Cash register checks were removed from the scope of Law No. 54-FZ

From March 1, 2022, the rules and regulatory framework for conducting cash register inspections will change.

Federal Law No. 170-FZ of June 11, 2022 amended Article 7 of Federal Law No. 54-FZ of May 22, 2003. It has been established that the organization and control over compliance with legislation on cash register systems will be regulated by the Federal Law on State and Municipal Control of July 31, 2022 No. 248-FZ.

The subject of control and supervision of compliance with legislation on the use of cash register systems remains the rules for the use of cash register equipment when making payments in Russia, the completeness of revenue accounting, including for tax purposes and ensuring the established procedure for the circulation of goods.

Changes to CCP in 2022

1. There is a deferment in the use of online cash registers only for individual entrepreneurs without employees - until July 1, 2022. It can be used by entrepreneurs who provide services, perform work or sell goods of their own production. If an entrepreneur decides to hire an employee, he will be required to register an online cash register within 30 days.

2. More entrepreneurs with a patent will be able to work without a cash register. The law of November 23, 2020 No. 373-FZ prescribed a list of types of activities on a patent, which can be carried out without a cash register. Now the list includes repairs and tailoring, repairs, cleaning, painting and shoe making, dry cleaning, key making and repair, and much more.

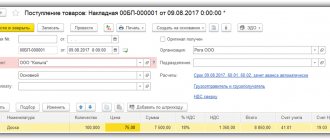

3. Couriers and delivery services will indicate a new detail on cash receipts - “product code”. This applies to those couriers who deliver marked goods on behalf of the seller (Government Decree No. 521 dated April 16, 2020). The transition period will end on April 20, 2022.

4. Those who sell labeled goods will need to update the fiscal drive to format 1.2 (FFD 1.2). This is necessary so that the seller can generate data about the product in the form of requests for the marking code and notifications about the sale of the marked product. Such a drive has a counter for requests for a marking code and notifications about the sale of a marked product, there is a function for receiving marking codes from cash registers, checking the authenticity of the marking code, receiving data for generating requests and notifications, receiving responses to requests from cash registers and receipts for notifications.

The deadline for the transition to fiscal drives with support for FFD 1.2 is August 6, 2022. From this date, it will no longer be possible to register old fiscal drives at cash registers. But those drives that have already been registered previously can be used until the end of their expiration date.

5. Individual entrepreneurs on special regimes will have to indicate the nomenclature on their checks. This rule for entrepreneurs using the simplified tax system, unified agricultural tax and patent has been in effect since February 1, 2022 (Article 7 of the Federal Law of July 3, 2016 No. 290-FZ).

Receipts will need to indicate the name, quantity and price per unit of the product, work or service. All this information must be no longer than 128 characters. At the same time, it is important that the buyer can understand exactly what product he purchased, so QR codes and barcodes will not work.

In addition, the fiscal document must indicate the name, serial number of the document, INN, taxation regime, calculation attribute, calculation amount, calculation form, FN number, fiscal attribute, QR code and cash register number assigned during registration.

There will be a fine for the absence of nomenclature on the check. Officials and individual entrepreneurs in the amount of 1,500 to 3,000 rubles, legal entities - in the amount of 5,000 to 10,000 rubles.

The new requirement will also apply to those who are not engaged in trade at all and work without a cash register. When preparing advance reports, you need to remember that checks without nomenclature no longer comply with the law, so they cannot be accepted.

6. From January 1, 2022, the Federal Tax Service’s moratorium on on-site inspections on compliance with the rules for working with cash registers will end. They may also be held accountable for violations committed in 2020.

7. The amount of fines under CCP will increase in 2022, and new sanctions will also appear. Thus, for imaginary and feigned payments or payments past the cash register, the fine for individual entrepreneurs will be 50% of the amount, but not less than 10,000 rubles, for legal entities - 100% of the settlement amount, but not less than 30,000 rubles. For the absence of the name of a labeled product in a fiscal document or its distortion - 50,000 rubles for individual entrepreneurs and 100,000 rubles for legal entities. For settlements in violation of legal requirements - 3,000 for individual entrepreneurs and 10,000 for legal entities. For failure to provide documents at the request of the tax authorities - 3,000 for individual entrepreneurs and 10,000 rubles for legal entities. These changes are in the draft, so not everyone can accept them.

Created a unified register of control activities

In accordance with Law No. 248-FZ, a unified register of control (supervisory) activities has been created. It accumulates information about (clause 1, part 1, article 19 of Law No. 248-FZ):

- carried out preventive measures (caution, preventive visit);

- control (supervisory) activities (control and monitoring procurement, random control, inspection visit, on-site inspection, documentary and on-site inspection).

It is prohibited to carry out control (supervisory) activities that are not in the register at the time of their initiation (Part 4 of Article 19 of Law No. 248-FZ).

Registration of CCP

Before equipping a cash register point of sale, you need to take care of connecting to the Internet. The cash register goes online and transmits information about sales after the receipt is punched or once every 30 calendar days. If there is no connection with the OFD for more than 30 days, the cash desk will be blocked.

Material on the topic Registration of an online cash register with the Federal Tax Service

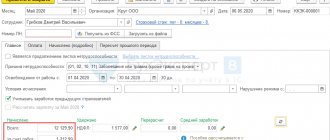

Let's look at registering a cash register step by step.

- Register a digital electronic signature.

- Register your personal account on the website of the Federal Tax Service (nalog.ru).

- Enter into an agreement with the OFD.

- Upgrade your old one or purchase a new cash register.

- Upgrade or purchase a new cash register software.

- Leave a request on the website to register the cash register by signing the application with an electronic signature.

Having received the application, the Federal Tax Service sends the registration number of the cash register to the organization. The number must be entered into the device.

Important! The number must be entered within one business day.

All! The cash register is ready for use.

Types of control

It is separately stated that when monitoring and supervising CCPs, planned control (supervisory) activities are not carried out (subclause “b”, paragraph 1, Article 60 of the Federal Law of June 11, 2021 No. 170-FZ). This means that the tax authorities will only conduct unscheduled checks of cash registers, about which the controlled person is not notified.

Tax authorities will be able to carry out control (supervisory) activities at the location of the taxpayer or at the location where the online cash register is installed (including in residential premises) (clause “b”, clause 1, clause “a”, clause 2, clause 3 of Art. 60 of Law No. 170-FZ).

The new regulation on control and supervision in the field of CCP must be approved by the Government.

According to the project, the following unscheduled control (supervision) activities are possible:

- test purchase,

- documentary check,

- monitoring compliance with mandatory requirements,

- on-site examination.

Do I need to change the fiscal drive now?

The key fact in the procedure for switching to online cash registers with FN-M from August 6, 2022 is that the Federal Tax Service has stopped registering drives of previous formats. Thus, wholesalers will be able to return unsold outdated FNs to their manufacturers , because no one will buy such devices anymore.

Algorithm of actions for switching to FFD 1.2

But what to do with those fiscal drives that are already working in cash registers? There are two options here:

- You sell labeled products. In this case, it is necessary to purchase, install and register the FN-M from August 6. Selling without it, you are guaranteed to receive a fine. Online checkout software must be updated to the new format by November 6th.

- You do NOT sell labeled products. In this case, you don’t have to worry about anything and continue using your old online cash register. The Federal Tax Service allowed entrepreneurs to use old drives before their expiration date. But given that labeling needs to be applied to clothing, shoes and dairy products, most entrepreneurs will actually have to switch to fiscal drives with format 1.2.

Monitoring compliance with mandatory requirements

Monitoring compliance with mandatory requirements means the collection and analysis of data on objects of control available to the control (supervisory) body, including data that:

- come in the course of interdepartmental information interaction;

- provided by controlled persons as part of the fulfillment of mandatory requirements;

- contained in state and municipal information systems;

- posted on the Internet;

- obtained from automatic cameras recording offenses.

If during the observation facts of harm (damage) or a threat of harm (damage) to legally protected values, information about violations of mandatory requirements or impending violations of mandatory requirements are revealed, the inspection may make a decision:

1) on carrying out an unscheduled control (supervisory) event;

2) the decision to issue a warning;

3) other decisions that will not entail interaction with the controlled person.

The nuances of using online cash registers

So, the trading company registered online cash registers in a new way. What do cashiers need to know? Here are a few important rules:

- the cash register must be used at the place of settlement with the buyer (client) at the time of settlement by the same person who makes settlements with the buyer (client), with the exception of settlements made by electronic means of payment on the Internet;

- your cash register must be connected to the Internet;

- On some cash registers you need to enter a password or use a special card before starting work.

Before starting settlements, the cashier must generate a report on the opening of a shift, and upon completion of settlements, a report on closing a shift. In this case, a cash receipt (CSR) must be generated no later than 24 hours from the moment the report on the opening of the shift is generated.

You also need to know that all payments from online cash registers are transferred through the OFD to the Federal Tax Service. And the check can now be not only paper, but also electronic.

If there is a connection failure, the online cash register will process checks for another 30 days, and then it will be blocked. As soon as the connection appears, all punched checks will be transmitted on a first-come, first-served basis through the OFD to the Federal Tax Service. You can obtain information about the functionality of the cash register and the possibility of data transfer in the Personal Account of the OFD “Takskom”.

Keep in mind! The fiscal drive of the cash register must ensure storage in an uncorrected form of reports on the opening/closing of shifts, cash receipts (CSR), reports on the current status of settlements, operator confirmation and other fiscal documents for 30 calendar days. This is established by paragraph 4 of Article 4.1 of the Federal Law of May 22, 2003 No. 54-FZ (as amended by the Federal Law of July 3, 2016 No. 290-FZ).

On-site examination

During an on-site inspection, the following control (supervision) actions can be performed in publicly accessible (open to the public) areas:

1) inspection;

2) sampling (samples).

The on-site examination is carried out without prior notification to the controlled person.

If, as part of an on-site inspection, signs of violations of mandatory requirements are identified, the official has the right to immediately conduct a test purchase. The test purchase is carried out without making a decision and without agreement with the prosecutor's office.

Sampling (samples) is carried out in the presence of a controlled person or his representative and (or) using video recording.

Issuing cash receipts

Even though sales information is transmitted online, issuing a paper receipt is still required.

54 of the Law on Cash Registers provides for new mandatory details on checks:

- calculation indicator (income or expense);

- date, time and place of settlement;

- applicable tax system;

- serial number of the fiscal drive;

- range of goods (services);

- calculation amount with a separate indication of the VAT rate and amount;

- calculation form;

- FN serial number;

- CCP registration number;

- OFD website address;

- fiscal sign of the document;

- serial number of the fiscal document;

- shift number;

- fiscal sign of the message.

If the buyer wants to receive a check by email or SMS, then his email address or phone number is indicated. Also in this case, the email address of the check sender is indicated.

What you need to know about online cash registers in 2022

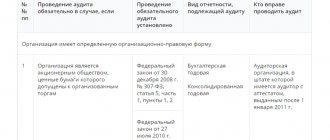

- An online cash register is an electronic device that issues a receipt to the buyer and informs the tax service about the sale.

- Almost all types of businesses that work with individuals have already switched to cash registers.

- If an individual entrepreneur or LLC does not use an online cash register, the entrepreneur will be fined; if the violation is repeated, the activity will be stopped.

- There is still a deferment for online cash registers for individual entrepreneurs without employees until July. Later, they are required to buy a cash register or start working as self-employed.

- Being self-employed has many restrictions; this status is not suitable for many entrepreneurs by law. Buying an online cash register is often more profitable.

- It is better to set up the cash register in advance to avoid fines. You can buy everything you need at once and register online.

Fine for lack of online cash register 2022

If an entrepreneur does not use a cash register in his work, he can be heavily fined. The tax office finds out about this during a test purchase or following a buyer’s complaint.

Online cash register for individual entrepreneurs in 2022 - fine.

For activities without an online cash register, you are fined 25-50% of the amounts spent past the cash register. The minimum fine is 10 thousand rubles. If an entrepreneur is caught a second time and the total amount of violations reaches 1 million rubles, his work may be suspended for 90 days.

For LLC.

A legal entity is fined 75-100% of the amount over the counter, no less than 30 thousand rubles. In case of repeated violation, the operation of the enterprise will also be stopped for 90 days.

In fact, the maximum fine for working without a cash register is unlimited - it depends only on how much the entrepreneur managed to sell without registering at the cash register.

Minor violations are fined separately if:

- use an outdated or unregistered cash register - 1.5-3 thousand rubles. for individual entrepreneurs, 5-10 thousand rubles. for LLC.

- failure to issue a paper or electronic check to the buyer - 2 thousand rubles. for individual entrepreneurs, 10 thousand rubles. for LLC.

With a cash register, all these fines can be easily avoided.

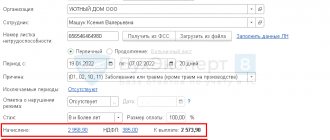

Postponement of the transition to online cash registers until 07/01/2021

In accordance with the new rules, individual entrepreneurs who do not have employees with whom employment contracts have been concluded have received the right not to use cash register systems when paying for goods, work and services until July 1, 2022 (Article 2 of Federal Law dated 06.06.2019 No. 129-FZ ).

But the deferment does not apply to all individual entrepreneurs without hired employees. To be able to work without an online cash register for another year, an individual entrepreneur must meet some mandatory requirements:

- provide services/perform work personally, without hiring employees;

- When selling goods, sell goods exclusively of own production.

Thus, if an individual entrepreneur is engaged in the resale of goods, the deferment does not apply to him, even if he has no other employees. If an individual entrepreneur independently, for example, makes repairs or sells, say, furniture of his own production, then he has the right not to use cash register until 07/01/2021.

| Who received a deferment of the transition to cash register until July 1, 2021 | Individual entrepreneurs without employees, independently providing services/performing work |

| Individual entrepreneurs without employees, selling their own products | |

| Who was exempted from using CCT? | Partnerships/cooperatives of property owners when accepting utility payments and paying for the services of the partnership/cooperative by the population |

| Educational organizations when paying for educational services to the population | |

| Physical education and sports organizations when paying for services in the field of physical education and sports | |

| Cultural organizations when paying for services in the field of culture | |

| Individual entrepreneurs selling theater tickets by hand or from a tray |

In this case, individual entrepreneurs lose the right to this deferment when hiring employees. If an employment contract is concluded, even with one employee, individual entrepreneurs are required to purchase and register a cash register no later than 30 calendar days from the date of conclusion of the contract.

Note that Federal Law No. 129-FZ dated June 6, 2019 speaks specifically about employment contracts. That is, theoretically, individual entrepreneurs, in order to obtain a deferment in the transition to online cash register systems, are not prohibited from hiring employees under GPC agreements. For example, under a contract or paid services.

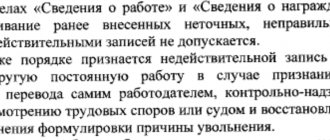

But this does not mean that tax authorities will not be able to re-qualify a work contract into an employment contract in court and impose on such individual entrepreneurs the obligation to use cash register systems as early as 07/01/2019.

Using cash registers and sending a cash receipt upon receipt of payment from third parties

Who should I send the check to if:

- an individual pays for another individual organization to a bank account

- for a non-resident (legal entity) an individual (third party) pays for the service

- settlement between an individual and a legal entity, paid by a relative or other third party

When making a payment, the user is obliged to issue (send) a cash receipt (CSR) to the buyer (client).

For the purposes of using cash registers, it is important not for whom the payment was made, but by whom exactly and in what way. The buyer (client) should be understood as an individual or legal entity who pays for goods, work or services.

In this regard, if an individual pays for a legal entity, then such a settlement will be identified as a settlement with an individual, which will require the use of a cash register and the generation of a cash receipt.

At the same time, when making non-cash payments, which exclude the possibility of direct interaction between the buyer (client) and the user or his authorized person, organization (individual entrepreneur), all measures must be taken to obtain the buyer’s (client’s) data for sending a cash receipt. This position is set out in the letter of the Ministry of Finance of Russia dated November 23, 2018 No. ED-4-20/22775.

That is, if payment is received for the item of payment from a third party, for example, a relative of the person with whom the agreement was concluded, a cash receipt must be issued and sent to the payer.

When accepting funds into a current account, does a housing cooperative have to punch a check? The money comes from residents.

In accordance with paragraph 13 of Article 2 of Federal Law No. 54-FZ, CCT may not be used when making payments by housing cooperatives for the provision of services to their members within the framework of the statutory activities of cooperatives, as well as when accepting payments for residential premises and utilities.

At the same time, the provisions of paragraph 13 of Article 2 of Federal Law No. 54-FZ do not apply to cash payments, as well as payments with the presentation of an electronic means of payment, subject to direct interaction between the buyer (client) and the user of cash register equipment.

Name of the item of payment in the cash receipt

How unique should the name of a product or service be on a receipt? For example, if, so to speak, a “meat grinder” is sold, is this name on the receipt sufficient if there are no other products with the same name in the assortment? Or do you need to specify the name of the product in any case?

In accordance with paragraph 1 of Article 4.7 of Federal Law No. 54-FZ, a cash receipt (CSR) must contain the name of goods, work, services (if the volume and list of services can be determined at the time of payment), payment, payment.

At the same time, Federal Law No. 54-FZ does not contain provisions specifying the requirements for the “name of goods (works, professional income tax)” in relation to income subject to professional income tax (clause 2.2 of Article 2 of Federal Law No. 54-FZ).

The buyer pays for the goods at the checkout and then goes to pick it up at the warehouse (about 30-50 minutes will pass from the moment of payment to the moment of receipt). Do you need to generate two checks (prepayment at the cash register and then Full payment at the warehouse) or is one enough at the cash desk immediately for Full payment?

Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] provides for the corresponding characteristics of the payment method (tag 1214), including “full advance payment before the transfer of the subject of payment - 100% advance payment”, “advance payment”, “full payment, including taking into account the advance payment (prepayment) at the time of transfer of the subject of payment - full payment.”

Thus, if payment for the subject of payment occurs before the moment of its transfer, then the indicator of the payment method “100% prepayment” or “advance payment” should be used if the name and volume of services are unknown at the time of payment.

When selling premises, a plot of land, or a residential building to an individual, is it necessary to have an online cash register of the organization when money is received into the organization's current account? If so, what is the sign of advance or sale? The transfer and acceptance certificate is signed on the day the funds arrive, and registration for the new owner occurs 14 days later.

Cash register equipment is used when receiving money for goods, including real estate under sales contracts.

Housing services (maintenance of common property of apartment buildings), simplified tax system for income and expenses. QUESTION. Is it necessary to generate checks for prepayment and offset of prepayment if the payer is an individual? the person pays for the services of the current month. For example, 08/13/2020 — pays for the service for August 2022. fully?

Upon transfer of the subject of payment (issuance of an invoice for housing and communal services), a second cash receipt is generated with the sign of the payment method “full payment” indicating the previously paid amount.

In turn, if the day of payment and shipment coincide, income for tax purposes is recognized on the cash basis, then with the consent of the client, the cash register user can generate one check with the sign of the payment method “full settlement” at the time of receiving 100% prepayment.

Regarding payments (cash or using electronic means of payment) between legal entities, does the CCT not apply in this case?

In accordance with paragraph 9 of Article 2 of Federal Law No. 54-FZ, CCT does not apply when making non-cash payments between organizations and (or) individual entrepreneurs, with the exception of settlements carried out by them using an electronic means of payment with its presentation.

In this regard, when making payments in the form of loans to pay for goods (works, services), offset of prepayment and (or) advances, counterclaims between organizations and (or) individual entrepreneurs, the use of cash register equipment is not required.

Our organization is an agent. We are engaged in booking air tickets. Very often there are such cases: the buyer gives an order to book an air ticket, we process it. Then, without paying for it yet, he refuses it after a few days. How many checks should we punch in this case? Only for your fee, when the buyer actually brings the money? Or 3 checks: 1 - at the time the ticket is issued (with a credit sign), 2 - at the time the ticket is returned (credit refund) and 3 - when the buyer brings money to pay our fee for issuing the ticket?

Payments mean, in particular, the acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, work, services, as well as the acceptance (receipt) and payment of funds in the form of advance payment and (or) advances , offset and return of prepayment and (or) advances, provision and repayment of loans to pay for goods, work, services, or provision or receipt of other consideration for goods, work, services.

Thus, cash register is used, in particular, when accepting funds for goods, work, services, including in the form of advance payment, when offsetting (returning) advance payment upon shipment of goods, performance of work, provision of services.

In this case, when booking (temporarily reserving a place in an automated system), payment or transfer of the item of payment does not occur, and accordingly, the obligation to use cash register does not arise.

However, if the reservation is a separate paid service, then the cash register is applied in the generally established manner.