A fixed asset is property used in the manufacture of products or provision of services. For example, this could be equipment, premises. The OS must be put on the balance sheet. Before putting the product into operation, a number of procedures must be carried out. In particular, this is checking the performance of the OS, establishing its compliance with standards and regulations. Preparation for commissioning is the responsibility of the commission. It is she who checks the fixed assets and then draws up the corresponding act. The commission is created on the basis of an order from the director.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Commissioning Features

The order of commissioning is determined by the characteristics of the OS. Objects that are not used in production, are not complex equipment and are not subject to increased danger, undergo a special lightweight procedure. To accept such OS, only an inspection is required. Based on its results, a transfer deed is signed. These employees sign it:

- Chief Accountant.

- Head of the department to which the OS is received.

- Storekeeper, if the product is transferred for storage.

- The person who accepts the OS for use.

The OS acceptance and transfer document can replace the commissioning certificate. This is relevant when the local acts of the company do not contain a requirement for mandatory execution of the act.

FOR YOUR INFORMATION! The simplified version of capitalization is relevant only in a number of cases. In all other cases, it is necessary to form a commission.

How to formalize the commissioning of fixed assets

At the commissioning stage, two important factors are taken into account: the initial cost of the property asset and the start date of its use.

The initial cost of an object is determined based on the method of its receipt by the organization:

- values received free of charge are included in the market valuation;

- created in the company - at the cost of all production and construction costs;

- made in the form of a contribution - at a monetary value determined by decision of the owners.

The date of commissioning of fixed assets registered with documents confirms that the property is used in the financial and economic activities of the company and is not lying in a warehouse. The period of commissioning of a fixed asset from the moment of receipt into the warehouse is not limited by law: each company decides this issue independently.

To accept assets for accounting, it is enough to draw up an “Acceptance and Transfer Certificate of Fixed Assets” in Form No. OS-1, and then calculate depreciation in accounting.

The act of commissioning of fixed assets - a sample form of the standard unified form OS-1 was approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7, . When commissioning fixed assets, other standard documents may be used:

- OS-1a – for real estate (industrial premises, office buildings, structures of various formats, etc.);

- OS-1B – for entering several assets simultaneously.

Instead of unified forms, a company can independently develop and use an act form with the details required for primary documents specified in Art. 9 of the Law on Accounting No. 402-FZ dated December 6, 2011. The act must also reflect: the main characteristics of the asset, its original cost, the date of registration and the persons responsible for its safety. The form of the act (unified or proprietary) is fixed by the company’s accounting policy.

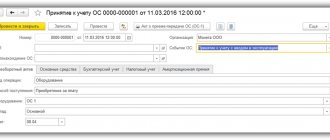

Commissioning of fixed assets - sample form OS-1:

In addition to the act of entry, a special card f. is also issued. OS-6 for warehouse accounting purposes.

The procedure for creating a commission for putting the operating system into operation

The commission is formed on the basis of a separate order. It is published by the head of the organization. The order requires disclosure of the composition of the commission. In particular, you need to personalize these representatives:

- Chairman.

- Secretary.

- Other members of the commission.

How many people should be included in the commission? This depends on the following factors:

- Organizational structure of the company.

- Number of employees.

- Availability of remote units.

- OS volume.

The activities of the commission are led by the chairman. He has the following responsibilities:

- General leadership.

- Signing protocols.

- Distribution of responsibilities between committee members.

- Organization of collegial discussion.

The secretary is responsible for documenting the activities of the commission.

FOR YOUR INFORMATION! It is not recommended to appoint the head of the organization as the chairman of the commission. In addition, it is recommended to assign responsibility for drawing up the act to one employee, and to another for approval. All these measures will help avoid problems during verification.

Requirements for the composition of the commission

The members of the commission are employees of the organization. In particular, these are:

- Representatives of the accounting department responsible for documenting and recording assets.

- Experts who can assess the suitability of equipment for use.

You can include experts in the commission who will be involved in work in certain cases. For example, when commissioning a PC, a system administrator may be involved. If the company does not have the necessary experts, it is permissible to attract third-party specialists.

IMPORTANT! If the individual entrepreneur does not have hired personnel, there is no need to form a commission.

ATTENTION! An employee responsible for the safety of valuables cannot become an expert.

Responsibilities of the commission

The purpose of the commission is to make a decision on registering the OS. This decision must be collective. The members of the commission perform these functions:

- Analysis of the feasibility of changing the cost of the operating system.

- Consideration of the feasibility of changing the useful life.

- Checking the health of the OS.

- Assessment of technical condition.

- Establishing the quality of installation.

- Establishing compliance with safety standards.

- Conducting a test run.

- Checking the availability of permits.

The commission members are responsible for creating and signing all related papers.

Commissioning dates

Over the years, the value of a tangible asset decreases. Therefore, placing fixed assets on the balance sheet of an enterprise allows us to apply to it such a concept as depreciation. Gradual write-off of the initial cost of the operating system due to uniform distribution over the service life.

The beginning of the use of a tangible asset for an enterprise is the exact date recorded in documents. It will be the beginning of the operation of new equipment and the maintenance of tax records.

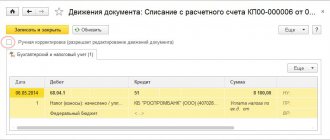

Commissioning in the 1C program on video:

Since there are no statutory deadlines for the commissioning of property assets, the decision is made by the management of the enterprise, based on the fact that the start of accounting is the date of commissioning. In tax accounting, depreciation charges start from the month following the commissioning of the asset. Penalties will be assessed on the difference.

If the start date for the implementation of equipment into operation is not specifically determined (the enterprise has not decided on the launch, or additional installation and commissioning is required), it is necessary to reflect these points in local documents.

In the absence or failure to provide appropriate documentation reflecting the date of commissioning of the equipment to tax authorities, accrued depreciation is not taken into account in income tax.

Thus, a correct reflection of the date of commissioning of the operating system will allow the enterprise to avoid penalties from the Tax Inspectorate.

Before generating an order, if the equipment requires testing and inspection, these procedures must be followed. The place of acceptance of the equipment must be reflected in the relevant supply contract (in case of purchase), or on the territory of the enterprise (manufactured in-house).

Basically, new products are checked for defects, malfunctions and defects, as well as for compliance with approved regulatory documents. These procedures are assigned to a specially created commission at the enterprise. After receiving the commission's conclusion, you must:

- draw up a technical or test report

- draw up an act of acceptance and transfer of products

- draw up an appropriate act in case of repair or reconstruction of equipment

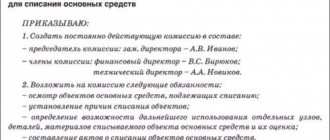

Order on the formation of a commission

To create a commission, you need to issue an order. It is on this basis that the commission will function. The order will look like this:

CJSC “Kvadrat” Order No. 09-01 “On the appointment of a commission for commissioning the OS”

From October 20, 2018

Moscow

In order to comply with legal requirements,

I order:

- Approve the commission for commissioning the OS in this composition:

- Chairman of the commission: Ivanov S.V. (CEO);

- Member of the commission: Basargina I.V. (Technical Director);

- Member of the commission: Vinogradov O.O. (chief accountant).

- Please familiarize the above-mentioned commission members with this document.

- I reserve control over the implementation of the order.

General Director: (signature) S.V. Ivanov

The following have been familiarized with the order:

Technical Director: (signature) I.V. Basargina Chief Accountant: (signature) O.O. Vinogradov

Regulatory regulation of commissioning

Federal Law dated December 6, 2011 N 402-FZ defines accounting

Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7 establishes unified documents

Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n approves the Regulations on accounting and reporting in the Russian Federation

Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n PBU 6/01

Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n approved the chart of accounts

Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n regulates accounting through methodological instructions

Decree of the Government of the Russian Federation dated January 1, 2002 N 1 provides the classification of fixed assets for the purpose of depreciation

The Tax Code of the Russian Federation, Part 2, determines the initial cost of more than 100,000 rubles for tax purposes

Features of the functioning of the commission

The commission operates on a permanent basis. Its activities are regulated by the Regulations on the Commission. The commission must hold at least 1 meeting per month. The period for putting the OS into operation is determined by the complexity of the equipment. However, it is recommended to spend no more than 14 days on one object.

To make a decision on a particular object, voting is required. The decision is recognized as legal when 2/3 of the total number of commission participants was present at the meeting. If the chairman is absent, the meeting will not be held.

Documents required for commissioning of real estate

To commission constructed real estate, the developer must obtain a special permit issued by the institution that authorized the construction (according to paragraph 2 of Article 55 of the Town Planning Code of the Russian Federation). To obtain a permit, the following documents are required:

- documents granting the right to a plot

- urban plan

- permission

- object acceptance certificate

- conclusion of Gosstroynadzor

- technical plan

Commissioning and posting must coincide.

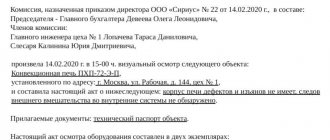

Registration of the results of the commission’s activities

The conclusions of the commission members are reflected in a special act. It is drawn up in free form. However, the act must necessarily contain the following information:

- OS inspection date.

- Place of examination.

- Data that will allow you to identify the object (for example, name, serial number).

- Specifications.

- Lifetime.

For example, a technical passport may serve as an annex to the act.

FOR YOUR INFORMATION! The act must bear the signatures of all commission members.

Basis for commissioning

According to clause 8 of PBU 6/01, the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for their acquisition, construction and production, excluding VAT and other refundable taxes.

Expert of the Legal Consulting Service GARANT E. Lazukova

Commissioning must be documented with primary documents, which indicates readiness for its use. From January 1, 2013, it is not necessary to use forms of primary documents from albums of unified forms. Commissioning can be done using the following forms:

- OS-1 – for 1 object (except buildings)

- OS-1a – for buildings and structures

- OS-1b – for groups of objects (except buildings)

If the document is developed independently, then it is necessary to keep in mind that the form is approved by the accounting policy and contains mandatory details (Part 2 of Article 9 of Law 402-FZ):

- Name

- date of compilation

- name of the organization making the document

- reflects the fact of activity

- natural and monetary meter (indicating units of measurement)

- positions of persons responsible for registration

- signatures with transcript to identify responsible persons

Important! When purchasing, manufacturing or constructing a fixed asset in one month, and reflected in account 01 in another, it is necessary to draw up documents reflecting its unreadiness for use.

The readiness of the facility for operation can be determined by a special commission for the acceptance of acquired fixed assets, making a conclusion that is indicated in the commissioning act.

An inventory card or book must be prepared for the fixed asset (depending on the accounting used). In this case, you can use the following forms: No. OS-6, OS-6a, OS-6b.

Tax accounting of introduced fixed assets

The procedure for calculating the initial cost of an introduced fixed asset does not depend on whether new fixed assets are being introduced or used ones and the entire amount of costs for the acquisition (manufacturing), delivery, repair (modernization) is taken into account, minus VAT and excise taxes, but when purchasing a fixed asset that has already been used by the seller, the reflection of the residual value according to the supplier’s documents and already accrued depreciation should not be taken into account.

When commissioning, it is necessary to establish a period of use as in accounting, determined independently on the date of commissioning, taking into account the classification. But for used fixed assets, the depreciation rate should take into account the SPI, when operated by previous owners based on their useful life:

- by classification (also applies to the acquisition of property from individuals - not individual entrepreneurs)

- established by classification and reduced by the period of use by the former owners in fact

- established by the previous owner and reduced by the period of use by the previous owners in fact

Commissioning accounting

In accounting, the initial cost of purchased fixed assets is the sum of all expenses of the organization, except for VAT and other refundable taxes.

The cost of these funds is reimbursed by calculating depreciation based on SPI, i.e. The more SPI, the slower its cost decreases.

In accounting (not in tax accounting) you can set any period and when determining it you can, but not necessarily, be guided by the Classification. But this period must be justified by the presented indicators, documentation, etc.