What standard tax deductions are established by Art. 218 of the Tax Code of the Russian Federation for 2022

The procedure for providing standard tax deductions is regulated by Art.

218 Tax Code of the Russian Federation. I would like to immediately note that the main difference between standard tax deductions and other personal income tax deductions is not the presence of specific expenses on the part of the taxpayer, but his direct membership in certain groups of persons. So, what are the standard tax deductions today?

- For certain categories of citizens, standard tax deductions can be 3,000 or 500 rubles.

- All citizens with children can be provided with a so-called child deduction.

Maximum amount of income for deduction per child

Since the essence of this benefit is material support for families with children, there is an income limit. As soon as your income from the beginning of the year exceeds 350 thousand rubles, you lose the right to the child tax deduction. This is stated in paragraphs. 4 paragraphs 1 art. 218 Tax Code of the Russian Federation.

Example:

Your monthly salary is 35 thousand rubles. In November, your total income since the beginning of the year will exceed 350 thousand, so you will not receive a deduction for the last two months. But from the beginning of next year, the accounting department will resume accrual of deductions.

Who is entitled to a deduction of 500 rubles.

These are persons awarded state awards, participants of the Great Patriotic War, former prisoners of concentration camps, disabled people of the 1st and 2nd groups and others. The full list can be found in sub. 2 p. 1 art. 218 Tax Code of the Russian Federation.

IMPORTANT! In the case where the taxpayer falls into both categories, the deductions are not summed up, but the maximum of them is provided. The taxpayer's income limit for receiving such deductions is not established by law.

If you have access to ConsultantPlus, check whether you have correctly determined the amount of the standard “for yourself” deduction. If you don't have access, get trial of online legal access.

How can an organization provide a standard tax deduction to an employee?

Certain categories of employees are entitled to standard tax deductions. The deduction amount can be either 500 rubles or 3000 rubles. (clause 1 of article 218 of the Tax Code of the Russian Federation). Moreover, if an employee has the right to both deductions, then he needs to be provided with the maximum possible (clause 2 of Article 218 of the Tax Code of the Russian Federation).

The standard tax deduction can be provided exclusively to employees who are residents of the Russian Federation in respect of income that is taxed at a rate of 13%.

Let us remind you that a resident is an individual (a citizen of the Russian Federation, a citizen of a foreign state, a stateless person) who actually stays on the territory of the Russian Federation for at least 183 calendar days within 12 consecutive months. Moreover, the 12-month period of stay in Russia is not interrupted by periods of travel abroad for short-term (less than 6 months) treatment or training. Also, this period is not interrupted if an employee leaves to perform work or provide services in offshore hydrocarbon fields (clauses 2, 3 of Article 207 of the Tax Code of the Russian Federation). If an agreement on the elimination of double taxation has been signed between the Russian Federation and a foreign state, which recognizes individuals as residents under other conditions, then these norms have priority over the norms of the Tax Code of the Russian Federation (Article 7 of the Tax Code of the Russian Federation).

Let us add that the possibility of obtaining a tax deduction does not depend on the amount of income of the employee (clause 1 of Article 218 of the Tax Code of the Russian Federation).

So, a deduction of 3,000 rubles is due to employees:

- those who have received or suffered radiation sickness and other diseases associated with radiation exposure as a result of the disaster at the Chernobyl nuclear power plant and the liquidation of its consequences;

- those who received disability as a result of the disaster at the Chernobyl nuclear power plant;

- who in 1986-1987 took part in the work to eliminate the consequences of the disaster at the Chernobyl nuclear power plant within the exclusion zone of the Chernobyl nuclear power plant or were engaged during this period in work related to the evacuation of the population, material assets, farm animals, and in operation or other work at the Chernobyl NPP.

A complete list of persons entitled to receive a standard tax deduction in the amount of 3,000 rubles is given in paragraphs. 1 clause 1 art. 218 Tax Code of the Russian Federation.

Get a comprehensive accounting reporting solution: automatically generate and send reports via the Internet

Try for free

As for the deduction of 500 rubles, the following deduction is due:

- heroes of the Soviet Union, heroes of Russia, persons awarded the Order of Glory of three degrees;

- persons of civilian personnel of the Soviet Army and Navy of the USSR, internal affairs bodies of the USSR and state security of the USSR, who held regular positions in military units, headquarters and institutions that were part of the active army during the Great Patriotic War, or persons who were in cities during this period, participation in the defense of which these persons are counted towards their length of service for the purpose of granting a pension on preferential terms established for military personnel of active army units;

- participants of the Second World War, military operations to defend the USSR from among military personnel who served in military units, headquarters and institutions that were part of the army, and former partisans;

- disabled people since childhood, as well as disabled people of groups I and II.

A complete list of persons who can count on this deduction is contained in paragraphs. 2 p. 1 art. 218 Tax Code of the Russian Federation.

Deduction for children

Now let's look at the standard child tax credit. The deduction is provided to each parent (adoptive parent, guardian, trustee, adoptive parent, spouses of parents) for each child aged:

- up to 18 years old;

- up to 24 years old - when studying full-time (letter of the Ministry of Finance of the Russian Federation dated December 16, 2011 No. 03-04-05/8-1051).

See also “The spouse of the child’s mother has the right to receive a “children’s” deduction.”

IMPORTANT! If the form of education is the decisive factor in granting a deduction, then the country in which the child receives education does not matter (letter of the Ministry of Finance of the Russian Federation dated April 15, 2011 No. 03-04-05/5-263).

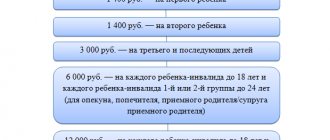

Starting from 2016, deductions for children are set in the following amounts:

- 1,400 rub. - for the 1st child;

- 1,400 rub. - for the 2nd child;

- 3,000 rub. - for the 3rd and each subsequent child.

And deductions for a disabled child from the same year became different depending on the type of person receiving the deduction:

- 12,000 rub. given to the parent, spouse of the parent, adoptive parent;

- 6,000 rub. receives a guardian, trustee, adoptive parent, spouse of an adoptive parent.

The deduction for a disabled child has the following features:

- it is applied simultaneously with a deduction that takes into account the order of birth of the child, i.e. it is summed up with it (letter of the Ministry of Finance of Russia dated March 20, 2017 No. 03-04-06/15803, Federal Tax Service of the Russian Federation dated April 6, 2017 No. BS-2-11 / [email protected] );

- For a disabled child of the 3rd group under the age of 24, studying full-time, this deduction cannot be obtained, but you can use the usual child deduction, which takes into account the order in which the child appears.

Read more about the possibility of summing up deductions in the following articles:

- “RF Armed Forces: the deduction for a disabled child does not absorb the usual “children’s” deduction, but complements it”;

- “Personal income tax deduction for a disabled child: the Ministry of Finance has changed its position.”

The standard tax deduction can be provided in double amount in the case where the child has only one parent (guardian, trustee, adoptive parent) for the following reasons:

- death of one of the parents (letter of the Ministry of Finance of the Russian Federation dated 08/06/2010 No. 03-04-05/5-426);

- recognition of one of the parents as missing (letter of the Ministry of Finance of the Russian Federation dated December 31, 2008 No. 03-04-06-01/399);

- if the paternity of the child has not been established (letter of the Ministry of Finance of the Russian Federation dated April 2, 2012 No. 03-04-05/3-413) - in this case, the deduction is provided before the parent enters into an official marriage.

A double deduction is also possible if the second parent refuses to receive the deduction. At the same time, it is important that he has income subject to personal income tax at a rate of 13% (letter of the Ministry of Finance of the Russian Federation dated 04/20/2017 No. 03-04-05/23946, dated 02/10/2012 No. 03-04-05/8-147).

See also “A spouse cannot receive a double “children’s” deduction for personal income tax if the spouse is on parental leave.”

The deduction is provided from the moment of birth of the child (adoption, guardianship) or from the date of entry into force of the agreement on the transfer of the child to be raised in a family until he reaches the age of 18 years (24 years) or until the death of the child or until the date of termination of the agreement.

IMPORTANT! The standard tax deduction for a child is given regardless of the provision of other standard tax deductions and is valid until the month in which income from the beginning of the year (excluding dividends) exceeds RUB 350,000.

Amounts of standard deductions in 2022

People who have special services to the Fatherland are given a standard tax deduction of 3,000 rubles. That is, they give 390 rubles to the budget monthly. Fewer payers who:

- have been diagnosed with “radiation sickness” or other pathologies caused by accidents at the Chernobyl Nuclear Power Plant or Mayak PA;

- received disability as a result of the events from the previous paragraph, participated in eliminating the consequences;

- worked in 1988–1990 at the Shelter facility;

- participated in testing or remediation of activities at military installations with elevated levels of radiation;

- received a disability during combat operations or receive a pension equivalent to this category.

The next group of beneficiaries under the standard tax deduction is exempt from paying personal income tax from 500 rubles. They calculate 60 rubles. less every month for tax residents of the Russian Federation who:

- have disabilities of groups 1 and 2 or are considered disabled since childhood;

- received full sets of Orders of Glory, as well as the title of Hero of the Russian Federation or the USSR;

- are participants in the Second World War, blockade survivors, prisoners;

- acquired a diagnosis of radiation sickness and other radiation-related pathologies in public service;

- were exposed in excess of the standard dose or received occupational diseases as a result of working in police, state police, penitentiary, and medical institutions;

- were bone marrow donors to save the lives of others;

- eliminated the accident at the Mayak Production Association or were forced to relocate after this event;

- are parents or non-remarried spouses of military personnel who died in the line of duty;

- participated in hostilities in Afghanistan or on the territory of the Russian Federation.

The largest standard tax deduction is for children. For the first-born and subsequent child - from 1,400 rubles, that is, 182 rubles monthly for each. For all subsequent ones - from 3000 rubles, to 390 rubles.

For a disabled child under 18 years old - from 12,000 rubles, which will reduce the tax amount by 1,560 rubles. The last benefit is extended for groups 1 and 2 up to 24 years of age if the child is studying at a university or other educational institution as a student, resident, intern, graduate student, or full-time as a student.

Adoptive parents, guardians, guardians are given the same benefits, except for standard tax deductions for disabled children - unlike natural parents, they will receive an exemption from personal income tax not from 12,000, but from 6,000 rubles. This will reduce the tax by 780 rubles.

The benefit for children in accordance with the priority is not absorbed by the tax deduction for a disabled child. If this is the first-born, then 182 + 1560 = 1742 rubles will not be withheld from the salary in personal income tax.

If there is only one parent or person replacing him, then he has the right to receive a double tax deduction. Until he gets married. In the month following the registration of marriage, the standard tax benefit for children will be provided to him in a single amount. One of the parents may have the right to a double deduction if the other parent refuses in writing this form of personal income tax compensation.

To receive a standard tax deduction, you must provide the employer or the Federal Tax Service with all the documents necessary to confirm your right to the benefit. In the month when the total income since the beginning of the year exceeds 350,000 rubles, the tax deduction for children ceases to be accrued.

The procedure for providing standard deductions for personal income tax

Standard tax deductions are provided to the taxpayer at his choice by one of the employers based on an application and supporting documents, which include:

- child’s birth certificate - when receiving a deduction for the 3rd and subsequent children, certificates are needed for all the employee’s children, regardless of their age and whether a deduction is provided for them or not (letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-04 -05/8-146, Federal Tax Service of the Russian Federation dated January 24, 2012 No. ED-4-3/ [email protected] );

- document on adoption, establishment of guardianship;

- certificate of disability;

- certificate from an educational institution.

To learn about what documents are needed to receive a tax deduction for education, read the material “What documents are needed for a tax deduction for education?” .

If an employee does not start work from the beginning of the year, the question arises: is a certificate of his income from his previous place of work required for deduction? Today there are 2 opposing opinions:

- provision of deductions is possible without a certificate from the previous place of work (letter of the Federal Tax Service of Russia dated July 30, 2009 No. 3-5-04 / [email protected] , resolution of the Federal Antimonopoly Service of the North Caucasus District dated April 14, 2010 in case No. A32-19847/2008-33/ 333);

- the employer does not have the right to provide a deduction without such a certificate (resolution of the Federal Antimonopoly Service of the North Caucasus District dated June 17, 2014 in case No. A32-11484/2012).

Therefore, if the employee has income from his previous place of work in the current year, it is advisable to still have a 2-NDFL certificate in order to avoid claims from controllers.

If the employer has not provided the taxpayer with a standard tax deduction, then the latter has the right to receive it from the Federal Tax Service at his place of residence. To do this, at the end of the year you need to submit a personal income tax return and documents confirming your right to deduction. By virtue of clause 7 of Art. 78 of the Tax Code of the Russian Federation, this can be done within 3 years. It is advisable to attach a 2-NDFL certificate to the declaration, which will speed up receipt of the deduction and refund.

For information on how to obtain a certificate, read the article “Where can I get (get) a 2-NDFL certificate?” .

How to return deductions for children for previous years

If for some reason you have not taken advantage of the personal income tax benefit for children for several years, then the money will not be used up. There is a limitation - you can receive a standard deduction for children only for the last three years and this can be done through the tax office.

To do this, you need to contact the Federal Tax Service and attach:

- application for personal income tax deduction, which indicates account details for transferring overpaid personal income tax;

- documents for the right of deduction;

- 2-NDFL certificates for the years for which you are claiming a deduction;

- Declaration 3-NDFL.

After a 3-month desk audit, a decision is made and within a month the money will be credited to your account.

Examples

In conclusion, here are some illustrative examples of the use of standard tax deductions.

Example 1

Citizen Krasnov I.A. is a liquidator of the consequences of the disaster at the Chernobyl nuclear power plant, in addition, he was awarded the Order of Glory, 3rd degree. He has a son aged 22 who is studying full-time. Krasnov I.A.’s monthly salary in 2021 is 65,000 rubles. What deductions can he expect?

He claims monthly deductions in the amount of 3,000 rubles. and 500 rubles, but according to current legislation these deductions do not add up, the maximum of them will be selected. Over the course of a year, this deduction will save Krasnov I.A. the amount of 4,680 rubles. (3,000 × 12 months × 13% = 4,680). As for the deduction for the child, since the son is a full-time student, Krasnov I.A. has the right to count on this deduction, however, it is worth noting that the deduction will no longer be provided as soon as Krasnov I.A.’s income exceeds 350,000 rubles. With the salary we indicated, this will happen in the 5th month. So, the amount of tax that Krasnov I.A. will save on his child’s education will be 728 rubles. (1,400 × 4 months × 13% = 728).

Let's summarize: Krasnov I.A. will save money in the amount of 5,408 rubles in 2022. (4 680 + 728).

Example 2

Ivanova A.A., due to the death of her husband, became the only parent for 3 children aged 25, 17 and 14 years. A. A. Ivanova’s monthly salary is 21,000 rubles. What deductions will she be entitled to?

The provision of a standard tax deduction for children in 2021 is limited to an income of 350,000 rubles. With her salary, Ivanova A.A. will be able to receive deductions throughout all 12 months of the year.

1st child aged 25 years - no deduction will be provided for him, however, he will be taken into account when counting children.

2nd child aged 17 years - the deduction for him will be 2,800 rubles. due to the fact that Ivanova A.A. is the only parent and has the right to receive a double deduction (1,400 × 2 = 2,800).

3rd child aged 14 years - the deduction for him will be 6,000 rubles, since starting from the 3rd child, the usual deduction is 3,000 rubles, and A. A. Ivanova has the right to double it as the only parent ( 3,000 × 2 = 6,000).

So, the amount of money saved by Ivanova A.A. will be: for the 2nd child - 4,368 rubles (12 months × 2,800 × 13% = 4,368), for the 3rd child - 9,360 rubles (12 months × 6,000 × 13% = 9,360).

The total amount of money saved by A. A. Ivanova for the year will be 13,728 rubles. (4,368 + 9,360).

ConsultantPlus experts reviewed even more examples with various nuances of providing a standard deduction for children. Learn the material by getting trial access to the system for free.

Personal income tax deduction codes for children for 2022

In 2022, the following personal income tax deduction codes for children are valid: 126-149:

| 126 | For the first child up to 18 years old or full-time student up to 24 years old | Parent, his spouse, adoptive parent |

| 127 | For a second child under 18 years of age or a full-time student under 24 years of age | Parent, his spouse, adoptive parent |

| 128 | For third and subsequent children under 18 years of age or full-time students under 24 years of age | Parent, his spouse, adoptive parent |

| 129 | For a disabled child under 18 years old or a full-time student under 24 years old, if he is a disabled person of group I or II | Parent, his spouse, adoptive parent |

| 130 | For the first child up to 18 years old or full-time student up to 24 years old | Guardian, trustee, adoptive parent, his spouse |

| 131 | For a second child under 18 years of age or a full-time student under 24 years of age | Guardian, trustee, adoptive parent, his spouse |

| 132 | For third and subsequent children under 18 years of age or full-time students under 24 years of age | Guardian, trustee, adoptive parent, his spouse |

| 133 | For a disabled child under 18 years old or a full-time student under 24 years old, if he is a disabled person of group I or II | Guardian, trustee, adoptive parent, his spouse |

| 134 | Double the amount for the first child under 18 years old or a full-time student under 24 years old | Sole parent, adoptive parent |

| 135 | Double the amount for the first child under 18 years old or a full-time student under 24 years old | Sole guardian, trustee, foster parent |

| 136 | Double for a second child under 18 years old or a full-time student under 24 years old | Sole parent, adoptive parent |

| 137 | Double for a second child under 18 years old or a full-time student under 24 years old | Sole guardian, trustee, foster parent |

| 138 | Double for the third and subsequent children under 18 years of age or full-time students under 24 years of age | Sole parent, adoptive parent |

| 139 | Double for the third and subsequent children under 18 years of age or full-time students under 24 years of age | Sole guardian, trustee, foster parent |

| 140 | Double the amount for a disabled child under 18 years old or a full-time student under 24 years old if he is disabled group I or II | Sole parent, adoptive parent |

| 141 | Double the amount for a disabled child under 18 years old or a full-time student under 24 years old if he is disabled group I or II | Sole guardian, trustee, foster parent |

| 142 | Double the amount for the first child under 18 years old or a full-time student under 24 years old | To one of the parents if the other refuses a tax deduction |

| 143 | Double the amount for the first child under 18 years old or a full-time student under 24 years old | To one of the adoptive parents if the second one refuses a tax deduction |

| 144 | Double for a second child under 18 years old or a full-time student under 24 years old | To one of the parents if the other refuses a tax deduction |

| 145 | Double for a second child under 18 years old or a full-time student under 24 years old | To one of the adoptive parents if the second one refuses a tax deduction |

| 146 | Double for the third and subsequent children under 18 years of age or full-time students under 24 years of age | To one of the parents if the other refuses a tax deduction |

| 147 | Double for the third and subsequent children under 18 years of age or full-time students under 24 years of age | To one of the adoptive parents if the second one refuses a tax deduction |

| 148 | Double the amount for a disabled child under 18 years old or a full-time student under 24 years old if he is disabled group I or II | To one of the parents if the other refuses a tax deduction |

| 149 | Double the amount for a disabled child under 18 years old or a full-time student under 24 years old if he is disabled group I or II | To one of the adoptive parents if the second one refuses a tax deduction |

It is convenient to maintain personnel records, pay salaries, travel allowances, and deductions in the accounting web service Kontur.Accounting. Keep records with us, generate reports and send them online, use the support of our experts. The first 14 days of work are free for everyone.

Get to know the service