Requirements

The application must comply with these standards:

- The information presented in the paper must be truthful. The accuracy of the figures should be double-checked. In particular, you need to correctly indicate the codes of regions and actions.

- The application must have a header. In it you need to enter the details of the tax office, which is the recipient of the document. You can clarify them using the nalog.ru service. To do this, you need to enter your registration address in the appropriate field.

- The header of the document must contain information about the sender: full name, address, INN.

- When filling out the application, you must use black ink. You must write legibly, preferably in block letters.

- If the application was drawn up in the presence of an inspector, the signature on it must be certified. If the document is sent by tax post, you need a notary visa.

The application consists of parts: “header”, title of the document, “body”, signature and date.

Procedure in case of lost payment

1. Check the correctness of the details in the payment order.

2. If an error was made in the payment order, contact the Federal Tax Service to clarify the payment (if the error is subject to clarification).

Sample wording of an application for clarification of payment (error in the purpose of payment):

Due to an error in the payment order dated _______ No. _____ for the transfer of payment to ___________, please clarify the purpose of the payment.

The purpose of payment was incorrectly indicated: __________________.

The following purpose of payment should be considered correct: _____________________.

Based on clause 7 of Art. 45 of the Tax Code of the Russian Federation, please make the appropriate changes to the payment details.

Enclosure: Copy of payment order dated ______ No. _____.

3. If all the details are indicated correctly in the payment order, then contact the tax authority to reconcile the calculations with the budget.

4. If the payment is not reflected in the joint reconciliation report, you need to contact the Federal Tax Service at your place of registration with an application to search for the payment, indicating the details that allow you to identify the payment.

Features of drawing up different types of statements

Different types of applications can be sent to the tax office. They are divided into types depending on the purpose of the direction and content.

About obtaining a TIN

Any tax payer is registered with the Federal Tax Service. Registration is carried out within 5 days after sending the application. The latter is compiled according to form No. 2-2-Accounting, established by order of the Federal Tax Service No. YAK-7-6 / [email protected] dated August 11, 2011.

About the deduction

A deduction is an amount that reduces the calculation base when determining tax. There are these types of deductions:

- Regular.

- Child deduction.

- For investment.

Tax refunds are made based on the application. Its form is established by order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated February 14, 2022.

On issuing a certificate stating that the payer has no debts

The payer may request information about the presence/absence of tax debts. To do this you need to request a certificate. It may be needed, for example, when obtaining a mortgage.

The application form has not been approved. That is, the document can be drawn up in free form. However, it is recommended to adhere to the standard structure: “header”, title, text with a formulated request, signature and date.

For a refund or offset of tax that was overpaid

A company may mistakenly pay too much in taxes. To get a refund, you need to send an application to the tax office. You need to formulate your request in the “body” of the document. It could be:

- refund;

- offset of funds against future payments.

The application must be submitted within 3 years from the date of overpayment. Funds must be returned within a month from the date of receipt of the tax paper. The application can be submitted in electronic format. To do this, you need to go to your personal account of the Federal Tax Service.

About deferment of payment

Sometimes individuals or legal entities cannot pay taxes on time. In this case, they can request an installment plan. The amounts for which the installment plan is issued cannot exceed the value of the debtor's property on which the tax is paid. To receive the benefit, you must fill out an application in the form specified in Appendix No. 1, approved by Order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated September 28, 2010.

ATTENTION! If an installment plan is issued, interest accrues.

Complaint to the tax service

If the rights of a taxpayer have been violated, he can write a complaint against the tax service or against individual employees; this is provided for in Article 139 of the Tax Code of Russia.

A complaint can be filed with a higher tax authority, the same tax office that you are complaining about. You can file a complaint within a year from the date a person receives information about a violation of their rights. The citizen himself or his representative can file a complaint.

It can be sent by mail, taken personally to the office, while you keep a second copy with a mark of acceptance, date, signature of the employee who accepted it and a seal. The complaint is sent by registered mail. Now the most popular and convenient way to send a complaint is by email or filing a complaint on the website.

There are situations when the tax service delays payment of tax deductions. The timing of payment of deductions is stipulated in the Tax Code of Russia. Some tax authorities transfer money even faster than the deadline of four months. When they delay implementation, explaining this by workload, then the need arises to push the process.

How to file a complaint

On the website of the tax inspectorate there is a section “contact the Federal Tax Service”, and you do not need to go and stand in line and wait. Your application will be reviewed and the protracted process will be expedited; from the moment you apply, you will receive the money no later than two weeks later.

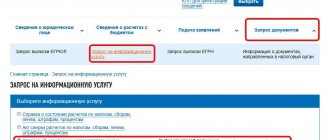

On the website, select the Individuals tab, then click on “Contact the Federal Tax Service of Russia”, at the bottom of the page click “Individual or Individual Entrepreneur”. And the registration form opens.

Here you need to fill in information about the Federal Tax Service of which city and region, your full name, Taxpayer Identification Number, telephone number for contact. The content field should reflect the essence of your complaint. When and to which tax office did you apply, with what question, what statements did you write, in what timeframe was the money supposed to arrive, and that at the time of writing the complaint it had not arrived, and the deadline had already passed. Indicate that you are asking to pay the tax deduction due to you, a penny for missing the deadline.

If there are documents, for example, a declaration signed by the operator, then you can attach them. Choose to have the answer sent to you by mail in paper form, and click the send button.

After this, the tax inspector should contact you.

Application for refund or credit of overpaid tax

Paying taxes can be quite a hassle and complicated task. It is quite possible that you give more to the state than you should. This may happen due to your oversight or a sudden change in the circumstances that made you eligible for the benefit. For example, an elderly person may pay full tax on his car, and then he finds out that he is entitled to a benefit. How can I get my money back? No way. But don't be upset. There will indeed be no physical refund. But you can ensure that the surplus is transferred to the next year. It can also be transferred to another taxation object or even to another type of tax.

There are also times when not the entire amount is paid. So that the tax inspectorate does not have any claims against you, the request to offset the remaining amount is made in the same application.

To submit such an application, a special form is required, a sample of which can easily be found online. It can also be obtained by visiting the tax office in person. Remember that taxes paid can only be recalculated for the last three years. If the overpayment took longer, then nothing can be done about it.

As is the case with many of the applications discussed above, this can be submitted online using the “Personal Account” on the Federal Tax Service website. If you haven't created your account yet, please register. This process will not take much time. All that remains is to do the following:

Log in to the site. The login is usually the TIN; you must remember the password. If you have problems with your password, you will have to contact your local Federal Tax Service department. You can also log in using the State Services portal and a qualified electronic signature.

Now you need to go to “Profile”, where you need to obtain an electronic signature verification key certificate. This is done for free, and the process definitely won’t take much time. It is recommended to store the signature in a secure storage facility of the tax service.

Next, go to the “Overpayment/Debt” section. Here you need to submit an application for a refund or offset of overpaid tax by filling out a simple form. Don't forget to attach the required documents.

That's all! You can wait for the decision of the NSF.

Application for deferment or installment payment of taxes

As you know, in the fall it is necessary to pay property, transport and land taxes. Usually the tax office even sends a letter reminding you about this. However, sometimes a person cannot pay the appropriate taxes. This could happen, for example, as a result of a natural disaster or an accident. A poor financial situation allows you to defer or spread out the payment of taxes. To do this, you need to send a corresponding application to the Federal Tax Service.

To write an application for an installment plan or deferred payment, you must fill out the form recommended in Appendix N1 to the procedure for changing the deadline for paying taxes. You can easily find a corresponding sample on the Internet. In the form you must enter the desired duration of the installment plan, the name of the tax, the amount and the reasons for providing you with an installment plan or deferment.

Don’t be too happy that the Federal Tax Service met you halfway. To use the deferment, you will also have to pay some interest on top.

Application to search for payment

Fill out a request for payment in any form.

Sample wording of an application to search for payment:

Please find a payment made on ________(date) in _____________ (name of credit institution) in the amount of _____________ (numbers in words) rubles.

A copy of the payment document is attached: name, number, date, purpose of payment, etc.

Attach copies of payment orders or other documents confirming the transfer of funds to the budget to the application for search for payment.

Application for benefits

There are a huge number of taxpayers living in Russia who are entitled to one or another benefit. It is provided when paying transport, land or property taxes. For example, disabled people of groups I and II, heroes of Russia, military personnel and, of course, pensioners can count on benefits. Tax breaks can also be introduced by local authorities. In particular, in some regions of our country tax benefits are provided to large families.

If you fall under the “fiscal amnesty,” then submit an application to the Federal Tax Service for a property tax benefit. Again, you can find a corresponding sample online for this. In it you will only need to enter your passport details and note the type of benefit.

For some time now, filling out a paper form is no longer required. You can get by by entering all the necessary data into an electronic form. To do this, you need to go to the “Personal Account” of the Federal Tax Service website. Next, go to the “Objects of Taxation” section, and then go to the subsection “Application for benefits on property taxes.”