How is the organization's property reflected in accounting?

To briefly answer the question of what accounting for an organization’s property consists of, we can name three main positions that fall into this category:

- funds (cash and non-cash, in accounts and at the cash desk);

- tangible assets (fixed assets and low-value assets);

- intangible assets.

Each property item has its location on a specific balance sheet account. This localization depends on many factors. In particular, on the cost. That property whose value is less than 40,000 rubles, but whose period of use exceeds a calendar year, is called low-value. It is taken into account on accounts 10, 11 and 15. Capitalization is expressed by standard accounting entries D10-K60.

Those same assets that cannot be classified as low-value and which the organization considers its fixed assets have a number of distinctive characteristics:

- this property is used to create goods that will be subsequently sold, as well as to provide services (perform work);

- operation of such property is possible for a long period (more than a year);

- the book value of the property is more than 40,000 rubles.

Fixed assets are capitalized by posting:

Debit 08 – Credit 60 (Purchase from supplier and classification as fixed assets).

Next, the cost of fixed assets is written off to the debit of account 01.

Both fixed assets and low-value assets are classified as tangible assets. That is, objects that have their own material expression and are localized in space. They can be touched, seen, used. But there are also those assets that also have value and are capable of generating income for their owner, and often considerable income, but they do not have a tangible physical form. These assets are considered to be intangible. And these include:

- intellectual rights;

- rights to use natural resources;

- business reputation of the organization;

- organizational expenses.

Intangible assets do not have physical form, but are capable of bringing economic benefits to an enterprise.

Features of accounting

Accounting entries for accounting for sources of property are formed exclusively using the double entry method. This means that a change in the ownership indicator cannot but affect the indicators of sources.

For example, the receipt of materials is reflected as a debit to account 10. But with a simultaneous increase in account 60 as a credit. That is, an increase in the amount of accounts payable is reflected. Even gratuitous receipts affect the passive side of the balance sheet. The credit turnover is reflected in account 98 “Deferred income”.

The values of the monetary valuation of property and sources are always equal - this is the basic rule of equality of assets and liabilities of the balance sheet. Moreover, the liability reflects the value of the sources, and the active side of the balance sheet is the one where the organization’s property is reflected.

The basis on which accounting of the sources of property formation takes place is a report reflecting:

- increase in the sources of ownership formation on the credit of accounts 60, 76, 66, 67 and capital and reserve accounts;

- reduction (expenditure) of sources is reflected in the debit of the listed accounts.

How to keep records of the sources of an organization's property

Accounting for an organization's property implies identifying the sources of formation of such property. All sources can be divided into two main groups - own funds and attracted resources. Often, an enterprise acquires property through the use of its own capital. The organization creates equipment and, using funds from its sale, updates the machine park: it expands the list of fixed assets with the help of which it makes a profit in the future. But equity capital is not always enough for large-scale activities. It is especially difficult to implement a developed business plan at the initial stage, when there are very few such funds. Often, a company attracts resources by concluding loan agreements with credit institutions, as well as with business partners. From an accounting point of view, property formed from borrowed funds is also considered to be property acquired by an enterprise on the terms of deferred or installment payment. In other words, the counterparty credited the organization for the amount of the cost of material assets supplied and services provided.

It is extremely difficult to carry out business activities without using attracted financing. In truth, there are no organizations that operate without borrowed funds.

Read material on the topic: Accounting services for companies

Next, we will consider what equity and borrowed capital are and what they consist of.

Each enterprise has certain assets on its balance sheet. But it is not always fully paid for by the company. That is, part of the property, as we have already said, can be formed through borrowed funds. Therefore, the value of its liabilities should be subtracted from the value of the organization’s property, and then you will receive the net value of the property - that is, the enterprise’s equity capital. It consists of several parts:

- The authorized capital is formed at the stage of formation of the enterprise from the contributions of the founders. The percentage of these contributions and their amount are not specified by law; there is only a minimum limit for the authorized capital - 10,000 rubles. If the owners of the company do not raise this amount initially, then they will not be able to register the organization.

- Additional capital is the amount formed as a result of the additional valuation of non-current assets, which is periodically carried out as part of accounting for the organization’s property. In general, ways to generate additional capital can be: revaluation of fixed assets as a result of inflationary processes, which led to an increase in their value;

- the result of conversions into domestic currency of contributions from foreign owners to the company’s authorized capital, the result of the impact of exchange rate differences on the assessment of the value of the company’s property. The day of registration of the enterprise and the day of actual payment of the authorized capital do not always coincide. That is why, on the day of registration, the founder’s contribution was valued at one amount, and at the time of payment this amount could increase significantly due to changes in the exchange rate;

- the appearance of share premium of a joint-stock company in cases where the real value of the shares sold exceeds their nominal value. The opposite situation during the initial issue of shares is simply unacceptable. And selling at a price higher than the nominal price is a common thing.

- Credit debt is the organization's obligations to counterparties. This may be arrears for settlements with partners, or perhaps the obligation to distribute GDP.

Sources of formation of property assets

The company's property is formed from specific sources. This can be either the entrepreneur’s or company’s own funds or borrowed assets. Among all sources of formation, there are three main categories:

- The company's own capital. This is not only the authorized capital of the company, which was formed during the creation of an economic entity. Own assets can also include additional capital, as well as reserve funds. These are funds accumulated during the activity of the institution. Also, the company’s profit and targeted financing can be included in equity capital.

- Borrowed capital. It is formed through loans and borrowings received from third parties. For example, loan financing can only be obtained from a licensed company (bank). But a loan can be obtained from both the counterparty and the founder.

- Accounts payable are the amount of debt a company owes to third parties, suppliers and contractors.

Inventory of sources of property formation is an important stage in the financial activity of a company. The procedure allows you to identify unused resources and reduce ineffective expenses of the subject.

How is an organization's property inventory recorded?

Accounting for an organization’s property is impossible without carrying out inventory measures, during which the property on the enterprise’s balance sheet is checked.

Tangible assets are subject to inventory, whether low-value or fixed assets. For this purpose, a commission must be created, which includes financially responsible persons. Before starting the preparation of annual reports, an inventory must be carried out every three years. Of course, it is advisable to do this only if the enterprise has any fixed assets on its balance sheet.

The Law “On Accounting” dated December 6, 2011 N 402-FZ declares the obligation of each organization to ensure the reliability of accounting information regarding the accounting of the company’s property and its reporting. This must be done by reconciling the existing accounting data in the enterprise with the data obtained as a result of the inventory.

Based on the results of the inventory, in order to most effectively account for property, an inventory sheet is compiled, which contains all the results of checking fixed assets. Accounting data is verified with the actual condition and location of these resources. The results of the reconciliation are recorded in the statement.

Inventory is of great importance for monitoring the current economic activities of an enterprise. With its help, you can check reporting and contributions to the tax authorities. Based on the results of the inventory procedure, it is possible to identify some surpluses that should be used rationally until the end of the current quarter, optimizing settlements with budget funds.

Read the material on the topic: What tax reporting do individual entrepreneurs submit?

Inventory is necessary to account for the organization’s property, which includes not only fixed assets accepted on the balance sheet, but also inventories, intangible assets, financial investments, finished goods, and raw materials.

The inventory commission identifies surpluses or deficiencies, identifies those responsible, and signs a reconciliation plan. Those responsible will subsequently face administrative punishment.

The entire reconciliation can be divided into three main stages. The first of them, preparatory, consists of the following actions:

- The head of the organization issues an order for the upcoming inspection in the INV-22 form. It is advisable to indicate in this document the timing of this event, as well as the composition of the commission created to organize it.

- The list of commission members is also approved by the head.

- It is necessary to determine the scope of this procedure: what exactly is being checked and within what time frame.

- Financially responsible officials must be familiarized with the issued preparatory orders against signature.

At the second stage, the actual inventory begins, which is an accounting of the enterprise’s property (all values, assets, liabilities are calculated and entered into reconciliation inventories, for which unified forms have been developed):

- fixed assets accounting (INV-1);

- inventory of intangible assets (INV-1a);

- inventory of inventory items (INV-3);

- inventory report of shipped goods and materials (INV-4);

- inventory of property accepted for safekeeping (INV-5);

- inventory of goods in transit: sent but not yet received by the addressee (INV-6).

- act of accounting for precious metals and products made from them (INV-8);

- inventory of precious metals available in semi-finished products, finished equipment, individual parts, instruments and products (INV-8a);

- act of inventory of precious stone products and precious stones themselves (INV-9);

- inventory of unfinished repair activities (INV-10);

- act on future expenses (INV-11);

- inventory of cash (INV-15);

- inventory of securities and strict reporting forms (INV-16);

- act of reconciliation of settlements with debtors and creditors (INV-17).

The third final stage is intended to draw up the organization's balance sheet. When all the property is described in fact, you can reconcile with the nominal positions in the accounting documents and make adjustments. You can check fixed assets using the INV-18 form, and record the difference in inventory accounting in a statement using the INV-19 form.

Specific individuals are not always to blame for shortages and surpluses. Often, differences between the theoretical amount of property and the actual amount are attributed to company expenses.

If, as a result of the inventory, it is possible to find unaccounted for fixed assets, they are recorded using the following entries:

Debit account 01 – Credit account 91/1 (at original cost).

Debit 91/2 – Credit 02 account (for the amount of depreciation).

If the inspection reveals a shortage, which also happens quite often, it is reflected in the following entries:

Debit 01/2 account – credit 01 (at original cost).

Debit 02 account – Credit 01/2 account (for the amount of depreciation).

Debit 94 accounts – credit 01/2 (at residual value).

In order to assign the deficiency to a specific guilty person, a basis in the form of a court decision is required. This is formalized by posting D 73/2-K 94.

If you simply write off the deficiency as losses of the enterprise, posting D 91/2-K 94 is used

Reflection of the transfer of property from account 21 to 1C: BGU 8

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: How can a landlord take into account the reimbursement of utility bills by a tenant in 2022?

Published 05/19/2021

How does registration of real estate of an organization take place?

People in the Russian Federation do not become taxpayers of their own free will. If a company owns any real estate, and also has separate divisions on the territory of the state, it is automatically obliged to register for taxation not only at its location, but also at the location of each existing separate division, as well as real estate and transport. The tax authority assigns the organization an individual taxpayer number.

The obligation to be registered with the tax authority at the location of the real estate forces the business company to write a corresponding application to the tax office at the location of such property within a specific period - 30 days from the date of registration of the property.

However, tax authorities themselves must also take measures to register taxpayers. Thus, after registering ownership of real estate, authorized services provide information to the tax inspectorate at the place of registration, and that, in turn, registers the organization within five days from the date of receipt of the relevant information. The inspection certificate is issued in person or sent by registered mail.

Tax registration at the location of the property subsequently entails the obligation to pay property tax and forces you to provide a calculation using the unified form KND 1152026 (submitted for each separate division and property).

Acceptance of VAT for deduction on fixed assets

When purchasing real estate, VAT is deductible if the following conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- OS must be used in activities subject to VAT;

- in stock - correctly issued SF (UPD);

- Fixed assets were accepted for accounting, including included in account 08.04 “Acquisition of fixed assets” (paragraph 3, paragraph 1, article 172 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated July 4, 2016 N 03-07-11/38824, Letter Ministry of Finance of the Russian Federation dated November 18, 2016 N 03-07-11/67999).

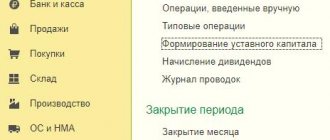

Acceptance of VAT for deduction on purchased real estate is documented in the document Formation of purchase ledger entries in the section Operations - Closing the period - Regular VAT operations.

To automatically fill out the Purchased Assets , you must use the Fill .

Postings according to the document

The document generates transactions:

- Dt 68.02 Kt 19.01 - acceptance of VAT for deduction.

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

VAT declaration

The VAT return reflects the amount of VAT deducted:

In Section 3 p.120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

How to keep records of corporate property taxes

The regional tax on property of enterprises is provided for by Chapter 30 of the Tax Code of the Russian Federation. The amount of tax paid depends entirely on the tax rate, which is established by law in the regions of the Russian Federation. The maximum amounts are indicated by the Tax Code of the Russian Federation. The tax payment deadline and procedure are also set out in this basic set of laws.

Bodies of constituent entities of the Russian Federation have the right to establish their own tax benefits for certain categories of taxpayers. But in addition to benefits and privileges, there is also such a thing as the complete exemption of individual objects from the need to pay taxes.

Objects not subject to property tax:

- natural resources, environmental management facilities;

- objects used for the needs of state defense, security and law enforcement that are under the operational management of federal executive authorities (that is, objects of military service and other equivalent service);

- objects of cultural heritage of the peoples of the Russian Federation;

- especially dangerous facilities that serve to store nuclear materials, radioactive waste, as well as nuclear installations themselves;

- shipping transport for nuclear technology services and ships containing nuclear installations;

- space objects;

- ships registered in international registries;

- fixed assets classified as the first and second depreciation groups according to the Classification of fixed assets approved by the Government of the Russian Federation.

Read the material on the topic: Optimization of company taxes

Acceptance of real estate under the acceptance certificate

Costs for the acquisition of office space, which will subsequently be taken into account as a fixed asset (FPE), are reflected in account 08.04 “Purchase of fixed assets” (1C chart of accounts).

Real estate objects suitable for exploitation are accepted into the fixed assets regardless of the moment of transfer of ownership rights and are accounted for at their original cost in a separate subaccount to the fixed assets accounting account (clause 52 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, clause 7 PBU 6/01).

The initial cost of the fixed assets is formed based on the actual costs of its acquisition, delivery and bringing the object to a condition suitable for use (clause 8 of PBU 6/01, clause 1 of Article 257 of the Tax Code of the Russian Federation).

Find out more about the formation of the initial cost in BU and NU

In 1C there are two options for registering the acquisition and accounting of fixed assets:

Standard option , which uses documents:

- capitalization of fixed assets - document Receipt (act, invoice) type of operation Equipment ;

- commissioning of OS - document Acceptance for accounting of OS ;

Simplified version , which uses a single document:

- capitalization and commissioning of fixed assets - document Receipt (act, invoice) type of transaction Fixed assets .

Learn more about Options for registering an OS in 1C, as well as the capabilities and limitations of each method

Real estate objects are reflected on the balance sheet of the organization at the time of receipt of the primary documents for its transfer, regardless of the date of transfer of ownership rights (clause 52 of the Guidelines for OS accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

When registering a property for which ownership has not yet been registered, you can choose any method, but you must take into account other restrictions provided for the simplified option.

In our example, there are no restrictions for using the simplified version, so we will formalize the acceptance of fixed assets for accounting using a single document Receipt (act, invoice) transaction type Fixed assets in the section Fixed assets and intangible assets – Receipt of fixed assets – Receipt of fixed assets.

The header of the document states:

- The method of reflecting depreciation expenses is the method of accounting for the costs of depreciation of fixed assets, selected from the directory Method of reflecting expenses .

In our example, depreciation costs will be taken into account as general business expenses, since the property will be used as an office.

- Assets accounting group - Buildings .

- OS location - location of operation of the OS, selected from the Division directory.

- The Objects are intended for rental checkbox is not selected: in our example, the purchased object will be used for our own needs.

The tabular section indicates:

- Fixed asset is a purchased property that must be created in the Fixed Assets directory .

In the NU for used assets, the useful life is indicated with the exception of the service life of the previous owner (clause 7 of article 258 of the Tax Code of the Russian Federation).

- Service life - useful life (USI) for an object. In this document, only one SPI can be established - the same for NU and BU.

- Accounting account - 01.08 “Fixed assets in the organization”, it must be set manually;

- Depreciation account - 02.01 “Depreciation of fixed assets accounted for in account 01” will be set automatically.

When posting a document, the fixed asset card in the Fixed Assets will be filled out as follows PDF. In this case, the depreciation group will be determined automatically depending on the service life specified in the document.

In the fixed asset card for used fixed assets, in the Depreciation group of the Classification section for this object, you must indicate the depreciation group established by the previous owner (clause 12 of Article 258 of the Tax Code of the Russian Federation). If necessary, you need to adjust the depreciation group of the fixed asset.

The remaining data in the OS card is filled in manually.

Postings according to the document

The document generates transactions:

- Dt 08.04.2 Kt 60.01 - formation of the initial cost of the asset.

- Dt 01.08 Kt 08.04.2 - acceptance of a real estate object into the OS, the ownership of which has not been registered;

- Dt 19.01 Kt 60.01 - acceptance of VAT accounting.

Documenting

The organization must approve the forms of primary documents, including the document on commissioning of the property and the form of the inventory card for further accounting of fixed assets. In 1C, the Certificate of Acceptance and Transfer of a Building (Structure) OS-1a and Inventory Card OS-6 are used.

The form of the Certificate of acceptance and transfer of a building (structure) OS-1a can be printed by clicking the Print button - Certificate of acceptance and transfer of OS (OS-1) of the document Receipt (act, invoice) . PDF

The Inventory card form in the OS-6 form can be printed by clicking the OS Inventory card (OS-6) in the fixed asset card (section Directories - OS and intangible assets - Fixed assets). PDF

How is the cost of OCDI reflected in account 0 210 06 000 “Settlements with the founder”?

According to Art. 298 of the Civil Code of the Russian Federation, an autonomous institution, without the consent of the owner, has no right to dispose of real estate and especially valuable movable property assigned to it by the owner or acquired by the autonomous institution at the expense of funds allocated to it by the owner for the acquisition of such property.

The autonomous institution has the right to dispose of the remaining property that it has under the right of operational management independently, unless otherwise established by the Law on Autonomous Institutions. In turn, a budgetary institution, without the consent of the owner, has no right to dispose of particularly valuable movable property assigned to it by the owner or acquired from funds allocated to it by the owner for the acquisition of such property, as well as real estate. The rest of the property that it has under the right of operational management can be disposed of by a budgetary institution independently, unless otherwise established by the Law on Non-Profit Organizations.

By virtue of clause 116 of Instruction No. 174n , clause 119 of Instruction No. 183n, account 0 210 06 000 is intended for accounting for property that the institution does not have the right to independently dispose of . The book value of particularly valuable property is reflected in this account.

Correspondence for account 0 210 06 000 , given in instructions No. 174n, 183n, differs from that contained in the Letter of the Ministry of Finance of the Russian Federation dated September 18, 2012 No. 02-06-07/3798 . The letter is not a normative act, unlike the above instructions . According to the correspondence of the accounts specified in clause 116 of Instruction No. 174n and clause 119 of Instruction No. 183n , account 0 210 06 000 is not closed. Due to the incorrect reflection of these transactions in accounting and reporting, the Ministry of Finance issued this letter. Projects were also developed to amend instructions No. 174n and 183n, which never became regulations. The information provided in the projects and the said letter is identical. By Order of the Ministry of Finance of the Russian Federation dated October 26, 2012 No. 139n, amendments were made to Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 No. 33n “On approval of the Instructions on the procedure for compiling and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions . According to these changes, it is possible to fill out the forms introduced by this order only if you reflect transactions on account 0 210 06 000 in the manner established by Letter of the Ministry of Finance of the Russian Federation No. 02-06-07/3798.

Let us give an example of how transactions with particularly valuable movable property are reflected in accounting.

Example 2

The medical institution received from the founder property that was previously in use. According to the transfer and acceptance certificate (f. 0306001), the book value of the equipment is 350,000 rubles. The amount of accrued depreciation is RUB 90,000. After some time, the property was transferred to another budgetary institution subordinate to the same founder. The amount of depreciation accrued on equipment during its operation by the institution amounted to 70,000 rubles. The numbers in the example are conditional. Let's assume that the property transferred and received is reflected in account 4,101,26,000.

In accounting, operations for the receipt, operation and disposal of property will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The property received from the founder was accepted for accounting: | |||

| – for the amount of book value | 4 101 26 310 | 4 401 10 180 | 350 000 |

| – for the amount of depreciation previously accrued on the received property | 4 401 10 180 | 4 104 26 410 | 90 000 |

| Settlements with the founder for the amount of the book value of the received property are reflected | 4 401 10 172 | 4 210 06 660 | 350 000 |

| The amount of depreciation accrued on equipment is reflected (operations are carried out using the “red reversal” method) | 4 401 10 172 | 4 210 06 660 | (90 000) |

| The amount of depreciation accrued on the property during the period of its operation by the institution | 4 109 00 271 | 4 104 26 410 | 70 000 |

| The amount of depreciation accrued on equipment during the reporting period is reflected (transactions are carried out using the “red reversal” method) | 4 401 10 172 | 4 210 06 660 | (70 000) |

| Property transferred to another institution: | |||

| – for the amount of book value | 4 401 10 241 | 4 101 26 410 | 350 000 |

| – the amount of depreciation accrued on the property | 4 104 26 410 | 4 401 10 241 | 160 000 |

| Settlements with the founder for the amount of the book value of the transferred property (350,000 - 90,000 - 70,000) rubles are reflected. | 4 401 10 172 | 4 210 06 660 | (190 000) |

The question also often arises related to the use of account 0 210 06 000 in relation to particularly valuable movable property acquired under activity code 2. The Ministry of Finance in Letter No. 02-06-07/3798 provides correspondence of accounts, according to which account 0 210 06 000 is applied and in relation to property accounted for under activity code 2. The same information was contained in the draft amendments to instructions No. 174n, 183n ( clause 116 of Instruction No. 174n , clause 119 of Instruction No. 183n ).