In 2022, FAS 5/2019 “Inventories” came into force, due to which the closure of accounts 25 and 26 in 1C program products changed, which led to many questions for accounting workers. Let's try to deal with them.

Let us recall that accounts 20,23,25,26,44 relate to cost accounting documents.

In turn, all types of expenses are divided into direct and indirect.

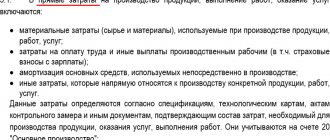

Direct costs are closely related to the production and release of products, the performance of certain works, and the provision of a range of services. These include: the cost of production raw materials and supplies, rental of factory facilities, depreciation of working equipment, wages of working personnel.

Indirect costs are not specifically related to a specific product, for example, salaries of administrative employees, use of an accounting printer, office rent.

One can draw a false conclusion from the above that all production costs are direct, but this is not so. For example, in production there is equipment that is not used for this type of product, and then the costs of its purchase and maintenance will be indirect.

Therefore, the most important thing is to decide which costs will be direct and which indirect.

Closing 26 accounts in 1C

Account 26 is usually used to reflect the amount of indirect costs in general cost items.

And if earlier it was possible to reflect expenses for everything related to the production process on account 26, now it is not. The current procedure allows only management expenses to be reflected in it.

At the end of the month, using the “Closing the month” processing, the program, according to a given algorithm, closes account 26 in such a way that there is no final balance on it. The question arises: on what principle of operation, and at what expense does the closing take place.

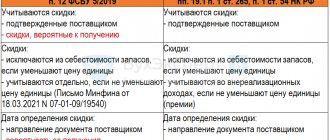

According to FAS 5/2019, the actual cost of finished products does not include administrative expenses, except in cases where they are direct.

That is, until 2022, account 26 could be closed at account 20, 23, 29 or 90. Currently the second method is not provided in the program!

Let's look at the settings.

In the 1C: Enterprise Accounting 8 program, go to the “Main” section to select the “Accounting Policy” item.

Until the beginning of 2022, there was a switch “General business expenses are included” and two options “In the cost of sales” and “In the cost of products, works, services.”

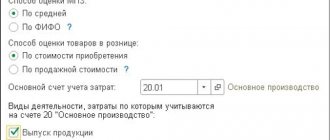

Now this switch is missing, closing the 26th account depends on the items “Release of products” and “Performance of work, provision of services.”

If at least one of the checkboxes is checked, then closing account 26 in accounting and tax accounting types will be on account 90.08.1

Let's look at an example: let's enter the data of a document for registering indirect costs, for example, an act for renting an office.

In the “Purchases” section, select the “Receipts (acts, invoices, UDP)” item. Click the “Receipt” button and select “Services (Act, UDP)” from the menu that appears.

In the new document that appears, you need to enter the necessary data from the act: number, date, counterparty data, contract number. Let’s add the line “Office rent, management company” to the document table and assign it to account 26. Let's review the finished document.

Select the “Operations” section and the “Month Closing” item.

In the window that appears, select the required month and click “Close the month.” After processing the data of all points, the font will change color and turn green. Click “Closing accounts 20,23,25,26”, and in the window that opens, select “Show transactions”.

Here you can see that the entire amount allocated to account 26 is written off to account 90.02.1

But we must not forget that there are organizations that operate without producing products and do not provide any services. For them, accounting policy data will be set up without the items “Production of products” and “Performance of work, provision of services to customers.”

In this version of settings 26, the account will be closed to account 90.02.1, and in tax accounting according to the information item “Methods for determining direct production costs in OU”.

Let's look at these settings.

In the “Main” - “Accounting Policies” section, check the boxes related to production.

Go to the “Taxes and reports” column.

In the window that opens, open the “Income Tax” item and follow the link “List of direct expenses”

We add a new line indicating that expenses on account 26 from the subaccount are closed to account 90.02.1

Attention! Settings are only necessary for direct costs. In this case, it is recommended to charge such costs to account 25. But let’s look at this setting as an example.

Once again, let’s close the month and look at the transactions in the operation “Closing accounts 20,23,25,26”

Thanks to correct settings, all entered costs are closed to account 90.02.1

If in the accounting policy item the checkboxes relating to production are not removed, and the line with the correspondence of account 26 is not entered into the settings for the list of direct costs, closing costs of account 26 will be on account 90.02.1 in the accounting data, and in tax reporting on 90.08 .1, then all postings will look like this:

Classification of enterprise costs

All expenses that make up the total costs of the enterprise and form the total cost of production are divided into 2 types:

- Direct are directly related to product output. These include costs for purchased raw materials, materials, employee wages and others related to specific products and work.

- Indirect costs are not directly associated with specific types of products or services. Such costs are distributed among the cost of manufactured products (services provided).

The composition of direct expenses is determined by the taxpayer independently in accordance with the established accounting policy of the organization. Refers to costs in the current period as products are sold or services are provided.

Indirect costs are subsequently distributed between the main, auxiliary and service industries, depending on the specifics of the enterprise's activities.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Closing 25 accounts in 1C

Account 25 contains the amount of indirect production costs.

At the end of each month, expenses from account 25 are closed to account 20 by distributing general production expenses for products, work, and services. The distribution is carried out in proportion to the figures of indicators determined by the accounting policy of the enterprise.

In the settings, select “Main” - “Accounting Policy”.

In the “Distribution base” item, we will select an indicator in proportion to which account 25 will be assigned to account 20. There may be direct costs, wages, etc.

At the same time, some enterprises need to distribute the costs of one workshop regarding wages, and the other according to the planned cost of production.

This setting can be made in the “Special distribution rules - not set” section. It will look like this:

Accounting has become a little clearer. In tax accounting, all distribution of costs is carried out in accordance with the setting of the list of direct costs specified above.

Let's look at a small example. Let us set labor costs as the basis for the distribution of indirect costs in account 25 in the accounting policy item. We will not take into account special distribution rules.

We enter costs for account 25, for which we open the “Purchases” section and select the “Receipts (acts, invoices, UPD)” item. Click the “Receipt” button and select “Services (act, UPD)”.

In the document that opens, enter all the necessary data from the act. We enter it into the table and assign it to the 25th count. We are creating a new document.

Before closing the month, we will review the cost distribution base. Let's draw up a balance sheet for account 20 with a sample under the article “Payment” by department. To do this, open the “Reports” column and select “Account balance sheet”

In the report that appears, set the period and select the score 20, click “Settings”. In the “Grouping” section we put “Division”, on the “Selection” tab and create a report.

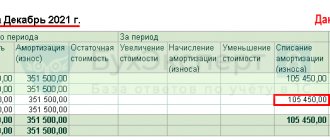

As a result, costs on account 25 will be distributed to account 20 in the established proportions of 1/3 and 2/3. Next, in the “Operations” section, select “Month Closing”.

In the window that appears, mark the desired month and close it. When all the items have been processed, the font will turn green, click on the operation “Closing accounts 20,23,25,26” and look at the transactions.

Here we see that the costs on account 25 (in our case, 20,000 rubles) were distributed among departments in the proportions of accrued wages. This can be easily checked by dividing 20,000 rubles by three to obtain the amount for workshop No. 1, then multiply by 2/3 to determine the amount for workshop No. 2.

It is necessary to pay attention to the fact that in tax accounting the amounts became a temporary difference, because taxes and reports, or rather the “List of direct expenses”, were not set up. As a result, the program closed account 25 as indirect expenses to account 90.08.1

To ensure that tax and accounting data coincide, select the “Taxes and reports” column in the main section.

Let's open the "Income Tax" tab and go to the "List of direct expenses".

We add an indication that costs with the type of expenses in tax accounting in the “Other costs” column are direct. This setup will look like this:

Let's close the month again and look at the postings.

There is no difference between accounting and tax accounting; costs are distributed in proportion to wages.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter