How can I apply for a certificate of income (payments made) to the Social Insurance Fund?

Today, an application can be submitted in two ways:

- by contacting the regional office of the FSS of the Russian Federation (in person, through an authorized person or by sending an application by mail);

— online through the personal account of the insured citizen.

For applications sent by other means without attaching a properly completed application with a personal signature (via email, feedback form on the website of a regional branch or the Federal Social Insurance Fund of the Russian Federation, etc.), the issuance of these certificates is IMPOSSIBLE!

Deadline for submitting certificate 2-NDFL

Nothing has changed regarding reporting deadlines. Tax agents are required to send this annual form to the territorial bodies of the Federal Tax Service at the place of registration before April 1 of the year following the reporting year. In 2020, April 1 fell on a Sunday, so the deadline for reporting will be April 2.

In addition, we should not forget that in relation to those incomes of taxpayers from whom it was not possible to withhold tax, it is necessary to report until March 1, 2022.

At the request of the employee, including after his dismissal, the employer is obliged to fill out and provide him with a 2-NDFL certificate at any time during the year (Article 230 of the Tax Code of the Russian Federation). The period for preparing the document is 3 days, as defined by Article 62 of the Labor Code of the Russian Federation.

How to order a certificate online?

The main condition: you must be an authorized user of the State Services portal.

In this case, you can send an application for the issuance of a certificate through the Insured Person’s Personal Account: https://lk.fss.ru/. On the website of the regional branch of the FSS of the Russian Federation, select the “Insured Person’s Account” icon.

Log in to the personal account of the Insured https://lk.fss.ru/

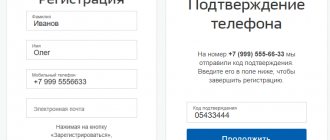

Login to the account is carried out depending on the method of registration on the Public Services portal; in this example, registration using SNILS is shown. You can select a registration method at the bottom of the page; the user can register by SNILS, phone number or email address

3.1. In order to print the Incapacity Sheet , you need to click on the line.

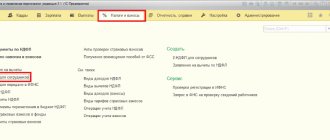

3.2. In order to obtain a Certificate from the Federal Tax Service on the income and tax amounts of an individual (2-NDFL) . In the “Submit a request” section, click “Create”.

In Step 1 , indicate how you will receive a response: only in your Personal Account or by mail. Click "Next".

Important: receiving a response by e-mail in this case is IMPOSSIBLE (see question 6)! If you choose this option, the certificate will be sent to your Personal Account or by mail.

In Step 2 , fill out the application details:

The text of the appeal must include the following information:

— type of certificate: certificate of payments made/income and tax amounts of an individual (2-NDFL);

— period for which a certificate is required: 01/01/2018-12/31/2018/2018;

— number of copies of the certificate (for example, 2 copies);

- full postal address indicating the postal code (if necessary, sending by post).

After filling out all the fields, click “Next”.

In Step 3 , if you have documents, upload them, then “Save”. After filling in all fields, the request will be saved in the “Draft” status. Click the "Submit" button.

How to fill out form 2-NDFL for submission to the tax office

In the “TIN” and “KPP” fields indicate:

- for tax agents - organizations - tax agent identification number (TIN) and reason for registration code (KPP) at the location of the organization in accordance with the Certificate of registration with the tax authority;

- for tax agents - individuals, only the TIN is indicated in accordance with the Certificate of registration with the tax authority of the individual at the place of residence on the territory of the Russian Federation.

If the certificate is submitted by the legal successor of the tax agent, this field indicates the TIN and KPP of the legal successor.

The field “Certificate Number” indicates the unique serial number of the certificate for the reporting tax period, assigned by the tax agent.

Please note: when a tax agent submits a corrective or canceling certificate in place of the previously submitted one, the number of the previously submitted certificate is indicated in the “Certificate Number” field.

The “Reporting year” field indicates the tax period for which the certificate is prepared.

In the “Characteristic” field the following is entered:

- number 1 - if the certificate is submitted in accordance with paragraph 2 of Article 230 of the Tax Code of the Russian Federation by a tax agent;

- number 2 - if the certificate is submitted in accordance with paragraph 5 of Article 226 and (or) paragraph 14 of Article 226.1 of the Tax Code of the Russian Federation by a tax agent;

- number 3 - if the certificate is submitted in accordance with paragraph 2 of Article 230 of the Tax Code of the Russian Federation by the legal successor of the tax agent;

- number 4 - if the certificate is submitted in accordance with paragraph 5 of Article 226 and (or) paragraph 14 of Article 226.1 of the Tax Code of the Russian Federation by the legal successor of the tax agent.

In the “Adjustment number” field:

- when preparing the initial certificate, “00” is entered;

- when drawing up a corrective certificate to replace the previously submitted one, the corresponding correction number is indicated (for example, “01”, “02” and so on);

- when drawing up a cancellation certificate, the number “99” is entered instead of the previously submitted one.

In the field “Submitted to the tax authority (code)” the four-digit code of the tax authority to which the tax agent submits the certificate is indicated.

In the “name of tax agent” field, when submitting a certificate from a tax agent by a legal entity or a separate division of a legal entity, the abbreviated name (if absent, the full name) of the organization is indicated in accordance with its constituent documents.

In the field “Form of reorganization (liquidation) (code)” the code is indicated:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

In the “TIN/KPP of the reorganized organization” field, the TIN and KPP of the reorganized organization or a separate division of the reorganized organization are indicated, respectively.

If the certificate submitted to the tax authority is not a certificate for a reorganized organization, then the fields “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” are not filled in.

The “Form of reorganization (liquidation) (code)” field is required when filling out the “Characteristic” field with the value “3” or “4”.

Next, you need to indicate the code of the municipality on the territory of which the organization or a separate division of the organization is located “OKTMO Code”.

In the “Telephone” field, the city telephone code and the contact telephone number of the tax agent are indicated, through which, if necessary, reference information regarding the taxation of personal income, as well as the credentials of this tax agent, can be obtained.

How can you use a document electronically?

The electronic format of KND 1151078 expands the possibilities of using the form: the certificate can be sent by Russian post, having previously printed the document, or it can be sent by e-mail. In .xml format, the form can be attached to a set of papers to submit a 3-NDFL declaration through the taxpayer’s personal account or other similar procedures. An individual also has the right to print an electronic certificate downloaded in .pdf format in order to sign and take it to the authority that requested the document.

Situations in which 2-NDFL may be useful;

- execution of loan agreements;

- collection of papers for the formation and sending of 3-NDFL in the personal account of the fee payer;

- when preparing documentation for a trip to another country: to confirm income;

- registration of pensions and benefits;

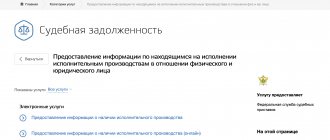

- for the court in various legal proceedings, for example, registration of alimony, etc.

KND 1151078 can be obtained immediately on the tax service website: there is no need to wait for registration, since the document has already been generated.

How has the 2-NDFL form changed after the update?

The main change in the 2-NDFL form occurred with the publication of the Federal Tax Service order No. ED-7-11/ [email protected] It cancels the certificate as an independent document and makes it an annex to the annual calculation of 6-NDFL.

As before, income certificates are now issued on two forms:

- The first one is used for submission to the Federal Tax Service.

It is an application to the calculation of 6-NDFL. At the very beginning of the document, data is provided about the taxpayer - the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, in section 4 - information about unwithheld tax, and the application provides a breakdown of income and deductions by month.

- The second form is issued to the employee, simply called “Certificate of income and tax amounts of an individual.” It almost completely repeats the previous form and is given in Appendix No. 4 of Order No. ED-7-11 / [email protected]

We described the procedure for issuing income certificates to individuals in the article “Procedure for issuing a 2-NDFL certificate to an employee.”

The same forms are used as messages about the impossibility of withholding personal income tax (instead of 2-personal income tax with sign 2). For details and a sample of such a message, see here.

Important! Recommendation from ConsultantPlus A certificate of income and personal income tax amounts must be filled out when preparing the calculation for the year. We recommend doing this in the following sequence: general part; section 1; Application; section 3; section 2.; section 4. Line-by-line filling algorithm, see K+. A full access trial is available for free.

Please note that the salary for December is reflected in the income certificate. The order depends on when it was paid. We reviewed it here.

Why you need it and how to get a certificate of income, we wrote here.

How to obtain a 2-NDFL certificate through the taxpayer’s personal account

In a personal account, an individual can view the documentation, also in .pdf format. KND 1151078 is located in the History of Income Forms tab, which reflects materials on profits for recent years when the person studied, worked or was registered with the Employment Center.

To use the form in electronic form, the service administration offers to download online forms with digital signature, and if the form needs to be printed, then it is allowed to use KND 1151078 without a signature. After downloading the documentation to a personal computer, the certificate is printed and signed by hand.

Before receiving a 2-NDFL certificate through the taxpayer’s personal account, you need to log in to your personal account as a fee payer. Instructions for receiving 2-NDFL on the personal page of the fee payer:

- Open the main login page and log in using one of the following methods:

- using the login-password scheme;

- using an electronic key;

- using your login details to the State Services server.

- Enter the My Taxes tab, where the fees that an individual pays will be displayed. Below are insurance deductions and a button labeled Income Information that you need to click on.

- It is now possible to see documentation of profits for all years. When 2-NDFL for 2018 is displayed in the taxpayer’s personal account, an entry about this will appear in the current section. Typically, the Federal Tax Service uploads forms for the previous year in June of the period following the previous one. That is, for 2022, the form will appear in the section during June 2022.

- If KND 1151078 has not yet been uploaded to the server, then when you click on the profit information button, a window will appear without the required form.

- In this situation, you will have to contact the accounting department of the company where the citizen works. Or to the employer, if the company is small and does not have an accountant on staff.

- After this procedure, in the window that appears, you can save the document on your PC. To do this, you need to click on the link of the form Certificate 2-NDFL or Certificate 2-NDFL with signature.

- The certificate must be saved in a convenient place on your personal computer.

Further, the citizen has the right to use it for its intended purpose.