Let's figure out why an organization needs authorized capital, what it actually is and how you can manage it.

From Article 66.2 of the Civil Code and Article 14 of the Law “On LLC” we can conclude that the authorized capital (AC) is the minimum amount, expressed in rubles, intended to ensure the property interests of the company’s creditors.

The authorized capital is expressed in shares or percentages. Each participant owns part of the capital.

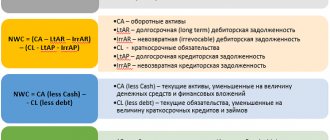

The value of each share can be nominal or real. The nominal is simply a part of the capital, proportional to the size of the share of the company participant. The actual value of the share is calculated based on the net asset value (NA) in proportion to the participant's share.

Example: The authorized capital of Palma LLC is 50 thousand rubles.

The cost of the private equity company is 65 million rubles.

Number of participants - 5, equal shares, 20% each.

The nominal value of the share is 10 thousand rubles (50 thousand rubles * 20%).

The actual cost of the share is 13 million rubles (65 million rubles * 20%).

What should be the minimum size of the charter capital?

For joint stock companies and LLCs - at least 10,000 rubles.

For a public joint stock company - 100,000 rubles.

There are also special rules for certain types of organizations.

So, for example, for a private security organization that provides services for armed security of property, the Criminal Code cannot be less than 250 thousand rubles (Part 1 of Article 15.1 of the Law of the Russian Federation No. 2487-1 “On Private Detective and Security Activities in the Russian Federation”) .

And the minimum for an organizer of gambling in a bookmaker’s office or totalizator is 100 million rubles (Part 9, Article 7 of Federal Law No. 244 “On State Regulation of Gambling”).

The minimum size determines the threshold below which the authorized capital cannot be reduced.

Postings on authorized capital

Accounting for the authorized capital is carried out on account 80. The credit balance of the account must be equal to the amount of capital specified in the charter, and entries in the account are made after fixing the amount in the constituent documents. The accountant makes entries to account 80 when depositing capital and when it changes.

Here is a list of typical transactions when working with capital:

- reflects the amount of capital specified in the charter: Dt 75 - Kt 80

- capital contributions made: Dt 08, 10, 41, 50, 51, 52 - Kt 75

- reduction of capital upon return of the share to the founder: Dt 80 - Kt 75

- reduction of capital without return of share: Dt 80 - Kt 84

- reduction of capital by canceling the organization’s share: Dt 80 - Kt 81

- increase in capital due to additional deposits: Dt 75 - Kt 80

- increase in capital due to retained earnings: Dt 84 - Kt 80

- increasing the authorized capital due to additional capital: Dt 83 - Kt 80

In the balance sheet, the authorized capital is reflected in section III “Capital and reserves” on the liability side of the balance sheet. If there is outstanding debt of the founders, it is reflected in section II “Current assets”.

Work with authorized capital, keep records, pay salaries and taxes, submit reports in the modern web service Kontur.Accounting. A simple and understandable system, automation of routine operations, automatic generation of reports saves time and helps you work without errors. The first 14 days are free for all newbies.

What can be contributed to the authorized capital

The management company can be paid both in cash and in non-monetary contributions:

- things, property (for example, a car, real estate, equipment, etc.);

- shares in other authorized capitals, stocks, shares, if the statutory documents of other companies and partnerships allow such manipulations;

- bonds - state and municipal;

- intellectual rights, rights under licensing agreements (for example, you can contribute the right to a trademark).

Important! The minimum amount of the authorized capital must be paid exclusively in cash (Clause 2 of Article 66.2 of the Civil Code of the Russian Federation).

With the addition of property to the authorized capital, its participant loses the right of ownership of his property. We also find confirmation of this conclusion in judicial practice: see Resolution of the Federal Antimonopoly Service of the Moscow District dated July 15, 2011 No. KG-A41/6740-11 in case No. A41-22744/10, Resolution of the Federal Antimonopoly Service of the Ural District dated November 15, 2007 No. F09-9287/07 -C4.

In return, the participant acquires obligatory rights in relation to the company:

- To receive part of the company's profit in the form of dividends.

- The right to participate in the management of the organization's affairs.

- During liquidation, a participant receives part of the property remaining after the company pays its creditors.

Do you own a share in an LLC and want to learn about what is happening in the organization, not only at the annual meeting? Do you manage the company and are afraid of risks when working with counterparties? Use the Taxcom-Dossier . Find out everything about the reliability of the company, its finances, litigation, changes in the Unified State Register of Legal Entities.

The decision of the meeting of participants to repay the company’s share by reducing the capital

Regulatory regulation

The share of the withdrawing participant, by decision of the general meeting of participants, must be distributed among all participants of the company in proportion to their shares in the authorized capital (AC) or offered for purchase to participants or third parties, unless this is prohibited by the charter of the company (clause 1, article 20, clause 2 Article 24 of the Federal Law of 02/08/1998 N 14-FZ).

If this is not done within a year, then the share of the withdrawing participant is repaid by reducing the authorized capital (paragraph 2, paragraph 8, article 23, paragraph 2, 5, article 24 of the Federal Law of 02/08/1998 N 14-FZ).

In accounting, transactions related to changes in the amount of the authorized capital, registration of changes in the charter, are reflected on the date of making an entry in the Unified State Register of Legal Entities (clause 4 of article 12 of the Federal Law of 02/08/1998 N 14-FZ, clause 2 of article 11 of the Federal Law dated 08.08.2001 N 129-FZ).

BOO

When reducing the capital by redeeming the company's share, an expense is generated in the amount of the difference between the actual and nominal value of the share, which is related to other expenses.

The following entries are generated in accounting (Instructions for using the chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation October 31, 2000 N 94n):

- Dt 80.09 Kt 81.09 - by the amount of reduction in the capital: in the amount of the nominal value of the share.

- Dt 91.02 Kt 81.09 - in the amount of the difference between the actual and nominal value of the share.

WELL

Costs associated with reducing the capital capital cannot be recognized as NU expenses: they do not correspond to the concept of economically justified expenses, because are not aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Let's calculate how the size of the participants' shares will change after the repayment of the share of the withdrawing participant transferred to the company due to a decrease in the capital.

The size of the participants' shares has changed, but their nominal value remains the same.

Accounting in 1C

Because the share is not sold or distributed, then it is repaid by reducing the authorized capital. This means that income and expenses are not generated for tax accounting purposes (Letter of the Ministry of Finance of the Russian Federation dated October 29, 2018 N 03-03-06/1/77371).

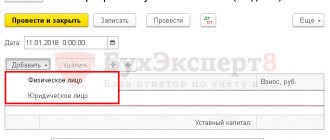

Redemption of a share by reducing the authorized capital is formalized using the Transaction document entered manually in the Transactions – Transactions section.

Please indicate:

- Date – the date of amendments to the Unified State Register of Legal Entities.

In the postings:

- repayment of the company's share: Debit – 80.09;

- Subconto is the name of the LLC, i.e. our organization;

- Credit – 81.09;

- Subconto – the name of the participant whose share has transferred to the company;

- Amount – the nominal value of the redeemed share.

- Debit– 91.02;

Control

Let's check the reduction of the capital and the repayment of the company's share with the report Turnover balance sheet for account 80.09 in the Reports .

Let's make sure that account 81.09 is closed.

See also:

- Withdrawal of a participant from the society

- Sale of a company share to other participants

- Distribution of the share of a withdrawn LLC participant among other participants

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Distribution of the share of a withdrawn LLC participant among other participants Let’s continue the analysis of the situation from the article Withdrawal of a participant from the company and...

- Formation of the authorized capital of a Limited Liability Company The authorized capital of an LLC is part of the company’s funds contributed during its…

- Net assets, reduction of authorized capital You do not have access to view To gain access: Complete a commercial...

- Test No. 7. Formation of authorized capital in LLC...

Rules for making contributions to the management company

As a general rule, ¾ of the authorized capital must be contributed before the registration of a business company / partnership, and ¼ - during the first year of operation of the company, unless otherwise provided by special laws (Part 4 of Article 66.2 of the Civil Code of the Russian Federation).

For an LLC , the authorized capital must be paid within the terms specified in the agreement on establishment, but no later than 4 months from the date of state registration of the company (Part 1, Article 16 of the Federal Law “On LLC”).

For JSC - at the discretion of the founders: in accordance with the terms of the establishment agreement (Part 5, Article 9 of the Federal Law “On JSC”).

Non-monetary contributions to the management company must be assessed in advance. If the size of the deposit (nominal value) is less than 20 thousand rubles, then a unanimous decision of the participants on its value is sufficient.

If the nominal value of the deposit is above 20 thousand rubles, an independent appraiser must be hired for the assessment.

To everyone and everyone - we are reducing the authorized capital

Reducing the authorized capital is not the best indicator of financial and economic activity. However, it will not be possible to hide this fact. Within the deadlines established by law, changes will have to be registered, and the decision made to reduce the authorized capital will have to be announced.

Currently, the Company is obliged, within 30 days from the date of the decision to reduce its authorized capital:

- notify in writing about the reduction of his authorized capital

and its new amount to all creditors of the company known to him; - publish a message

about the decision made in the press, which publishes data on state registration of legal entities.

The company's creditors have the right, within 30 days from the date of notification to them or within 30 days from the date of publication of the message about the decision made, to demand in writing the early termination or fulfillment of the relevant obligations of the company and compensation for losses.

State registration of a decrease in the authorized capital of a company is carried out only upon presentation of evidence of notification of creditors in the manner established by paragraph 4 of Article 20 of Law No. 14-FZ.

Documents for state registration of changes made to the company's charter in connection with a decrease in the authorized capital of the company and changes in the nominal value of the shares of the company's participants must be submitted to the body carrying out state registration of legal entities within one month from the date of sending the last notice to creditors about the reduction in the authorized capital of the company and about its new size.

For third parties, such changes become effective from the moment of their state registration (clause 4 of article 20 of Law No. 14-FZ).

Certification of the fact of contribution of property to the authorized capital

In practice, the question often arises: what documents prove the fact of payment of the company’s authorized capital.

To do this, let us turn to the Letter of the Federal Tax Service of Russia (FTS of Russia) dated December 13, 2005 No. ШТ-6-07/1045 “On documents confirming payment of the authorized capital.”

According to the explanations of the Federal Tax Service of Russia, the fact of payment of the authorized capital in money is confirmed by a certificate signed by the head and accountant of the bank in which the current account for payment of the authorized capital is opened. If money is transferred to the organization’s cash desk, then copies of the primary payment documents will serve as evidence of the fact of payment.

In the event that the authorized capital is paid in kind , the supporting documents will be:

- property assessment report and

- act of acceptance and transfer of property from a participant to the company.

estate is contributed to the authorized capital , then the fact of payment of the authorized capital will be certified by a certificate of ownership, and not by a transfer deed (see Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated September 29, 2010 in case No. A43-45379/2009).

Procedure for reducing the authorized capital

The following procedure for reducing the amount of capital is relevant:

- Convening a meeting of participants.

- Sending notification of changes to the tax office . It must be sent within three days after the meeting at which the relevant decision was made. The notification is drawn up in form P14002. The director signs the application.

- Sending notices to creditors . The announcement of changes is published in the State Registration Bulletin.

- Submitting papers to the Federal Tax Service to register the reduction . The Inspectorate of the Federal Tax Service is provided with the minutes of the meeting, the new Charter of the organization, a receipt for payment of the fee, a statement of changes, and the journal “Bulletin” in which the corresponding announcement was published. In the event that the procedure is carried out due to the ratio of the capital and net assets, you must also submit a calculation of the value of the assets.

- Receiving documents on changes in capital . The new charter and extract from the Unified State Register of Legal Entities are provided by the tax office within 5 days.

The procedure is quite simple, but it is important to follow all the nuances. You cannot skip items, otherwise the changes will be considered illegal.

Reflection of the authorized capital in accounting

The authorized capital in the company’s balance sheet is located in the “Liabilities” section and occupies line 1310 (see figure below).

In accounting, the amount of the authorized capital is recorded in account 80 “Authorized capital”. It reflects the size of the authorized capital specified in the company’s constituent documents and representing the totality of contributions of all founders (participants) of the organization (regardless of payment of shares).

It is more convenient to conduct accounting in the 1C Accounting program. Its installation, configuration and subsequent support will be undertaken by Taxcom .

Participate in the promotion, open a bank account and connect to 1C:Fresh at a super price. Details here .

Reduction of the authorized capital in connection with the sale of a property owned by the LLP

After state registration of the purchase and sale agreement, the property is removed from the ownership of the LLP and becomes the property of the new owner.

According to current legislation, a decrease in the authorized capital is not required in this case.

However, if the size of the authorized capital of the LLP is quite large, it makes sense to think about reducing the size of the authorized capital for the following reasons:

To consider this issue, it is necessary to refer to the definition of the concept of “limited liability partnership”.

According to Article 2 of the Law of the Republic of Kazakhstan “On Limited and Additional Liability Partnerships”:

A limited liability partnership is a partnership established by one or more persons, the authorized capital of which is divided into shares of sizes determined by the constituent documents; Participants in a limited liability partnership are not liable for its obligations and bear the risk of losses associated with the activities of the partnership, within the limits of the value of the contributions they made . Exceptions to this rule may be provided for by the Civil Code of the Republic of Kazakhstan and this Law.

Participants of the partnership who have not fully contributed to the authorized capital are jointly and severally liable for its obligations to the extent of the value of the uncontributed portion of the contribution of each participant.

The amount of contributions made and, accordingly, the amount of liability of the sole participant of the LLP is determined by the size of the authorized capital. For example, if the charter of a LLP provides for an authorized capital of 1,000,000 tenge, then the founder (participant) of this LLP will be liable within this amount. The sale of property owned by the LLP does not affect the size of the authorized capital in any way. That is, when a property is sold, the size of the authorized capital does not automatically change.

The authorized capital is regulated by Article 23 of the Law of the Republic of Kazakhstan “On Limited and Additional Liability Partnerships”:

Formation of the authorized capital of a limited liability partnership

1. The authorized capital of a limited liability partnership is formed by combining the contributions of the founders (participants).

2. The initial size of the authorized capital is equal to the amount of contributions of the founders and cannot be less than an amount equivalent to one hundred times the monthly calculation index on the date of submission of documents for state registration of the partnership, with the exception of a limited liability partnership that is a small business entity , as well as state Islamic special financial companies whose minimum authorized capital is determined by the zero level .

3. A contribution to the authorized capital of a limited liability partnership can be money, securities, things, property rights, including land use rights and the right to the results of intellectual activity and other property (with the exception of special financial companies created in accordance with the legislation of the Republic of Kazakhstan on project financing and securitization, Islamic special financial companies created in accordance with the legislation of the Republic of Kazakhstan on the securities market, the authorized capital of which is formed exclusively in money, as well as cases provided for by the Law of the Republic of Kazakhstan “On Banks and Banking Activities in the Republic of Kazakhstan”.

Contributions in the form of personal non-property rights and other intangible benefits are not allowed.

4. Contributions of founders (participants) to the authorized capital in kind or in the form of property rights are valued in monetary form by agreement of all founders or by decision of the general meeting of participants of the partnership. If the value of such a deposit exceeds an amount equivalent to twenty thousand monthly calculation index, its assessment must be confirmed by an appraiser.

5. In cases where the right to use property is transferred to the partnership as a contribution, the amount of this contribution is determined by the fee for use calculated for the entire period specified in the constituent documents.

Without the consent of the general meeting, early withdrawal of property, the right to use of which serves as a contribution to the authorized capital of the partnership, is not permitted.

Unless otherwise provided by the constituent documents, the risk of accidental loss or damage to property transferred for use to the partnership rests with the owner of the property.

6. Unless otherwise provided by the constituent agreement, the ratio of the contribution of each participant to the total amount of the authorized capital is the participant’s share in the authorized capital.

Any change in the size of the authorized capital associated with the admission of new participants to the limited liability partnership or the retirement of any of the former participants from the partnership entails a corresponding recalculation of the participants’ shares in the authorized capital at the time of admission or retirement.

7. The allocation of a land plot in kind, the right to which has been transferred as a contribution to the authorized capital of the partnership (including the right to a conditional land share), is carried out in accordance with the land legislation of the Republic of Kazakhstan.

If a LLP wishes to change the size of its authorized capital downward, the law provides for the following procedure.

Reducing the authorized capital of a limited liability partnership

1. A reduction in the authorized capital of a limited liability partnership can be carried out by proportionally reducing the size of the contributions of all participants in the partnership or by fully or partially repaying the shares of individual participants.

2. When the authorized capital is reduced by redeeming the share of a participant, the shares of the remaining participants change proportionately.

3. From the moment the general meeting of participants of a limited liability partnership makes a decision to reduce the authorized capital, the partnership is obliged to inform creditors about this decision for obligations arising after the decision is made.

4. Within two months from the date the general meeting of participants of a limited liability partnership makes a decision to reduce the authorized capital, the partnership is obliged to send all its creditors written notices about the reduction of the authorized capital or place a corresponding announcement in the official publication in which information about the partnerships is published. Creditors of the partnership have the right, within a month from the date of receipt of the notice or publication of the announcement, to demand from the partnership additional guarantees or early termination or fulfillment by the partnership of relevant obligations and compensation for losses. Requirements are sent to the partnership in writing, and their copies can be submitted to the body that carried out the state registration of the partnership.

5. A decrease in the authorized capital of a limited liability partnership is registered by the body that carried out the state registration of the partnership after the expiration of the period given to creditors for filing claims against the partnership (clause 4 of this article). If the body that carried out the state registration of the partnership has received copies of the claims of its creditors, the decrease in the authorized capital is registered subject to the partnership providing evidence of the fulfillment of these requirements or the absence of any objections from the creditors who submitted them to the registration of the reduction in the authorized capital of the partnership.

6. If, within six months from the date the general meeting of participants of a limited liability partnership made a decision to reduce the authorized capital, the partnership does not submit an application for re-registration or does not provide the necessary evidence (clause 5 of this article), the reduction of the authorized capital is considered failed. In this case, a decrease in the authorized capital can be made only by a new decision of the general meeting of participants of the partnership in compliance with the requirements of this article.

7. A decrease in the authorized capital in case of violation of the procedure established by this article is the basis for the liquidation of the partnership by a court decision at the request of interested parties.

8. A limited liability partnership has the right to make payments to its participants in connection with a decrease in the authorized capital only within the limits of the part of net assets exceeding the new amount of the authorized capital. Payments are made after registering a decrease in the authorized capital within the period established by the charter of the partnership or a decision of the general meeting on reducing the authorized capital, but no later than three months from the date of registration.

Payments are made according to the size of the shares of the partnership participants.

9. A decrease in the authorized capital can be carried out only after the participants have made their contributions to the full amount of the authorized capital stated in the constituent documents, with the exception of the case provided for in part two of paragraph 4 of Article 24 of this Law.

In connection with the above, in order to reduce the authorized capital of a LLP it is necessary:

1) Approve the decision of the sole participant to reduce the size of the authorized capital of the LLP.

2) Notify creditors within 2 months (send written notices to all creditors about the reduction of the authorized capital or place a corresponding announcement in the official publication - the corresponding newspaper of the republican level).

3) Submit an application for re-registration to the registering authority (in accordance with paragraph 6 of Article 42 of the Civil Code of the Republic of Kazakhstan, if the size of the authorized capital of the LLP is reduced, it is subject to state re-registration).

The application for re-registration is submitted through the Public Service Center.

Change in the size of the authorized capital

The authorized capital is not a static value; it can be changed either upward or downward.

Taking into account the guarantee function of the authorized capital, it is logical to assume that a company with an authorized capital of 200,000 rubles will inspire more confidence among counterparties than a company with a capital of 10,000 rubles.

Important! It is possible to increase the authorized capital only after it has been fully paid (Clause 1, Article 17 of the Federal Law “On LLC”).

Reducing the authorized capital is an even more complicated procedure.

Firstly, it reflects (negatively) on the interests of creditors. After all, when capital decreases, assets decrease and funds are withdrawn.

Secondly, the company’s reputation and its position in the market may suffer. For example, suppliers will decide that the company's financial position is unstable.

It is impossible to reduce the capital if its size becomes less than the established minimum.

It is not only possible to reduce the authorized capital, but in some cases defined by law, it is necessary.

Cases of mandatory reduction of the authorized capital, in particular, include the situation when, for the last 3 reporting years in a row, the value of the company’s private capital was lower than the size of the authorized capital (clause 6, article 35 of the Federal Law “On JSC”, clause 4, article 30 Federal Law "On LLC").

Understanding the essence of the processes of reducing and increasing the authorized capital is necessary to avoid mistakes in the company's work.

Thus, in judicial practice there are cases when the parties mistakenly considered the donation (alienation) of real estate as a reduction of the authorized capital (see Resolution of the Federal Antimonopoly Service of the Far Eastern District dated June 16, 2008 No. F03-A24/08-1/2071 in case No. A24-4446/ 07-07).

The court refuted this conclusion and concluded that the authorized capital represents a conventional unit constituting the initial amount of the nominal value of the participants' shares. For this reason, the amount of the authorized capital may change both upward and downward.

How to reduce the authorized capital of a joint stock company

Lawyer Antonov A.P.

1. When a JSC reduces its authorized capital, the Company reduces its authorized capital in the following cases (clause 1 of Article 29 of the Law on JSC): 1) this is its obligation by force of law. Such an obligation arises if: • the JSC has not, within a year, sold the shares placed upon establishment that were transferred to it due to non-payment by their shareholders (Clause 1, Article 34 of the Law on JSC); • the value of the net assets of the JSC at the end of the year following the second reporting year or each subsequent year turns out to be less than the authorized capital of the JSC (if of the two possible decisions - to reduce the authorized capital or voluntary liquidation - the company made the first) (clause 6 of Article 35 of the Law about JSC). Note! If the value of the net assets of a JSC is less than the size of its authorized capital at the end of 2022, then such a decrease is not taken into account for the purposes of clause 6 of Art. 35 of the Law on JSC (Part 2 of Article 12 of Federal Law dated 04/07/2020 N 115-FZ); • The JSC acquired (repurchased) or received its shares as a result of the merger of another company and did not sell them after a year from the date of acquisition (redemption) (clause 4.1 of article 17, clause 3 of article 72, clause 6 of article 76 of the Law about JSC); 2) on your own initiative. Please note that you can reduce the authorized capital only to the minimum amount - 10,000 rubles. for non-public joint-stock companies and 100,000 rubles. for PJSC. But if a JSC reduces its authorized capital in connection with the performance of an obligation, then it can reduce it to the minimum amount established by the legislation in force at the time of the creation of the company. For example, if a closed joint-stock company was created in April 1998, then its authorized capital can be reduced to 100 minimum wages as of this date, that is, to 8,349 rubles. (Article 26, paragraph 1 of Article 29 of the Law on JSC). For credit institutions, special minimum values of authorized capital have been established (Article 11 of the Law on Banks and Banking Activities).

2. How can a JSC reduce its authorized capital by reducing the par value of shares? To implement this method, you need to make a decision at a general meeting of shareholders, notify the registration authority and creditors of the decision, enter information into the EFRSFYUL, register changes to the decision to issue securities and register the changes in the company's charter regarding the size of the authorized capital.

2.1. How to make a decision to reduce the authorized capital by reducing the par value of shares Such a decision must be made at a meeting of shareholders by a 3/4 majority vote of shareholders - owners of voting shares participating in the meeting. If a JSC has a board of directors, then the meeting makes decisions only on its proposal (clause 3 of Article 29 of the Law on JSC). The decision adopted at the general meeting of shareholders is documented in minutes.

Contents of the decision to reduce the authorized capital by reducing the par value of shares When drawing up the minutes, be guided by the general requirements for its content. The decision to reduce the authorized capital may provide for compensation for shareholders for a reduction in the nominal value and (or) the transfer to them of equity securities owned by the company placed by another legal entity. Accordingly, the decision must determine (clause 3 of Article 29 of the Law on JSC): • the amount by which the authorized capital of the company is reduced; • categories (types) of shares, the par value of which is reduced, and the amount by which the par value of each share is reduced; • par value of shares of each category (type) after its reduction; • the amount of money paid to the company's shareholders when the par value of each share is reduced, and (or) the number, type, category (type) of issue-grade securities transferred to the company's shareholders when the par value of each share is reduced.

2.2. How to notify the registering authority and creditors about the decision to reduce the authorized capital by reducing the par value of shares and enter information into the EFRSFYUL For this (clause 1, article 30 of the Law on JSC, paragraph “n. 7”, paragraph 7, paragraph p. 8, 9, Article 7.1 of the Law on State Registration of Legal Entities and Individual Entrepreneurs): • submit to the registration authority an application in form N P13014 and a decision to reduce the authorized capital. This must be done within three working days after such a decision is made. Documents are submitted in the same way as for state registration of changes to the Unified State Register of Legal Entities; See also: How to fill out an application in form N P13014 for entering into the Unified State Register of Legal Entities information about the presence of a business company in the process of reducing the authorized capital • after making an entry in the Unified State Register of Legal Entities about the location of the joint-stock company in the process of reducing the authorized capital, publish a message in the “Bulletin of State Registration”, and after month, post a repeat message (clause 1 of the Order of the Federal Tax Service of Russia dated June 16, 2006 N SAE-3-09 / [email protected] ). The form of the message and the procedure for its placement are given on the website of the “Bulletin of State Registration” - https://www.vestnik-gosreg.ru/order_filing_messages/; • submit a notification to the EFRSFYUL about the reduction of the authorized capital. Indicate in it, in particular, the method, procedure and conditions for reducing the authorized capital, the procedure, terms and conditions for filing claims by creditors. This must be done within three working days from the date of the decision to reduce the authorized capital.

2.3. How to register changes in the decision to issue securities associated with a decrease in the par value of shares of a joint-stock company This is a very important stage in reducing the authorized capital, including because failure to comply with the procedure for issuing securities entails administrative liability in the form of a fine for a legal entity in the amount of 500 to 700 thousand . rub., and for the director - from 10 to 30 thousand rubles. (Article 15.17 of the Code of Administrative Offenses of the Russian Federation). It is allowed to pay half the amount of the fine if the payment is made no later than 20 days from the date of the decision and its execution is not delayed or spread out (Part 1.3-1 of Article 32.2 of the Code of Administrative Offenses of the Russian Federation). For the correct implementation of this stage, it is necessary for the general meeting of shareholders to make a decision to reduce the authorized capital by reducing the par value of its shares, and to register changes to the decision to issue shares of the company (clause 2 of Article 12 of the Law on JSC).

2.3.1. How to make changes to the decision on the issue of shares related to a decrease in the par value of shares of a joint-stock company Changes to the decision to issue shares related to a decrease in the par value of shares of this issue are made by decision of the general meeting of shareholders to reduce the authorized capital by reducing the par value of its shares. Carried out by making appropriate changes to the decision to issue securities. Registration of a new issue of securities and placement of securities are not carried out (clause 2 of article 12 of the Law on JSC, clause 2 of article 24.1 of the Law on the securities market). Changes are made to the securities prospectus (if it has been registered) and (or) the document containing the terms of placement of shares. If the changes made affect the conditions determined by the decision on the placement of securities, then a decision of the authorized body of the issuer, whose competence includes making the relevant decision, is also required (clause 4 of article 24.1 of the Law on the Securities Market, clause 12.5 of the Issue Standards). Changes to the securities prospectus and (or) the document containing the terms of placement of shares are made by decision of the authorized body of the issuer, whose competence includes their approval (clause 4 of article 24.1 of the Law on the Securities Market, clause 12.5 of the Issue Standards). Changes to the decision to issue securities and to the registered document containing the conditions for the placement of shares are signed by the person holding the position (performing the functions) of the sole executive body of the issuer, or an official authorized by him. In this case, you must indicate the date of signing (clauses 3.5, 12.8 of the Issue Standards). Amendments to the securities prospectus are signed by the person holding the position (performing the functions) of the sole executive body of the issuer, or an official authorized by him. At the discretion of the issuer, the document may be signed by a financial consultant in the securities market. In this case, the signature of an authorized official or financial consultant is required if the changes affect information, the completeness and reliability of which is confirmed by these persons (clause 2 of article 22.1 of the Securities Market Law, clause 12.8 of the Issue Standards).

2.3.2. How to register changes made to the decision on the issue of shares associated with a decrease in the par value of these shares Registration of changes to the decision on the issue of shares in terms of changes in their par value is carried out by the Bank of Russia (clause 9 of article 24.1 of the Law on the Securities Market, clause 12.10 emission standards). As a general rule, submit the following documents for registration (clause 6, article 24.1 of the Law on the Securities Market, clauses 12.14, 12.16, 12.19 of the Issue Standards, clause 53, clause 1, article 333.33 of the Tax Code of the Russian Federation): • application according to the established form; • changes to the decision to issue securities in the established form (in triplicate); • changes to the document containing the terms of placement of securities, in the established form, if changes made to this document are registered (in triplicate); • changes to the securities prospectus in the prescribed form, if changes made to the prospectus are registered (in triplicate); • a copy of the minutes (extract from it) of the general meeting of shareholders, which decided to amend the decision on the issue of shares and (or) the registered document containing the terms of their placement, or the securities prospectus; • a copy of the minutes (extract from it) of the meeting (session) (order, instruction or other document) of the authorized management body of the issuer, which decided to change the conditions determined by the decision on the placement of shares, if the changes made affect such conditions; • a receipt for payment of state duty in the amount of 35 thousand rubles. If, after registration of the issue (additional issue) of securities in the company, there was a redistribution of powers of management bodies, and changes to the decision on the issue of securities, a document containing the conditions for the placement of shares, a prospectus of securities or a decision on the placement of securities were made by decision of the new management body, whose the authority to make such a decision is not confirmed by the documents submitted for state registration of the issue (additional issue) of securities; for the state registration of such changes, the issuer must additionally submit documents confirming the powers of the management body that made the decision to make changes (clause 5.4 of the Bank of Russia Information “List of frequently identified violations and typical errors"). Documents must be submitted to the Bank of Russia within 15 days from the date of the decision to amend the decision to issue shares (clause 12.20 of the Issue Standards). Changes made to the decision on the issue will be registered within 15 working days, and if changes are also made to the securities prospectus - within 20 working days from the date of receipt of the documents submitted for state registration (clause 5 of article 20, clause 11 Article 24.1 of the Law on the Securities Market, paragraph 12.21 of the Issue Standards). Registration of changes made to the documents specified in this section is carried out according to the rules that are provided for the registration of an issue (additional issue) of issue-grade securities (clause 11 of Article 24.1 of the Law on the Securities Market).

2.4. How to register changes to the charter of a joint-stock company on a reduced amount of authorized capital This action is carried out on the basis of a decision to reduce the authorized capital by reducing the par value of its shares, adopted by the general meeting of shareholders, and registered changes made to the decision to issue shares of the company (clause 2 of Art. 12 of the Law on JSC, Article 24.1 of the Law on the Securities Market).

3. How a JSC can reduce its authorized capital by redeeming shares To implement this method of reducing the authorized capital, first of all, make an appropriate decision at the general meeting of shareholders. Next, notify the registration authority and creditors about the decision made, enter information into the EFRSFYUL, and draw up a report on the results of the redemption of shares. Then register the reduced amount of authorized capital, and after that notify the registrar, who will send a corresponding notification to the Bank of Russia.

3.1. How to make a decision to reduce the authorized capital by reducing the number (redemption) of shares Make such a decision at a meeting of shareholders by a simple majority of votes of the shareholders present at the meeting (clause 2 of Article 49 of the Law on JSC). The decision adopted at the general meeting of shareholders is documented in minutes.

Contents of the decision to reduce the authorized capital by reducing their number (redemption) When drawing up the protocol, be guided by the general requirements for its content. But at the same time, as part of the decision to reduce the authorized capital, we recommend that you reflect the following information: • the size of the authorized capital of the company and the amount by which it is reduced; • method, procedure and conditions for reducing the authorized capital of the company; • categories (types) of redeemable shares and the number of redeemable shares of each category (type); • description of the procedure and conditions for the company’s creditors to submit claims provided for in paragraph 3 of Art. 30 of the Law on JSC, indicating the address (location) of the permanent executive body of the company, additional addresses to which demands can be made, as well as methods of communication with the company (telephone numbers, fax numbers, email addresses and other information). In addition, if shares that have not yet been acquired by the company will be redeemed, then the decision will also reflect: • the number of shares of each category (type) acquired by the company, redeemed when the authorized capital is reduced; • purchase price. It is determined in accordance with Art. 77 of the Law on JSC; • form and term of payment for shares (in money, unless otherwise established by the company's charter); • the period allotted for shareholders to submit applications for the sale of their shares to the company (at least 30 days), as well as for the withdrawal of these applications.

3.2. How to notify the registration authority and creditors about the decision to reduce the authorized capital by reducing the number (redemption) of shares and enter information into the EFRSFYUL For this (clause 1, article 30 of the Law on JSC, subsection “n.7”, clause 7, p Clauses 8, 9, Article 7.1 of the Law on State Registration of Legal Entities and Individual Entrepreneurs): • submit to the registration authority an application in form N P13014 and a decision to reduce the authorized capital. This must be done within three working days after the AO makes this decision. Documents are submitted in the same way as for state registration of changes to the Unified State Register of Legal Entities; See also: How to fill out an application in form N P13014 for entering into the Unified State Register of Legal Entities information about the presence of a business company in the process of reducing the authorized capital • after making an entry in the Unified State Register of Legal Entities about the location of the joint-stock company in the process of reducing the authorized capital, publish a message in the “Bulletin of State Registration”, and after month, post a repeat message (clause 1 of the Order of the Federal Tax Service of Russia dated June 16, 2006 N SAE-3-09 / [email protected] ). The form of the message and the procedure for its placement are indicated on the website of the “Bulletin of State Registration” - https://www.vestnik-gosreg.ru/order_filing_messages/; • submit a notification to the EFRSFYUL about the reduction of the authorized capital. Indicate in it, in particular, the method, procedure and conditions for reducing the authorized capital, the procedure, terms and conditions for filing claims by creditors. This must be done within three working days from the date of the decision to reduce the authorized capital.

3.3. How to draw up and approve a report on the results of the redemption of shares The report on the results of the redemption of shares is approved at a meeting of the board of directors or a meeting of shareholders, if it performs the functions of the board of directors. Without this report, you will not be able to make changes to the charter. This is the only requirement that is presented to the report on the results of the redemption of shares by the Law on JSC (clause 3 of Article 12, clause 1 of Article 64 of the Law on JSC). The information that must be contained in the report on the results of the redemption of shares is not provided for by the Law on JSC. We recommend including the following data in it: • information about the joint-stock company - full name, OGRN, INN, address; • categories (types) of redeemed shares; • number of redeemed shares of each category (type); • the size of the company's authorized capital before and after the redemption of shares. There is no deadline for drawing up such a report; you can prepare it and approve it at any time after making a decision to reduce the authorized capital of the joint-stock company. We recommend doing this after the expiration of 30 days from the date of the second publication in the “Bulletin of State Registration” (Clause 3 of Article 30 of the Law on JSC).

3.4. How to make changes to the charter of a joint-stock company to reduce the size of the authorized capital by redeeming shares. This must be done within seven working days from the date of approval of the report on the results of redemption of shares (clause 5 of article 5, clause “k” of clause 1 of article 5 of the Law on state registration of legal entities and individual entrepreneurs). To do this, the required documents must be submitted to the registration authority, as well as a report on the results of the redemption of shares, approved by the board of directors of the company (clause 3 of Article 12 of the Law on JSC).

3.5. How to notify the registrar about the redemption of shares when the authorized capital is reduced To notify the registrar, provide him with the following documents (clause 3.48 of the Procedure for opening and maintaining personal and other accounts): • a decision to reduce the authorized capital of the JSC by redeeming the JSC's own shares; • orders of the JSC to make changes to the register of shareholders. The period for making an entry is set by the registrar, but cannot exceed three working days (clause 3.48 of the Procedure for opening and maintaining personal and other accounts).

3.6. How to notify the Bank of Russia of a reduction in the authorized capital of a joint-stock company by redeeming shares. The registrar who maintains the register of shareholders must notify the Bank of Russia of the redemption of outstanding shares of a joint-stock company in connection with a decrease in the authorized capital (clause 70.1 of the Issue Standards). He must send a notification to the department of corporate relations or a territorial branch of the Bank of Russia about changes in information related to the issue (additional issue) of securities (clauses 19.1, 71.2 of the Issue Standards). This must be done within three working days from the moment when the registrar or depository makes transactions in the register of share owners (in depository accounting registers) to write off shares from the issue account upon their redemption (clauses 70.2, 71.3 of the Issue Standards).

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

Use of authorized capital

Russian legislation does not directly prohibit the expenditure of funds credited to the company's account as authorized capital, or the use of property contributed to the authorized capital as a contribution. The concept of “authorized capital” itself is a conditional value, therefore, we believe that the use of authorized capital funds in the commercial activities of the company is possible.

The main parameter of the authorized capital, which must be observed annually by the company and monitored by an accountant, is its relationship with the value of net assets: the value of net assets cannot be less than the value of the authorized capital.

How to contribute authorized capital

A participant can contribute capital in different ways:

- To the current account by payment order : then you need to write in the purpose of the payment: “Contribution to the authorized capital from such and such a participant in such and such a share.”

- Through the organization's cash desk : then the general director creates a cash receipt order and indicates in the payment instructions which of the participants paid their share in the management company and in what amount.

- Property : if the founders have provided for the contribution of capital in non-monetary property in the charter, then the participants must conduct a monetary valuation of the property that is contributed to the authorized capital. The assessment is made by an independent person for any type of property. After this, the non-monetary contribution is transferred to the company and is recorded in the acceptance certificate, which also indicates who made the contribution and in what amount.

A payment order, a cash receipt order or a transfer and acceptance certificate must be kept: they may be useful when selling a share. But there is no need to notify the Federal Tax Service or other authorities about the contribution of capital.