Why do you need an advance report?

An advance report is a prerequisite for the procedure for issuing money. The employee reports on expenses made within the prescribed period using a special reporting form. Its main goal is complete control over financial expenses in a budget organization. With the help of this document, the movement of spent funds issued to fulfill the needs of the institution is checked and the expenses incurred are written off.

Who is the accountable person

Accountable funds are issued by the manager to the employee of the enterprise for general production or general business expenses. The employee reports for the amounts disbursed on time through an advance report. An employee, having received funds for the needs of the enterprise, is an accountable person.

IMPORTANT!

Advances are issued not only to employees of the enterprise, but also to freelance employees who have entered into civil law contracts with the employer (clause 5 of the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014).

Accountable funds are transferred to responsible employees not only in cash, but also to a bank card by wire transfer (letter of the Ministry of Finance of the Russian Federation No. 03-11-11/42288 dated 08/25/2014).

The employer determines the circle of accountable employees in a special order. Employees agree with the appointment. The management order approves the list of responsible employees who receive accountable funds.

All accountable persons are required to report on expenses incurred, attaching supporting documentation, and provide advance reports to the accounting department on time.

Deadlines for submitting advance reports

The deadline for delivery depends on the purpose of issuing the advance:

- The employee submits the travel advance report to the accounting department within three days after returning. If he returned on a weekend or holiday, then three days are counted from the moment he returned to work (Resolution of the Government of Russia dated October 13, 2008 No. 749).

- An advance report on business expenses is submitted no later than three days after the expiration of the period for which the advance was issued (clause 6.3. Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

General rules

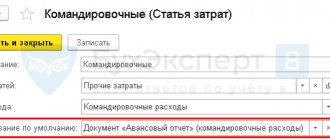

There is no single, legally regulated formal type. The accountant has the right to draw up an advance report using the unified form No. AO-1 or develop a personal form, approving it by order.

Documentation is maintained both in paper and electronic form. If the institution provides for completion in electronic form, then the JSC is signed electronically by each of the participants in the accountable process.

There are a number of generally accepted rules for filling out (Decree of the State Statistics Committee No. 55 of 01.08.2001):

- The report is generated within a three-day period from the expiration of the period for which accountable funds were issued (it must be determined by order or regulation), the employee’s return from a business trip or the employee’s departure from sick leave, provided that the specified day of return of the accountable account fell during the period of incapacity for work.

- If the deadline for returning the advance money is violated, the employer applies sanctions to the employee, including financial ones.

- The accountant provides full assistance to the accountable person in filling out.

- The document, completed and executed in accordance with all rules, is signed by the head of the organization.

- The reporting is accompanied by primary documentation confirming the expenses incurred (receipts, tickets, statements, invoices).

Advance report for budget organizations

Employees of budgetary organizations must use special forms when preparing expense reports.

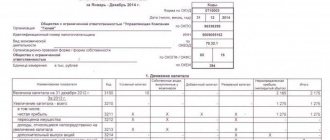

Advance report OKUD 0504505 was approved by Order of the Ministry of Finance No. 52n dated March 30, 2015. The sample has been used in the formation of accounting policies since 2015. Reporting must be provided:

- when issuing cash to an employee for expenses related to the activities of the organization - within the period specified by the employer;

- when issuing funds for a business trip - within 3 working days upon return from a work trip.

Form 0504505 is only suitable for paper reports. When preparing electronic reporting, you need to use form 0504520, which was approved by the same Order of the Ministry of Finance No. 52n and is applied from September 27, 2020.

Download the advance report form in Excel (OKUD form 0504505)

Download the advance report form in Excel (OKUD form 0504520)

The organization has the right to modify the unified form, including expanding or narrowing columns and lines, introducing additional lines or loose sheets. Any such changes should be formalized by order of the manager. Various ministries and departments can also develop instructions that will regulate the procedure for preparing reports for a business trip, the purchase of goods or settlements with contractors, and also approve a sample of such a report. For example, the Ministry of Internal Affairs has order No. 268 on foreign business trips of military personnel and employees of internal affairs bodies. An advance travel report form is used as an attachment to the order.

Procedure for compilation

Information required:

- about the establishment, number and date of the document being drawn up;

- about the employee who received an advance;

- the amount of funds issued and their intended purpose;

- actual expenses (all supporting primary documents are attached).

The front part contains data on the movement and write-off of advances and on analytical accounts reflecting the accounting of funds in the organization. All completed information is certified by the signatures of the responsible accountant who issued the money and accepted the return of the accountable amounts, the chief accountant and the employee who received the advance amount. The accountant fills out a tear-off receipt confirming the verification of the primary documents. This is confirmed by an example of filling out an advance report. After registration and tearing off, the receipt remains with the accountable person. On the reverse side, the employee enters a detailed breakdown of expenses, and the responsible accounting employee indicates the amount to be recorded and the accounting account through which the expenses will be posted.

Advance reporting is generated in a single original copy. This is the nomenclature internal document flow of the institution; it is not necessary to affix a seal.

IMPORTANT!

Corrections excluded! If you make any mistakes, or even more so, you will have to fill out a new form.

How to fill out an advance report correctly

The advance report can be divided into 3 parts:

- The first (front) part is filled out by the accountant. Here the details of the document are reflected (its number and date), information about the organization and the accountable person, about the advance issued to him, summary information about the funds spent and accounting accounts that reflect their movement and write-off, as well as information about the issuance of overexpenditure to the employee or the receipt from him an unused advance.

- The second part is a tear-off receipt confirming the acceptance of the report for verification. The accountant fills it out, cuts it off and gives it to the accountant.

- The third part of the document (the reverse side of form AO-1) is filled out collectively. The reporting employee reflects in it line by line the details of the documents with which he confirms the expenses he has made, as well as the amount of the expense “according to the report.” And the accountant enters the amount accepted for accounting and the accounting account into which the expense will be “posted.”

The report is signed by the employee, accountant and chief accountant. Then it is submitted to the manager for approval - the corresponding stamp is on the front side of the document.

An advance report can be prepared not only in paper, but also in electronic form.

For more information about this, see the article “Advance report can be signed with an electronic signature” .

A line-by-line commentary on filling out advance reports was prepared by ConsultantPlus experts. Get free trial access to the system and proceed to the instructions.

Step-by-step instruction

In an organization, the reporting employee and accountant are responsible for filling out the advance report.

The employee who received the advance funds fills out the front side. Information required:

- short, full name of the organization, its code in accordance with the OKPO classification;

- details of the document - its number and date;

- next, it is necessary to leave a place for the head of the company to endorse the statements - after checking the document by an accountant, the head puts his signature, date and indicates the accountable amount in words;

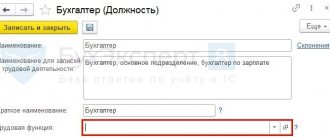

- last name, first name and patronymic of the accountable person, his position, personnel number and structural unit;

- purpose of the amount issued under the report.

After entering the primary information, the reporting employee must fill out the tabular part of the report.

If you are guided by form AO-1, then the employee must enter information in the left and right tables.

The left table shows data on advances:

- total amount;

- advance monetary unit - ruble or foreign currency;

- balance or overrun (if any).

The right table provides accounting information: accounts and subaccounts for which the advance is made, indicating the exact amounts of costs. This part is completed by the accountant.

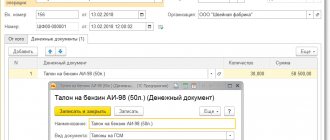

Next, you need to register supporting documentation: the number of checks and receipts confirming expenses.

The front part of the document contains space for the resolution of the chief accountant. After checking the table information and documents submitted on time, the chief accountant writes down the reporting amount in figures and words.

If there is an overexpenditure on the advance payment or, conversely, a balance of funds, reflect this in the reporting. The incoming (outgoing) cash order on the basis of which transactions with balances were carried out is also indicated.

After the tabular part, the accountant, cashier and chief accountant sign.

Next, fill out the back side.

First of all, the table contains the details and names of all applications - supporting documentation (checks, invoices, tickets, receipts). Write down not only their number and date, but also the exact accounting amount and accounts, sub-accounts on which transactions will be carried out. The tabular part of the reverse side is certified by the signature of the person who received the advance.

At the end, an accountant's receipt is issued, which is cut off and given to the employee. The cut-off part confirms the fact that the employee accounted for the advance payment and provided all the necessary documents. The accountant fills in the following information under his signature: Full name. the responsible employee, details of JSC-1, the amount of the advance in words, the number of supporting documents and the date on which the employee reported. The accountant signs the document only if the reporting is submitted on time.

Material on the topic How to draw up a regulation on accountable persons The procedure for drawing up

The unified form AO-1 consists of three parts:

- facial;

- negotiable;

- tear-off receipt.

| Form AO-1 | Details to fill out | Who fills it out |

| Front part of the form |

| Accountant |

| Information about the accountable person (full name, personnel number, position, structural unit) | Accountable person | |

| Tear-off part of the form (receipt) | Details of the accepted advance account | Accountant |

| Reverse side of the form |

| Accountable person |

Material on the topic Maximum amount to report in 2019 The document is drawn up in one copy and is “internal”; it may not be certified by the organization’s seal.

For the accountable person, confirmation of the delivery of the necessary papers is the detachable part of the form: a receipt indicating the number and date of the document, as well as the number of supporting documents attached to it.

You can fill out the 2022 advance report by the accountable person at the end of the article.

How can an accountant check a report?

The advance report is submitted to the accounting department on time. The head of the enterprise has the right to approve a different deadline for submitting the report, enshrining this standard in his local legal acts and accounting policies.

After the employee has submitted reports on the advance payment issued to the accounting department, it must be checked. The accountant checks not only the correctness of filling out the documentation, but also the correctness of the amounts entered and their compliance with the provided checks and other supporting registers.

After the check, the accountant fills out the front side of the report and gives the responsible employee a tear-off receipt confirming the submission of advance reports.