The register of 2-NDFL certificates and a set of certificates on the income of individuals are formed by employers when preparing annual income tax reports. These documents are submitted to the tax office to record the amount of accrued, withheld, and paid personal income tax to the budget. If the tax is withheld in full, the certificates are sent to the Federal Tax Service no later than April 1 of the year following the reporting year. If it is not possible to withhold the tax in full, the interval for preparing reports on such individuals for the employer is reduced - certificates must be sent to the Federal Tax Service no later than March 1.

How to create a register of information on income for 2-NDFL in 1C 8.3 ZUP

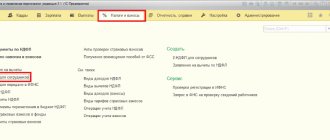

In the 1C Enterprise program 8.3 Salary and personnel management, ed. 3, this can be done through the Reporting menu, certificates - 2 personal income tax for transfer to the Federal Tax Service:

Click the Create button to generate the information:

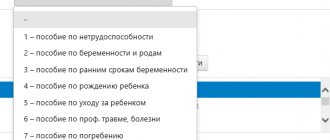

- Select the type of certificate: Annual reporting with code 1; About the impossibility of withholding personal income tax with code 2;

- When choosing an organization (in our case, it is Kron-Ts) the Federal Tax Service and OKTMO/KPP will be filled in:

By clicking on the Open button opposite OKTMO/KPP, you can see and edit information about registration with the tax authority:

It is the choice of OKTMO/KPP in 1C 8.3 that regulates the possibility of submitting individual information 2 personal income tax for a separate division.

We will create the tabular part by clicking on the Fill button:

In this case, the Transferred column will be filled in if the document journal entries Transfer of personal income tax to the budget (menu Taxes and contributions) in 1C 8.3 ZUP rev. 3 have been generated:

The entry Transfer of personal income tax to the budget can be generated directly from the Statement to the cashier or the Statement to the bank if the Tax transferred along with the salary checkbox is checked on the hyperlink Payment of wages and transfer of personal income tax:

For more details on how personal income tax withheld in 1C 8.3 ZUP is taken into account, watch our video:

But let’s return to the formation of Information in Form 2 of Personal Income Tax. By clicking the Print button we can create a Register from 2014 or an additional Register:

Sample of filling out the register of information on income for certificates 2-NDFL in 1C 8.3 ZUP

Since 2014, the register contains the following information in the tabular section: certificate number, full name of the individual, date of birth. This is the form provided for by regulatory documents:

But sometimes tax inspectors ask for expanded information. To submit such information, you can use the Additional Register form from 2014, where the table has 4 more columns with the amounts of income calculated, withheld and transferred tax:

If in the Register the total is the number of certificates, then in the Additional Register the total amounts of income and taxes are also considered.

Who forms?

Responsibility for drawing up the certificate depends on the form in which the certificates are submitted in Form 2NDFL.

Actions in this case are justified as follows:

- If they are sent to the tax authorities electronically, then the tax agent is relieved of the obligation to compile a list of the issuance of 2nd personal income tax certificates. The document will be automatically generated on the tax office side. This is indicated in the text of paragraph 29 of the Procedure approved by the Federal Tax Service of the Russian Federation on September 16, 2011 No. ММВ-7-3/576. After 5 days after sending the reports, the tax agent should receive a response by email with a protocol on the acceptance of the certificates and the formation of the register.

- When tax agents submit certificates on paper or electronic media (flash card, disk, or similar device), the reporting person cannot do without a register. He must first create a document, then print it on paper in 2 copies, and then attach it to the information on the 2NDFL certificates. This provision is justified in clauses 6 and 15 of the Procedure.

- Tax inspectors check certificates and the 2NDFL register for errors and, if they are found, cross out inaccurate data. Upon completion of the inspection, a protocol is drawn up, to which one copy of the register is attached for return to the reporting party. They can be issued either immediately after the report is accepted or after a ten-day period, starting from the moment the information on the income of individuals is received.

How to create a register of income information for 2-NDFL in 1C 8.3 Accounting

We use the section Salaries and personnel - 2 personal income tax for transfer to the Federal Tax Service. The rest of the procedure for creating the Personal Income Tax Register in 1C 8.3 is similar to that discussed above:

Filling out the register of information on income 2-NDFL for separate divisions in 1C 8.3 Accounting 3.0 (Professional and basic)

Note that for separate divisions it is possible to automatically fill out 2 personal income taxes only in the 1C 8.3 version of CORP Accounting, where for separate divisions we can indicate our OKTMO/KPP. For this:

- We will hire employees to these separate divisions;

- Then we will calculate wages and withhold taxes in the context of these OKTMO/KPP.

In standard configurations of 1C 8.3 Accounting Basic and PROF there is no such option. But let's look at how to “outwit” the program and still get certificates 2 personal income tax and the Register in 1C 8.3 Basic and PROF accounting.

Method 1. For separate departments with a small number of employees

We fill out 2 personal income taxes according to the main set of OKTMO/KPP, retain only the employees of the separate division, record data on employees, change the OKTMO/KPP set in the header to the required one, restore (manually) the data and create the Register.

This option is acceptable for separate departments with a small number of employees. We proceed from the fact that it is small companies that calculate salaries in accounting.

Step 1

From the Salaries and Personnel menu, we create a new set of personal income tax information for transfer to the Federal Tax Service. When choosing an organization (in our example - Servicelog), OKTMO/KPP 45395000/771001001 were filled in:

It was according to this OKTMO/KPP that the personal income tax was taken into account in the 1C 8.3 program for all employees. But, for example, you need to provide information on Pushkin to Alexander Sergeevich, who worked in a separate unit with another OKTMO/KPP.

Step 2

Click on the Fill button. We fill out the form for all working employees. In this case, all information about them is filled in:

Step 3

We are removing all employees, except for employees of a separate division. Following the example, we leave only A.S. Pushkin in the table. We may need to correct the reference number. You can do the opposite - use the Selection button and immediately select employees for a separate department.

Step 4

We record the data. For example, using a screenshot we will record data on A.S. Pushkin:

Step 5

We change the OKTMO/KPP set in the header of the document to the OKTMO/KPP set of a separate unit:

Step 6

You can ask the programmer to add a checkbox Do not change the tabular data when selecting other OKTMO/KPP and register this option in the 1C Accounting 3.0 configurator. Then you wouldn’t have to fill in the data manually. But so far there is no such daw. The data is reset, but using previously taken screenshots, we restore it manually for the employee.

Step 7

We record the document and create a Register and certificates. The result was a set of information for a separate unit. We create another set of information for all other employees according to the main set of OKTMO/KPP, while removing A.S. Pushkin from the tabular part.

So, despite recording data for one set of OKTMO/KPP, in 1C 8.3 a personal income tax register was formed for another set. But you should always check manually entered data. Of course, this solution is not very beautiful, since it is not done automatically and requires a lot of work.

How to enter OKTMO/KPP of a separate division in 1C Accounting rev. 3

You can enter additional information about registration (another set of OKTMO/KPP) in 1C Accounting edition 3 by clicking on the link More in the organization card:

We enter additional information about registration - another set of OKTMO/KPP:

Method 2

Let's use the trick. The essence of this trick is that we count all employees except employees of a separate department. At the same time, we have installed the main tax inspectorate of the organization. Then we establish the Federal Tax Service Inspectorate of the separate division as the main one for the organization and carry out the calculation, payment and transfer of salaries of the employees of the separate division:

- An undeniable plus : the necessary OKTMO/KPP are recorded in registers. And we will not only form 2 personal income tax certificates with the Register correctly for a separate division, but also, for example, the Tax Accounting Register for personal income tax;

- The disadvantage of this option is not to forget to correctly set the main Federal Tax Service when making recalculations, paying wages and when making personal income tax transfers.

So, let's look at how to do this step by step using an example.

Step 1

Our organization Servicelog has IRS 7710 selected in its card:

Step 2

We calculate the salaries of Abdulov and Larionova’s employees, except for employees of a separate division (following the example of Pushkin). We can view movements by register using the DtKt button or using the menu View - Settings of the form navigation panel.

When the Payroll document is open, you can display the required register in the document form for ease of viewing. So, we display the Income Accounting register for calculating personal income tax in the form:

In the register we see that the entry was recorded according to the main inspection selected in the organization’s card:

We pay salaries and transfer personal income tax. Let's look at filling out the Registration details. We are interested in the registers Calculations of taxpayers with the budget for personal income tax and Calculations of tax agents for personal income tax:

Step 3

We change the Federal Tax Service Inspectorate in the organization’s card to the Federal Tax Service Inspectorate of a separate division:

Step 4

We calculate salaries, make payments and transfer personal income tax to the budget for employees of a separate division. In our case, according to Pushkin A.S.

We will receive the necessary entries in the registers, where the registration will already be marked as IFTS 7720:

It is necessary that all fields of 2-NDFL are filled out correctly: income, personal income tax accrued, withheld, transferred. Therefore, we control the register entries - Accounting for income for calculating personal income tax, Calculations of taxpayers with the budget for personal income tax, Calculations of tax agents for personal income tax.

Step 5

Now that records in the registers for employees of a separate division contain correct information about registration with the Federal Tax Service, you can automatically fill out the personal income tax register for a separate division.

Select the required OKTMO and click the Fill button:

Thus, we completed the task of creating a Register of information on income 2-NDFL for a separate division in 1C 8.3 Professional and Basic Accounting.

However, it is more convenient to take into account salaries and prepare reports for organizations with separate divisions in 1C 8.3 ZUP rev.3.

The accountant and payroll clerk will be interested not only in the Personal Income Tax Registers for transfer to the Federal Tax Service, but also in the registers of accrued and withheld personal income tax in various sections to monitor the correct completion of 6-NDFL and 2-NDFL. Read more about this in the article Personal income tax calculated and withheld in 1C 8.3.

The procedure for submitting 2-NDFL and the accompanying register

When preparing certificates in Form 2 of Personal Income Tax and the Register, you must follow the Procedure for submitting information on the income of individuals and messages about the impossibility of withholding tax and the amount of tax on personal income (approved by Order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/576).

The register usually accompanies 2-NDFL certificates submitted to tax agents on paper or floppy disks and flash cards.

Attention! If a company submits information on Form 2-NDFL via telecommunications channels, the register is created by the tax office itself.

Companies must submit 2-NDFL certificates to the tax authorities annually, based on the results of the completed tax period:

- Thus, in 2016, 2-NDFL certificates with code 2 had to be submitted before March 1, 2016 if the company had employees who were unable to withhold personal income tax on 2015 income.

- And before April 1, 2016, it was necessary to submit 2-NDFL certificates with code 1 - for the income of all company employees for 2015.

Moreover, there is a letter from the Federal Tax Service dated March 30, 2016 (No. BS-4-11/5443) which says that information on employees who were submitted with code 2 must also be submitted with code 1. However, there are also court decisions that were decided in the benefit of tax agents who submitted certificates for persons from whom it was not possible to withhold personal income tax, only 1 time. Court decisions note that this is legal if the submitted certificates with code 2 contained all the necessary data.

A Register is prepared in two copies for submission to the tax office. The representative of the Federal Tax Service must return one copy (together with the protocol on acceptance of information) to the organization in the next 10 days. True, tax authorities do this more often if there are errors in the certificates and information about an individual with erroneous data is deleted from the register.

If you submit 2 personal income tax certificates in paper form or on storage media without a register, you may be fined. An exception is the submission of certificates via telecommunication channels (in this case, the register is formed by the tax authorities upon acceptance of the certificates).

You can learn more about the procedure for submitting Information on the income of individuals in Form 2-NDFL to the Federal Tax Service (deadlines for submission and payment, accounting system for settlements with the budget, composition and filling algorithm) in our course in the module Guide to reporting in Form 2-NDFL ( information about the income of individuals).

How to correctly generate personal income tax reporting in 1C 8.3 programs, what changes have occurred in “salary” reporting since 2015, see our video:

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Certificate on form 2-NDFL in 2022

Home / Reporting for employees

| Download form 2-NDFL (valid until the end of 2022) View a sample of filling out the certificate Below are detailed instructions for filling out | The following situations are considered: 1. Income was taxed at different rates 2. Salary for December was paid in January |

ATTENTION!

From January 1, 2022, Form 2-NDFL will be updated again.

What has changed + new forms can be found in this article.

2-NDFL is an official document about the income of an individual received from a specific source (usually an organization or individual entrepreneur) and the personal income tax withheld from this income.

Organizations and individual entrepreneurs submit certificates only in case of payment of income to employees and other individuals. But individual entrepreneurs do not draw up form 2-NDFL for themselves.

You are required to submit certificates both to the tax office and to your employees.

2-NDFL employees are issued within three working days from submitting an application for a certificate. A certificate may be needed when leaving a job and moving to another job, filing tax deductions, applying to a bank for a loan, applying for a visa to a significant number of countries, applying for a pension, adopting a child, submitting documents for various benefits, etc. .

Due dates

Tax certificates are submitted once a year:

- no later than April 1 (until April 2, 2022, since the 1st is a day off);

- until March 1, if it is impossible to withhold personal income tax (certificates with sign 2).

Information about the income of non-employees in the company

In the following common cases, we must file income information for individuals not employed by the company:

- The company paid for the work/services under the contract;

- The LLC paid dividends to participants;

- Property was rented from an individual (for example, premises or a car);

- Gifts worth more than 4,000 rubles were presented;

- Financial assistance was provided to those not working in the organization/individual entrepreneur.

When not to submit 2-NDFL

There is no obligation to file 2-NDFL when:

- purchased real estate, a car, goods from an individual;

- the cost of gifts given by the company is less than RUB 4,000. (in the absence of other paid income);

- damage to health was compensated;

- financial assistance was provided to close relatives of a deceased employee/employee who retired from the organization or to the employee/retired employee himself in connection with the death of his family members.

In what format to submit 2-NDFL

1) If the number of completed tax certificates is 25 or more, you need to transmit 2-NDFL via telecommunication channels (via the Internet), for which an agreement must be concluded with a specialized organization (operator of electronic document flow between taxpayers and inspectorates).

The list of operators can be viewed on the tax service website. You can also use the Federal Tax Service website to submit certificates.

2) If the number is smaller, you can submit certificates on paper - bring them in person or send them by mail.

When submitting 2-NDFL in paper form, a register of information on income is also compiled - a consolidated document with data about the employer, the total number of certificates and a table of three columns, the first of which contains the numbers of the tax certificates submitted, the second indicates the full name of the employees, the third their dates of birth are indicated.

The register also reflects the date of submission of the certificates to the tax authority, the date of acceptance and the data of the tax officer who accepted the documents. The register is always filled out in 2 copies.

The current form of the register is given in the order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/ [email protected] When submitting via the Internet, the register will be generated automatically and there is no need to create a separate document.

When accounting is carried out in a special program (for example, various versions of 1C Accounting), personal income tax reporting is generated automatically; all that remains is to double-check the correctness of filling out. Also, some developers offer separate programs for filling out personal income tax reporting (for example, the resource 2ndfl.ru).

Instructions for filling out the 2-NDFL certificate

Cap part

We indicate:

- The year for which 2-NDFL was compiled;

- Serial number of the certificate;

- Date of compilation.

Column "sign"

Specify the value:

- “1” – in all cases where personal income tax was withheld, if the certificate is submitted by a tax agent (“3” – if the form is submitted by the legal successor of the organization or its OP on the same grounds);

- “2” – when it was not possible to withhold personal income tax if the document is submitted by a tax agent (“4” – if the form is submitted by the legal successor on the same basis).

The need to provide 2-personal income tax with sign 2 may arise in such common cases as:

- Presenting a non-monetary gift worth more than 4,000 rubles to a person who is not an employee of the company;

- Payment of travel and accommodation for representatives of counterparties;

- Forgiveness of debt for a resigned employee.

It should be borne in mind that submitting a certificate with feature 2 does not cancel the obligation to submit a certificate with feature 1 for the same income recipient.

Column "Adjustment number"

When the certificate is submitted for the first time, “00” is entered. If we want to correct the information from the previously provided certificate, the column indicates a value greater than the previous one by one - 01.02, etc.

If a cancellation certificate is submitted to replace the one submitted earlier, “99” is indicated.

Note: when filling out the corrective document, the successor of the tax agent must indicate the number of the certificate submitted by the previously reorganized company and the new date of preparation.

Code of the tax office with which the organization or individual entrepreneur is registered

You can find out on the Federal Tax Service website through this service).

Section 1

OKTMO code

OKTMO is the All-Russian Classifier of Municipal Territories. The code can be viewed on the tax service website in this service).

Individual entrepreneurs on UTII and PSN indicate OKTMO at the place of business in relation to their employees employed in these types of business.

The legal successor of the tax agent fills out OKTMO at the location of the reorganized company (RP).

TIN and checkpoint

Extracted from the tax registration certificate. In 2-NDFL for employees of separate divisions, OKTMO and KPP of these divisions are indicated. Individual entrepreneurs do not indicate checkpoints.

If the certificate is submitted by the successor of the tax agent, the TIN/KPP of the legal successor is filled in.

Tax agent

The abbreviated (if absent, full) name of the organization (full name of the entrepreneur) is indicated.

If the certificate is submitted by the legal successor, the name of the reorganized company (RP) should be indicated.

Reorganization (liquidation) codes

In the “Form of reorganization” field, the codes of reorganization (liquidation) of the legal entity (LP) are indicated:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

The codes of the reorganized company (OP) are entered in the TIN/KPP field.

If the certificate is not submitted for a reorganized legal entity (LE), these fields are not filled in.

If the title of the certificate contains the sign “3” or “4”, these fields must be filled in in the prescribed manner.

Section 2

Taxpayer status

Indicated by code from 1 to 6:

Code 1 - for all tax residents of the Russian Federation (persons staying in the territory of the Russian Federation for 183 or more calendar days within 12 consecutive months), and for those who stayed less than 183 days, the following codes are indicated:

- 2 – when the recipient of the income is not a resident and does not fall under other codes;

- 3 – if we invited a highly qualified specialist to work;

- 4 – if our employee is a participant in the program for the resettlement of compatriots;

- 5 – if the employee brought a certificate of recognition as a refugee or provision of temporary asylum in the Russian Federation;

- 6 – when our employee is accepted on the basis of a patent (foreign workers from countries whose citizens do not require entry visas to the Russian Federation, with the exception of those included in the Customs Union. For example, citizens of Azerbaijan, Tajikistan, Uzbekistan, Ukraine , temporarily staying in Russia, for the right to work for legal entities and individual entrepreneurs are required to obtain patents).

We determine the status at the end of the year for which information is submitted. Those. if the employee became a resident during the year, in the “Taxpayer Status” column we enter the number 1. This does not apply only to filling out certificates for those working on the basis of a patent (for them, code is always 6).

If the 2-NDFL is issued before the end of the year, the status is indicated as of the date the document was drawn up.

Country of citizenship code

Indicated in accordance with OKSM (All-Russian Classifier of Countries of the World). For example, for Russian citizens this is code 643. For codes for other countries, see this link.

Identity document code

Indicated according to the directory “Codes of types of documents proving the identity of the taxpayer” (see table below). Usually these are codes 21 (passport of a citizen of the Russian Federation) and 10 (passport of a foreign citizen). Next, indicate the series and number of the document.

| Code | Title of the document |

| 21 | Passport of a citizen of the Russian Federation |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on its merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

| 24 | Identity card of a military personnel of the Russian Federation |

| 91 | Other documents |

Sections 3-5

Indicators (except for personal income tax) are reflected in rubles and kopecks. The tax amount is rounded according to arithmetic rules.

If we paid income that was not subject to personal income tax in full (the list of such income is given in Article 217 of the Tax Code of the Russian Federation), we do not include the amount of such income in 2-personal income tax. For example, 2-NDFL does not reflect:

- benefits for pregnancy and childbirth and child care up to 1.5 years;

- payment to the dismissed employee of severance pay in the amount of no more than three monthly salaries;

- one-time payment at the birth of a child in the amount of up to 50,000 rubles.

Section 3

It includes data:

- about income taxed at one of the rates (13, 15, 30, 35%);

- about tax deductions applicable to these types of income (in particular, amounts not subject to personal income tax).

Income received is reflected in chronological order, broken down by month and income code.

Employee income was taxed at different rates - how to fill it out?

If during the year one person received income subject to taxation at different rates, one certificate is filled out containing sections 3 - 5 for each rate. Those. all employee income, regardless of the type of income, must be included in one certificate.

If all the data does not fit on one sheet, fill out the second page of the certificate (in fact, we will have 2 completed 2-NDFL forms with the same number).

On the second page, indicate the page number of the certificate, fill in the heading “Certificate of income of an individual for ______ year No. ___ dated ___.___.___” (data in the header, including the number, are the same as on the first page), enter data in sections 3 and 5 (sections 1 and 2 are not filled in), the “Tax Agent” field (at the bottom of the document) is filled in. Each completed page is signed.

An example of such a situation is an organization issuing an interest-free loan to its employee. The recipient of the loan will have both income taxed at a rate of 13% (salary) and income subject to a rate of 35% (material benefit).

If dividends to a participant who works in the organization, they are reflected along with other income. There is no need to fill out separate sections 3 and 5 for dividends.

For example, on June 5, 2022, participant Nikiforov, who also works as Deputy General Director, was paid dividends of 450,000 rubles. In the data for June (see sample above), we will reflect wage income with code 2000 and dividend income with code 1010.

Income and deduction codes

Income and deduction codes are established by orders of the Federal Tax Service (the latest changes were approved by order dated October 24, 2017 No. ММВ-7-11/ [email protected] ). See the full list of income codes here.

But most often you will have to indicate the following:

| The most used deductions for this section:

|

See the full list of deduction codes here.

If there are no total indicators, a zero is entered in the certificate columns.

Salary for December was paid in January – how to reflect it?

In the certificate, income is reflected in the month in which such income is considered actually received according to the norms of the Tax Code. For example:

1) Our employee’s salary for December 2022 was paid on January 12, 2022 - we will reflect its amount in the certificate for 2022 as part of income for December (since, in accordance with paragraph 2 of Article 223 of the Tax Code, the date of receipt income in the form of wages is recognized as the last day of the month for which income is accrued in accordance with the employment contract).

2) For a craftsman working for us under a contract, payment for work completed in December 2022 was made on January 12, 2018 - this amount will be included in 2-NDFL for 2022 (since there are separate standards for payment for contracts of a civil law nature are not provided for by the Tax Code, therefore, we apply the general rule, according to which the date of actual receipt of income is defined as the day of its payment - clause 1 of Article 223 of the Tax Code of the Russian Federation).

Vacation pay is reflected in the certificate as part of the income of the month in which they were paid (Letter of the Ministry of Finance of the Russian Federation dated 06.06.2012 No. 03-04-08/8-139).

For example, our employee Nikiforov was on vacation from January 9 to January 21, 2022. Vacation pay was paid to him on December 29, 2022. In 2-NDFL for 2022 (see example of filling), we include the amount of vacation pay in income for December with code 2012.

Some types of income are not taxed up to certain limits. In 2-NDFL, opposite such income, you need to indicate the code and deduction amount in the amount of the non-taxable amount.

For example, for his birthday (September 10), employee Nikiforov was given a phone worth 18,000 rubles by the company. Because The cost of gifts for the year is not subject to personal income tax in an amount not exceeding 4,000 rubles. In the 2-NDFL certificate in the data for September (see example of filling) we will reflect:

- income 18,000 rub. with code 2720 (price of gifts);

- deduction 4000 rub. with code 501.

Section 4

The most commonly used deduction codes:

- 126, 127, 128 – deductions for the first, second, third and subsequent children;

- 311 – for expenses for the purchase of housing;

- 312 – for mortgage interest paid;

- 324 – for treatment expenses.

See the full list of codes here. Deductions are received exclusively by tax residents in respect of income taxed at a rate of 13% (except for dividends).

We can provide a social or property deduction at the place of work if the employee has brought a notification from the tax office about the right to such a deduction. Notification details are indicated at the bottom of section 4.

Section 5 states:

- Total amount of income from section 3 (add up the indicators in the “Amount of Income” column);

- Tax base (from the total amount of income we subtract the amount of deductions from the columns “Amount of deductions” of sections 3 and 4);

- The amount of tax calculated and withheld from this income (indicator in the column “tax base” * tax rate; in certificates with the attribute “2” (“4”), the amounts of calculated and withheld tax will differ);

- The amount transferred to the personal income tax budget.

The columns for information on fixed advance payments for a patent are filled out in certificates for those working on the basis of a patent based on information from the notice of confirmation of the right to a tax reduction received from the tax office.

In the “Tax Agent” column the following is indicated:

1 – when the certificate is presented by the head of the organization (successor company) in person or the certificate is sent with a digital signature of the head;

2 – in other cases (for example, when submitting 2-NDFL on paper by the chief accountant or courier).

Below are the details of the person who submitted the certificate and his signature.

The representative also indicates the power of attorney data.

Did you like the article? Share on social media networks:

- Related Posts

- Sample of filling out the zero 4-FSS for the 1st quarter of 2022

- 6-NDFL for the 1st quarter of 2022

- Form SZV-STAZH - new reporting 2022

- Sample of filling out form 4-FSS (2nd quarter 2022)

- Deduction codes in the 2-NDFL certificate in 2022

- 6-NDFL for the whole year

- Sample of filling out the KND form 1110018

- Unified calculation of insurance premiums to the Federal Tax Service

Discussion: 17 comments

- Elena:

02/01/2018 at 12:24Good afternoon. Please tell me, in section 5 on “tax amount transferred”, it is necessary to indicate the actual personal income tax transfers and salary payments in January for the accrued December salary, or will “calculated tax amount”, “withheld” and “transferred” be the same?

Answer

Alexei:

02/03/2018 at 04:04

Hello. If on the date of filing the 2-NDFL certificate the tax had already been withheld and paid to the budget, then it should be indicated as calculated, as withheld, and as transferred.

The fact of tax withholding and payment in 2022, and not in 2022, does not matter (letters of the Federal Tax Service of the Russian Federation dated 03/02/2015 No. BS-4-11/3283, dated 02/03/2012 No. ED-4-3/ [email protected] and No. ED-4-3/ [email protected] , dated 01/12/2012 No. ED-4-3/74). Thus, all Section 5 tax amounts will be the same.

Answer

02/13/2018 at 15:56

tell. An employee of mine purchased an apartment in 2022. He needs to submit a 2nd personal income tax certificate

Answer

- Alexei:

02/14/2018 at 16:45

Hello. If an employee was paid income during 2017, a 2-NDFL certificate must be submitted. Apparently, your question concerns how property deductions for purchased housing are reflected in the certificate.

The deduction is provided on the basis of a notification from the Federal Tax Service submitted by the employee and is reflected in 2-NDFL in the following order:

In section 4 you enter: deduction code “311” and the deduction amount.

Below you provide the details of the Federal Tax Service notification confirming your right to a property deduction.

The “Tax Base” column of Section 5 is filled out taking into account the amount of the deduction provided. If its size exceeds income, then the tax base is recognized as equal to 0.

Answer

03/24/2018 at 16:11

How to fill out section 5 in 2-NDFL, if the organization calculates salary monthly, pays with a delay of 9 months (in cash), and has never transferred personal income tax to the budget for the year (the account is blocked)? For example, the amount of tax calculated is 50,000 the amount of tax withheld is 20,000 the amount of tax transferred is 0

Answer

- Alexei:

03/25/2018 at 18:51

Hello. The following point is important here: whether the salary was issued and, accordingly, personal income tax was transferred before the submission of 2-NDFL certificates, that is, already in 2022. If you have paid off your obligations before submitting the certificate, fill out the form as usual.

If at the time of submitting the certificate there is a debt to employees and the tax has not been received into the budget, then in section 5 the indicators for the amount of tax calculated, withheld and transferred will differ, and the line “Amount of tax not withheld by the tax agent” will be filled in. In this case, after paying off obligations to employees and the budget, you will need to submit corrective certificates to the Federal Tax Service in Form 2-NDFL with the same number, but with a new date.

Answer

03/27/2018 at 21:11

Please tell me in form 2-NDFL for 2022 in the column “Tax amount transferred”:

1) Indicate the amount transferred for accruals in 2022? After all, the tax for December 2016 was also transferred in 2022.

2) How to distribute the tax among people if for November 2017 the tax amount calculated for all employees was 10,000 rubles, and 7,000 was paid to the budget? And the remaining 3,000 tax for November and tax for December have not yet been transferred.

Answer

- Alexei:

03/28/2018 at 00:54

Hello. If the tax for the past tax period was transferred to the budget before the date of submission of certificates in Form 2-NDFL to the Federal Tax Service, then such tax should have been included in these reports. Thus, the tax for December 2016, paid in Q1. 2022, should have been included in the primary reporting for 2016.

In cases where, on the date of submission of certificates in Form 2-NDFL, the tax has not been repaid in full, the amounts of calculated, withheld and transferred tax in Section 5 of the primary certificates will differ. After transferring personal income tax to the budget, the tax agent is required to submit corrective certificates, in section 5 of which the above amounts coincide.

Therefore, personal income tax for 2016 should not appear in certificates for 2022 (letter of the Federal Tax Service dated March 2, 2015 No. BS-4-11/3283).

As for the distribution of the amount of personal income tax not transferred, there are no official explanations on this issue, but there is the following opinion: since in this case the tax agent is clearly at fault, it is more logical for the personal income tax transferred from employee remuneration to be reflected in full, and the amount of the debt to be included in the manager’s certificates and founders.

Whether to follow this recommendation or distribute the amounts in proportion to the number of employees is up to you.

Answer

12/15/2018 at 19:02

Good evening! Can you please tell me that the 2-NDFL certificate must have the employer’s stamp?

Answer

01/15/2019 at 12:01

Good afternoon. How to generate (print) a 2-NDFL certificate for an employee? When printing from the program, it issues Appendix No. 1 to the order ММВ-7-11/566 dated 10/02/2018. Is this form suitable for issuing to employees? They will take it to the Federal Tax Service for reimbursement of costs.

Answer

01/24/2019 at 09:54

Good afternoon. Please tell me this is the situation. A husband and wife in an official marriage purchased an apartment, but the husband refused his share, but now he wants to receive a deduction for the purchase of this apartment, since his income is much higher than that of his wife. Does he have the right to make a deduction in 3-NDFL? We purchased the apartment in 2017, but never rented it out for 3-personal income tax.

Answer

02/05/2019 at 13:36

Good afternoon. If the accountant did not take into account the deduction of 4,000 rubles. from the gift and in the personal income tax report 2, this deduction is not indicated; will this be considered an error?

Answer

02/26/2019 at 20:28

Good evening. I don’t quite understand the answer to the question: Should the employer’s signature be stamped on the Form 2 personal income tax certificate?

Answer

01/23/2020 at 21:30

Please tell me, the amount of tax calculated is 54,000, withheld and transferred 9,600, and not withheld by the tax agent 44,600, what should I indicate in the 3NDFL certificate?

Answer

01/29/2020 at 16:35

Hello! My husband works in the Ministry of Internal Affairs. Recently he took out a certificate of 2nd personal income tax. In my opinion, paragraph 4 is filled in incorrectly. If 1400 per child, then it should be 16800 for each child. Deductions for two children. You can check and comment.

Answer

01/29/2020 at 16:37

I wanted to attach a scan, but it seems it’s not possible here. Now in the certificate in the deductions line it is 126-8400 and 127-8400. Certificate for 2022 for 12 months

Answer

02/04/2020 at 16:43

For which last months should 3 and 6 months be indicated in the certificate? A certificate must be submitted to the tax office for a package of documents for purchasing a home for a tax refund.

Answer