What is the essence of the document?

The list of standard management archival documents generated in the process of activities of state bodies, local governments and organizations has been updated. We are talking about documents generated in the process of activities of government agencies and companies in the implementation of the same type (common to all or most) management functions. For a number of documents, the retention period has been increased, and some documents will require a shorter retention period. The list includes, among other things, accounting, personnel, government procurement documents, contracts and much more.

What retention periods are established for basic accounting documents?

The storage period for invoices has been increased by a year: from four years to five.

Salary receipt documents must be kept for six years, not five. This only applies to cases where employees have personal accounts.

The storage period for registers of information on the income of individuals was reduced by 15 times. Now it's five years instead of 75.

For employee personal accounts, the retention period has also been adjusted. The previous period of 75 years remained only for documents for which the paperwork was completed before the end of 2002. If it was completed after January 1, 2003, you need to keep the personal account for 50 years.

The storage period for primary accounting documents remains the same - five years. However, the rule now contains a clarification: if there are disputes or disagreements, documents must be kept until a decision is made on the case.

There is an obligation to keep certificates for five years:

— on the fulfillment of the obligation to pay taxes, fees, contributions, penalties and fines;

— about the state of settlements with the budget.

In addition, there is now a direct standard for calculating insurance premiums. Both annual and quarterly documents must be kept for 50 or 75 years, depending on when the paperwork is completed.

The storage period for documents on receivables and payables remains the same - five years. However, now it has been clarified that it applies subject to repayment of the debt.

Document flow and storage of bank documents

Memorial documents are used to make non-cash transfers to accounts. The main place among them is occupied by settlement documents.

Payment documents are used when the supplier collects payment for products, work performed, services rendered from their customer-buyer or when paying off obligations, debts to the budget, the Pension Fund, other creditors, when servicing the bank’s clients or paying off its own debts.

Memorial documents (memorial orders) are issued by the bank when registering intra-bank transactions: loans issued, repaid, interest accrued, receipts and disposals of fixed assets, depreciation, wages and various charges on it, when accounting for expenses incurred, income received and calculating profits.

All cash and memorial documents must have the signatures of bank officials. The official who signed the document is responsible for the legality of the transaction and the correct execution of the document.

The listed documents are intended for recording transactions that affect balance sheet indicators and are subject to reflection on balance sheet accounts.

At the same time, a considerable amount of information about the bank’s activities is occupied by off-balance sheet indicators, indicating the issued guarantees, sureties, various types of collateral for loans issued, letters of credit issued in the name of bank clients, and other transactions.

Off-balance sheet documents include memorial orders. These documents formalize the acceptance and issuance of valuables and documents stored at the cash desk and in the accounting department.

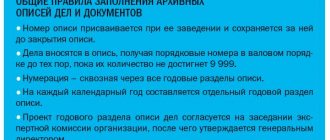

The basis for organizing primary accounting is the document flow schedule approved by the chief accountant. Document flow refers to the path that documents take from the moment they are issued to the moment they are deposited in the archive. The document flow schedule defines the circle of persons responsible for the preparation of documents, and indicates the order, place, and time of passage of the document from the moment of preparation to delivery to the archive.

The procedure for passing documents through the bank's structural divisions is established by the chief accountant in accordance with the basic Rules of document flow and control. When making non-cash payments, memorial documents are posted to the debit of the payers' accounts, and then to the credit of the recipients' accounts. Each document is subject to preliminary control to establish the legality of the transaction. To confirm the inspection, the responsible executor signs the document and its copy.

Cash expense transactions are subject to additional control. The responsible executive, on the basis of the cash receipt document, checks the legality of the transaction and the possibility of its completion, taking into account the availability of funds in the account. The correctness of the document is checked, the client's signatures and seal impressions, the check number are compared with the number recorded in the sample signature card, then the document is handed over to the controller. The controller checks the correctness of the document and records the amount in the cash register, then the document is sent to the cash desk for cash dispensing.

Crediting of funds for incoming cash transactions is carried out only after the actual receipt of money at the cash desk. The document is registered in the cash receipt journal and transferred to the cash desk. Having received an order from the cash register with the cashier’s signature confirming the receipt of money, the responsible executor credits the funds to the client’s account.

Banks are required to store primary accounting documents, accounting registers and financial statements for periods established in accordance with the rules for organizing state archival affairs, but not less than five years.

Responsibility for the correct organization and compliance with the established procedure for storing accounting documents rests with the managers and chief accountants of the bank. The manager and chief accountant must instruct bank employees and private security on these issues, distribute and assign to employees certain places for storing documents in cabinets and other storage facilities, and establish, if necessary, the order and sequence of removing documents to safe places.

Accounting documents generated in accordance with the established procedure and bound for the working day after drawing up the daily balance and conducting a comprehensive audit are transferred for storage to the archive with limited access to them.

In the archive, documents of the current year and the previous year are stored separately in metal cabinets (safes).

After submitting the annual report, documents from the year preceding the reporting year are transferred to the archive for storage on a general basis.

The procedure for storing documents of permanent use (legal and credit files, agreements, contracts, urgent obligations, etc.) is determined by the head of the bank and the chief accountant, with a view to ensuring their safety.

Accounting (memorial) documents are kept filed for each working day in ascending order of numbers of debited balance sheet accounts. The selection of documents is carried out by the employee who is entrusted with the formation of the documents of the day.

It is allowed to form memorial documents in batches formed to transmit information for processing. In this case, the documents are placed in a folder along with their counting tapes.

Documents that affect more than one debit account are placed at the end of the folder, ahead of documents on off-balance sheet accounts.

Cash documents, documents on citizen deposits, on loans to individual borrowers, on transactions with precious metals, foreign currency, on business and other bank operations, with different storage periods are placed in separate folders.

The bound documents are counted, and their sum is checked against the total turnover on the turnover sheet. If the overall totals and the totals for the batches do not match, then the documents and turnover for individual balance sheet accounts are reconciled.

Memorial orders and other documents for off-balance sheet accounts (except for documents recorded in the books of the value store) are selected in ascending order of numbers separately for debited and credited off-balance sheet accounts, except for accounts 99998 and 99999, placed in documents of the day after memorial documents for balance sheet accounts and bookleted together with them.

Documents on off-balance sheet accounts are also counted, and their amounts are reconciled with the turnover sheet.

Employees who are entrusted with the preparation of documents must carefully check the presence in memorial orders that have attachments, references to the number of attached sheets and the presence of the attachments themselves.

Documents for the past day after the control must be drawn up in the order indicated above and no later than the next day transferred to the archive. Until the next morning, unbound documents must be stored in a fireproof cabinet. — On the front cover of the folder of bound documents, information about the documents contained in the folder is indicated. A document can be seized only upon written requirements of judicial and investigative authorities, a higher bank, by filling out a seizure act.

Memorial documents are used to make non-cash transfers to accounts. The main place among them is occupied by settlement documents.

Payment documents are used when the supplier collects payment for products, work performed, services rendered from their customer-buyer or when paying off obligations, debts to the budget, the Pension Fund, other creditors, when servicing the bank’s clients or paying off its own debts.

Memorial documents (memorial orders) are issued by the bank when registering intra-bank transactions: loans issued, repaid, interest accrued, receipts and disposals of fixed assets, depreciation, wages and various charges on it, when accounting for expenses incurred, income received and calculating profits.

All cash and memorial documents must have the signatures of bank officials. The official who signed the document is responsible for the legality of the transaction and the correct execution of the document.

The listed documents are intended for recording transactions that affect balance sheet indicators and are subject to reflection on balance sheet accounts.

At the same time, a considerable amount of information about the bank’s activities is occupied by off-balance sheet indicators, indicating the issued guarantees, sureties, various types of collateral for loans issued, letters of credit issued in the name of bank clients, and other transactions.

Off-balance sheet documents include memorial orders. These documents formalize the acceptance and issuance of valuables and documents stored at the cash desk and in the accounting department.

The basis for organizing primary accounting is the document flow schedule approved by the chief accountant. Document flow refers to the path that documents take from the moment they are issued to the moment they are deposited in the archive. The document flow schedule defines the circle of persons responsible for the preparation of documents, and indicates the order, place, and time of passage of the document from the moment of preparation to delivery to the archive.

The procedure for passing documents through the bank's structural divisions is established by the chief accountant in accordance with the basic Rules of document flow and control. When making non-cash payments, memorial documents are posted to the debit of the payers' accounts, and then to the credit of the recipients' accounts. Each document is subject to preliminary control to establish the legality of the transaction. To confirm the inspection, the responsible executor signs the document and its copy.

Cash expense transactions are subject to additional control. The responsible executive, on the basis of the cash receipt document, checks the legality of the transaction and the possibility of its completion, taking into account the availability of funds in the account. The correctness of the document is checked, the client's signatures and seal impressions, the check number are compared with the number recorded in the sample signature card, then the document is handed over to the controller. The controller checks the correctness of the document and records the amount in the cash register, then the document is sent to the cash desk for cash dispensing.

Crediting of funds for incoming cash transactions is carried out only after the actual receipt of money at the cash desk. The document is registered in the cash receipt journal and transferred to the cash desk. Having received an order from the cash register with the cashier’s signature confirming the receipt of money, the responsible executor credits the funds to the client’s account.

Banks are required to store primary accounting documents, accounting registers and financial statements for periods established in accordance with the rules for organizing state archival affairs, but not less than five years.

Responsibility for the correct organization and compliance with the established procedure for storing accounting documents rests with the managers and chief accountants of the bank. The manager and chief accountant must instruct bank employees and private security on these issues, distribute and assign to employees certain places for storing documents in cabinets and other storage facilities, and establish, if necessary, the order and sequence of removing documents to safe places.

Accounting documents generated in accordance with the established procedure and bound for the working day after drawing up the daily balance and conducting a comprehensive audit are transferred for storage to the archive with limited access to them.

In the archive, documents of the current year and the previous year are stored separately in metal cabinets (safes).

After submitting the annual report, documents from the year preceding the reporting year are transferred to the archive for storage on a general basis.

The procedure for storing documents of permanent use (legal and credit files, agreements, contracts, urgent obligations, etc.) is determined by the head of the bank and the chief accountant, with a view to ensuring their safety.

Accounting (memorial) documents are kept filed for each working day in ascending order of numbers of debited balance sheet accounts. The selection of documents is carried out by the employee who is entrusted with the formation of the documents of the day.

It is allowed to form memorial documents in batches formed to transmit information for processing. In this case, the documents are placed in a folder along with their counting tapes.

Documents that affect more than one debit account are placed at the end of the folder, ahead of documents on off-balance sheet accounts.

Cash documents, documents on citizen deposits, on loans to individual borrowers, on transactions with precious metals, foreign currency, on business and other bank operations, with different storage periods are placed in separate folders.

The bound documents are counted, and their sum is checked against the total turnover on the turnover sheet. If the overall totals and the totals for the batches do not match, then the documents and turnover for individual balance sheet accounts are reconciled.

Memorial orders and other documents for off-balance sheet accounts (except for documents recorded in the books of the value store) are selected in ascending order of numbers separately for debited and credited off-balance sheet accounts, except for accounts 99998 and 99999, placed in documents of the day after memorial documents for balance sheet accounts and bookleted together with them.

Documents on off-balance sheet accounts are also counted, and their amounts are reconciled with the turnover sheet.

Employees who are entrusted with the preparation of documents must carefully check the presence in memorial orders that have attachments, references to the number of attached sheets and the presence of the attachments themselves.

Documents for the past day after the control must be drawn up in the order indicated above and no later than the next day transferred to the archive. Until the next morning, unbound documents must be stored in a fireproof cabinet. — On the front cover of the folder of bound documents, information about the documents contained in the folder is indicated. A document can be seized only upon written requirements of judicial and investigative authorities, a higher bank, by filling out a seizure act.

Have the retention periods for contracts and agreements changed?

Yes, for example, a contract of gift (donation) of property must be kept “until the liquidation of the organization.”

Permanent storage was previously installed. The leasing agreement should be kept for 5 years after the expiration of the agreement or the purchase of the property. If there is a disagreement, the agreement must be kept until a decision is made on the case. As before, the list had to be kept constantly. Similar changes affected all leasing documents.

Real estate mortgage documents are kept for 10 years instead of permanent storage. As with leasing, the period is counted from the moment the contract expires or the property is purchased. In case of a dispute, documents are kept until a decision is made on the case.

The agency agreement should be kept for 15 or 10 years, depending on the type of property, instead of five years.

A credit or loan agreement with the condition of pledging property must be kept for 10 years. The requirement also applies to documents confirming the provision of funds and the fulfillment of obligations by the debtor. This is an exception to the general rule of 5-year retention of loan agreements.

What problems does the electronic archive solve?

Electronic archive is a successful business technology, since the implementation of this system within an organization allows you to solve a number of problems: putting the archive in full order according to given parameters, reducing the risks associated with various checks, and increasing the level of protection of bank documents, reducing the overall costs of doing business and improving workday efficiency.

Organization of structured storage

Often, before proceeding with the direct digitization of a bank archive, it is necessary to give it a clear coordinate system, that is, to restore order. What is it for? Structured storage will allow you to solve several problems at once. First of all, an organized system of (for now) paper documents will help facilitate searches in the physical archive in the event that the original on paper is needed. The manager or responsible person will always have an idea of how many documents related to one division or type of agreement are stored in his archive. In addition, when creating an electronic archive, having a clear structure will simplify and, therefore, speed up the process of implementing the system, since part of the structuring work has already been done at the preparatory stage.

Preparation for audits and inspections of the Central Bank of the Russian Federation

Did the audit take you by surprise? Not a single employee is capable of working in a critical situation as quickly and calmly as a computer. The functionality of the electronic archive will help significantly reduce the standard preparation time for audits and inspections of the Central Bank of Russia. Firstly, a bank employee can easily view electronic images of documents from the system itself and documents recorded on disk. Secondly, the program automatically prepares inventories based on printed documents and issued disks. Thirdly, any document can be easily found in a matter of seconds, and then uploaded to a folder, sent by email or printed. And finally, the system provides the ability to generate a report based on specified criteria.

Increased document security

The electronic archive works not just as a database, but as a smart system with customizable access rights to specific documents. Each employee, division or branch of the organization will have access only to those documents that are open for work in the program settings. The right to edit documents can also be limited depending on the specialist’s set of powers. In addition to this, thanks to an automated accounting system based on barcoding technology, you can track the movement of any banking document.

What has changed in the retention periods for personnel documents?

Several personnel documents will have to be kept longer than now, for example:

- vacation schedule - three years, not a year;

- books, magazines, record cards, vacation databases - five years instead of three.

Some documents will need to be stored less than now:

- documents on disciplinary sanctions - three years instead of five years;

- applications for the need for foreigners - one year instead of five years;

- documents on the status and measures to improve working conditions and safety - five years, not permanently;

- books, log books, databases of industrial accidents, accident records - 45 years, not permanently.

For a number of documents, the storage period will depend on when the paperwork for them was completed: if before January 1, 2003, then they need to be stored for 75 years, if after - 50 years. Among them are employment contracts, documents on hiring, transfer, dismissal, and personal cards of employees. In the previous list, a storage period of 75 years was established for such documents.

In addition, a special storage period has been established for certain types of documents. Thus, notifications and warnings to employees will need to be kept for three years. Employee applications for the issuance of work-related documents and copies thereof will have to be kept for a year. Magazines and books of records of labor safety briefings (introductory and on-the-job) will need to be stored for 45 years.

Creating backup copies of documents

In order to ensure information security of the entire fund of documents stored electronically, some systems implement a mechanism for creating backup copies of documents. A system of configurable access rights prevents unauthorized copying, replacement of storage units and access to their backup copies. Step by step: implementation of the electronic archive project

Implementation of the electronic archive of banking documents project includes several stages.

1. Determine system requirements

At the initial stage, it is important to specify all the requirements for the future system. To do this, you need to think over a list of tasks and requirements that will be associated with the work of the electronic archive. At the same time, you should not include in the list those parameters that are imposed by IT fashion, but do not actually participate in solving the assigned tasks. Think on the merits - and you will significantly reduce the cost and time of the project.

2. Selecting a software product and installing the program

When choosing a software product, consider not only the characteristics of the program, but also the reliability of the developer. If the company has implemented similar projects in the past, this will increase its chances of success working with you. Find out about the project details. To do this, you need to make an appointment with a company representative or come to their office, where they will demonstrate the capabilities of the program to you. Today, many companies offer to test a demo version of the electronic archive for free. Despite the fact that in this version the functionality and volume of document loading is limited, it will allow you to come into contact with the product live and evaluate its advantages and possible disadvantages. In addition, when choosing software, the technical characteristics required for the program to operate (server requirements, DLP, etc.) are no less important.

3. Scanning documents, entering attributes, document recognition

The lion's share of work when creating an electronic archive falls on the translation of all documents into electronic format. Depending on the organization’s capabilities, there are several options for digitizing bank documents.

Creating your own scanning department. To do this, you will have to purchase professional scanning equipment (mainly in-line scanners), as well as conduct training among company employees and, if necessary, hire new ones.

Outsourcing of documents. If a company generates a large number of documents every day, then a scanning point can be organized in the bank itself. In this case, the scanning will be carried out by employees of the performing company. If there are few documents and they are not sent to the central office every day, then it is better to resort to a subscriber scanning service. In the latter case, employees of the archival company will convert documents into electronic form in periods (for example, once a month).

At the request of the bank, the archival company performs text recognition of electronic images of documents. This is necessary to organize a quick contextual search for all documents. The process of scanning documents is accompanied by entering attributes into the database and simultaneously loading them into the electronic archive system. This is a lot of work. Each document is assigned its own attribute characteristics (usually 3-6), which are entered into the program. Due to the need to process a huge amount of data, typists are most often involved at this stage.

Important! According to Article 10 of the Federal Law of July 29, 2004 N 98-FZ (as amended on July 11, 2011) “On Trade Secrets,” a credit institution must organize records of persons who have access to this information. Before starting work on scanning documents, employees of the archiving company must undergo a check by the bank's security service, regardless of whose territory the work will be carried out. In addition, a civil law agreement on non-disclosure of information must be concluded with the executing company (link to the law https://www.rg.ru/2004/08/05/taina-doc.html). If the bank plans to carry out all document scanning work on its territory, the security service must first conduct a check of employees authorized to work with documents, after which it is necessary to find a separate room (room) in the bank and, if possible, install video surveillance in it.

4. Training bank employees to work with electronic archives

Obviously, the new program requires training of employees who will work with the bank's electronic archive system. Even if it seems very simple to you, and the interface is intuitive, do not rush to conclusions: only experts will be able to tell you about all the capabilities of the program to fully work with it.

5. Modernization and refinement of the program

Business does not stand still. As the business grows, the company's needs also grow. Therefore, it may happen that after some time the bank will need to install new program modules. The easiest and most inexpensive way to cope with this task is to contact a performing company. Minor problems may also arise while working with the electronic archive. Some companies provide technical support absolutely free of charge for one year.

What storage periods are established for budgetary organizations?

Reports on the implementation of grant and subsidy agreements must be kept for 5 years.

According to the previous list, reports on the implementation of grants should have been kept permanently. The financial and economic activity plan must be kept for as long as the budget estimate: 5 years at the place of approval and permanently at the place of development. According to the previous list, budget estimates at the place of approval and development had to be stored permanently. In addition, there were no separate provisions for the FHD plan. It was subject to the general requirements for the organization's annual plans - permanent storage.

Separate standards have appeared for reports on the implementation of FCD plans: annual reports must be kept permanently, quarterly reports - for 5 years, monthly reports - for 1 year.

Documents on the transfer of property to operational management or economic management must be kept “until the liquidation of the organization.” The previous list determined only the storage periods for correspondence about the transfer of property. It had to be stored for 10 years, unless the expert commission extended this period.

What about government procurement documents?

Procurement documents have been identified that must be retained for a specified period.

The regulations (regulations) on contract managers, contract service, and procurement will have to be kept indefinitely. Schedules should be kept for 3 years.

Documents compiled during competitive public procurement methods will need to be stored for 3 years, regardless of the object and volume of the purchase. For government procurement, these rules have been extended to notices, documentation, protocols, changes and clarifications of documentation provisions, participants’ applications, and audio recordings of participants opening envelopes. For procurement under Law No. 223-FZ, notices, procurement regulations and protocols will be stored according to such rules.

For contracts and agreements, the retention period will remain the same - 5 years.

The storage period for registration logs of applications and representatives of participants has been reduced. According to the new rules, it will be 3 years instead of 5 years.

What else did the Order of Rosarkhiv bring?

A separate section has appeared that concerns documents related to anti-corruption.

A long storage period is established for certificates of income, expenses, property and property-related obligations - 50 or 75 years, depending on whether the paperwork was completed before or after January 1, 2003. A retention period of 5 years is established for notifications: - about the intention of a state or municipal employee to perform other paid work;

— about receiving gifts in connection with protocol or other official events, as well as business trips;

- about appeals with the aim of inducing corruption;

— personal interests that lead or may lead to a conflict of interest.

The previous rules only mentioned notifications of facts of incitement to corruption and the implementation of other paid activities. The term was also 5 years, but the expert commission could extend it.

The list also sets storage periods for other documents.

Accustomed to order, ready to check

Every banker knows the value of time and money, but often forgets about the value of the primary material that makes up the work of a credit institution.

The operational activities of a bank are inevitably associated with the need to create, process and further store a huge number of paper documents (memorial orders, payment orders, etc.). Almost all key departments of the bank face the problem of organizing a large amount of data stored on paper: the department of lending and investments, the department of retail business, the department of treasury operations, the department of foreign exchange transactions and international settlements, etc. How to correctly organize bank documents of different departments and at the same time meet representatives of regulatory authorities with confidence? Electronic archive is a new tool for solving a number of business problems that are on the agenda of any credit organization. At the same time, it allows not only to solve the problem of physical storage of documents by converting them into electronic form, but also to bring the scattered paper flow into a full-fledged structured archive even before the scanning stage. As you know, bank documents are often stored according to the notorious Russian principle “at random”: outside of any structure and sometimes outside of any law. As a result, this leads to the fact that the required document is difficult to find (if it is not completely lost), and the total number of documents (transactions with counterparties, dossiers, etc.) is difficult to calculate.

It is no secret that electronic archiving technology did not appear yesterday. However, its use became truly justified only after a strong legislative framework was created in Russia, allowing electronic archive documents to function on an equal basis with traditional paper documents. Thus, in 2010, the instruction of the Central Bank of the Russian Federation dated November 25, 2009 No. 2346-U “On storing in a credit institution in electronic form certain documents related to the execution of accounting, settlement and cash transactions when organizing accounting work” came into force. according to which a number of banking operations can be carried out on the basis of documents stored electronically.

What liability is provided for failure to comply with storage deadlines?

Responsibility for violating the terms of storage of documents is provided for by various regulations.

For example, administrative liability for violation of the law on storage of documents is provided for in Articles 13.20 and Art. 13.25 Code of Administrative Offenses of the Russian Federation. In the first case, this is a fine for officials in the amount of 300 to 500 rubles, and in the second case, a fine for officials in the amount of 2,500 to 5,000 rubles; for legal entities - from 200,000 to 300,000 rubles. According to Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, the absence of a company’s primary accounting documents, and (or) accounting registers, and (or) accounting (financial) statements within the established storage periods for such documents is qualified as a gross violation of accounting requirements. It entails a fine on officials in the amount of 5,000 to 10,000 rubles.

According to Art. 120 of the Tax Code of the Russian Federation, the absence of primary documents, invoices, accounting or tax registers is considered a gross violation of the rules for accounting for income and expenses and taxable items, for which a fine of 10,000 rubles is levied; for the same violation over several periods - 30,000 rubles. If the lack of documents resulted in an underestimation of the tax base, then the fine imposed on the company will be 20% of the amount of unpaid tax, but not less than 40,000 rubles.

In addition, the absence of primary accounting documents during a tax audit is fraught with additional tax assessments by calculation.