Reasons for requesting clarification from the tax office

When conducting a desk inspection, the inspector has the right to request written explanations from the organization about the identified discrepancies. Clause 3 of Article 88 of the Tax Code of the Russian Federation indicates the main reasons when it is necessary to give an explanation of what happened:

| There are errors in the report | The inspector may send a notice and ask for clarification or provide updated tax reporting. |

| In the updated declaration, the amounts are much lower than in the original document | An employee of a government agency may suspect the company of deliberately understating the tax base and will require written explanations of the changes made. |

| The income statement reflects losses | If the company’s accountant knows that the company is incurring losses, then it is better to prepare a message in advance about the factors that influenced the current situation. |

The company's management must send a reasoned response to the request within 5 days from receipt of the notification.

In what situations will clarification be required?

If during the reconciliation the Federal Tax Service specialists encounter any discrepancies in the available documentation, a request will be sent to the subject. The basis for writing an explanation may be:

- The taxpayer reflects information about all income received during the year (constant, one-time). Meanwhile, tax officials have additional sources of information. And if, during the reconciliation, the declaration data does not coincide with the information of the competent authorities, then a request will be sent to the citizen.

- Explanations will be required from a business entity if, based on the results of checking the declaration and calculating the taxable base, it is discovered that the organization’s activities resulted in a loss. This fact is the basis for exemption from paying the fee. It is necessary to prepare a reasoned answer in advance.

- Giving explanations on the issue of financial and economic activities will be required if the subject of taxation has submitted a zero declaration under the simplified tax system. The explanation must be provided based on the balance sheet data.

Responsibility

No matter how much tax officials intimidate with financial sanctions, it will not be possible to hold people accountable for failure to provide explanations.

Let's find out why:

- according to Art. 126 of the Tax Code of the Russian Federation cannot be a reason for a fine when requesting clarification, since this is not a requirement to provide documents;

- Article 129.1 of the Tax Code of the Russian Federation cannot be applied, since this is not a counter-check;

- According to Article 19.4 of the Code of Administrative Offences, it is impossible to bring to administrative liability, since this article is applicable only in case of failure to appear at the inspection when called.

But, in any case, it is better to check and find out why the discrepancies appeared. Perhaps this will help to detect an accountant's mistake when drawing up the report.

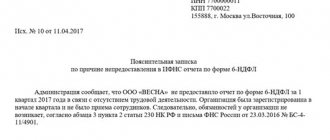

Explanation of discrepancies regarding 6-NDFL

Quarterly, the accounting department submits Form 6-NDFL to the Federal Tax Service, which indicates information about income and withheld tax amounts for each employee.

What to do if tax authorities ask for clarification on inaccuracies in the report? To get started you need:

- check all indicators reflected in the form;

- check the indicated figures with other reports with which the tax office is reconciling;

- specify the amount of the transferred tax;

- if it turns out that there is no error, then you need to send a logical explanation; if an error is discovered, send a clarifying report.

If it turns out that there is an error in the personal income tax information, the company may be fined for inaccurate provision of information in the amount of 500 rubles. for each document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). The company is released from liability if the error was identified independently and corrected. Therefore, every accountant should know the rules for preparing all types of reporting in order to avoid mistakes.

How to use the tax or Ministry of Finance response received for another organization?

Note!

It makes no sense to use responses from the Ministry of Finance or tax authorities addressed to other organizations or individual entrepreneurs, because

An answer provided to another taxpayer and applied by you will not relieve you of liability

, because such letters do not have a regulatory status, but are of an informational and explanatory nature.

You can use the explanations of the Ministry of Finance only if they are sent to an unspecified circle of people.

Explanation of low wages

In Russia, the process of legalizing wages is underway. The rule has been established that workers for their work must receive no less than the minimum wage approved at the state level. At the same time, in the regions of the Far North or equivalent areas, wages should be calculated taking into account increasing factors.

If the inspector discovers that in the submitted calculation the workers’ wages are below the maximum value, then he has the right to demand an explanation of the discrepancies.

Reasonable reasons for this situation may be:

- due to the difficult situation of the organization, employees were transferred to part-time work, the salary was calculated based on the time actually worked;

- if the employee went on vacation, then this circumstance can be pointed out. Often employees go on vacation for a long period of time, receive vacation pay in one month, and the subsequent period remains without accruals or they are insignificant;

- There may be another situation, for example, a person got sick, issued a sick leave, and handed it over to the accounting department for payment later;

- If tax officials ask to explain the reasons for the discrepancy in wages from industry indicators, then they can write that workers receive according to the minimum wage level. But it is not possible to increase the amount, since the company is still young and production volumes are insignificant.

Any explanations must be supported by documents. In this case, you can attach orders about vacation, about switching to a shortened working day, payslips about accruals, sick leave, etc.

Late payment of tax, explanation from the Federal Tax Service

For such reasons, inspectors rarely request clarification; they have the right to send a demand for payment of the relevant tax after the expiration of the regulated period for payment.

What to do if the tax authorities asked to indicate the reasons for the delay in paying taxes?

| Cause | Explanation |

| Technical reason | The company's management may discover that the tax was calculated correctly, but when paying, incorrect details were indicated in the payment documents, for example, in KBK or OKTMO. In this case, you will need to write an application to clarify the payment. If it passes by the current date, and not the actual date of payment, you will have to pay a penalty for late payment. |

| There is a discrepancy between the period of accrual and payment of personal income tax | In paragraph 6. Article 226 of the Tax Code of the Russian Federation stipulates that the taxpayer must transfer the amount the next day after payment of wages. In cases where the salary is transferred on the last day of the reporting quarter, and the tax is transferred in the next period, you will need to explain the situation. But this fact is not a violation of the law. |

In these cases, financial sanctions can be avoided; the main thing is to respond to the notification in a timely manner and take measures to provide explanations.

Registration of a document with the fiscal authority

Sample letters to the tax office are drawn up as follows:

- The “header” of the explanatory letter is placed in the upper right side of the A4 sheet. In this section, you must indicate the Federal Tax Service number, the position of the authorized employee to whom the message is addressed and the city where the tax office is located. Below is the author of the application (full name), his passport details and registration address (legal entities and individual entrepreneurs write their name and details).

- Next, in the middle of the sheet, the name of the document “Explanation” is indicated.

- The title reveals the essence of the appeal. It is necessary to reflect all facts confirming the accuracy of the previously submitted information. If the taxpayer agrees to the adjustments, then the documentation to which the amendments were made and which amendments were made should be identified. If employees of the fiscal authority have several questions for the business entity, the answer can be formatted in the form of a numbered list of explanations.

- Under the text of the main part, you must provide a list of attached documentation to confirm the amendments made or the correctness of the original data. This section should be titled "Applications".

- Below, under the text of the letter, the taxpayer must sign and write the date the document was drawn up in the format day, month, year.

Explanation of lack of activity

When conducting business activities, the company's management often encounters financial difficulties, which serves as a reason for suspending activities.

To avoid misunderstandings, it is recommended to immediately inform the tax authority, the Pension Fund of the Russian Federation, and social security services that for specific reasons the organization’s activities have been suspended, employees have been fired, and wages have not been accrued.

Let's find out what arguments can be written in a letter. Most often these are the following reasons:

- due to the economic crisis in the country;

- production volumes have decreased, activities have been temporarily suspended, if work is resumed, the organization undertakes to notify government authorities about this;

- The company decided to liquidate.

Suspension of a company's business activities does not relieve the taxpayer from submitting reports. Penalties are provided for late submission of even zero declaration forms.

How to correctly write an explanatory note to the tax office

When running a business, it is very important to know how to correctly write an explanatory note to the tax office. If you ever need to write a similar note to the tax authority, you need to do it very competently. Today you can familiarize yourself with recommendations on how to write an explanatory note to the tax office. The recommendations given below will also be useful in interaction with superiors and other officials. First, let's define what it is, an explanatory note to the tax office. You need to write a memorandum addressed to the director, but it is also possible to write an explanatory note. The key difference between these two documents is the absence of proposals and conclusions at the end of the document, and the design itself is, in principle, very similar to each other. This document explains the point of view of the author of this paper. This event may well be a failure to complete tasks assigned by management, as well as a violation of generally accepted labor discipline. This document is able to explain in full any unpleasant situations that have arisen at work, with an ambiguous interpretation of the reasons for what is happening, which led to unpleasant and inevitable consequences. There is another function that this document performs: it can clearly explain the contents of another document. In this case, the explanatory note is attached to the main document as an appendix. Absolutely all taxpayers, without exception, are simply obliged to submit the appropriate reports to the tax control authorities within specific deadlines and in the prescribed manner. In some exceptional cases, the taxpayer may be required to write an explanatory note to the tax office, which can adequately and fully explain the reason for the actions that led to certain consequences.

How to fill out an explanatory form correctly

The document is drawn up in any form, since there is no approved standard form. The explanation can be drawn up by hand or using computer technology.

When drawing up a document, you should follow the general rules:

- the name of the inspection that requested the explanation is written in the header;

- The answer can be issued on the company’s letterhead. If there is no such form, then you must indicate the full name of the company, OGRN, INN, KPP and legal address;

- the date and number of the inspection requirement for which an explanation is provided should be indicated;

- further details of the situation that require clarification are described in detail;

- It is best to document the facts that caused the discrepancies identified. For example, if an employee’s salary is less than the subsistence minimum, then a vacation order can serve as a supporting document. This will be understandable if vacation pay was accrued in one month, and the rest days were in the next period.

If, after receiving a request from the Federal Tax Service, the organization’s accountant discovers errors in the submitted reports, you must immediately submit corrective declarations.

For the convenience of our readers, we will provide a unified example that is suitable for almost any situation for sending reasonable explanations to tax authorities about identified discrepancies.

When requesting clarification about VAT discrepancies, the response should be sent only electronically. Even if the organization sends a response to the request within the prescribed period, but on paper, the information will be considered not provided.

Summarize. Whatever the request from the tax authorities, a response must be given within 5 days. This will help to identify the mistake made in a timely manner. If the reporting was submitted correctly, then it is enough to write an explanation and attach supporting documents.

☎️ Still have questions after reading the article? Get a free consultation from a qualified lawyer. Call now! +7 800 302-76-57

When submitting an explanatory note to the Federal Tax Service

Every organization regularly faces the need to send a written explanation to the tax office about reporting indicators. There are two types of explanations.

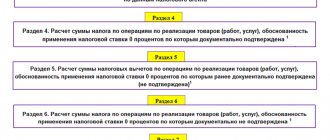

Explanations in the annual financial statements

Explanations for reporting are prepared by all legal entities, with the exception of small enterprises that are not subject to mandatory audit, and non-profit organizations. The document contains disclosure of information in the lines of the balance sheet and its annexes. For example, the line “Accounts receivable” consists of the current debt of customers minus the reserve for doubtful debts. The amount of the reserve is not visible in the reporting, so it is in the interests of the enterprise to decipher it in the explanations. The line “Accounts payable” contains the total value of debts to suppliers, other counterparties, the budget, funds, employees (wages), etc. The explanatory note reveals all the components of this indicator. A recommended example of this document is contained in Appendix 3 to Order of the Ministry of Finance No. 66n dated July 2, 2010.

An example sample of filling out an explanatory note to the balance sheet looks like this:

| Explanatory note to the balance sheet LLC "Clubtk.ru" for 2022 1. General information Limited Liability Company (LLC) "Clubtk.ru" was registered by the Ministry of Taxes and Taxes No. 1 for St. Petersburg on December 12, 2012, INN 1234567898, KPP 123401001, OGRN 1234567898765, legal address: 123456, St. Petersburg, st. Pravdy, no. 1. The balance sheet is formed in accordance with the accounting and reporting rules in force in the Russian Federation. Authorized capital: 100,000 (One hundred thousand) rubles. Main activity: providing services for posting information, operating information portals on the Internet (OKVED 63.11). Composition of affiliates: Voronov Andrey Viktorovich - General Director; Semenov Igor Fedorovich - deputy director. 2. Basic accounting policies The accounting policy was approved by order of the director No. 21 dated December 30, 2019. The depreciation method is linear. The method of valuing goods and inventories is based on average cost. The method of assessing liabilities is based on the cost of their occurrence. 3. Composition of fixed assets: | 45 000 000 | 5 000 000 | 40 000 000 |

| Vehicles | 2 600 000 | 750 000 | 1 850 000 |

| Equipment | 3 540 000 | 1 985 000 | 1 555 000 |

4. Accounts receivable are reflected on line 1230 in the amount of 1,560,000 (One million five hundred sixty thousand rubles 00 kopecks) minus the reserve for doubtful debts in the amount of 320,000 (Three hundred twenty thousand rubles 00 kopecks). The total amount of accounts receivable is 1,880,000 (One million eight hundred eighty thousand rubles 00 kopecks). The reserve was formed due to the presence of overdue debt of Chaika LLC.

5. Accounts payable are reflected on line 1520 in the amount of 3,460,000 (Three million four hundred and sixty thousand rubles), including:

| Suppliers and contractors | 2 910 000 |

| Payments to personnel regarding wages | 380 000 |

| Debt to the budget and extra-budgetary funds | 162 000 |

| Other creditors | 8 000 |

General Director: /Voronov A.V./

Response to tax demand

Upon receipt from the Federal Tax Service of a document containing an order to clarify certain information in the declaration, a written response is drawn up in any form, which should be sent within 5 working days from the date of sending the receipt (clauses 12, 13 of the Procedure, approved by order of the Federal Tax Service No. ММВ -7-2/ dated 02/17/2011, clause 11 of the Procedure, approved by order of the Federal Tax Service No. ММВ-7-2/ dated 04/15/2015).

ConsultantPlus experts discussed how to respond to the tax authorities’ demands. Use these instructions for free.