Where can I find the registration number and address of my FSS branch? This question is asked by entrepreneurs who need to get an appointment on one of the following issues:

- Opening of a separate division. In accordance with current regulations, it must be registered with the funds at its location;

- Submitting reports if done in person;

- If there are pregnant women in the organization, whose benefits are generated from the Social Insurance Fund;

- In the event of a work-related injury to an employee, to provide the necessary materials;

- When interacting on issues related to registration of sick leave.

If an accountant previously communicated with the Social Insurance Fund for you, or a lot of time has passed since registration and there were no reasons to contact you, it may turn out that no one knows the address of the required branch. Our instructions “How to find the Social Insurance Fund number using the TIN of an organization in Moscow in 4 steps”

.

The algorithm described below is intended for those who are already registered with the FSS. To find out what to do for individual entrepreneurs who are just planning to register, follow the link.

Most of the issues with the Social Insurance Fund can be resolved without a visit to the branch if you use the 1C:Fresh cloud service.

Explore the possibilities and try for free

The procedure for registering an individual entrepreneur with the Social Insurance Fund

So, if you have entered into your first employment or civil contract with an employee or contractor, then you need to submit an application to social insurance for registration as an employer. The deadline for submitting documents is no later than 30 calendar days from the date of conclusion of the contract.

In accordance with the Order of the Social Insurance Fund dated April 22, 2019 N 125, the mandatory list of documents for registration of an individual entrepreneur includes:

- application in the prescribed form;

- a copy of the policyholder's identity document (passport of an individual entrepreneur);

- copies of the employee’s work record book or concluded employment contract;

- copies of a civil law agreement or an author's order agreement, if the conditions provide for the payment of insurance premiums for injuries.

Copies of documents are certified by an enhanced qualified electronic signature (when submitted via the Internet) or by FSS employees when verified with the originals. Depending on the type of contract concluded, an application for registration of the policyholder with the Social Insurance Fund is submitted using different forms.

For an employment contract:

- application form (approved by Order of the Social Insurance Fund dated April 22, 2019 N 215).

For a civil contract:

- application form (approved by Order of the Social Insurance Fund dated April 22, 2019 N 214).

Documents must be submitted to the social insurance department at the place of registration of the individual entrepreneur. If you have access to the State Services portal, you can register by submitting documents remotely.

Choose a profitable current account

Who should register with the FSS

Registration of an individual entrepreneur with the Social Insurance Fund as an employer is mandatory in two cases:

- when concluding an employment contract;

- when concluding a civil law contract or an author's contract, if its terms provide for the payment by the customer of contributions to insure the performer against accidents.

What about individual entrepreneurs’ contributions for themselves? An individual entrepreneur is not required to pay insurance contributions for his social insurance, but can do so voluntarily. However, given that an individual does not have the right to conclude an employment contract with himself, registration of an individual entrepreneur with the Social Insurance Fund as an employer does not occur in this case.

In order for an entrepreneur to receive payments for temporary disability or in connection with maternity, he submits a special application for voluntary insurance of an individual to his FSS branch. Moreover, in order to receive benefits in the current year, contributions must begin to be paid in the previous year.

Branch 1 of the Federal Tax Service No. 43 m. River Station Address: 125565, Moscow, Leningradskoye Shosse, 84, building 1 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 3 of the Federal Tax Service No. 2, 13, 26 metro station Nagornaya Address: Moscow, Elektrolitny proezd, building 9, building 1, 4th floor Telephone, Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 4 of the Federal Tax Service No. 25, 48 metro station Kozhukhovskaya Address: 115193, Moscow, st. Petra Romanova, 16, building 1 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 6 only FOREIGN REPRESENTATIONS m. Chkalovskaya Address: 105120, Moscow, 3rd Syromyatnichesky lane, 3/9, building 2 Telephone; 916-81-48; 916-81-56 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 7 of the Federal Tax Service No. 7, Paveletskaya metro station Address: 115054, Moscow, Ozerkovskaya embankment, 50 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 8 of the Federal Tax Service No. 9 metro station Marksistskaya Address: 109147, Moscow, st. Marksistskaya, 34, cor. 7 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 11 of the Federal Tax Service No. 4, Kurskaya metro station Address: 105062, Moscow, Lyalin lane. 7/2, p. 4 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 13 of the Federal Tax Service No. 6, 22, 49 m. Perovo Address: 111398, Moscow, st. Kuskovskaya, 9 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 15 of the Federal Tax Service No. 23 metro station Semenovskaya Address: 105187, Moscow, st. Shcherbakovskaya, 50/52, under. 2 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 16 of the Federal Tax Service No. 21, metro station Nakhimovsky Prospekt Address: 117638, Moscow, st. Sivashskaya, 7, building 1 Phone (499) 317-42-81 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 17 of the Federal Tax Service No. 17, 45 m. Avtozavodskaya Address: 115432, Moscow, 2nd Kozhukhovsky proezd, 23 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 18 of the Federal Tax Service No. 36, Tretyakovskaya metro station Address: 115035, Moscow, st. Bolotnaya, 18 (floor 2) Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 19 of the Federal Tax Service No. 27 metro station Kozhukhovskaya Address: 115088 Moscow, 2nd Yuzhnoportovy proezd, 20A, building 4 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it. Website: https://www.filial19.ru/

Branch 20 of the Federal Tax Service No. 14 metro station Nagornaya Address: 115230, Moscow, Electrolitny pr-d, 9, building 1, floor. 5 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 21 of the Federal Tax Service No. 10, 29 metro station Kozhukhovskaya Address: 115088 Moscow, 2nd Yuzhnoportovy proezd, 20A, building 4 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 24 of the Federal Tax Service No. 19, Semenovskaya metro station Address: 105318, Moscow, Semenovskaya sq., 7 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 25 of the Federal Tax Service No. 31, 33 metro station Smolenskaya Address: 119002, Moscow, Smolensky Blvd., 20 Telephone; Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 27 of the Federal Tax Service No. 1, 50 m. Aviamotornaya Address: 111024, Moscow, Entuziastov sh., 21 Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 28 of the Federal Tax Service No. 24, 30 metro station Taganskaya Address: 109240, Moscow, st. Nikoloyamskaya, 11 Telephone; 915-77-50 ext.113 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 29 of the Federal Tax Service No. 15, 16 metro station Alekseevskaya Address: 129626, Moscow, st. 3rd Mytishchinskaya, 16, bldg. 60 Telephone; 602-97-13 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 30 of the Federal Tax Service No. 8, Paveletskaya metro station Address: 115054, Moscow, 5th Monetchikovsky lane, 11, building 7 Telephone; 953-08-83 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 31 of the Federal Tax Service No. 5 metro station Nagatinskaya Address: 117105, Moscow, Nagatinskaya street, building 1, building 2 Telephone ext. 141 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 34 of the Federal Tax Service No. 28, Belyaevo metro station Address: 117279, Moscow, st. Profsoyuznaya, building 93 A Phone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 35 according to INFS No. 6 metro station Dmitrovskaya Address: 127287, Moscow, st. 2nd Khutorskaya, house 38 A, building 23 Telephone, (495)685-92-23 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 36 of the Federal Tax Service No. 3, 34 Paveletskaya metro station Address: 115054, Moscow, Ozerkovskaya embankment, 50, building 1 Telephone (administration and personnel department); 959-28-71 (department of work with policyholders); 959-23-89 (department of organizing accident insurance). Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 38 of the Federal Tax Service No. 18 metro station Semenovskaya Address: 105318, Moscow, Semenovskaya sq., 7 Telephone; 926-43-48 Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 39 of the Federal Tax Service No. 20 Perovo metro station Address: 111141, Moscow, Zeleny Prospekt, 13 Telephone Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

Branch 40 of the Federal Tax Service No. 35 Zelenograd Address: 124365 Moscow, Zelenograd, bldg. 2003 Phone, Email: This email address is being protected from spambots. You must have JavaScript enabled to view it.

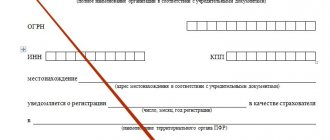

Confirmation of registration

After receiving the documents, the Social Insurance Fund, within three working days, assigns the individual entrepreneur a registration number and subordination code, and also enters information about him in the register of policyholders.

All this data is indicated in the notice of registration of an individual entrepreneur as an insured, which is sent in the manner specified in the application (in person, by mail or electronically). In addition, another notification is issued - about the amount of accident insurance premiums, which depend on the professional risk class of the individual entrepreneur’s activities.

If documents for registration of the policyholder are not submitted within 30 days from the date of conclusion of the first contract, the entrepreneur will be fined under Art. 26.28 of Law No. 125-FZ of July 24, 1998.

The amount of the fine depends on the length of the delay:

- up to 90 days inclusive - 5,000 rubles;

- more than 90 days - 10,000 rubles.

What are extrabudgetary funds responsible for?

There are three extra-budgetary funds in Russia: FSS, PFR and FFOMS.

The Social Insurance Fund is a social insurance fund that monitors the correctness of calculations and complete payment of the following insurance premiums for employees:

- in case of temporary disability;

- in connection with motherhood;

- from accidents at work and occupational diseases.

The collection of contributions for pension and health insurance is entrusted to the Federal Tax Service, but their accounting is also carried out by the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Please note: registration of an individual entrepreneur as an employer with the tax office does not occur by application, but automatically. The Federal Tax Service will learn that you have hired employees when you transfer insurance premiums for employees and submit a quarterly unified calculation. There is also no need to submit an application for registration of an individual entrepreneur as an employer to the Pension Fund of Russia (letter of the Federal Tax Service of Russia dated January 31, 2017 N BS-4-11 / [email protected] ).

Code of subordination of the policyholder in the Social Insurance Fund: how to find out

Subordination code is a number assigned to an organization (or individual entrepreneur) upon registration with the Social Insurance Fund. It consists of 5 characters: the first 4 of them indicate the division that registered the policyholder, the last one indicates the type of policyholder (organization, individual entrepreneur, separate division).

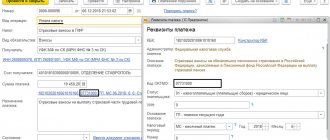

The subordination code is reflected in the 4-FSS report submitted by all employers to Social Insurance based on the results of each quarter. In addition, the subordination code is entered on the sick leave certificate received from the employee.

You can find out the FSS subordination code in two ways:

- From the notification received from the FSS.

The period for issuing a notification to an organization is 3 days from the date of application. Individual entrepreneurs and separate units receive it on the day of registration with the Social Insurance Fund. The notification is sent to the insured person in one of the ways chosen by him: by TKS, by email or on paper. To receive a notification in paper form, you will need to make a separate written request to the FSS.

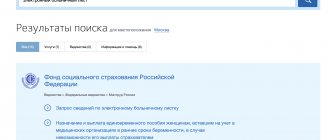

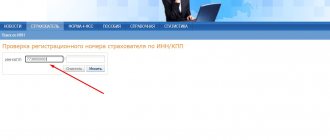

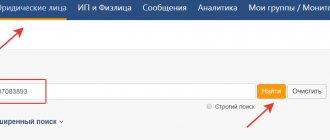

- By TIN.

You can find out your subordination code number quickly and free of charge without leaving your home: using a special service on the FSS website. To do this, you only need to indicate the organization’s TIN. Let's take a closer look at how to do this.