Currently, the Seller often provides the Client with a deferred payment for goods to increase its advantage over competitors. However, he has to pay income tax before the actual receipt of funds. To avoid this, many organizations indicate in contracts that the transfer of ownership of goods occurs under certain conditions (payment, shipment, etc.). With a deferred transfer of ownership, the seller does not pay income tax on sales for which the agreed condition has not yet occurred.

Let's look at how this feature is implemented in the 1C:ERP Enterprise Management 2 configuration.

To register a sale with a deferred transfer of ownership, you must do the following:

- program settings;

- setting up the Agreement;

- creating a Customer Order;

- registration of Sales of goods and services;

- registration of transfer of ownership.

Regulatory regulation

Sales of goods can occur (Articles 458, 459, 491 of the Civil Code of the Russian Federation) at the moment:

- transfer of goods to the buyer or a person indicated by him;

- established by the contract, if it is different from the moment of transfer.

More details:

- Determining the moment of sale of goods (general rules)

- Accounting for sales with deferred transfer of ownership

BOO. When shipped without transfer of ownership, goods are reflected in account 45 “Goods shipped” (Chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n).

On the date of transfer of ownership:

- revenue is reflected in income from ordinary activities (clause 5, clause 12 of PBU 9/99);

- cost - in expenses for ordinary activities (clauses 5, 7, 9, 19 PBU 10/99).

WELL. Income and expenses from the sale of goods are recognized on the date of transfer of ownership from the seller to the buyer (clause 3 of Article 271 of the Tax Code of the Russian Federation, clause 3 of clause 1 of Article 268 of the Tax Code of the Russian Federation).

VAT. The seller calculates VAT as of the date (clause 1 of Article 167 of the Tax Code of the Russian Federation):

- shipment - the first time the primary document was drawn up, issued in the name of the buyer or carrier (Letter of the Ministry of Finance of the Russian Federation dated 06.10.2015 N 03-07-15/57115), regardless of the moment of transfer of ownership;

- receiving an advance payment.

The seller applies VAT deduction from the advance payment:

- after shipment in the amount of tax on the shipment for which an advance was received (clause 8 of Article 171 of the Tax Code of the Russian Federation, clause 6 of Article 172 of the Tax Code of the Russian Federation).

VAT deduction from the seller upon receipt of an advance payment

In accordance with the terms of the concluded agreement, the buyer can make a full or partial advance payment for goods (work, services), property rights.

According to subparagraph 2 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation, on the day of receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the moment of determining the tax base for VAT arises, and the tax base is determined based on the amount of payment received from taking into account tax (clause 1 of article 154 of the Tax Code of the Russian Federation).

Upon receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights realized on the territory of the Russian Federation, the taxpayer is obliged to present to the buyer of these goods (work, services), property rights the amount of VAT calculated in the manner established by paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause 1 of Article 168 of the Tax Code of the Russian Federation). Therefore, the seller must issue an invoice to the buyer for the amount of the prepayment received no later than 5 calendar days (clause 3 of Article 168 of the Tax Code of the Russian Federation).

The invoice is filled out in accordance with Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax.”

Invoices for the received amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights are registered by the taxpayer in the sales book (clause 2 of the Rules for maintaining the sales book, approved by Resolution No. 1137).

The seller can accept VAT calculated from the prepayment amount as a tax deduction from the date of shipment of the relevant goods (work, services, property rights) (clause 8 of Article 171 of the Tax Code of the Russian Federation).

In this case, VAT amounts are deducted in the amount of tax calculated from the cost of goods shipped (work performed, services rendered), transferred property rights, in payment of which the amount of previously received advance payment is subject to offset according to the terms of the contract (if such conditions exist) (clause 6 of Art. 172 of the Tax Code of the Russian Federation).

The date of shipment (transfer) of goods for value added tax purposes is the date of the first drawing up of the primary document issued to their buyer or carrier for delivery of goods to the buyer, regardless of the moment of transfer of ownership established by the contract (letter of the Ministry of Finance of Russia dated March 14, 2019 No. 03 -07-11/16880, dated 08/28/2017 No. 03-07-11/55118).

Consequently, the right to a tax deduction arises from the seller after shipment of the goods, even if at the time of shipment the ownership of the goods, according to the terms of the concluded agreement, does not pass to the buyer.

To claim a tax deduction, the invoice issued upon receipt of an advance payment is registered by the seller in the purchase book for the amount of VAT to be deducted (clause 2 of the Rules for maintaining the purchase book, approved by Resolution No. 1137).

| 1C:ITS In the “Legislative Consultations” section you can find useful articles from 1C experts: on calculating VAT when receiving an advance; on drawing up an invoice for an advance payment; on the deduction of VAT on advances. |

Accounting in 1C

The organization has entered into a supply agreement with the buyer, according to which the transfer of ownership occurs at the moment the goods arrive at the buyer's warehouse.

On June 22, the Organization received 100% prepayment under the contract for the supply of goods in the amount of 21,000 rubles. (including VAT 20%).

On June 22, the Organization calculated VAT on the prepayment and issued an invoice to the buyer.

June 23 goods worth 21,000 rubles. shipped to the buyer.

On July 2, the goods arrived at the buyer’s warehouse.

Let's look at the step-by-step instructions for creating a PDF example

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receipt of advance payment from the buyer | |||||||

| 22nd of June | 51 | 62.02 | 21 000 | 21 000 | Receipt of advance payment from the buyer | Receipt to the bank account - Payment from the buyer | |

| Calculation of VAT on advance payment and issuance of tax invoice to the buyer | |||||||

| 22nd of June | 76.AB | 68.02 | 3 500 | Calculation of VAT on advance payment and issuance of tax invoice to the buyer | Invoice issued for advance payment | ||

| — | — | 3 500 | Reflection of VAT in the Sales Book | Sales book report | |||

| Shipment without transfer of ownership | |||||||

| June 23 | 45.01 | 41.01 | 15 000 | 15 000 | 15 000 | Shipment of goods | Sales (act, invoice) - Shipment without transfer of ownership |

| 62.02 | 62.OT.1 | 21 000 | 21 000 | 21 000 | Crediting the advance to a special account | ||

| 76.OT | 68.02 | 3 500 | VAT accrual on shipment | ||||

| OT.01 | 21 000 | Accounting for shipments on balance | |||||

| OT.01 | 21 000 | Write-off of shipments from off-balance sheet accounting | |||||

| Issuance of SF for shipment to the buyer | |||||||

| June 23 | — | — | 21 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 3 500 | Reflection of VAT in the Sales Book | Sales book report | |||

| Acceptance of VAT for deduction when offsetting the buyer's advance payment | |||||||

| 30 June | 68.02 | 76.AB | 3 500 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 3 500 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Sales of shipped goods | |||||||

| July 2 | 90.02.1 | 45.01 | 15 000 | 15 000 | 15 000 | Write-off of the cost of goods | Sales of shipped goods |

| 62.OT.1 | 62.01 | 21 000 | 21 000 | 21 000 | Advance offset | ||

| 62.01 | 90.01.1 | 21 000 | 21 000 | 17 500 | Revenue from sales of goods | ||

| 90.03 | 76.OT | 3 500 | Accounting for calculated VAT on shipped goods | ||||

Accounting for shipping transactions from the seller

Upon transfer of goods, the supplier's accounting records the write-off of the cost of products sold and charges VAT on the sale price. The postings will be as follows:

| Operation | D/t | K/t |

| on the date of shipment | ||

| The shipment is reflected at the cost of the goods | 45 | 41 |

| VAT charged | 76 | 68/2 |

| on the date of payment | ||

| Funds have been received from the buyer to the account | 51 | 62 |

| Revenue included | 62 | 90/1 |

| Disposal of goods in transit | 90/2 | 45 |

| When recognizing revenue, VAT accrued on sales is taken into account | 90/3 | 76 |

Example:

Rio LLC, on the basis of an agreement with Container LLC, shipped a batch of hardware worth 600,000 rubles on 03/03/2020. (including VAT 100,000 rub.). Cost of products sold – 200,000 rubles. Payment for the goods from the buyer was received on March 25, 2020. The following entries were made in the accounting of Rio LLC:

| Operation | D/t | K/t | Sum |

| as of 03/03/2020 | |||

| The transfer of hardware from the warehouse is reflected | 45 | 41 | 200 000 |

| VAT charged (600000/20 x 120) | 76 | 68/2 | 100 000 |

| VAT paid | 68/2 | 51 | 100 000 |

| as of 03/25/2020 | |||

| Payment received | 51 | 62 | 600 000 |

| Revenue taken into account at sales price | 62 | 90/1 | 600 000 |

| Write-off of the cost of goods in transit | 90/2 | 45 | 200 000 |

| VAT on goods sold is included in revenue | 90/3 | 76 | 100 000 |

Receipt of advance payment from the buyer

Setting up the program

To enable the ability to reflect the shipment of goods without transfer of ownership, select the Shipment without transfer of ownership in the Main - Functionality - Trade tab.

To calculate VAT at the time of shipment without transfer of ownership, check

the VAT is charged on shipment without transfer of ownership checkbox in the Main - Taxes and reports - VAT section.

More details Setting up Functionality: Shipment without transfer of ownership

Reflect the receipt of the prepayment with the document Receipt to the current account transaction type Payment from the buyer (section Bank and cash desk - Bank statements - Receipt button).

Postings according to the document

The document generates the posting:

- Dt Kt 62.02 - receipt of advance payment from the buyer.

Calculation of VAT on advance payment and issuance of tax invoice to the buyer

Create a document Invoice issued transaction type For advance payment based on Receipts to the current account (section Bank and cash desk - Bank statements - button Create based on - Invoice issued).

The data will be filled in automatically according to the document Receipt to the current account .

Pay attention to filling out the field:

- Contents of the service, additional information - wording Advance payment is undesirable and may entail tax risks. In gr. 1 “Name of goods...” of the invoice, it is safe to indicate either the specific name of goods, works, services, or their general name.

Postings according to the document

The document generates the posting:

- Dt 76.AV Kt 68.02 - calculation of VAT on the buyer's advance payment.

Shipment without transfer of ownership

Document the shipment of goods with the document Sales (act, invoice) (section Sales - Sales (acts, invoices) - button Sales - Shipment without transfer of ownership).

In the header of the document, indicate the following link Calculations :

- Account for accounting for settlements of advances - an account in which advances for the counterparty are recorded, in our example 62.02;

- The method of crediting the advance Automatic in our example .

On the Products , pay attention to filling out the fields:

- Accounting account - which records the material assets being sold (in our example - 41.01 “Goods in warehouses”);

- Transfer account - transfer account depending on the type of value (in our example - 45.01 “Purchased goods shipped”).

Postings according to the document

The document generates transactions:

- Dt 45.01 Kt 41.01 - shipment of goods without transfer of ownership;

- Dt 62.02 Kt 62.OT.1 - crediting the advance to a special account;

- Dt 76.OT Kt 68.02 - calculation of VAT on shipped goods;

- Dt OT.01 - accounting for shipment on an off-balance sheet account;

- Kt OT.01 - writing off shipments from an off-balance sheet account.

Transfer of goods without transfer of ownership (comment to bill 45)

In practice, trading organizations often transfer goods intended for sale to third parties without transferring ownership of them. The most common cases are:

— Transfer of goods to buyers under contracts that provide for a different time from the generally accepted transfer of ownership (for example, at the time of payment for the delivered goods, when sold under export contracts, etc.). — Transfer of goods under an exchange agreement, in the case when the organization ships the goods first (unless otherwise provided by the agreement). The exchange agreement is considered fulfilled when both parties have fulfilled their obligations to transfer property, therefore, in the case when the organization ships the goods first, until the receipt of the property from the counterparty, ownership of the shipped goods does not pass. — Transfer of goods to intermediaries for their subsequent sale to customers. Shipment of goods without transfer of ownership of them is not recognized as revenue for accounting purposes, since, according to clause 12 of PBU 9/99, one of the mandatory conditions for its recognition is the transfer of ownership (possession, use and disposal) of goods from the seller to the buyer. In addition, at the time of these transfers, all expenses that have been or will be incurred in connection with this operation cannot be reliably determined (which is also a condition for recognizing revenue in accounting).

At the same time, organizations that transfer goods without transfer of ownership and expect to receive income on them in the following reporting periods incur certain expenses directly related to the shipment of goods and incurred before the revenue is recognized in accounting (for example, costs of loading goods into vehicles, insurance , transportation to the point stipulated by the contract and other similar expenses).

Not included in cost of sales for the current period

Based on the principle of matching income and expenses (which assumes that when determining the financial result from performing any transactions in ordinary activities, one should take into account exactly those expenses that are associated with generating income) for the purpose of generating an organization’s financial result from ordinary activities The cost of goods sold (realized) (products, works, services) is determined.

According to clause 9 of PBU 10/99, the cost of goods (work, services) sold is formed on the basis of expenses for ordinary activities recognized both in the reporting year and in previous reporting periods, and carryover expenses related to the generation of income in subsequent reporting periods periods, taking into account adjustments depending on the specifics of production, performance of work and provision of services and their sale, as well as the sale (resale) of goods. Based on the above, the costs of shipping goods transferred to third parties without transfer of ownership (including transfer of goods to intermediaries for sale), trading organizations should not be included in the cost of sales in the current period, since revenue from the sale of such goods cannot be recognized as income of the current period.

The instructions for using the Chart of Accounts provide for a special account 45 “Shipped Goods”, intended to summarize information on the availability and movement of shipped goods, the proceeds from the sale of which cannot be recognized in accounting for a certain time.

In accordance with the new Chart of Accounts, goods shipped without transfer of ownership are recorded on account 45 “Goods shipped” at a cost consisting of two components:

— actual cost of purchased goods; — expenses for shipping goods (if they are partially written off). The valuation of goods shipped without transfer of title has changed from the previous norms: according to the old Chart of Accounts, such goods were valued at actual cost without taking into account shipping costs. Accounting on account 45 “Goods shipped” for the actual cost of goods transferred without transfer of ownership does not cause any difficulties, since it is fully formed on account 41 “Goods”. At the time of transfer of goods under agreements that provide for a different time from the generally accepted transfer of ownership, or under commission agreements, the amounts recorded in the debit of account 41 “Goods” are subject to transfer to the debit of account 45 “Goods shipped”.

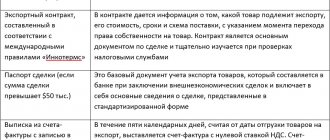

Let's understand the terms

A different situation arises when taking into account in account 45 “Goods shipped” the costs of shipping goods, which are also included in the cost of shipped goods.

The main difficulty is to determine what is meant by the term “costs of shipping goods” for accounting purposes and under what cost item these costs are taken into account. Using this new concept for accountants in the new Instructions for using the Chart of Accounts, the Russian Ministry of Finance does not explain it, proposing the following expenses as cost items incurred by trading organizations: for the transportation of goods; for wages; for rent; for the maintenance of buildings, structures, premises and equipment; for storage and processing of goods; for advertising; for entertainment expenses; other expenses similar in purpose.

Since the rules for accounting for costs of selling goods by elements and items are also established by separate regulations and methodological guidelines for accounting (clause 10 of PBU 10/99), let us turn to the Methodological recommendations for accounting of costs included in distribution and production costs, and financial results at trade and public catering enterprises approved by Roskomtorg and the Ministry of Finance of Russia on April 20, 1995? 1-550/32-2 (hereinafter referred to as “Methodological recommendations for cost accounting”). Trade organizations can be guided by this document when attributing expenses to a specific cost item (to the extent that does not contradict current PBUs). However, the Methodological Recommendations for Cost Accounting do not include such a cost item as the cost of shipping goods.

On the one hand, the concept of “shipment costs” is close in meaning to the concept of “selling costs”, but it is unlikely that both of these concepts coincide. In addition, if the legislator had meant that the two concepts under consideration coincided, he would have directly indicated that the cost of shipped goods includes part of the sales expenses (accounted for in account 44 “Sales expenses”) attributable to goods shipped without transfer of title property. Selling expenses are a broader concept than shipping costs and include costs that cannot be directly associated with the shipment of goods (for example, depreciation of fixed assets, rental and office costs, costs of storing goods before shipment of goods and sorting them and so on.). At the same time, some costs are directly related to the shipment of goods: loading goods into vehicles and delivering them to the buyer, insurance and security of cargo in transit, payment of customs duties and duties, storage in temporary warehouses, etc. expenses.

On the other hand, it can be assumed that by shipping costs, the Russian Ministry of Finance means transportation costs associated with the delivery of goods to the buyer. Under the item “Transportation costs”, trading enterprises take into account (clause 2.2 of the Methodological Recommendations for Cost Accounting):

— transport services of third-party organizations for the transportation of goods and products (payment for transportation, for supplying wagons, weighing goods, etc.); — services of organizations for loading goods and products, vehicles and unloading from them, fees for forwarding operations and other services; — the cost of materials spent on vehicle equipment (shields, hatches, racks, racks, etc.) and insulation (straw, sawdust, burlap, etc.); — services for temporary storage of goods at stations, piers, ports, airports, etc. within the regulatory time limits established for the export of goods in accordance with concluded agreements; - fees for servicing access roads and non-public warehouses, including fees to railways in accordance with agreements concluded with them. Although the specified list does not include the costs of cargo insurance, payment of various fees and charges, storage in the warehouse of the commission agent (if storage costs are reimbursed by the principal under the terms of the commission agreement) and some other expenses, the Methodological Recommendations for Accounting for Costs define forwarding expenses as transportation costs operations, that is, operations carried out within the framework of a transport expedition agreement.

According to paragraph 1 of Art. 801 of the Civil Code of the Russian Federation, under a transport expedition agreement, one party (the forwarder) undertakes, for a fee and at the expense of the other party (the client - the shipper or consignee), to perform or organize the performance of services specified in the expedition agreement related to the transportation of goods. Consequently, trade organizations under the item “Transportation costs” can take into account all operations that are associated with the transportation of goods, including those that are specified (or not specified) in the Methodological Recommendations for Cost Accounting.

A transport expedition involves performing various duties related to the transportation of goods. Such duties may include carrying out any operations necessary for the delivery of cargo, for example, obtaining documents required for export, completing customs and other formalities, checking the quantity and condition of cargo, loading and unloading it, paying duties, fees and other expenses, as well as fulfilling other operations.

Taking into account the above, in the opinion of the author, the costs of shipping goods transferred without transfer of ownership and reflected in the debit of account 45 “Goods shipped” should include part of the costs of trade organizations for the transportation of goods, which are reflected in accounting under the item “Transportation costs” and include for goods shipped without loss of title.

How to deal with partial write-offs

At the same time, the accountant of a trade organization is faced with the question: is it always necessary to debit account 45 “Goods shipped” for part of the expenses attributable to goods shipped without transfer of ownership?

This is due to the presence in the text of the Instructions for using the Chart of Accounts of the phrase that the costs of shipping goods are reflected in account 45 “Goods shipped” when they are partially written off. Therefore, we can conclude that if a trading organization has adopted in its accounting policy the procedure for recognizing all sales expenses incurred in the reporting period as expenses for ordinary activities subject to write-off to the cost of goods sold (in the debit of account 90 “Sales”), then there is no need to make any partial write-off of shipping costs to the debit of account 45 “Goods shipped”.

If, in accordance with the adopted accounting policy, selling expenses are written off in proportion to the cost of goods sold, transportation costs incurred in the reporting period and accounted for in account 44 “Sales expenses” should be distributed not only between goods sold and the balance of goods, but between goods shipped with or without transfer of ownership. In this case, all transport costs are divided into three parts:

- the part of transport costs attributable to goods transferred to buyers’ ownership will increase by the cost of goods sold (debited to account 90 “Sales”); - part of the transportation costs related to goods transferred to buyers without transfer of ownership will increase the cost of shipped goods (debited to account 45 “Goods shipped”). - part of the transport costs attributable to the balance of goods in the organization’s warehouse will be included in the balance on account 44 “Distribution costs” (balance on the specified account). Let's look at a specific example of how to distribute transportation costs between the goods sold and the balance of goods at the end of the month, taking into account the fact that part of the goods is transferred to buyers under a sales contract with a different procedure for transfer of ownership than the generally accepted one.

Such a condition may be the moment of payment, including sale on credit, or any other condition: a month after actual receipt, on a specific day, etc.

Example 1: During the reporting period, a wholesale trade enterprise acquired goods worth RUB 120,000 under sales contracts, including VAT - RUB 20,000.

During the same period, goods were shipped to customers at actual cost in the amount of 80,000 rubles, including:

- under contracts with the generally accepted moment of transfer of ownership of the shipped goods - 50,000 rubles;

- under agreements, according to which ownership of the shipped goods will transfer in the following reporting periods in the amount of 30,000 rubles.

Transport costs for the reporting period, recorded in account 44 “Sales expenses”, amounted to 11,000 rubles.

Let us assume that at the beginning of the reporting period there are no balances of goods and transportation costs.

Reflection of transactions in the accounts of a trading enterprise

Receipt of goods: Debit account 41 Credit account 60 - 100,000 rub. — goods were received into the warehouse at supplier prices in accordance with the purchase and sale agreement excluding VAT (120,000 rubles - 20,000 rubles); Debit account 19 Credit account 60 - 20,000 rubles. — VAT is reflected on the received goods. Sales of goods: Debit account 62 Credit account 46 - 72,000 rubles.

— reflects the cost of goods sold at selling prices, including VAT (the figure is taken conditionally);

Debit account 46 Credit account 68 - 12,000 rubles.

- accrued debt to the budget for VAT on turnover of goods sold;

Debit account 46 Credit account 41 - 50,000 rubles.

— the actual cost of goods sold is written off.

Transfer of goods without transfer of ownership: Debit account 45 Credit account 41 - 30,000 rubles.

— the cost of the goods transferred to the buyer without the right to transfer ownership is reflected at actual cost.

Formation of sales expenses under the item “Transportation expenses”: Debit account 44 Credit account 60 - 11,000 rubles.

— reflects the amount of transportation costs for the reporting period (excluding VAT).

Write-off of transportation expenses at the end of the reporting period:

In order to write off sales expenses in terms of transportation costs to the appropriate accounts (90 “Sales expenses” and 45 “Shipped goods”), you should make a special calculation:

- firstly, calculate the total amount of transportation costs attributable to shipped goods ( transferred to buyers both with and without transfer of ownership); - secondly, distribute the amount of transportation costs obtained as a result of the first calculation between goods, the ownership of which has transferred to the buyer, and goods shipped without transfer of ownership.

Calculation of the amount of transportation costs attributable to goods transferred into the ownership of buyers and goods shipped without transfer of ownership

1. The amount of the balance of goods at the end of the reporting period in the organization’s warehouse is determined (balance on account 41 “Goods”):

- balance of goods in the organization’s warehouse at the beginning of the reporting period - none; — goods received — 100,000 rubles; — goods shipped — 80,000 rubles; — balance of goods in the organization’s warehouse at the end of the reporting month — 20,000 rubles. (100,000 rubles - 80,000 rubles). 2. The average percentage of transportation costs related to the balance of goods in the organization’s warehouse is calculated:

- transport costs attributable to the balance of goods at the beginning of the month - no; — transportation expenses incurred during the reporting period — 11,000 rubles; - the amount of transportation costs attributable to the balance of goods at the beginning of the month and incurred in the reporting month - 11,000 rubles. - the cost of goods shipped in the reporting month and the balance of goods at the end of the month - 100,000 rubles. (RUB 80,000 + RUB 20,000) - average percentage of transportation costs as the ratio of the amount of transportation costs attributable to the balance of goods at the beginning of the month and produced in the reporting month to the cost of goods shipped in the reporting month and the balance of goods at the end of the month — 11% (RUB 11,000: RUB 100,000 x 100%). 3. The amount of transportation costs for the balance of goods in the organization’s warehouse is calculated by multiplying the amount of the balance of goods at the end of the month (calculated in paragraph 1) by the average percentage of transportation costs - 2200 rubles. (RUB 20,000 x 11%: 100%);

4. The total amount of transport costs attributable to shipped and sold goods is determined as the difference between the amount of transport costs attributable to the balance of goods at the beginning of the month and made in the reporting month, and the amount of transport costs for the balance of goods in the organization’s warehouse - 8800 rubles. (RUB 11,000 - RUB 2,200);

5. The amount of transportation costs for goods shipped without transfer of ownership and for goods sold (transferred into ownership of buyers) is calculated:

- total goods shipped - 80,000 rubles, - goods shipped with transfer of ownership - 50,000 rubles; — goods shipped without transfer of ownership — RUB 30,000; - total transport costs attributable to shipped goods - 8800 rubles; — transportation costs attributable to goods shipped with the transfer of ownership — 5,500 rubles. (50,000 rub. x 8,800 rub.: 80,000 rub.); — transportation costs attributable to goods shipped without transfer of ownership — RUB 3,300. (30,000 rub. x 8,800 rub.: 80,000 rub.). Based on the calculations, the following entries are made:

Debit account 90 Credit account 44 - 5500 rub.

— the amount of transportation costs related to goods sold during the reporting period is written off to the cost of sales;

Debit account 45 Credit account 44 - 3300 rub.

— the amount of transportation costs related to goods transferred to buyers during the reporting period without transfer of ownership was written off as an increase in the cost of shipped goods. The amount of transportation costs in the amount of 2,200 rubles, relating to the balance of goods in the organization’s warehouse, remains listed in account 44 “Sales expenses”. In example 1, we examined the procedure for distributing and writing off transport costs, provided that at the beginning of the reporting period there are no balances of goods and transport costs. Let's consider how to distribute these expenses in the case when such balances are listed on the organization's balance sheet.

Example 2:

Let's take the data from example 1 and assume that in the next reporting period a wholesale trade enterprise purchased goods worth 180,000 rubles, including VAT - 30,000 rubles.

During the same period, goods were shipped to customers at actual cost in the amount of 140,000 rubles, including:

- under contracts with the generally accepted moment of transfer of ownership of the shipped goods in the amount of 90,000 rubles; - under agreements, according to which ownership of the shipped goods will transfer in the following reporting periods in the amount of 50,000 rubles. In addition, the ownership of goods shipped in the previous period, the actual cost of which amounted to 15,000 rubles, was transferred to the buyers. (excluding shipping costs).

Transport costs for the reporting period, recorded in account 44 “Sales expenses”, amounted to 20,000 rubles.

For convenience, we present all the data on the operations under consideration and the necessary calculations in the form of a table.

| ? p/p | Initial and calculated data | Numerical indicators | Notes |

| 1 | 2 | 3 | 5 |

| 1 | The balance of goods in the warehouse at the beginning of the month at actual cost, rub. | 20 000 | Account balance 41 “Goods” (data from example 1) |

| 2 | Transportation costs for the balance of goods at the beginning of the month, rub. | 2200 | Balance of account 44 “Sales expenses” (data from example 1) |

| 3 | Balance of goods shipped without transfer of ownership at the beginning of the month, rub. including: | 33 300 | Account balance 45 “Goods shipped” (data from example 1) |

| 3a | — actual cost, rub. | 30 000 | Balance in terms of actual cost (data from example 1) |

| 3b | — shipping costs, rub. | 3300 | Balance regarding shipping costs (data from example 1) |

| 4 | љљљGoods were received during the reporting month at actual cost, in rubles. | 150 000 | Debit turnover on account 41 “Goods” (data from example 2) |

| 5 | Total goods shipped in the reporting month at actual cost, rub. including | 140 000 | Credit turnover on account 41 “Goods” (data from example |

| 5a | — shipped under contracts with a generally accepted procedure for transferring ownership, rub. | 90 000 | Posting from the credit of account 41 “Goods” to the debit of account 44 “Sales expenses” (data from example 2) |

| 5 B | љљљ—shipped without transfer of ownership, rub. | 50 000 | Posting from the credit of account 41 “Goods” to the debit of account 45 “Goods shipped” (data from example 2) |

| 6 | Accounting value of goods sold, shipped in previous periods without transfer of ownership, rub. including: | 16 650 | Posting from the credit of account 45 “Goods” to the debit of account 90 “Sales” (page 6a + page 6b) |

| 6a | — actual cost, rub. | 15 000 | in terms of actual cost (data from example 2) |

| 6b | — shipping costs, rub. | 1650 | in terms of shipping costs (RUB 15,000 x RUB 3,300: RUB 30,000) |

| 7 | Transport costs for the reporting month, rub. | 20 000 | Debit turnover on account 44 “Sales expenses” in terms of amounts recorded under the item “Transportation expenses” (data from example 2) |

| 8 | Transportation costs subject to distribution in the reporting month, rub. | 22 200 | The amount of transportation costs attributable to the balance of goods at the beginning of the month (page 2) and incurred in the reporting month (page 7) (RUB 2,200 + RUB 20,000) |

| 9 | Balance of goods in the organization's warehouse at the end of the reporting month, rub. | 30 000 | The sum of the cost of the balance of goods at the beginning of the reporting month (line 1) and the cost of goods received (line 4) minus the cost of goods shipped in the reporting period (line 5) (20,000 rubles + 150,000 rubles - 140,000 rubles .) |

| 10 | Average percentage of transportation costs, % | 13,05 | The ratio of the amount of transportation costs subject to distribution (p. 8) to the cost of goods shipped in the reporting month (p. 5), and the balance of goods at the end of the month (p. 9) [RUB 22,200. : (RUB 140,000 + RUB 30,000) x 100%]. |

| 11 | Amount of transportation costs for the balance of goods in the organization’s warehouse, rub. | 2610 | The product of the amount of goods remaining at the end of the month (page 10) by the average percentage of transportation costs (page 10 - 2200 rubles (20,000 rubles x 13.05%: 100%). |

| 12 | Amount of transportation costs attributable to goods shipped in the reporting month, rub. including: | 19 590 | The difference between the amount of transport costs subject to distribution (line 8) and the amount of transport costs for the balance of goods in the organization’s warehouse (line 11) (RUB 22,200 - RUB 2,610) |

| 12a | — transportation costs attributable to goods shipped with the transfer of ownership, rub. љ | 12 594 | Distribution of transport costs attributable to goods shipped in the reporting month (p. 12), based on their cost of goods shipped with the transfer of ownership (5a) and the total cost of goods shipped (p. 5) (90,000 rub. x 19,590 rub. : 140,000 rub.). Posting to the credit of account 44 “Sales expenses” to the debit of account 90 “Sales” |

| 12b | — transportation costs attributable to goods shipped without transfer of ownership, rub. | 6996 | Distribution of transport costs attributable to goods shipped in the reporting month (p. 12), based on the cost of goods shipped without transfer of ownership (5b) and the total cost of goods shipped (p. 5) (50,000 rub. x 19,590 rub. : 140,000 rub.). Posting to the credit of account 44 “Sales expenses” to the debit of account 45 “Goods shipped” |

The example proposed by the author for calculating transport costs attributable to the balance of goods, goods shipped and goods sold is not the only possible one.

You can distribute these costs in other ways (for example, first distribute transportation costs to goods owned by the organization and to goods the ownership of which has transferred to the buyer, and then make another distribution between goods in the organization’s warehouse and goods shipped). This method is, in the author’s opinion, more accurate, but more labor-intensive, since the distribution of transportation costs should be done in proportion to the actual cost of goods, while the data on account 45 “Goods shipped” also includes shipping costs. The final word in determining the order of transportation costs remains with the Russian Ministry of Finance. In conclusion, we note that in the author’s opinion, the most complete and reliable from an accounting point of view would be to reflect on account 45 “Goods shipped” the costs of shipping goods in the following order.

If shipping costs in full can be directly attributed to a specific batch of goods transferred without transfer of ownership, then such costs are immediately reflected in account 45 “Goods shipped.” For example, shipped goods, the proceeds from the sale of which cannot be recognized in accounting in the reporting period, are delivered to the counterparty by one vehicle. In this case, delivery costs do not go to account 44 “Sales expenses”, but are immediately taken into account in the cost of shipped goods, increasing it.

If shipping costs relate to both goods sold and goods transferred without transfer of ownership, then they can be distributed between these goods in proportion to their accounting value. For example, if one vehicle delivers goods transferred to the buyer's ownership and shipped without granting title. In such a situation, expenses can either be immediately (at the time of their commission) distributed to the appropriate accounts or first reflected on account 44 “Sales expenses”, and at the end of the reporting period, part of the expenses related to goods transferred without transfer of ownership can be recorded in the account 45 “Goods shipped.”

This article expresses the author’s point of view, which may not coincide with the official position of the Russian Ministry of Finance. Therefore, we recommend that organizations transferring goods without transfer of ownership follow the relevant explanations of the Russian Ministry of Finance on the procedure for writing off shipping costs to the debit of account 45 “Goods shipped” and make appropriate changes to the financial statements in a timely manner.

The article was published in Accounting Supplement No. 34 (211) of the weekly “Economy and Life”.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Issuance of SF for shipment to the buyer

Issue an invoice to the buyer using the Issue an invoice document (act, invoice) .

Invoice data is automatically filled in based on the Sales document (act, invoice) .

Please pay attention to filling out the fields:

- Payment documents - date and number of the buyer’s payment order for the advance;

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Acceptance of VAT for deduction when offsetting the buyer's advance payment

Reflect the deduction of VAT calculated on prepayment in the usual manner during the period of shipment of goods using the document Formation of purchase ledger entries (section Operations - Regular VAT operations - Create button).

By clicking the Fill in data on shipment without transfer of ownership rights will be reflected on the Received advances :

- Buyer - the name of the buyer who paid the advance;

- Advance document - a document that reflects the receipt of an advance;

- Event - Settlement of advance payment ;

- Event date - date of shipment of goods;

- Amount - the cost of the shipped goods, covered by prepayment;

- % VAT - percentage of VAT on the advance received;

- VAT is the amount of VAT subject to deduction.

Postings according to the document

The document generates transactions:

- Dt 68.02 Kt 76.AV - acceptance of VAT for deduction on shipped goods.

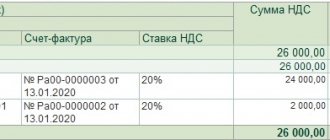

The deduction amount will be reflected in the purchase book by the date of shipment: PDF

- operation type code "".

Read more Acceptance of VAT for deduction when offsetting the buyer's advance payment

Accounting for VAT on shipment before receiving payment in different periods

The letter of the Ministry of Finance of the Russian Federation No. 03-07-11/7135 dated March 11, 2013 reflects the opinion: if the shipment is made in one reporting period, and the ownership (more often this happens with the transfer of payment) is transferred to the buyer in another, then VAT is charged during the period of shipment and at the tax rate in force for that period.

For example, if the shipment was made in 2022, and payment was made in 2020, VAT should be charged on the day of actual shipment in 2019. The tax base is calculated in accordance with the provisions of Art. 154 of the Tax Code of the Russian Federation - from the cost of the goods sold excluding taxes. That is, if the selling price of a product is 10,000 rubles, then it is subject to VAT. The seller prepares an invoice for the shipped goods, regardless of the fact of receipt of payment, and sends it to the buyer. When transferring payment for goods in 2022, the tax will no longer be recalculated.

In the seller's accounting, VAT, accrued and presented to the buyer before the recognition of sales proceeds, may be reflected, for example, in the account. 45 or on account. 76/VAT. On the date of revenue recognition, VAT is written off from accounts 45 or 76/VAT to the debit of account 90/3. The postings in supplier accounting will be the same as in the example above.

If the buyer receives ownership of the goods at the time of its transfer, then even for unpaid goods in transit, he has the right to claim a tax deduction. Moreover, if the transaction is completed at the turn of two periods, and the buyer attributes the amount of VAT accrued by the seller on the invoice to the shipment period, there will be no error in this.

Sales of shipped goods

At the moment of transfer of ownership, fill out the document Sales of shipped goods based on the document Sales (act, invoice) transaction type Shipment without transfer of ownership (or through the Sales - Sales of shipped goods section).

The document will be filled out automatically according to the Sales document (act, invoice) .

[New in UT 11] Shipment of goods with deferred transfer of ownership

What is this article about?

In the release of the UT 11.1.6 , a new type of operation of the document “Sales of goods and services” called “Sales (goods in transit)” has been added for the shipment of goods with a deferred transfer of ownership.

Let's consider this functionality.

Applicability

The article was written for the editors of UT 11.1

. If you use this edition, great - read the article and implement the functionality discussed.

If you are working with older versions of UT 11, then this functionality is relevant

. The most noticeable difference between UT 11.3/11.4 and 11.1 edition is the Taxi interface. Therefore, in order to master the material in the article, reproduce the presented example on your UT 11 base. Thus, you will consolidate the material with practice

Implementation of shipment of goods with deferred transfer of ownership (goods in transit)

The transaction type in the document is filled in automatically in accordance with the established transaction type in the agreement with the client.

To arrange a shipment with a deferred transfer of ownership (goods in transit), the “Shipment without transfer of ownership is possible” checkbox must be checked in the agreement with the customer.

Let’s open an existing standard agreement in the UT11 program called “Model Sales Rule”.

To enlarge, click on the image.

As you can see, there is no checkbox “Shipment possible without transfer of ownership” in the agreement.

To be able to use the “goods in transit” functionality, you need to enable the “Statuses of sales of goods and services” checkbox in the “Administration” - “CRM and Sales” section of the program.

To enlarge, click on the image.

After this, open our standard agreement again and check the box “Shipment without transfer of ownership is possible.”

To enlarge, click on the image.

We will draw up the document “Sales of goods and services”. If the shipment of goods with a deferred transfer of ownership (“Sales (goods in transit)”) is used, then the shipment of the goods from the warehouse is first processed and the document is posted in the status “In transit.”

Let’s go to the “Sales” program tab – “Sales Documents” and create a new document.

We will fill in all the necessary details. Let’s set the type of operation “Sales (goods in transit)” and the status of the document “In transit”.

When using the “Sales (goods in transit)” transaction type and the “In transit” document status, the “Transfer of Rights” field becomes available for filling, where you need to indicate the date of delivery and transfer of the goods to the client.

If the document status is set to “In transit”, filling in the date of transfer of ownership is not necessary. Therefore, we will leave the field blank for now.

Let's review the document.

To enlarge, click on the image.

I would like to note that the client’s debt to our organization for the goods shipped to him is recorded at the time the document “Sales of goods and .

Let's open the card of the partner for whom we registered the sale of the product. On the navigation panel, select the “Mutual settlements” item and generate the “Statement of settlements with a partner” report.

To enlarge, click on the image.

We won't see anything in the report. Everything is correct, since the goods have not yet been delivered to the client and the “Sales of goods and services” document is in the “On the way” status.

Let's imagine that the product was delivered to the client the next day.

Accordingly, after transferring the goods to the client, the “Sales of goods and services” document must be posted in the “Sold” status. Let's set the required status and try to post the document.

The program will display an error that the “Date of transfer of ownership” field is not filled in.

To enlarge, click on the image.

When setting the “Sold” status, you must indicate the date when the product was delivered (transferred) to the client.

Since the goods were delivered to the client the next day, we will set the “Date of transfer of ownership” as document date + 1 day. Let's review the document.

To enlarge, click on the image.

Let’s open the partner’s card and generate a report on mutual settlements:

To enlarge, click on the image.

This time the report contains information - the partner’s debt is 15,000 rubles. That's right.

There is also the possibility of registering a “Customer Order” document when shipping goods with a deferred transfer of ownership.

For this shipment option, a “Customer Order” is issued and on the “Additional” page the type of operation “Sales (goods in transit)” is indicated.

After creating the “Sales of goods and services” document based on the order, the transaction type is filled in automatically in accordance with the customer’s order.

To enlarge, click on the image.

Here is a short educational program on the functionality of shipping goods with a delayed transfer of ownership in the new release UT 11.1.6.

If your activity uses the points described above, then go ahead and use the functionality of the new release UT 11 - 11.1.6.

PDF version of the article for members of the VKontakte group

We run a VKontakte group - https://vk.com/kursypo1c.

If you have not yet joined the group, do so now and a link to download materials will appear in the block below (on this page)

.

Article in PDF format

You can download this article in PDF format from the following link: Link is available for registered users)

Link available for registered users) Link available for registered users) Link available for registered users)

If you are already a member of the group

– you just need to log in to VKontakte again for the script to recognize you.

In case of problems,

the solution is standard: clear the browser cache or subscribe through another browser.

Other articles on new features of UT 11.1:

"Seasonal odds"

“Search and remove duplicate elements”

“Control of provision (reservation) for orders”