Features of salary documentation

The issuance of wages in an institution must be timely and transparent, regardless of whether the amount of remuneration is paid in cash or by bank transfer.

A document confirming the correctness of accruals and payments for each employee in the case of mutual settlements with employees in cash is a salary slip; you can download the form for free below.

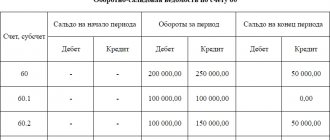

The accrual and payment of wages is reflected in the corresponding accounting records, and the document that serves as the basis for such entries is the salary slip (SW). It is compiled by an accountant according to legally approved forms:

- payment and settlement (unified form T-49, T-51) - indicates the calculation and actual payments for each employee, form T-49 - for cash payments, T-51 - for non-cash payments;

- settlement (unified form T-53) - illustrates the calculation of monthly remuneration for each employee.

A salary payment form (you can download the form in our article) must be drawn up monthly for each salary paid at the institution in accordance with the rules and regulations of current legislation.

The document itself consists of a title page, a content (tabular) part and a section including information about the deposited salary.

The payment and settlement document reflects information about the salaries of each employee, the number of days worked, accruals and deductions made. The payment and settlement system accumulates the data contained in the settlement and payment documents. We offer a salary slip form to download for free.

Sample and form of payroll slip

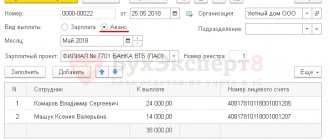

Let us remind you that by virtue of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, all organizations, regardless of the form of ownership, industry focus and tax payment regime, are required to maintain accounting records. In this case, accounting means the formation of documented, systematized information about accounting objects in accordance with the requirements of Law No. 402-FZ and the preparation of accounting (financial) statements on its basis (clause 2 of Article 1 of Law No. 402-FZ). Article 9 of Law No. 402-FZ obliges organizations to document each fact of economic life with the appropriate primary accounting document. Since payroll is calculated on the basis of clause 8 of Art. 3 of Law No. 402-FZ relates to the facts of the economic life of an organization, the rule on documentation fully applies to payroll. If an organization uses a payroll for payroll, then to issue it it will have to use: • payroll of the unified form No. T-53 in case of payment of wages in cash from the cash register; • documents provided by the bank when issuing wages by transferring them to employee card accounts (payment of wages within the framework of a salary project).

By the way, we note that if wages are paid by an organization through a bank, then to calculate wages, a payroll is always used, in which the employee’s wages are calculated, taking into account all payments and deductions due to him for the month. The amount directly to be paid to the employee is indicated in a separate column. Filling out the payroll form is regulated by Section 2 of the instructions on the use and completion of primary accounting documentation forms for accounting for labor and its payment, given in Resolution No. 1.

In the RF you need to fill in the following details: • document number; • Date of preparation; • reporting period; • employee's personnel number; • FULL NAME. employee; • job title; • tariff rate; • number of hours worked; • amount of accrued payments (salary, bonus, social benefits); • amount of taxes withheld; • the amount of debt of the organization; • the amount of the employee's debt; • amount to be paid;

In the “Accrued” field, you need to indicate the amount of all payments from the payroll fund (wage fund), as well as other income, including in the form of property benefits. The easiest way to understand the filling procedure is in specific samples, which are presented below in the article.

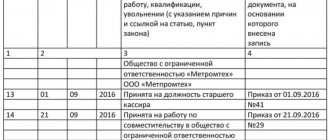

Personal account, form

When calculating salaries in institutions, the unified form T-54 is also used; it is mandatory for use and is enshrined in Resolution of the State Statistics Committee No. 1 of 01/05/2004. It reflects the accrued earnings for each individual employee for the billing period (year or period of work). Employee personal card - the salary form for each employee is available for download.

Who fills out the form

The payroll form is prepared in the accounting department by an employee in the payroll department. The basis for filling it out is the payslip. Its data is transferred to the payroll, and then, within the established time frame, is transferred to the cashier for issuance.

This statement can also be compiled by another accountant or official whose responsibilities include payroll.

You might be interested in:

Certificate of absence of an employee from the workplace: how to draw up, sample [year] year

For the payroll, Rosstat provides a special form T-53. Firms can use it or use a form developed independently.

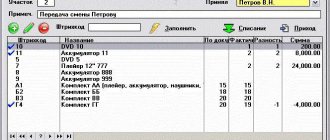

The use of specialized programs allows you to generate a payroll automatically. That is, you just need to fill out the pay slip, and the pay slip will be generated right there. The statement must be written out in a single copy.

Attention! In large enterprises, salary payments can be made through several pay slips, which are filled out for each department.

The completed statements are registered in a special journal in the form T-53a in continuous numbering. This journal is opened every year, and after its completion is stored for another 5 years. Registration of the statement in the journal is carried out by the number and date of its registration.

Filling procedure

It can be compiled in either paper or electronic form. The electronic payment document must be signed with an electronic signature. The filling procedure is regulated by Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014.

Next, we will tell you how the salary sheet is formed; you were able to download the form earlier.

First of all, the title page is filled out: all organizational details of the institution are indicated (name, INN/KPP, OKPO). It is also necessary to indicate the total amount paid, indicate the billing period, number and date of the PO. The head and chief accountant put their signatures in the title part.

The tabular part is formed from the following information data:

- serial number;

- employee position;

- Personnel Number;

- FULL NAME.;

- salary (rate) according to the tariff;

- the amount of time worked according to the time sheet;

- deductions and accruals carried out for each employee;

- signature column.

The bottom lines indicate the total amounts for all employees: how much money was paid and how much was deposited. It is also noted who made the salary payment, the name and initials of the responsible employee - the accountant, as well as the date of verification of the payment document.

The terms for issuing funds are limited - no more than five working days. In the event that the employee has not received wages within the specified period, the amount is deposited, and the corresponding mark is placed in the notice.

In what case does it apply?

The payroll is used when making cash payments to employees of the enterprise.

In this case, wages are calculated in another document - the payslip. In addition, other documents can be used to calculate salaries - payroll form 49, time sheet form T 12, etc. Which documents should be used is determined by the enterprise itself based on the specifics of its activities. The chosen method is reflected in the company’s accounting policies and other local documents.

It makes sense to use a statement in the T-49 form in small enterprises, since it simultaneously calculates wages and issues them. This is very convenient for optimizing document flow in an enterprise.

However, a significant disadvantage of this method is its cumbersomeness. Therefore, if there is a significant number of staff, it makes sense to use two documents at once - a separate payroll and payroll.

Thus, the main difference between forms T-49 and T-53 is that the latter only formalizes the payment. Its use also involves the use of the T-51 form in terms of performing calculations. However, you can use the T-53 statement when issuing an advance on wages, when it is necessary to record the very fact of issuing funds, without making any calculations.

When a company has a small staff and uses a payroll, payroll can be issued without issuing a payroll. Employee benefits may be paid under cash settlement.

bukhproffi

Important! If an organization pays wages by transferring amounts to plastic cards, then the payroll is not applied, even if the number of employees is small. In this case, a register is drawn up for transfer to the bank.

Creating statements for advance payments: 4 practical tips

Continuing the topic of filling out statements, we will consider popular cases of erroneously filling out statements for an advance payment.

1. If the advance payment form is not filled out, then it is possible:

1. There is already a statement for the same month, in which the “Pay” field is filled in as “Salary for the month”, the “Payment month” field is the month for which we are trying to pay the advance. You can check this by evaluating the entire list of statements (“Payments” - “All statements for salary payments”).

Correction:

- correct previously entered statements, guided by the advice from the previous article (the header of the document “Statement” should indicate the month FOR which we pay the amounts, and not in which we make the payment).

- temporarily post a statement for the same month with the payment method “Salary for the month.”

In theory, the situation is not always clear, so let’s look at a specific example:

1) We create and fill out a statement for the payment of an advance (for example, an advance for June).

2) We see that by clicking on the “Fill” button, the amounts do not appear in the statement.

3) Go to the journal “All statements for salary payments”

4) We see that there are already statements for June and the payment method is “Salary for the month”

They could have appeared either by mistake, when indicating the month in the statement, or justifiably - in order to formalize the payment of any amounts at the beginning of the month, it was necessary to draw up exactly such a statement.

In any case, to create our advance payment, such a statement must be temporarily posted and returned when the advance payment is completely ready.

2. An employee has been assigned an advance payment “Accrual for the first half of the month”, but the document “Accrual for the first half of the month” has not yet been created.

You can see which method of calculating the advance payment is assigned to the employee in the employee’s card (select on the section panel “Human Resources” - “Employees” - find the employee).

Anastasia's comment:

— If you do not agree with this method of calculating the advance, then enter the appropriate personnel document.

If there are employees with the “Calculation for the first half of the month” method of calculating the advance, then before filling out the statement for the advance payment, the “Accrual for the first half of the month” document must be created and filled out.

The document journal “Accrual for the first half of the month” is often hidden. For it to become available, at least one employee must be assigned an advance “Calculation for the first half of the month.” If there really are such employees, but the log of these documents does not appear in the “Salaries” section, you need to do the following:

1) section “Salary” - “Navigation settings” - see below

2) Find on the left side of the window “Accruals for the first half of the month”

3) click the “Add” button - the item will move to the right side of the window, click OK.

A new item will appear in the “Salary” section.

4) create and fill out the document “Accrual for the first half of the month” for the required period.

Anastasia’s comment: only those employees who have the method of calculating the advance payment “By calculation for the first half of the month” will be added to this document.

Employees who are assigned an advance in a fixed amount are not included in this document, but are reflected immediately in the statement. 3. The employee does not have a single day worked in the first half of the month.

If the employee was really absent for the first half of the month, and it was decided to pay the advance, then you need to add the employee to the advance payment sheet using the “Selection” button and specify the advance amount manually.

Anastasia's comment:

— You can check the employee’s time worked using the timesheet: section “Salary” – “Salary reports” – “Timesheet (T-13)”

4. The employee has a debt to the organization for past periods.

In this case, the amount of the employee’s advance, depending on the size of the debt, will either be completely absent or reduced. A reduction for this reason occurs even if the advance is assigned as a fixed amount.

Anastasia's comment:

— You can check the balances of mutual settlements with an employee in the “Salary Arrears” report in the “Payments” – “Payment Reports” section.

Read the first part of the article: Preventing and correcting errors in working with statements in ZUP 3.1

- Along with this read:

- Look wider. Lifehack when working with a report in 1C

- Why is the regional coefficient not calculated or has ceased to be calculated?

- How to set up a production calendar in 1C:ZUP, edition 3

How to close a payroll

The payroll is opened for a strictly defined period of time - usually on the days when employees are paid. As soon as the final day of the validity period passes, the document must be closed.

During closing, the cashier checks the statement for the absence of employee signatures. In case there are those who were unable to receive their salary on time, their amounts are subject to deposit. To do this, o is entered in the column where the signature should be, after which, at the end of the document, the amounts issued and deposited are summed up.

An expense cash order is issued for the amount of the paid salary, to which a closed statement is attached. The completed document is submitted to the accountant for verification. If everything is correct, then it should be signed by him.