Document role

The value of a payslip cannot be overestimated - it allows an enterprise employee to understand exactly what his salary is formed from, and also, in some cases, to see in a timely manner the inconsistencies between the calculation of wages and the terms of a specific employment contract or legal requirements. If such facts are identified, an employee can turn to the company’s accounting department for clarification of controversial or unclear issues, and if it comes to a conflict, then go to the labor inspectorate or court to restore justice.

Employer's liability

By sending payslips by email, the employer may face penalties for the slightest miscalculations:

- For violation of labor legislation under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

For example, for handing over pay slips to employees in a manner other than that specified in the company’s local regulations or employment contracts, the fine may be:

- from 30,000 rub. up to 50,000 rub. - for the company;

- from 1,000 rub. up to 5,000 rub. - on officials (IP).

- For violation of the requirements of the law on the protection of personal data.

For example, for transferring a payslip through a third party (an employee’s colleague) and the absence of the employee’s written consent to this method of transfer, that is, for violating clause 1 of Art. 3, art. 7 of Law No. 152-FZ. The fine in this case may be 75,000 rubles. (Part 2 of Article 13.11 of the Code of Administrative Offenses of the Russian Federation).

For the transfer of personal data by e-mail without the use of cryptographic information protection means (CIPF) certified by the FSB of Russia, the following types of liability may be applied to the employer:

- disciplinary (clause “c” of clause 6 of Article 81 of the Labor Code of the Russian Federation);

- administrative (part 1 of article 13.6, part 6 of article 13.12, article 13.14, part 7 of article 15.15 of the Code of Administrative Offenses of the Russian Federation);

- civil law (Article 151 of the Civil Code of the Russian Federation);

- criminal (Article 272 of the Criminal Code of the Russian Federation).

The employer may also face a fine for using an unapproved form of pay slip (Resolution of the Armed Forces of the Russian Federation dated December 23, 2010 No. 75-AD10-3).

When should you create a document?

The payslip must be made several days before salary payments, but it can also be issued in advance or on the day the salary is paid. At the same time, it should be remembered that usually the payment of salaries is divided into two stages, two weeks apart - so the pay slip should be provided to employees on the day they receive their “graduation”, when all the necessary amounts have already been calculated.

It must be said that the payslip concerns only wages, so there is no need to create it for issuing, for example, vacation pay.

When resigning, it is mandatory to provide a payslip (it is given to the resigning person on his last working day along with his salary).

How to fill out a payroll slip

In 2013, the unified form of the document was canceled. That is, organizations were given the opportunity to independently develop and approve their own version of the document, which takes into account the features and specifics of the activities of their particular legal entity.

IMPORTANT!

Cancellation of the standard form is not a basis for refusing to issue a receipt to employees! This is a direct violation of Art. 136 of the Labor Code of the Russian Federation, for which administrative liability is provided.

Approve the individual form of the form in the accounting policy of the enterprise or by a separate order from the manager. Please ensure that the form contains the required information:

- Business name.

- Period (usually equal to a calendar month).

- Information about the employee. Here write down the position, full name, department and personnel number of the employee.

- Information about calculations. It is most convenient to present it in the form of a table, which is divided into the following parts:

- income: here it is necessary to indicate comprehensive information about all accrued income of the employee (salary, incentive and compensation payments, benefits, vacation pay, allowances, part-time work, etc.);

- deductions: include in this part of the table personal income tax, deductions based on writs of execution, trade union dues, alimony, voluntary contributions to non-state pension funds, etc.;

- payments: indicate the dates and amounts of transfers made in a specific period, advances, compensation for food or cellular communications, sick leave or vacation pay during the inter-payment period;

- “Debt” or “Payable”: the final tabular part in which the difference between accrued income and payments made is calculated.

When designing a ticket yourself, you can add additional information. For example, information about the amounts of deductions for dependents and more.

Who prepares the payslip

The payslip is prepared by a specialist from the accounting department, i.e. an employee who has complete data on all payments due to a particular employee. Typically, it is not necessary to certify the sheet with the signature of the head of the company or even the accountant himself, nor is it necessary to affix a stamp on it.

This is due to the fact that the sheet is purely informational in nature, in other words, it does not in any way confirm the fact of receiving exactly the amount of wages that was indicated for payment on it.

But as for the employee of the organization, he must sign for the receipt of the pay slip. To do this, an accountant or cashier can provide him with a special form called a “sheet for issuing pay slips.”

When to issue a payslip

Don't know when pay slips are issued? It is provided to the employee regardless of the salary payment option: upon the accrual and transfer of wages to the employee’s card or at the time the employee receives the monthly cash remuneration in hand. Settlements are received by both main employees and employees working under civil contracts, to whom the employer also pays wages.

The document is issued only at the time of final payment; the form does not need to be provided on the day of advance payment in the organization or when transferring vacation pay. When directly transmitting calculations, the accountant must comply with the principle of confidentiality.

The fact that an employee has received a pay slip can be confirmed in the following ways:

- develop a detachable part of the document in which the employee will sign the form, thereby certifying the fact of receipt;

- keep a log of the issuance and receipt of pay slips.

Sample pay slip

Since 2013, standard unified forms for most primary accounting documents have been abolished, as has the obligation to use them. Now representatives of enterprises and organizations have the right to develop their own document forms approved in their accounting policies, or use previously commonly used templates.

Regardless of which option the employer chooses, the document’s structure must comply with office work standards, and its text must comply with the rules of the Russian language.

Registration procedure

- At the beginning of the sheet write:

- company name,

- job title,

- Full name of the employee,

- the period for which the document is drawn up (usually one month),

- the department in which the employee works,

- his personnel number.

- Next comes the main part, which looks like a table with several sections.

- The first includes all types of accruals for the period (salary, bonus, compensation, interest, etc.). All data is entered here indicating the number of days and hours subject to payment for one or another type of accrual.

- The second section includes everything related to tax withholdings.

- The third contains information about contributions to extra-budgetary funds.

- Next, indicate the amount of the advance payment and information about additional insurance premiums.

- After all the calculations, at the end of the document the total amount of deductions and the salary to be paid are written. If the company has a debt to the employee, or vice versa, the employee owes the employer, information about this must also be included in the payslip.

If necessary, the form can be supplemented with other information, for example, information about the statement on which the payment will be made, the date of payment of wages, etc.

What it is

At the end of the month, each employee receives a special sheet with a breakdown of salary information, which reflects all accruals and deductions made for the last month worked. Article 136 of the Labor Code of the Russian Federation provides for the obligation of the employer, when paying wages, to notify in writing each employee about the components of the salary. The slip is issued simultaneously with the payment - no later than the 15th of the next month.

Poignant moments

Taking into account the fact that 2022 has ended and there are employees who, based on the results of the year, were short of bonuses and allowances, it is worth paying attention to checklist 7 “On checking compliance with general requirements for the establishment and payment of wages.” The checklist contains, for example, the following questions:

- the employer notifies each employee in writing about the components of wages and the amounts of other amounts accrued to the employee, about the amounts and grounds for deductions made, about the total amount of money to be paid;

- the employer has approved the form of the pay slip, taking into account the opinion of the representative body of employees (if there is one);

- wages are paid at least every half month. The specific payment date is established by internal labor regulations, a collective agreement or an employment contract, but no later than 15 calendar days from the end of the period for which it was accrued.

As we see, when conducting an inspection, the subject of which is compliance with labor legislation, there are a sufficient number of questions about the pay slip, but in practice, employers neglect this document.

Article 136 of the Labor Code of the Russian Federation establishes that the employer must provide the employee with the following information: about the components of the wages due to him for the relevant period, as well as about the amounts of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for the payment of wages , vacation pay, dismissal payments and (or) other payments due to the employee. In addition, the company provides the employee with information about the size and basis of the deductions made and the total amount of money to be paid.

The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of the Labor Code of the Russian Federation for the adoption of local regulations.

Please note that the issue of mandatory issuance of payslips is also covered in the Compliance Guidance Report, which explains what is lawful behavior and explains new regulatory requirements for Q3 2022.

note

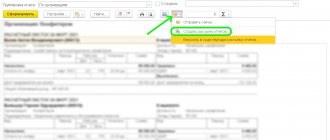

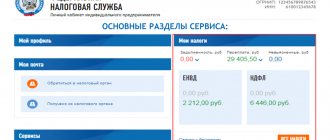

If the document is sent to the employee using internal electronic document management software, then confirmation of receipt of the pay slip will be an electronic signature. Please note: the form of the pay slip must be independently approved by the employer and enshrined in local regulations.

By not issuing a pay slip, the employer violates labor legislation and is exposed to risks, which include the fact that the employee may appeal to the labor inspectorate, as well as to the court. All of these employee actions can have negative consequences for the company.

For violation of labor legislation, liability is provided in the form of a fine in accordance with paragraphs 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation for officials in the amount of 1,000 to 5,000 rubles, for legal entities - from 30,000 to 50,000 rubles or administrative suspension of activities for a period of up to 90 days. In case of a repeated similar violation, the official may be disqualified by the court for a period of one to three years.

Despite the fact that many consider the payslip to be a throwback, in practice there are quite a lot of workers going to court, where the failure to issue this document is the basis for the conclusion that the employer underpaid. Thus, in the Appeal ruling of the Moscow City Court dated June 30, 2022 in case No. 33-8525/2017, the court indicated that Article 136 of the Labor Code of the Russian Federation is a guarantee of the implementation of the employee’s right to timely and prompt full amount of wages paid. According to Article 56 of the Code of Civil Procedure of the Russian Federation, each party must prove the circumstances referred to in support of its claims and objections. The circumstances of the case, which in accordance with the law must be confirmed by certain means of proof, cannot be confirmed by any other evidence. The fact of accrual of amounts is confirmed in court by the pay slips of the defendant’s organization and certificates of Form 2-NDFL.

So, a payslip can be, among other things, proof that the employer made payments in full.