in SZV-STAZH .

Employee Apelsinova A.A. was on annual leave from July 5 to July 18, 2022. She had no other absences during the year.

Since none of the conditions for designating a period with the DLOTPUSK code are met in our case, then in SZV-STAZH there will be only one line for the period from January 1 to December 31, 2022, without specifying any code.

An example of filling out the SZV-KORR form for 2021

Instructions for filling out the SZV-KORR correction form, sections 1-3

Instructions for filling out the SZV-KORR correction form, section 4

Instructions for filling out the corrective form SZV-KORR, sections 5, 6

Filling rules

The rules for filling out the SZV-KORR form are defined in the Procedure approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This document contains basic reporting instructions. Also, the designated regulatory legal acts approved the format required for submitting the SZV-KORR corrective report in electronic form.

The procedure for filling out the SZV-KORR form is given in section. IV Appendix 5 to the Resolution of the Pension Fund Board of January 11, 2017 No. 3p (hereinafter referred to as Appendix 5).

Penalties

By submitting the SZV-KORR pension form, the policyholder actually admits the presence of errors in previously submitted reports or the failure to submit reports for one of the employees. Will the Pension Fund of Russia fine for this? It's possible! The fine may be 500 rubles for each insured person for whom incorrect information about the length of service was provided (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ).

Together with the SZV-KORR , the EDV-1 type “initial” form must be submitted

Filling out the main form for length of service - in the material “SZV-STAZH: detailed information from Pension Fund specialists”

New reporting form: purpose

The new form of the SZV-KORR report was approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. A new SZV-KORR form is submitted to the Pension Fund if an error is found in previously submitted reports on individual (personalized) information. For example, if you discovered that in the 2016 report for an employee you incorrectly indicated payments and contributions, provided more or less length of service than necessary, or used the wrong length of service code - submit the SZV-KORR report and clarify the information. See “Form SZV-KORR: who, when and why should submit it.”

Please keep in mind that using SZV-KORR, SZV-M monthly reports are not adjusted. After all, SZV-M is submitted solely for the purpose of informing the Pension Fund of Russia about the fact of work of insured persons in order to suspend the indexation of their pensions. The data from SZV-M does not affect the status of individual personal accounts in any way.

Instructions for adjusting SZV-M

Is it possible to submit an adjustment to SZV-M and how to make an adjustment to SZV-M?

Sooner or later, all specialists whose responsibilities include the monthly preparation and submission of this report to the Pension Fund of Russia face such questions. If you need to correct SZV-M data, we suggest the following sequence of actions:

Step 1: preliminary

Before deciding how to adjust the SZV-M, make sure that the personalized accounting data that you are going to adjust has been accepted by the Pension Fund:

Previously, we talked about the ways in which SZV-M can be presented.

Step 2: Select Form Type

If you are convinced that the initial report has been accepted by the fund, you can proceed directly to the adjustment procedures.

The SZV-M adjustment in 2022 is made according to the same rules that were in force in previous periods.

First determine what needs to be done:

- supplement the information in the original SZV-M;

- cancel (zero) the information from the report submitted to the Pension Fund.

Depending on this, select the required type of SZV-M form for adjustment:

The “Additional” form type is selected in the case when you forgot to reflect the data on the insured person (or several persons) in the original SZV-M, and all other information in the original report is correct (does not contain errors).

The “Cancelling” form type is used when the following is detected in the original SZV-M:

- unnecessary data (for example, data is provided for an employee who was fired a long time ago);

- erroneous/inaccurate information (for example, incorrect personal information of employees).

Step 3: Filling out the adjustment form

Once you have decided on the scope of corrections and selected the desired type of form, you can begin to draw up the corrective SZV-M.

To make adjustments, use the form on which you submitted the original report:

- from May 2022 - approved. Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p;

- until April 2022 - by Resolution of the Board of the Pension Fund of the Russian Federation dated 02/01/2016 No. 83p.

To clarify:

- in sections 1 and 2, fill in the details of the policyholder and the reporting period in the same way as the original SZV-M, which you are adjusting;

- in section 3 “Form type (code)” enter the selected form type (for example, you need to cancel previously submitted information):

Correction of information in SZV-M regarding personal data of insured persons is made in section 4 “Information about insured persons”. In this section, provide the information you want to cancel. For example, this is what section 4 of the adjustment report looks like if an extra employee is included in the original SZV-M:

In such a situation, you should duplicate the data on the extra employee from the original SZV-M.

Download a sample of the corrective SZV-M

If it is necessary to correct erroneous information about an employee, you first need to submit the SZV-M form with the “Cancelling” type (similar to the sample presented above), and then the SZV-M form with the “Additional” type, in which you indicate the correct information. This should be done, for example, if the reason for completing the SZV-M adjustment was an error in the surname of the insured person.

The corrective form SZV-M includes information only for those employees whose data is subject to correction. Information on the remaining employees included in the original SZV-M and initially indicated correctly does not need to be re-entered.

See how and what errors can be corrected in the SZV-M report.

What sections need to be completed?

The SZV-STAZH form has five sections. To submit the 2021 report, the following sections must be completed:

| Section SZV-STAZH | How to fill |

| Section 1 “Information about the policyholder” | Fill in the section fields with the following information:

In a separate field opposite the “Original” type, put the “X” sign. |

| Section 2 “Reporting period (code)” | Enter "2021". |

| Section 3 “Information about periods of work of insured persons” |

Columns 1, 5, 6 and 7 must be filled out. |

Leave the remaining sections of the annual SZV-EXPERIENCE blank.

The completed form must be signed by the manager and certified with a seal if it is used by the employer (clause 1.8 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Useful information from Consultant Plus

See a sample of filling out the SZV-STAZH for 2022, prepared by specialists of the Consultant Plus reference and information system (free access).

Sample SZV-STAZH for 2022

Information type

In the “Type of information” column the code is indicated (clause 4.1 of Appendix 5):

- - “CORR” (corrective) – if you need to clarify previously submitted data, which are provided for in Section. 3 – 6 forms SZV-KORR;

- - “CANCEL” (cancelling) – if you need to cancel previously submitted data. In this case, only sections are filled in. 1 and 2 forms SZV-KORR;

- - “OSOB” (special) – when submitting information about the insured person, if there was no information about this person in the previously submitted reports.

Section 1

Section 1 indicates the short name of the policyholder, registration number in the Pension Fund of Russia, TIN, KPP. The data is presented in accordance with clause 2.1 of Appendix 5. You need to fill out both the subsection “In the reporting period” and the subsection “In the adjusted period” (clause 4.2 of Appendix 5).

Section 2

In section 2, you should record the last name, first name, patronymic in the nominative case and SNILS of the insured person. This information must correspond to the data of the insurance certificate (clauses 2.3.1, 4.3 of Appendix 5).

Section 3

In section 3 you need to provide data taking into account the adjustments (clauses 4.4.1 – 4.4.5 of Appendix 5):

- in column 1 – category code of the insured person;

- Column 2 – meaning “labor” or “civil” depending on the type of contract;

- other necessary data.

Contract number and date

The columns “Agreement number” and “Date of conclusion of the agreement” are filled in when adjusting data for periods up to and including 2001 (clause 4.4.4 of the Filling Out Procedure).

Section 4

Section 4 indicates (clauses 4.5.1 – 4.5.5 of Appendix 5):

- in column 1 - month code;

- columns 2 – 6 – adjusted payment amounts;

- columns 9, 10 – additional accrued insurance premiums for reporting periods from 2002 to 2013;

- column 11 – additional accrued insurance premiums for reporting periods since 2014;

- other necessary information.

Section 5

In section 5 you need to indicate (clauses 4.6.2 – 4.6.3 of Appendix 5):

- in column 1 - month code;

- Column 2 – code for special assessment of working conditions;

- columns 3, 4 – the corresponding amounts of payments, taking into account the adjustments.

Section 6

In Section 6, add (clauses 2.3, 4.7 of Appendix 5):

- in columns 1 and 2 – the adjusted start and end dates of the insured person’s work period;

- column 3 – code of territorial conditions;

- column 4 – code of special conditions;

- other necessary information.

You can also fill out a sample SZV-KORR report in Excel format.

Features of information types

CORR (corrective). If the SZV-KORR report indicates the type of information KORR, then only the data specified in sections 3 – 6 of the form are corrected on the individual personal account of the insured person:

- data on earnings (remuneration), income, amount of payments and other remuneration of the insured person (section 4) replaces the data recorded on the individual personal account of the insured person;

- data on accrued and paid insurance premiums (section 4) supplements the data recorded on the individual personal account of the insured person;

- the data in sections 5 – 8 replaces the data recorded on the individual personal account of the insured person.

OTMN (cancelling). In a form with the OTMN type, only 1–2 sections of the form are filled out. Based on the form with the information type OTMN, the data recorded on the ILS based on reporting for the reporting period that is being adjusted will be cancelled.

OSOB (special). A form with the OSB type is submitted to the insured person, information on which was not included in the reports previously submitted by the policyholder.

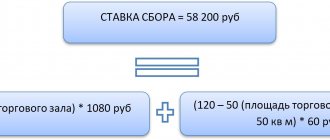

How is the fine calculated?

The accountant did not include an external part-time worker in the report for 2022 - he had no accruals or payments for the reporting period - and doubled the information about the full-time employee. Let's look at how to correct errors and whether there will be a fine for canceling the SHV-M form. We fix it like this:

- For an external part-time worker, a SZV-STAZH form with the “Additional” type is generated.

- Regarding another employee, the information must be removed - SZV-KORR “Canceling” is being prepared.

- Both forms are sent to the Pension Fund.

The accountant overstayed the required five days, so she will have to pay a penalty. The fine is calculated as follows: 500 rubles for errors for each insured person. Total 1000 rubles for two employees.

Deadline for submitting the corrective report

Send the SZV-KORR report to the Pension Fund authorities at any time. There is no need to wait until the deadline for submitting information about experience for 2022 comes. Also see “Form SZV-STAZH: how to fill out and submit a new form for annual reporting to the Pension Fund of Russia.” As we have already said, previously corrective individual information could only be submitted with current RSV-1 reporting. As of March 4, 2022, this approach no longer exists.

If, for example, on April 10, 2022, the accountant of Lobzik LLC discovered that in the RSV-1 for 2016, section 6 for the employee was filled out incorrectly (errors in length of service and payments), then already on April 10, 2022, you can transfer the form to the Pension Fund of Russia division SZV-KORR to clarify the data.

There is no need to wait for a request from the territorial unit of the Pension Fund to submit a SZV-KORR report. This report can be submitted proactively.

Deadlines for Corrective Forms

The policyholder has 5 days from the date of receipt of the notification from the Pension Fund. It turns out whether there will be a fine for the supplementary SZV-M form depends only on the time of filing the adjustment. Both the SZV-KORR and the supplementary SZV-STAZH must be submitted within 5 days after the contractor receives a control message from the Pension Fund of the Russian Federation.

There is another option not to receive a penalty - to correct the violations yourself and redirect the corrected information to the personalized accounting authorities.

What errors occur

There are several types of violations:

- critical - errors in registration information, incorrect electronic signature (the report is redone immediately);

- mechanical - inaccuracies in the last name, first name and patronymic of the insured person or in SNILS;

- accounting - information about the employee is not included in individual personal accounts due to errors in reporting indicators.

All these violations require correction. The initial report is not updated, but adjusted; the contractor generates SZV-STAZH with the “Additional” or SZV-KORR type. Here's how to add an employee without penalty when adjusting SZV-M:

- We take the initial SZV reporting form.

- Change the type of information and indicate the status “Additional”.

- We enter information about the missed employee.

Other errors are corrected using the same algorithm. The performer’s task is to correctly fill out the initial SZV form, indicate the adjustment and reflect all corrections (full name, SNILS, length of service).

And once again (to avoid confusion): if the policyholder incorrectly indicated information about one or more employees, we form a SZV-KORR. If the contractor missed one or more employees, then we prepare and send to the Pension Fund a supplementary SZV-STAZH. When unnecessary information is removed, we compile a SZV-KORR with the “Cancelling” type. Correction forms are submitted with the obligatory list of attachments EDV-1 “Initial”.

How to fix errors

The most important thing in the report is not to make a mistake in the personal data of employees, assign the correct codes to periods of work, otherwise there will be penalties: for failure to comply with the procedure for submitting reports in electronic form, a fine of 1000 rubles is provided. (Article 17 of Federal Law No. 27-FZ). The fine for late submission of the SZV-STAZH form or submission of incomplete and (or) false information will be 500 rubles. for each insured person.

The Pension Fund of the Russian Federation has moved away from the standard work when adjusting statements: now accountants will have to work not with the same SZV-STAZH form and edit it, but with a special, independent form SZV-KORR, which is designed to correct the information reflected by the policyholder in previously filed reports (Resolution of the Board PFR dated January 11, 2017 No. 3p). The SZV-KORR form was created and provided just in case of need to clarify, correct or cancel the data recorded on the individual personal accounts of the insured persons. This form has three types of information: corrective, canceling and special.

SZV-KORR is submitted with the “corrective” type of information if it is necessary to clarify or correct the data recorded on the individual personal accounts of insured persons (hereinafter referred to as ILS PL), for example, the period of work was erroneously recorded. This is the most common type of form.

The type of information “cancelling” is submitted to the Pension Fund if it is necessary to cancel previously specified information. For example, if an accountant entered information about an extra employee or mistakenly indicated him twice. With the “special” information type, the SZV-KORR is submitted to the insured person, information on which was not included in the reporting previously provided by the policyholder. For example, if entering data is required by a court decision.

The SZV-KORR form itself consists of six sections, where sections 1, 2 and 3 contain general information about the policyholder and the employee and are filled out regardless of the type of information. Section 4 contains information about adjustments to the insured person's earnings and contributions. Section 5 includes information about adjustments to income from which insurance premiums are calculated at the additional rate. In the sixth section, the policyholder makes changes according to the periods of work of the insured person.

Accordingly, depending on the type of form, certain sections presented in Table 1 are filled out in the SZV-KORR.