Law on choosing a bank to receive your salary

The employee’s right to choose a credit institution is specified in Art. 136 Labor Code of the Russian Federation. The essence of this legal norm is that every employee has the right to choose the bank to whose card or account his salary will be received.

There was no prohibition on such a choice previously. If a specific bank was not specified in the employment contract, the client could change the salary credit organization, knowingly informing the employer about this.

Before the adoption of the legislative norm, disagreements often arose between the parties to the employment agreement. The law did not indicate anything on this matter, so it was difficult for the employee to prove anything to his employer. After the introduction of amendments to the Labor Code of the Russian Federation in July 2019, in the event of a controversial situation, employees must rely on this legal norm.

The notice period for changing the bank for paying wages will be extended to 15 calendar days.

The legislator is thinking about increasing the period for notifying an employer of an employee’s change of credit institution for the purpose of transferring wages.

The fact is that, given the legal requirements for the payment of wages every six months, the settlement services of large enterprises with a large number of employees do not always have time to process applications received from employees. Therefore, increasing the notice period from 5 working days to 15 calendar days will eliminate the risk of the employer’s failure to comply with labor legislation. Draft Federal Law No. 677255-7 “On Amendments to Part Three of Article 136 of the Labor Code of the Russian Federation”

How to transfer salary to a card of another bank

Initially, you need to decide on a credit institution. This must be a Russian bank. The card does not have to be a salary card - this is a symbol for mainly debit cards to which organizations transfer wages to their employees. If a full-fledged salary project is drawn up, then a legal entity or individual entrepreneur within its framework receives a number of additional preferences.

You can make any card a salary card: the date it was issued does not matter. An employee may have a card in his hands long before he decides to make it a salary card. This is a fairly common practice. You can change the bank to receive your salary as follows:

- Fill out an application addressed to the employer.

- Submit your application to your employer and wait for it to be reviewed.

An application to change a salary card is submitted to the employer, and not to the accounting department. The reason for this is that in most organizations accountants are not authorized to deal with such issues. Moreover, changing the salary card of even a single employee means an increase in the amount of work for the accountant. Disagreements arise precisely on this basis.

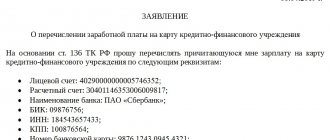

How to write an application to change your salary details

There is no unified form for such a statement. In fact, it is compiled in free form. After the “header” (to whom, from whom, for what reason), the following document structure is used:

- Recipient - full name of the applicant.

- The account number for crediting wages can be checked in the Internet bank, through an ATM, or by calling the hotline.

- Name of the credit institution.

- Correspondent account.

- BIC.

To clarify the purpose of the payment, indicate “salary transfer”. On the websites of most major credit institutions, you can download such an application form and submit it to your employer or accounting department.

What needs to be agreed upon with the bank

Using Sberbank as an example, a salary project is opened without additional contracts and approvals. After issuing a Mastercard card, the client, through Sberbank Online, performs the following actions:

- Log in to Sberbank Online and select a card.

- In the card settings, select the “Make a salary card” option.

- Create and download an application.

- Submit your application to your place of work.

- Wait for your salary to be transferred.

After the first salary transfer, the Sberbank salary project is activated automatically. The client receives a corresponding SMS message and push notification. From this moment on, the client enjoys all the benefits of the salary project.

How to change a salary card from one bank to another?

It is worth immediately noting that salary cards are issued as part of the salary project. It is to the holders of such cards that the bank can provide various benefits when using its other products (preferential rates on loans, increased rates on deposits, free credit cards, etc.). If a person issues himself another card, then it may no longer be serviced within the framework of this project, which deprives him of all kinds of benefits. Most often this is a regular debit card, less often the company enters into an additional salary project with the selected bank. The last option is too expensive for the employer, because he will have to pay commissions for two (or more) salary projects at once, and the accountant needs to prepare much more documents.

What to do with a card on which wages were received before changing banks

Such issues are resolved at the discretion of the client. Most salary projects involve free service and the use of a number of additional preferences. It is beneficial for credit institutions to have as many clients as possible use their bank cards. With free card servicing, the bank's profit consists of commissions from the payment system and paid services and options that holders can activate at will.

After excluding the card from the previous salary project, most of the previously existing preferences will be canceled. The service will become paid, and banking services (loans, mortgages, deposits) will be provided on general terms - as not for salary clients of the bank.

The client can keep the card for use or close it to minimize their expenses. There are no restrictions in this case, since an employee of the organization is no longer a salary client. If the card is not needed, it should be closed according to the rules established by the bank.

Advantages and disadvantages of a salary project over the usual issuance of wages

We will clearly show what the benefits of the salary project are for the bank’s corporate clients and their employees.

Advantages:

| For employers | For employees |

|

|

But the salary project also has disadvantages. For employees they are as follows:

- you cannot choose a premium card if regular ones are provided for employees;

- There are not always ATMs of servicing banks near your home or work office.

The only drawback of the salary project for the employer is the need to spend money on servicing the card and paying commissions for transfers. However, these costs quickly pay off even with a small team.

Answers to questions on the topic

1. When can I apply to transfer my salary to another bank?

In Art. 136 of the Civil Code of the Russian Federation states that an application to change a credit organization is submitted by an employee no later than 15 calendar days before the day of payment of wages. If the deadline for submitting an application is violated, its consideration and satisfaction is postponed to the next time the salary is calculated.

2. Can an employer refuse to transfer wages to another bank?

There is such a possibility, but refusal will be a violation of labor legislation. This threatens the application of sanctions against the employer by supervisory authorities. It makes no sense for an employer (the head of an organization) to limit his employee in such a choice. In most cases, difficulties arise with accountants, whose workload increases with each new transition.

3. What to do with the salary bank entry in the employment agreement?

If the employment contract contained an entry about a specific salary bank, then after the employee transfers to another bank, it (the entry) should be canceled by drawing up an additional agreement. In this case, the wording is written stating that the employee independently indicated in the application the choice of a specific bank.

4. How many times can you change your salary bank?

The legislation does not establish restrictions in this regard. You can change your salary bank any number of times. The main thing is to meet the deadlines for submitting an application to the employer. In view of compliance with corporate ethics, it is recommended to pay attention to the interests of the employer who is interested in working with one bank.

5. How do changes affect government employees?

From July 1, 2022, budget employees receive wages only on NSPK MIR cards. They are prohibited from using cards from other payment systems to receive salaries. However, there are no restrictions on changing credit institutions. The bank can be any, but the cards are only for the MIR payment system.

Information sources:

- Official website of Sberbank of Russia - link.

- Labor Code of the Russian Federation - link.

- Materials of the reference and legal system "Garant" - link.

5 / 5 ( 1 voice )

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Design nuances

IMPORTANT! A sample application for transfer of salary to a third party from ConsultantPlus is available here

If there is a voluntary expression of the employee’s will to transfer the amounts of his earnings to a third party’s bank card, the company must obtain documentary evidence. The form of written confirmation of the employee’s wishes is a statement drawn up and signed by him personally.

Application rules:

- The document is submitted to the employer before the date of payment of wages (submission deadline is 5 days before the day the funds are transferred).

- The wording should explain what types of payments are covered by the wish to transfer to another person’s account: salary, bonus, vacation pay, compensation accruals, or all types of income.

- It is prescribed in what amount income should be transferred to a third party: in full or as a percentage of the total amount of earnings.

- The frequency of payments is fixed: monthly, with each payment, once a quarter.

- For non-cash payments, it is not necessary to draw up a power of attorney, but the application must indicate the necessary personal data about the recipient of the funds: his last name and initials, bank details of the card or current account for crediting funds.

When considering an employee’s application, the employer is guided by the content of the concluded labor agreement and the collective agreement in force at the enterprise. If one of the documents provides for the possibility of going beyond the salary project and making transfers in favor of third parties (who do not have an employment relationship with the company), then the application may be granted. At the stage of agreeing on details, the issue of covering the costs of commission services is clarified.

REMEMBER! In situations with forced transfers based on court decisions or writs of execution, the employee is not required to complete an application. The document serving as the basis for payments is received directly by the employer from government agencies.

When generating a payment order for the forced transfer of funds in favor of third parties, the employer must indicate in the purpose of the payment:

- for whom the funds are transferred;

- the fact of making deductions;

- use as a base for withholding wages;

- what document is the basis for deductions.

In accounting, the transfer of an employee’s earnings according to the details he has declared will be reflected in account 76. It is necessary to open a separate sub-account for it, in which the amounts of settlements and deductions based on employee statements are supposed to be accumulated. The following invoice correspondences apply:

- D70 – K76 when deducting the principal amount from earnings;

- D70 – K73 – entry to reflect the withheld amount of bank commission for transferring funds in favor of other persons;

- D76 - K51 - when the salary, at the request of the employee, is transferred according to the details of third parties.

Comments: 21

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Lily

01/21/2022 at 01:36 Hello, I work as a teacher. I was refused to change the bank in the accounting department of our regional educational institution. They said that they pay Akbars Bank for transferring employees' salaries to the card. If I transfer to another bank, I will have to pay for it myself. And approximately how much?

Reply ↓ Anna Popovich

01/21/2022 at 02:05Dear Lilia, an employer cannot prevent an employee from receiving his salary on the card of any bank he chooses. In this case, the employee is obliged to notify the employer in writing of his desire to receive a salary from another credit institution, indicating new details no less than 15 calendar days before the salary is paid (Article 136 of the Labor Code of the Russian Federation). The presence of a “salary project” in the company should not limit the employee when choosing a credit institution. Withholding a commission from an employee's salary for transferring funds to another bank is illegal.

Reply ↓

09.24.2021 at 15:56

Is it possible to submit an application to change the salary bank by email?

Reply ↓

- Olga Pikhotskaya

09.24.2021 at 16:15

Elena, good afternoon. This issue needs to be clarified at your enterprise, since an application to change the salary bank must be submitted to the accounting department at the place of work.

Reply ↓

Anonymous

09.24.2021 at 16:22

Thank you.

Reply ↓

08.28.2021 at 13:38

I want to receive salary in another bank and not in the industry. But the transfer to my account comes with a commission. Who pays it

Reply ↓

- Anna Popovich

08/31/2021 at 22:14

Dear Oleg, you pay the commission. You should order a card from the bank of your choice, and then write an application to the accounting department of your company so that your salary is transferred to another card. This way you will avoid commissions when transferring from card to card yourself. You can also consider the option of simply transferring funds to another card using a fast payment system. Then you will not need to submit any applications.

Reply ↓

08/11/2021 at 16:29

Now I am paying off the loan at the salary bank. If I switch to another bank to receive a salary, will the service in the first one become paid?

Reply ↓

- Olga Pikhotskaya

08/11/2021 at 16:31

Lyudmila, good afternoon. It depends on the bank's policy. As a rule, the client is transferred to standard terms of service. You can clarify this information by contacting your bank’s support service (the phone number is listed on the back of the card).

Reply ↓

06/13/2021 at 19:42

Hello, if you have a loan debt from one bank and this bank has blocked all accounts and your salary card, is it possible to change your salary card to another bank?

Reply ↓

- Anna Popovich

06/14/2021 at 10:36

Dear visitor, of course you can do it. However, this will not help unblock accounts. According to the FSSP writ of execution, the new bank will also be required to block your account.

Reply ↓

06/10/2021 at 15:02

Can I transfer my salary to the post office bank if it is now in savings?

Reply ↓

- Olga Pikhotskaya

06/10/2021 at 15:33

Polina, good afternoon. You have the right to open a card account in any bank and provide account details for transferring salaries to the accounting department of your company.

Reply ↓

04/26/2021 at 15:57

Did I understand correctly, if I work in a budget organization and I need to change my salary card, then by definition they will refuse me right away? Does the Labor Code of the Russian Federation have no power over state employees?

Reply ↓

- Anna Popovich

04/26/2021 at 18:25

Dear Elena, if your salary is transferred to the Mir card, then you can apply for a national payment system card in almost any bank. There are no restrictions for state employees.

Reply ↓

03/29/2021 at 14:58

Hello, they refused to change the bank. They said that they work only with Sberbank, and they do not have the opportunity to transfer to another bank. How so. If I work for them, then only savings. And I can’t get it in cash. Where to write a complaint??

Reply ↓

- Anna Popovich

03/29/2021 at 15:08

Dear Alina, for refusing to change the bank, the employer faces a warning or an administrative fine in accordance with Part 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. You can complain to the labor inspectorate or apply to the court.

Reply ↓

09.28.2020 at 09:46

If you convert a Visa card to a salary card, will the functionality of the card remain for payments in other countries?

Reply ↓

- Anna Popovich

09.28.2020 at 11:32

Dear Christina, all functions and services connected to the card are preserved.

Reply ↓

08/25/2020 at 14:16

Thanks a lot. The article is very useful.

Reply ↓

- Anna Popovich

08/25/2020 at 14:20

Dear Nadezhda, thank you, we are glad to be useful to our readers