What transfers are taxes paid on?

A year ago, news portals massively published articles in which it was written in black and white: any transfer to a card is subject to tax (here, for example, the story of “Russia-24” and a link to “Vesti.ru” from the Google cache). It is not true.

Taxes, in particular personal income tax, are levied

exclusively on income

. And the tax code clearly states what is considered income:

...income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed... ...the receipt of property by its actual owner from a nominal owner is not recognized as income (economic benefit), if such property and its nominal owner is indicated in a special declaration...

A more detailed list of income is presented in Art. 208 of the Tax Code of the Russian Federation.

Typically, tax agents are responsible for calculating and withholding taxes. This is, for example, an employer or a freelance platform (if you enter into a secure deal). You rarely have to calculate and pay taxes on your own.

But if, for example, you won more than 4 thousand rubles in the lottery, sold an iPhone, rented out an apartment or garage, etc., you will have to calculate and pay yourself.

All this is income, which means that 13% of it will have to be given to the state

.

Important : sales on Avito and other similar sites are subject to tax. But there is a nuance: you can get a property deduction if you first sold something and then spent that money on another product.

Rent

Now let's imagine something pleasant: your grandmother left you an apartment (room, cottage, car - choose what you like best), and you rent it out.

Money from renting out property is the income of the lessor (clause 4, clause 1, article 208 of the Tax Code of the Russian Federation). If your tenant is an individual (not a tax agent for personal income tax), then you, as a lessor, are required to calculate and pay tax on your income (clause 1 of article 226, clause 1 of clause 1 of article 228 of the Tax Code of the Russian Federation).

Consequently, when receiving rent on the card, the landlord is obliged to submit a tax return (clause 1 of Article 229 of the Tax Code of the Russian Federation) and pay tax to the budget (clause 4 of Article 228 of the Tax Code of the Russian Federation).

By the way, the authorities recently boasted that they have learned to identify landlords who hide their income from renting out apartments.

When you don't need to pay tax

Income is not taxed

tax if it is: ▪️ Alimony ▪️ Charitable assistance ▪️ Benefits and scholarships ▪️ Daily allowance within the limit ▪️ Reimbursement of legal expenses ▪️ Money and property inherited ▪️ Income from the sale of vegetables and fruits from the garden, etc.

The full list is much longer, you can check it here. In what form you received this money (cash, card, etc.) does not matter.

It happens that you repaid a debt to a colleague. Or everyone dropped on your card to buy a common gift. Or someone got sick and friends decided to help. Or a grandmother topped up her grandson’s card so he could buy a new gadget.

All this is not income. This means that you do not need to pay taxes on such transfers.

Gifts from individuals

are also not taxed.

An exception is only if non-close relatives donate a car, real estate or shares worth more than 4 thousand rubles. It’s better to take money

from them . If a company or individual entrepreneur gave you a gift cheaper than 4 thousand rubles, you don’t have to pay tax on it. And if this is a gift for the birth of a child, then you don’t have to pay tax if the price of the gift is less than 50 thousand.

Personal income tax for transfers between bank cards of citizens: card owners are in for trouble

Good afternoon

There have been reports in the media for quite some time that from 2020 citizens will be required to pay personal income tax on transfers between bank cards! And there really is cause for concern.

The Ministry of Finance in its letter dated 06/07/2019 No. 03-04-05/41947 indicated that “money received free of charge from an individual, including by bank transfer, is not subject to personal income tax. In addition, the mere fact of a bank transfer of funds between individuals is not subject to taxation.”

From this position it is clear that the fact of transferring money from card to card does not mean that the recipient citizen must pay personal income tax on it. But in some situations you will still have to replenish the budget.

Meanwhile, there is another no less interesting position contained in the said letter, namely: “At the same time, funds received into the account of a taxpayer - an individual, for example, as payment for property sold or, for example, as remuneration for services rendered services are recognized as the income of such an individual, subject to personal income tax in the prescribed manner.” It seems to be a common situation, when one sells something and the other buys something, then personal income tax must be paid, even though such a situation may be of a one-time nature.

As it seems, in this case the goal of the Ministry of Finance is not the imposition of personal income tax on one-time “household” transactions, but is a little broader. And here a reasonable question arises: what is the real goal of such movements towards ordinary citizens?

In fact, everything is much more prosaic. Let's try to figure it out.

As a remark:

Personal income tax will be asked to pay specifically for goods sold, work performed or services rendered. Let me remind you once again that if the funds are transferred free of charge, then no one will demand payment of personal income tax. And as we know, money transfers in the form of a gift are also not subject to personal income tax, and it does not matter whether the donor and the donee are related; in fact, it also does not matter what the amount of the transfer is. If the tax authority identifies income, then taxes, fines and penalties will be assessed.

The question is: how is the tax authority going to identify transactions subject to personal income tax?

And here is the answer:

Everything is quite simple.

Let us remind you that from 07/01/2019, amendments to Federal Law No. 54-FZ “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as 54-FZ on cash register systems) came into force for organizations and individual entrepreneurs. And as we now know, in relation to any settlements with individuals, a cash receipt is issued.

And it doesn’t matter how the payment was made (by wire transfer, cash payment, bank card or offset of advances), including if the money is transferred to an individual by bank transfer to a card and is associated with payments for goods, work, services. The issued cash receipt will be entered into the Federal Tax Service database online.

Here we see the following scheme, which many people know about and have encountered, including in everyday life, and which is not customary to talk about out loud.

Thus, from the actions of our Ministry of Finance it is clear that it is trying to stop situations where an individual entrepreneur selling, for example, tobacco products or vegetables in his small tobacco shop or vegetable kiosk does not issue a cash receipt and at the same time accepts funds from an individual buyer to his personal bank account. map. By the way, products purchased for subsequent resale can be partially capitalized, and another part of the subsequently resold products can also be purchased under the guise of personal needs and “as if” not for business activities.

But, let’s not go into the specifics of our business, but return to the subsequent mechanics of identifying such situations.

When identifying such transfers, the task of the tax authority is simplified to purely technical actions - this is the correlation and joining of statements of an individual and the corresponding information about issued cash receipts. As is known, for failure to issue cash receipts to organizations and individual entrepreneurs, Art. 14.5 of the Code of Administrative Offenses of the Russian Federation provides for impressive sanctions when such situations are identified.

So, part 2 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation provides that the non-use of cash register equipment in cases established by the legislation of the Russian Federation on the use of cash register equipment entails the imposition of an administrative fine on officials in the amount of one-fourth to one-second of the amount of the settlement carried out without the use of cash register equipment, but not less than ten thousand rubles; for legal entities - from three-quarters to one of the amount of the settlement made using cash and (or) electronic means of payment without the use of cash register equipment, but not less than thirty thousand rubles.

According to Part 3 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, repeated commission of an administrative offense provided for in Part 2 of this article, if the amount of settlements made without the use of cash register equipment amounted, including in the aggregate, to one million rubles or more - entails in relation to officials disqualification for a period of one to two years; in relation to individual entrepreneurs and legal entities - administrative suspension of activities for up to ninety days.

Conclusion: Ordinary citizens should not be afraid when transferring funds to their card by another person. Therefore, if the transfer is carried out in ordinary life, and you are not an entrepreneur, then you should have no reason to worry, but if you are an individual entrepreneur and practice the above, then be prepared for increased attention from the tax authority.

Thank you for your attention!

Should you be afraid of the attention of the tax authorities?

At the beginning of summer there were rumors that the tax authorities would audit all transactions

according to citizens' cards.

They say that banks will automatically

transmit data, and inspectors will demand explanations about each transfer.

In fact, since 2013, banks have actually reported to the tax authorities about all new open accounts

.

And only if the tax office makes an official request

, the bank will tell you how much money is in a particular account and what transactions were carried out on it.

The amendments affected only metal accounts – those from which banks buy precious metals. From June 1, banks were required to report the opening of such accounts to the tax authorities. And upon request, they provide data on balances and transactions.

What could be the reason for a request from the tax office to the bank? Tax debt or audit in connection with a specific case. In addition, the tax office may identify a questionable transaction and ask you to explain why the money was transferred and whether you are conducting business without registering a legal entity.

What does the Federal Tax Service say?

According to information received from lawyers specializing in tax legal relations, such attention may be rather accidental, initiated during a tax audit of the customer of services - a legal entity or individual entrepreneur.

In turn, representatives of the Federal Tax Service note that a mass check of all individuals to determine whether they have received undeclared income has not yet been carried out. But, as you know, if information is received, tax authorities have the right to conduct tax audits in relation to individuals (Article 89 of the Tax Code of the Russian Federation). Also, representatives of the Federal Tax Service draw attention to the fact that information about the movement of funds in a taxpayer’s account is not unambiguous evidence that the taxpayer has received income. A bank statement on the flow of funds on a current account cannot serve as sufficient evidence to establish the fact of transactions for the sale of goods or services.

Who is at risk? These are, as a rule, realtors, persons receiving income from foreign assets, self-employed citizens (freelancers, persons providing various types of services, or performing various types of work for individuals).

According to paragraph 2 of Art. 86 of the Tax Code of the Russian Federation, the tax office can request information from banks about the accounts of individuals who are not individual entrepreneurs only with the consent of the head of a higher tax authority, the head of the Federal Tax Service or his deputy - in cases of tax audits against these citizens. However, as Federal Tax Service specialists point out, such a restriction does not apply if an individual is actually engaged in business without registration.

How does the tax office control transfers?

The wealthiest are usually targeted

. For example, those who bought a car or an apartment, but did not declare income or pay tax on the minimum wage.

Theoretically, if someone bought something expensive from you

, then he can transfer this data to the tax office.

Lately, this often happens when buying expensive gadgets. For example, if a person bought an iPhone from you and then sold it, he can declare income from the sale and attach a receipt indicating that he transferred the money to you. As a result, he will receive a property deduction

, and you are fined for not paying tax on the income from the sale.

By the way, here we describe in detail how to obtain a property deduction.

Neighbors can also knock

. For example, if your tenants organized festivals in the apartment, and you did not pay taxes on rental income.

Finally, a tax agent

. If he does not withhold personal income tax, he will simply send the data to the tax office so that the inspector will calculate everything and send you a notification.

What to do if in doubt

First of all, don't panic. Proving that there was a violation is the tax office’s responsibility.

. The inspector must gather the facts and establish that you received income from the sale, and not repayment of a debt or a gift.

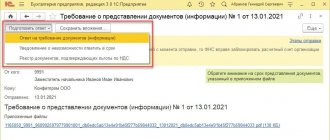

You can also send a request to your tax office. They have to explain everything there. The form is here. True, answers do not always come quickly.

If you regularly receive transfers to your card for your work, but do not want to register as an individual entrepreneur, you might consider registering as a self-employed person

. For the self-employed, taxes are lower: 4% of income when working with individuals and 6% when working with legal entities.

Payment for services rendered

Money paid under a contract for the provision of paid services is recognized as the income of the contractor (clause 10, clause 1, article 208 of the Tax Code of the Russian Federation). As in the case of rental income, the recipient of the income independently calculates and pays personal income tax to the budget (clause 1, clause 1, article 228 of the Tax Code of the Russian Federation).

By the way, taxable income arises from the performer, even if the agreement was concluded between family members or close relatives recognized as such by the Family Code of the Russian Federation (clause 5 of Article 208 of the Tax Code of the Russian Federation).

Tax officials cannot yet distinguish between a transfer to a card under a service agreement and a transfer from a husband or girlfriend. Paying tax is up to the conscience of the income recipient.

Are they blocked for frequent transfers?

Often, ordinary people and representatives of small and medium-sized businesses are afraid that they will be targeted by the tax authorities and banks for making too frequent transfers. They say this is a sign of cashing out cryptocurrency, virtual money, funds from cards, or conducting commercial activities.

It's actually not that bad. Firstly, it is profitable for banks to make money

on normal clients and it is unprofitable to refuse cooperation. Secondly, the bank will refuse a client only if it suspects him of illegal activity.

Of course, they can check you. And they won’t even inform you about the measures being taken. And if everything ends badly, they won’t reveal the reason

denial of service - this is prohibited. 2 tbsp. 4 115-FZ.

At the initial stage, the check is performed automatically. There are expensive and complex financial monitoring systems that are constantly being improved. They are the ones who signal suspicious transactions, which are then checked manually.

will recognize the cash out with almost 100% probability

, even if it masquerades as information services.

will not be denied

service .

What if you transfer dollars?

If both the sender and the recipient are tax residents of the Russian Federation (citizens of the country and those who have received a residence permit), then transferring currency is prohibited

. But there are exceptions to the rule:

- If you transfer currency to an account in a foreign bank (but not more than 5 thousand dollars during one business day through one Russian bank);

- If you make a transfer from an account in a foreign bank to an account in a Russian one (there are no limits in this case);

- If funds are transferred to close relatives (husband, wife, children, parents, grandparents, grandchildren, brothers and sisters, adoptive parents and adopted children);

- If both parties spent more than 183 days abroad in a calendar year.

In general, this is clearly not the case when you need to throw $500 for an iPhone or cryptocurrency purchased. If a violation is discovered, you will not be sent to prison.

, but you will have to pay a fine in the amount of 75 to 100% of the amount of the currency transaction under Art. 15.25 Code of Administrative Offenses of the Russian Federation.

Money on personal bank cards - income?

In their letter, Federal Tax Service specialists recalled that, by virtue of Article 2 of the Civil Code of the Russian Federation:

Entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services.

This means that if a person does something and receives money for it, he is engaged in entrepreneurial activity. And, accordingly, according to tax legislation, he is obliged to pay taxes. Therefore, if such a person receives money into his card account (or any other account) for hairdressing services, design, writing articles, drawing pictures or illustrations, sewing, knitting and all that, he must pay taxes. And there is nothing new in this.

True, as specialists from the Federal Tax Service of Russia themselves noted last year, it is quite difficult to differentiate such receipts on citizens’ cards. After all, such cards are intended for personal use. Relatives can transfer money to them and friends can lend money to them. This could include refunds for returned purchases, gifts for birthdays and other holidays, or simply the account owner's personal money on which taxes have already been paid. To prove that income is related to business activities, tax authorities need evidence. If desired, the Federal Tax Service authorities can obtain them. But to do this, they are forced to monitor social networks, advertisements in newspapers, and even conduct raids on apartments. This phenomenon has not yet gained mass popularity. In addition, in 4 regions, a special tax regime for the self-employed was launched on an experimental basis from January 1 this year. The tax rate there ranges from 4 to 6%, so the new regime is popular among those who want to legalize their activities and income.

But that is not all. After all, now such citizens are threatened not only by the collection of personal income tax from “entrepreneurial” income, but also by the imposition of VAT on them. This is exactly what is discussed in the letter from the Federal Tax Service.

Will they be jailed for non-payment of taxes on a transfer?

Almost certainly not. If you unintentionally fail to pay tax on a transfer that is subject to personal income tax, you will be forced to make a payment and pay a penalty of 20% of it. If they prove that they did not pay intentionally, the fine will double.

The statute of limitations for this type of offense is 3 years. As you can see, everything is not as critical as many people think.

The most important thing is not to consider others stupider than yourself. And don’t be lazy to honestly fill out the “Destination of transfer” field. It will come in handy.

(

65 votes, overall rating: 4.00 out of 5)