Liquidation of an LLC is the termination of the existence of a limited liability company without the transfer of its rights and obligations through succession to other persons. A legal entity may be liquidated by its participants voluntarily or by court decision in the cases specified in Article 61 of the Civil Code of the Russian Federation. In this article we will look at the process of voluntary liquidation of an LLC.

The process of liquidating a company is complex and lengthy. Before you start, think about whether, in your case, there is an opportunity to sell your share in the organization to other persons. In this case, the LLC will continue to exist, but without your participation. This option is also called “alternative liquidation,” although it would be more correct to call it “alternative to liquidation.”

In addition to liquidation, the company may be reorganized. Here is a brief description of the types of LLC reorganization:

| Type of reorganization | Description | Article of the Law “On LLC” |

| Merger | Creation of a new company with the transfer of all rights and obligations of two or more companies and the termination of the latter | 52 |

| Accession | Termination of one or more companies with the transfer of all their rights and obligations to another company | 53 |

| Separation | Termination of a company with the transfer of all its rights and obligations to newly created companies | 54 |

| Selection | Creation of one or more companies with the transfer to it (them) of part of the rights and obligations of the reorganized company without terminating the latter. | 55 |

| Conversion | The company has the right to transform into a business company of another type, a business partnership or a production cooperative | 56 |

Before the start of liquidation, the LLC must inform its employees and the employment service authorities about this fact and the upcoming dismissal, no later than two months before the start of the process. Dismissed employees are paid severance pay in the amount of average monthly earnings, in addition, they retain their average monthly earnings for the period of employment, but not more than two months from the date of dismissal (Article 178 of the Labor Code of the Russian Federation).

If in your case it is necessary to liquidate an LLC without transferring its rights and obligations to other persons, then we suggest that you first familiarize yourself with the sequence in which liquidation should take place, after which we will consider these points in detail.

- Making a decision on liquidation and appointing a liquidation commission.

- Notification of the fact of liquidation of the tax office and funds.

- Publication about liquidation in the “Bulletin of State Registration”.

- Notice of liquidation to the Federal Resources Agency (EFRSFYUL).

- Notification of each creditor about the liquidation of the company.

- Drawing up an interim liquidation balance sheet.

- Submitting a package of documents for liquidation to the tax office.

- Obtaining documents on state registration of LLC liquidation.

Making a decision on liquidation and appointing a liquidation commission

Making a decision on the voluntary liquidation of an LLC falls within the competence of the general meeting of participants, but liquidation can be proposed by the board of directors, the sole executive body (director) or a member of the company. The decision to liquidate the LLC must be made unanimously by all participants. If there is only one participant in the society, then such a decision, naturally, is within his competence.

The liquidation committee may include a director, chief accountant, legal adviser and other qualified specialists, but it may also be one person called the liquidator. The responsibilities of the liquidation commission (liquidator) are given in Article 62 of the Civil Code of the Russian Federation. All powers to manage the affairs of the company and represent it in court are transferred to the commission, therefore it (or the liquidator) is responsible for all stages of the liquidation of the LLC.

Example of minutes of a general meeting of participants on the liquidation of an LLC

An example of a decision by a sole participant to liquidate an LLC

Notification of the fact of liquidation of the tax office and funds

The tax office must be notified of the liquidation of the LLC within three working days after the relevant decision is made using form P15016, certified by a notary. The decision on liquidation itself is also attached to the notice. Based on these documents, the tax office enters information into the Unified State Register of Legal Entities that the LLC is in the process of liquidation. It is no longer necessary to notify the funds (PFR and Social Insurance Fund) about this fact independently.

After receiving notice of the liquidation of an LLC, the tax inspectorate can begin an on-site audit, regardless of when and on what subject the previous audit was carried out. Funds – Pension and Social Insurance Fund – can also request documents related to the assignment, recalculation and payment of pensions, payment of contributions and benefits.

Registration of notice of the commencement of liquidation proceedings

After a decision is made to liquidate the LLC, there is an obligation to notify the registrar about this within 3 days. The applicant is the RLC, who must submit documents in person, through a representative by proxy, or electronically with the digital signature of a notary or applicant. To register you need to submit:

- Protocol (or Decision) on the liquidation of the LLC and the appointment of a liquidation commission (RLC);

- Notification in the prescribed form P15016, which the RLC must sign and notarize.

Within a week, the registration authority will enter the relevant information into the Unified State Register of Legal Entities and issue a registration sheet. You can check the readiness of documents here.

Publication on the liquidation of an LLC in the State Registration Bulletin

According to paragraph 1 of Art. 63 of the Civil Code of the Russian Federation, the liquidation commission must publish a message in the media about the liquidation of the LLC. The message indicates the procedure and deadline for filing claims by creditors, which cannot be less than two months from the date of publication.

Order of the Federal Tax Service of Russia dated June 16, 2006 N SAE-3-09 / [email protected] ) established that the publication in which the notice of liquidation is published is the “Bulletin of State Registration”. You can post a message using a special form.

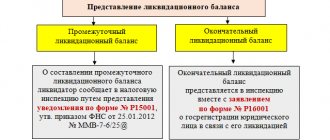

Drawing up an interim liquidation balance sheet

An interim liquidation balance sheet containing information on the composition of the property of the LLC being liquidated and the list of creditor claims is drawn up after the end of the period specified in the publication in the Bulletin (at least two months).

The preparation of such a balance must again be reported to the tax office using Form No. P15016. If, when you first submitted the form, section 2 indicated the reason for filing the application “3”, then to notify about the preparation of an interim balance sheet, you must enter the number “4”. In addition to the notification, the decision to approve the interim liquidation balance sheet, the balance sheet itself and a copy of the “Bulletin” sheet with the publication or supporting documents are submitted to the tax office.

After approval of the interim liquidation balance sheet, the commission begins to make settlements with creditors. The requirements are satisfied in the order of priority established by Article 64 of the Civil Code of the Russian Federation:

- claims of citizens to whom the liquidated LLC is liable for causing harm to life or health, as well as claims for compensation for moral damage;

- calculations for the payment of wages and severance pay for employees hired under an employment contract and for the payment of royalties;

- calculations of mandatory payments to the budget and extra-budgetary funds;

- settlements with other creditors.

If the funds of a liquidated LLC are not enough to pay off all debts, then the company’s property must be sold at public auction.

Please note: if the property of a liquidated legal entity is insufficient to satisfy the claims of creditors, the liquidation commission is obliged to apply to the arbitration court with an application for bankruptcy of the legal entity (Article 63 of the Civil Code of the Russian Federation). Based on this, voluntary liquidation of an LLC is possible only if the organization has no debts.

If even before the liquidation of the LLC it becomes clear that the company’s funds and property are not enough to satisfy the claims of all creditors, we recommend that you immediately contact bankruptcy specialists. There are a lot of nuances here, such as who will initiate bankruptcy and who will appoint an insolvency administrator. You should also not try to get rid of the property of an LLC on dubious advice before its liquidation, so as not to be held vicariously liable.

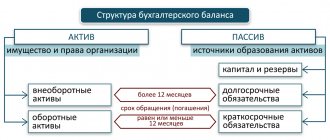

Liquidation balance

The liquidation balance sheet is drawn up after settlements with creditors. The property remaining after satisfaction of their demands is transferred to the owners of the company (clauses 5 and 7 of Article 63 of the Civil Code of the Russian Federation).

This distribution is made on the basis of Article 58 of Law No. 14-FZ. It also establishes a special order, namely:

- first of all, payment to the company's participants is made of the previously distributed but unpaid part of the profit (in the balance sheet, this debt is reflected in account 75 “Settlements with founders”, sub-account “Dividends”);

- secondly, the property of the liquidated company is distributed among the participants in proportion to their shares in the authorized capital of the company.

The requirements of each queue are satisfied after the requirements of the previous queue are fully satisfied.

It may turn out that the property available to the company is not enough to pay the distributed but unpaid part of the profit.

Then the property is distributed among its participants in proportion to their shares in the authorized capital of the company. Example 2

There are two participants in an LLC, the shares of each of whom in the authorized capital are 30% (legal entity) and 70% (individual). The amount of authorized capital is 100,000 rubles. According to the liquidation balance sheet, the company's retained profits amount to 1,000,000 rubles. There are no accounts payable, they have been repaid. Total liabilities – RUB 1,100,000. (100,000 + 1,000,000). That is, all liabilities are represented by equity capital. Assets are cash in the amount of 1,100,000 rubles. When making payments to participants, the LLC acts as a tax agent. Payments to a legal entity within the limits of the share of the authorized capital paid by it, that is, the amount of 30,000 rubles, are not subject to taxation. Taxes are subject to withholding and transfer to the budget at a “dividend” rate of 9%:

- for a legal entity - income tax in the amount of 27,000 rubles. ((RUB 1,100,000 x 30% - RUB 30,000) x 9%),

- for an individual - personal income tax in the amount of 69,300 rubles (1,100,000 rubles x 70% x 9%).

In this situation, the LLC accountant will use the following entries:

DEBIT 80 CREDIT 75

— 100,000 rub. — the authorized capital is written off;

DEBIT 84 CREDIT 75

— 1,000,000 rub. — profit distributed;

DEBIT 75 CREDIT 68

— 96,300 rub. (27,000 + 69,300) – taxes are withheld from the participants’ income;

DEBIT 68 CREDIT 51

— 96,300 rub.

– withheld taxes are listed; DEBIT 75 CREDIT 51

- 1,037,700 rub. (1,100,000 – 96,300) – payments were made to participants.

The balance on the liquidation date will be zero.

* * *

Summarize. During the liquidation of a company, the accountant becomes the most important figure. The company practically no longer needs other employees. The role of the accountant is so great that it is advisable to include him in the liquidation commission.

Elena Dirkova

, editorial staff of “PB”, for the magazine “Practical Accounting”

Accounting statements from balance sheet to explanatory note

All the necessary information for the correct preparation of any form of accounting statements in Berator “Accounting statements”: detailed line-by-line commentary for each form with examples of completion; recommendations for approval and submission of reports to the inspection. Find out more >>

If you have a question, ask it here >>

Submitting a package of documents to the tax office for liquidation of an LLC

After the creditors' claims are satisfied, the commission draws up the final liquidation balance sheet, containing information about those assets of the company that remain and must be distributed among the participants. Both the interim and final liquidation balance sheets are approved by the general meeting of participants.

If, due to dishonest actions of the liquidator, the organization’s assets in the final balance sheet turn out to be greater than in the interim balance sheet, then the tax inspectorate may refuse to liquidate the LLC.

Indeed, the assets indicated in the interim balance sheet, in most cases, can only decrease (due to satisfying the claims of creditors), but not increase in any way. If there is an increase in assets according to the final balance sheet, then this may indicate that the assets were temporarily withdrawn from the LLC so as not to “go to creditors.” While the LLC liquidation process is underway, the organization can continue to conduct profit-generating activities, but in practice, counterparties are very distrustful of such transactions. Business transactions for which assets in the LLC “arrived” after the approval of the interim balance sheet may be subject to thorough inspection by the tax authorities, and become the reason for refusal to liquidate the LLC.

A claim to invalidate the liquidation of an LLC due to the fact that the amount of assets on the final balance sheet exceeded the amount of assets on the interim balance sheet may subsequently be filed by creditors whose claims remained unsatisfied. There is judicial practice on this issue, and it is not always in favor of unscrupulous participants in the LLC being liquidated.

After completing settlements with creditors, the property of the liquidated organization is distributed among the participants of the company (Article 58 of the Law “On LLC”). First of all, the distributed but unpaid part of the profit is paid, and secondly, the remaining property of the company is distributed according to the shares in the authorized capital.

The final package of documents for registering the fact of liquidation of an LLC consists of:

- third application in form No. P15016, notarized;

- final liquidation balance sheet;

- decisions of the general meeting on approval of the liquidation balance sheet;

- document confirming payment of state duty (800 rubles);

- a document confirming the submission of personalized accounting information to the Pension Fund and the Social Insurance Fund.

State registration of the liquidation of an LLC is carried out within no more than five working days from the date of submission of documents to the Federal Tax Service.

Submission of liquidation balance sheet, registration of liquidation

The final stage, as a result of which the LLC will be officially liquidated with an entry about this being made in the Unified State Register of Legal Entities.

The organization's accountant must draw up a liquidation balance sheet, and the founders of the LLC must approve it. Regarding the format and forms of reporting, the corresponding recommendations were first given by the Federal Tax Service only on November 25, 2019.

The following set of documents is submitted for registration:

- Application in form P15016, the authenticity of the signature on which is certified by a notary;

- Liquidation balance;

- Paid state duty (if documents are submitted not by digital signature, but in person);

- Certificate from the Pension Fund (if it is not available, the registration authority will receive information through interdepartmental interaction with the pension fund).

It is not necessary to submit a protocol (or decision) on approval of the liquidation balance sheet.

Important information: in Moscow, if the company has no creditors, it is allowed to simultaneously submit two sets of documents for registration - an interim liquidation balance sheet and the liquidation balance sheet itself. In this case, you will be able to complete the process faster.

Please note that in different regions the requirements for sets of documents may differ slightly. If you are liquidating an LLC not in Moscow, check the list of required documentation before submitting.

We hope that with such detailed instructions, closing an LLC on your own will not be difficult.

If you still have questions, look for answers on our forum!

Obtaining documents on state registration of LLC liquidation

The only document that confirms the liquidation of an LLC is the entry sheet of the Unified State Register of Legal Entities in form N P50007.

The methods for submitting and receiving documents during the liquidation process of an LLC are the same as for other applications to the tax office:

- personally by the chairman of the liquidation commission or the liquidator;

- a representative under a notarized power of attorney;

- by mail with declared value and an inventory of the contents;

- signed with an electronic digital signature.

After the liquidation of the LLC is confirmed by a record sheet from the Unified State Register of Legal Entities, all that remains is to: close the current account; destroy the seal in a specialized organization; hand over the documents of the liquidated company to the archive (Article 23 of the Law of October 22, 2004 N 125-FZ).