Content

- Who should pay personal income tax on income abroad?

- How to declare foreign income?

- What happens if you don't file a declaration?

- Do you have to pay taxes on wages, scholarships, pensions, etc. twice?

A Russian taxpayer must pay tax on income received not only in the Russian Federation, but also abroad. In particular, personal income tax is subject to:

- foreign salary;

- pensions;

- benefits;

- scholarships;

- remuneration received by an individual under GPC agreements (for example, for the provision of services in another state), etc.

Important!

Art. 217 of the Tax Code of the Russian Federation exempts from taxation only scholarships, pensions and benefits received in the Russian Federation. This exception does not apply to such foreign income.

About the taxation of scholarships

In accordance with paragraphs. 7 clause 1 art. 208 of the Tax Code of the Russian Federation, scholarships and other similar payments received by an individual in accordance with current Russian legislation are recognized as income received from a source in the Russian Federation.

Moreover, in accordance with paragraph 11 of Art. 217 of the Tax Code of the Russian Federation are not subject to personal income tax (exempt from this tax) scholarships:

- students, undergraduates, graduate students, residents, adjuncts or doctoral students of institutions of higher professional education or postgraduate professional education, research institutions, students of institutions of primary vocational and secondary vocational education, paid to them by these institutions, students of religious educational institutions, paid to them by these institutions;

- scholarships established by the President of the Russian Federation, bodies of legislative (representative) or executive power of the Russian Federation, bodies of constituent entities of the Russian Federation, charitable foundations;

- scholarships paid from budget funds to taxpayers studying under the direction of the employment service.

As we can see, the Tax Code of the Russian Federation does not establish any restrictions regarding the source of funding for scholarships for pupils, students, graduate students and doctoral students - the main thing is that the scholarship is paid to them by the educational institution where they study, and it is not at all necessary that it be budget funds.

Moreover, as was explained in the Letter of the Federal Tax Service of Russia dated 04.03.2005 N 04-1-03/848 (communicated by the Letter of the Federal Agency for Education dated 15.03.2005 N 16-55-69in/04-06), increased scholarships are also exempt from personal income tax , paid to students by educational institutions in the manner determined by the academic council of this institution or scientific organization.

The same Letter also explained that since, in accordance with paragraph 1 of Art. 217 of the Tax Code of the Russian Federation exempts from personal income tax state benefits, payments and compensations paid in accordance with current legislation, then it is not necessary to tax personal income tax and payments in the form of social support for students studying full-time, made at the expense of the scholarship fund in the manner prescribed Standard provision N 487.

But if the student is not paid a scholarship or not only a scholarship, but also material incentives for academic success and active participation in research work, as provided for in the university’s charter (clause 7 of article 16 of Law No. 125-FZ), such payments are subject to personal income tax in the generally established manner, because they are neither scholarships nor measures of social support at the expense of the scholarship fund.

Particularly noteworthy are cases where an educational institution trains its own employees for free in its graduate school and, perhaps, even pays them stipends. As explained in the Letter of the Federal Tax Service of Russia for Moscow dated September 17, 2007 N 20-12/088410, the current tax legislation does not provide for the inclusion in expenses for the purposes of calculating income tax of payments of scholarships to graduate students and other related expenses for the preparation of dissertations of graduate students and applicants who are employees of the organization and study for free. In addition, such an educational institution does not have the right to take into account, for the purpose of calculating income tax, expenses for payment of contractual services of attracted teachers for free postgraduate education for employees of the organization - due to the non-compliance of such expenses with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation and on the basis of paragraphs 16 and 29 of Art. 270 Tax Code of the Russian Federation.

Editor's note. Grounds for exemption from personal income tax for amounts of one-time financial assistance paid from the scholarship fund in accordance with Federal Law of August 22, 1996 N 125-FZ “On Higher and Postgraduate Professional Education” and the Model Regulations on Scholarships and Other Forms of Material Support (approved. Decree of the Government of the Russian Federation of June 27, 2001 N 487) by decision of the head of an educational institution or scientific organization on the basis of a personal application to needy students studying full-time in federal state educational institutions of secondary and higher professional education, in Art. 217 of the Tax Code of the Russian Federation is not contained.

Who should pay personal income tax on income abroad?

Tax on foreign income is paid only by taxpayers with resident status. Tax residency in the Russian Federation is not tied to Russian citizenship. To determine it, they look at the actual presence of a person in the country for a certain amount of time, namely 183 days or more over a continuous 12 months.

Important!

In 2022, one could recognize oneself as a resident of the Russian Federation by application if one spent at least 90 days in the territory of the Russian Federation during this year. This rule does not apply to other periods.

You can clarify all the current requirements and rules of tax legislation within the framework of a consultation with Consult Group experts.

Let's look at how this works, using the example of Ivan N., who studies and works part-time in China.

If during the year Ivan spends at least 183 days in Russia, he:

- will be considered a tax resident;

- will have to pay personal income tax on all of his foreign income at a rate of 13%.

If Ivan spends less than 183 days in Russia in 12 months, he will be recognized as a non-resident. For Ivan this means that:

- for foreign sources (scholarship and earnings under an employment contract in China), he is not required to pay personal income tax;

- but on income received within the Russian Federation, he will pay personal income tax at a rate of 30% (for example, if Ivan decides to sell his property in Russia).

Order the submission of the 3-NDFL declaration!

Leave a request and we will help you submit your tax returns

Choose and arrange financial and insurance services

How to pay taxes on foreign scholarships sir, Thanks to ODB's weekly newsletter. In Brussels, many Belarusians and Belarusian women were able to find suitable grants and scholarships for themselves. When the application is approved, the question arises of how to properly receive the money and use it for the requested purposes, and whether taxes need to be paid on this money. Last year, Belarusian Marina received an EU scholarship to pay for a year of study at a master's degree program at one of the European universities. She could not find information on the correct payment of taxes on this scholarship, so she directly addressed her questions to the Inspectorate of the Ministry of Taxes and Duties of the Republic of Belarus, as well as to the Social Protection Fund. Marina shares the information she received with readers. According to paragraph. Individuals who were actually outside the territory of the Republic of Belarus for a day or more in a calendar year are not recognized as tax residents of the Republic of Belarus. The time of actual stay on the territory of the Republic of Belarus includes the time of direct stay of an individual on the territory of the Republic of Belarus, as well as the time for which this person traveled outside the territory of the Republic of Belarus for treatment, rest, or on a business trip 2 Art.

This is important to know: Judicial practice on VAT in favor of the taxpayer

What income is not taxed? The main innovations include the following: The cost of the trip is not included in the total monthly annual taxable income.

How to declare foreign income?

Let's say Ivan often comes to Russia, therefore he is a tax resident of the country. This means that his earnings received in China are subject to personal income tax in Russia, and Ivan must independently declare his income

and pay tax on it.

Important!

If, for Russian salaries, individuals have tax agents - employers who themselves record the income of employees and report on them to the Federal Tax Service, this scheme does not work with foreign income. The taxpayer reports on such income himself.

Reporting is completed in Form 3-NDFL and submitted to the tax authority at the place of tax registration before April 30

. In this declaration, you will need to fill out Appendix 2, dedicated to sources of income outside of Russia.

The deadline for personal income tax payment is July 15.

What happens if you don't file a declaration?

For failure to submit 3-NDFL on time or failure to pay tax on foreign income, the Federal Tax Service holds the taxpayer accountable.

- If Ivan does not file a return, then for each month of delay he will be charged a fine of 5% of the unpaid tax amount. The sanction has maximum and minimum limits. Thus, the fine cannot be less than 1,000 rubles. and more than 30% of the unpaid tax.

- If Ivan does not pay the tax or pays it incompletely, he will be fined 20% of the unpaid amount.

- If the Federal Tax Service inspector finds out that Ivan deliberately violated his tax obligation to pay personal income tax, then the fine will be 40%.

Do you have to pay taxes on wages, scholarships, pensions, etc. twice?

Ivan, having learned about his tax obligation, was indignant: “Do I really have to pay personal income tax if the PRC has already withheld income tax from me on my salary and scholarship?”

The answer to this question is contained in the agreement between China and Russia on the avoidance of double taxation. It states that in the Russian Federation, the taxpayer pays personal income tax minus the tax paid in China.

China has a progressive tax rate, which depends on the type and amount of income. It can be from 3% to 45%.

- If the PRC withholds 13% or more from Ivan’s salary, then in the Russian Federation the amount of income tax paid in the PRC will be fully offset against personal income tax. Ivan will need to file a return and confirm the tax paid in China by attaching the relevant documents (for example, a Chinese return).

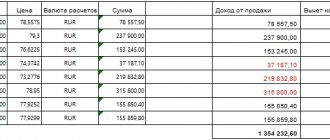

- If Ivan paid tax in China at a rate of less than 13%, then in Russia he will only pay the difference. For example, if Ivan paid 8% tax in China, then in Russia he will pay personal income tax on the remaining 5%. In this case, to calculate the tax, you will need to convert income in yuan into rubles at the Bank of Russia exchange rate on the date of payment.

Important!

Russia has double taxation agreements with many countries (the list can be viewed here). In relation to income from each country, you need to look at the credit conditions. But, as a rule, the same system is applied as with China. If there is no such agreement between the Russian Federation and another state, then income tax will have to be paid in both countries at full rates.

WHAT DOES THE APPRENTICE AGREEMENT GIVE US (IN THE PLAN OF OPTIMIZING TAX PAYMENTS)

October 29, 2022: Webinar “Solving current issues related to personnel in times of crisis”

Yulia Khachaturyan,

CEO of NIKA, RISK PLAN

“Accounting: simple, clear, practical”, No. 20 2012

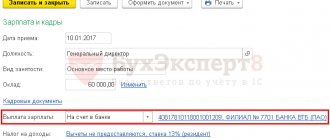

To save on insurance premiums, the company’s lawyers proposed concluding apprenticeship agreements with employees. The accountant doubts that this will have a tangible effect. Let’s look into the specifics of concluding student agreements and find out whether the desired savings on taxes and fees will be real or imaginary. An apprenticeship agreement is an agreement on training or retraining. The company has the right to enter into such an agreement with full-time employees and with persons who are just looking for work (Article 198 of the Labor Code of the Russian Federation). If we talk about full-time employees, their training (or retraining) can take place both off-the-job and on-the-job. In any of the options, the student agreement must specify the amount of the scholarship (Part 1 of Article 199 of the Labor Code of the Russian Federation). Moreover, the scholarship cannot be lower than the minimum wage, that is, 4,611 rubles. (Part 1 of Article 204 of the Labor Code of the Russian Federation, Article 1 of Law No. 106-FZ 1), and its maximum size is not limited.

Types of training costs

If a company enters into an apprenticeship agreement, it may face two types of training costs:

• tuition fees to an educational institution;

• scholarship for a student.

IT IS CLEAR THAT... ...

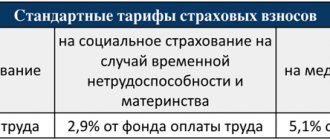

a student agreement with an employee is drawn up in addition to the employment contract (Article 198 of the Labor Code of the Russian Federation). Depending on the training conditions, costs may decrease or increase. Suppose a company plans to train a full-time employee in its own production to obtain a higher rank. In this case, of course, there will be no payment to the educational institution. At the same time, the scholarship must always be paid if the student agreement is concluded. Even if the employee is trained on the job. This is a requirement of Art. 199 Labor Code of the Russian Federation 3. Please note that the scholarship is not paid if the employee undergoes training, but does not receive any specialty or qualification (for example, evening courses in a foreign language). In this case, as a rule, a student agreement is not concluded. Savings on fees are real Amounts of tuition fees for basic and additional professional programs, including for vocational training and retraining JUST KEEP IN MIND Officials agree that the scholarship under the student agreement is exempt from insurance contributions to the funds (letter of the Federal Social Insurance Fund of the Russian Federation dated November 17, 2011 No. 14-03-11/0813985). employees are not subject to insurance contributions to extra-budgetary funds (clause 9, part 1, article 9 of Law No. 212-FZ 2). Consequently, fees to the educational institution are excluded from the assessment base. Please note that under the terms of the apprenticeship contract, the apprentice is not obliged to perform labor functions or any work (provide services). Consequently, insurance premiums are also not paid from the scholarship of such an employee (Part 1, Article 7 of Law No. 212-FZ 2). It turns out that if you replace part of your earnings with a stipend, you can actually save on insurance premiums. At the same time, during the audit, inspectors from the tax office or funds may have questions about the validity of the decrease in earnings. In other words, there is a risk that the benefit received will be recognized as unjustified. Moreover, if the salary is lower than the stipend, the tax authorities may call the company to a salary commission. Personal income tax will have to be paid. If the employing company transfers tuition fees to an educational institution, the student himself does not generate any income. Therefore, tuition fees do not form the tax base for personal income tax (clause 1 of article 210 of the Tax Code of the Russian Federation). With a scholarship for a student, the situation is the opposite: you won’t be able to save money on the NFDL. Tax legislation, in principle, states that various scholarships should not be subject to personal income tax (clause 11, article 217 of the Tax Code of the Russian Federation). The only exception is scholarships for student contracts. They do not fall under this standard. Officials of the Russian Ministry of Finance firmly adhere to this position. They argue that scholarships are paid to students not by educational institutions, but by employing companies. Moreover, only payments within the framework of employment contracts can be exempted from personal income tax, but not student payments. In this regard, personal income tax must be paid on the entire amount (letter of the Ministry of Finance of Russia dated 05/07/2008 No. 03-04-06-01/123). Tuition fees reduce income tax. The company has the right to reduce income tax by the amount of fees under student agreements. Let's find out how to correctly account for scholarships and tuition fees in expenses.

Employee stipend. Experts from the Ministry of Finance do not object to the fact that when calculating income tax, the entire amount of payment under a student agreement is written off as labor costs (letter dated 06/08/2011 No. 03-03-06/1/336).

JUST KEEP IN MIND

As a rule, companies operating without a license do not issue documents confirming qualifications or professions upon completion of training. Hence the difficulty in indicating a specific profession or specialty in the student agreement.

• if an employee is studying outside of work, then the scholarship paid to him can be taken into account on the basis of clause 19 of Art. 255 Tax Code of the Russian Federation. This item is specifically intended for expenses on advanced training or retraining of personnel;

• if an employee is trained on the job, then it is better to include costs in expenses on the basis of clause 25 of Art. 255 of the Tax Code of the Russian Federation (as other types of expenses in favor of the employee provided for by the employment contract);

• if the scholarship is paid to a person who is just looking for a job, then the costs should be written off as other expenses associated with production and sales (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

Let us remind you that in order to account for expenses, expenses must be justified and documented, as required by Art. 252 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated 06/08/2012 No. 03-03-06/1/297). Payment to educational institution. Payment to an educational institution may be included in other expenses associated with production and (or) sales, according to subclause. 23 clause 1 art. 264 Tax Code of the Russian Federation.

However, for this to happen, the conditions provided for in paragraph 3 of Art. 264 Tax Code of the Russian Federation:

• training must take place on the basis of an agreement with a Russian educational institution that has the appropriate license, or a foreign educational institution that has the appropriate status;

• employees who have entered into an employment contract with the company must undergo training;

• if the student is not on the staff of the company, then an agreement must be concluded with him, which stipulates his obligation, no later than three months after training, to conclude an employment contract and work under it for at least one year.

ADVICE FOR THE DECISIVE

Make sure the request is written correctly. If the request does not indicate what specific inspection is being carried out, then the documents do not need to be submitted. Notify the tax authorities about this by letter. They will most likely impose a fine on the company. But there is a good chance of overturning it in court. In most cases, the judges side with the companies.

FOR THE CAREFUL

Do not substitute your salary for a stipend. If inspectors identify unjustified benefits, then insurance premiums will have to be paid, and even with fines. Moreover, it will be necessary to justify the economic need to reduce wages for employees. If this is not done, there is a risk that the student agreement will be declared invalid in court.

Other tax planning articles:

SEPARATION OF A NEW BUSINESS DIRECTION: ASSESSMENT OF THE TAX EFFECT

Our events:

Master classes_Tax planning

Seminars on taxes, tax planning (for accountants, financial directors, managers and company owners)