Issuing 2-NDFL certificates to employees is the responsibility of employers, including in cases where the person has already stopped working in the organization.

However, there are often cases when, having applied for a certificate, a citizen receives an unmotivated refusal from the employer. How to act in such cases is described in this article.

Why such a rush

Usually, workers rush to receive a certificate of income in order to early declare deductions - property, social - for the past year and, accordingly, quickly receive a personal income tax refund from the budget. This is not a quick matter: up to 3 months are allotted for the desk verification of the 3-NDFL declaration and after that, up to another month for a refund. The sooner a person submits a declaration, the sooner he will receive money from the budget.

In fact, neither the Tax Code nor other regulations require attaching a certificate of income to the 3-NDFL declaration. In theory, when checking the declarations of individuals, the inspectorate should compare their contents with data from forms 2-NDFL, which it received from tax agents (available electronically to individuals themselves in their personal taxpayer accounts).

However, now, in January, neither the inspectorates nor the personal accounts of individuals have this data, because you, as a tax agent, will submit forms 2-NDFL for 2022 to your Federal Tax Service later: the deadline for their submission is March 2, 2022.

However, even if you report earlier, tax officials are unlikely to immediately upload the certificates to the personal accounts of individuals. And if desired, the inspectorate where the employee is registered may, during a desk audit of his declaration, request a certificate from him. That’s why workers are asking their employers for certificates now so they can immediately submit them along with their declarations.

In addition, they need a certificate of income as a basis for filling out some information in the 3-NDFL declaration:

- OKTMO code in line 030 of section 1;

- the amount of deductions you provided in Appendix 5 to the 3-NDFL declaration.

Assess the risk

To date, there has already been quite a lot of judicial practice on the issue of additional tax assessment in connection with the payment of wages “in envelopes”. But, in fairness, it is necessary to clarify that judges’ decisions are distributed both in favor of the Federal Tax Service and in favor of taxpayer organizations.

Courts do not always accept testimony in the form of evidence of the employer’s guilt when considering such cases; an example is the Appeal ruling of the Tula Regional Court dated August 9, 2012 in case No. 33-2174.

The arbitrators will evaluate the evidence. And such proof can be the same certificate for the bank. Even if a company does not use a seal in its work, the signature of the employer agreeing to endorse a document with the specified amount of the employee's earnings may be enough for judges.

If it is proven that the salary actually amounted to, say, 1000 rubles, and not 100, as the employer stated in the reporting documents, additional insurance premiums will be charged from the amount of the difference, personal income tax will be withheld and penalties will be imposed.

note

Having analyzed several forms of such certificates, we can clearly conclude that some of the required fields in the document are the amount of income minus personal income tax and data on the employee’s length of service. In most cases, the form provided by the credit institution does not contain information about the organization’s registration data.

But this is only if the amount of arrears is not equated to large or especially large, because in this case liability is already provided for under Article 199 of the Criminal Code.

In conclusion, I would like to separately mention the fact that the employee has, as they say, “in hand” a certificate in the form of the bank. It can be assumed that if a document is issued, it should be stored in the credit structure itself. That's how it is. However, modern realities dictate their own rules.

Most banks today accept documents for consideration in electronic form: this makes sending questionnaires, certificates, and copies of work records convenient for all parties to a potential transaction. Bankers request original documents from the borrower only if the loan application is approved. You also need to remember that such documents have an “expiration date”. Thus, if you send a package of documents to the bank and wait for a response for several weeks, the certificate may lose its relevance. It is also possible that the borrower changes his mind about taking out a loan. This means that there is a possibility that an employee may accidentally retain a certificate in the form of a bank, signed by the director of the company, and this probability is quite high. And then... We talked about what could happen next above.

In what form should a certificate be issued to an employee?

As you remember, two forms of income information have been approved since last year:

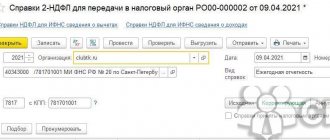

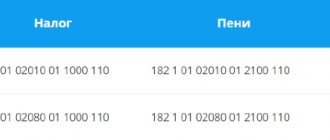

- form 2-NDFL - for submission by the tax agent to the Federal Tax Service (hereinafter we will call it form 2-NDFL);

- form of a certificate of income and tax amounts for an individual - for issuance by a tax agent to employees and other individuals who have received income from him (hereinafter referred to as the certificate).

Attention: The deadline for issuing a certificate of income upon dismissal is the last day of work. For employees who quit in January, issue two certificates: for 2022 and for the time elapsed from 01/01/2020 to the day of dismissal.

At the same time, the employee asks you for a certificate precisely in order to submit it to the tax office. Moreover, at the time of its submission by the employee, the tax authorities, as we said, will not yet have your 2-NDFL forms. Does this mean that a certificate needs to be drawn up for an employee using Form 2-NDFL, and not according to the form approved for issuance to employees? Not at all.

Although the data in form 2-NDFL and in the certificate for employees is the same, these documents have different purposes and status. Form 2-NDFL is intended to control tax agents. And the certificate is for informing employees and confirming the amounts of income paid to them, deductions provided and tax withheld. The employee, when submitting the declaration, confirms with the help of a certificate:

- income declared by him on his own behalf in the declaration;

- calculated by the tax agent taking into account the deductions provided and the withheld amount of tax, which the employee requests to be returned to him from the budget.

There is no tax agent control when checking the employee’s declaration. Therefore, employees need to be issued not 2-NDFL forms, but certificates in the form intended for this purpose.

Advice Last year, some tax authorities required individuals to attach form 2-NDFL to their declaration, and certainly with the same number and date with which the tax agent submitted this form to the tax office. Therefore, do not be surprised by such a request from an employee. If you want, you can give him, in addition to the required certificate, a copy of form 2-NDFL. But we do not recommend doing this before you submit your personal income tax reports for 2019 to your tax office.

Do you have the right to refuse to issue certificates until March?

Often, accounting departments do not want to issue income certificates to employees until they have generated 2-NDFL forms for submission to the tax office. It takes time to check personal income tax register data for the entire year, and the already short working month of January is busy with other reporting. Let's see if you have the right to force workers to wait until March.

Clause 3 of Art. obliges tax agents to issue income certificates to individuals. 230 NK. However, the issuance period is not specified there. Liability for failure to issue a certificate is not established in the Tax Code.

The Labor Code has a deadline for issuing copies of work-related documents to employees, including salary certificates - 3 business days from the date the employee submits a written application to this effect. Since it is said here about copies, there is an opinion that this period only applies to documents that the organization already has. And in January, when employees come for certificates, the employer may still quite legitimately not have generated Form 2-NDFL, since according to the Tax Code he is obliged to make and submit it only by March.

However, you must issue the employee not Form 2-NDFL, but a certificate of income. The deadline for generating this certificate has not been established, that is, it is assumed that it can be done at any time. It contains personal income tax register data for the past year. You should already have this data, since you need to constantly keep records of an individual’s receipt of income from you, calculation, deduction and transfer of personal income tax.

Thus, you are obliged to issue them to all employees who have requested certificates in writing - both current and former - no later than on the 3rd working day. Violation of this deadline may result in a fine. What if the certificate was requested by a person who does not have an employment contract with you, to whom you paid some income in 2022, for example, your landlord, contractor or executor under the GPA? Then you have 30 days to issue the certificate. There is also a fine for refusal.

In addition, an individual can request a certificate from you through the court, applying there to protect their rights. Although this is unlikely, it is not excluded.

Legislative regulation

Employers are responsible for issuing documents to citizens confirming the amount of wages received (Article 230 of the Tax Code of the Russian Federation).

In this case, the document must be issued before the expiration of 3 days from the moment the person submitted the corresponding written application.

If an employee leaves his position, all papers must be issued on the day of dismissal (Article 62, 84.1 of the Labor Code of the Russian Federation).

How to number certificates?

The approved form does not provide a number - you only need to enter the date of issue of the certificate. Therefore, compliance with the number of form 2-NDFL for this employee, which you submit to the inspection, is not required.

Advice If, when preparing a certificate for an employee, you discover that your personal income tax for 2022 was erroneously underwithheld, if possible, first withhold and transfer the tax, and then issue a certificate. If the employee insists on observing the 3-day deadline for issuing the certificate, try to convince him to wait. Explain that this is also in his interests. Otherwise, later, after the tax has been withheld, you will need to show it in form 2-NDFL as withheld and a discrepancy will arise with the certificate issued to the employee. The inspectorate will ask you for clarification, and the employee may have difficulty returning this tax amount.

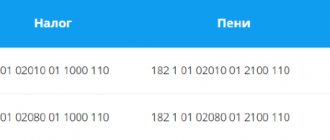

How to indicate tax amounts?

Information on tax withholding and transfer is reflected as of the date of signing the certificate. Therefore, tax that is calculated on income for 2022, but withheld and transferred to the budget in the period from January 1, 2022 until the date the certificate is issued to the employee, is shown as withheld and paid. This is for example:

- tax on December wages paid in January and bonuses based on work results in December;

- tax on monthly benefits for December and excess daily allowances according to annual reports approved in December, withheld from salaries for December paid in January. The date of receipt of all these incomes is December 31, 2019;

- a tax that could have been withheld in 2022, but was not withheld on time by mistake.

How to reflect wages not yet paid for 2022?

If at the time of issuing the certificate to the employee, the salary and/or monthly bonus for December or other months of 2022 have not yet been paid, then in the certificate:

- show them as income for December;

- Include personal income tax from them in the amount of calculated tax, but do not include it in the amounts of withheld, transferred and unwithheld tax.

Keep in mind that if by the time you submit your 2-NDFL certificates to the tax office, your salary has already been paid, then this tax will need to be shown in them as withheld and transferred. And the employee will have to issue a new certificate so that the data in the 2-NDFL form you submitted and in the income certificate issued to him coincide.

However, if an employee requests a certificate just a few days before the payment of this salary, try to agree with him that you will issue a certificate after the payment of the money. Explain that then the certificate will immediately reflect all the tax withheld from 2022 income and he will not have to submit the certificate to the inspectorate again.

Response steps

In accordance with current legislation, such documents must be stored at the enterprise for five years, after which it is possible to completely destroy the existing documentation. Thus, if the accountant does not provide documents after this period, then in this case there is no possibility of demanding this document, since the taxpayer is not responsible for issuing this paper.

Thus, if an employee cannot obtain the certificate he needs because he received a refusal from the accountant to issue this document, then in this case, first, it is worth filling out an application in free form with a request to issue this document.

After this, it is best to ask for a copy signed by an accountant, which will confirm that this document was actually requested from the employer. If within three working days the authorized persons do not have time to prepare a certificate, then in this case you can prepare a complaint to the Labor Inspectorate and take other actions.

How long is a 2-NDFL certificate valid for the tax office? - depends on the period for which the form is submitted. A sample of a 2-NDFL certificate with zero income can be viewed below.

What the register of certificates for 2-NDFL looks like - we will explain here.

How many certificates should I issue when changing inspections in 2022?

Is it possible for an employee to be issued one certificate for submission to the inspection, summarizing all the data for the year and indicating the new OKTMO? After all, the employee will in any case have to submit the declaration at his place of residence. And the procedure for filling out certificates for employees has not been approved.

No, despite this, you need to issue the employee two certificates, then:

- he will be able to correctly enter data into the 3-NDFL declaration. There, in line 030 of section 1, OKTMO indicates the place of transfer of the amount of tax claimed for refund. Accordingly, he needs to fill out two blocks of lines 010–050, showing separately the tax amounts for each of the two OKTMOs;

- there will be no discrepancies with your personal income tax reporting. After all, to the Federal Tax Service you must submit two forms 2-NDFL: a separate one with data on the old OKTMO and a separate one with data on the new OKTMO.

How many certificates should I issue if it is impossible to withhold tax?

Let's say that for some reason an employee does not have a salary for December, but at the end of the year he received non-cash income from you. You didn’t pay him any money, so you couldn’t withhold the personal income tax calculated on non-cash income until the end of 2022. It is no longer possible to withhold this tax from 2022 income, but you must inform the inspectorate and the employee about the impossibility of withholding.

To do this, you must submit form 2-NDFL to your Federal Tax Service no later than 03/02/2020 with the “2” sign (and if you are submitting it as a legal successor, with the “4” sign). Please indicate this income on your certificate. Its second copy must be given to the employee at the same time.

If in January an employee asks you for a certificate of income, then show this tax as part of the unwithheld tax.

Where to contact?

To protect their rights, a citizen has the right to apply:

1. Labor inspection (LIT). If the certificate is not issued, a written application must be submitted to the State Tax Inspectorate at the place of registration of the organization. The application must be accompanied by documentation confirming the fact of applying for a certificate and the refusal to issue it (if any).

Consideration and verification of the circumstances is carried out within a month, after which an order is issued to the employer to correct the violation (Article 357 of the Labor Code).

In addition, the powers of the State Tax Inspectorate include imposing a fine on employers in the amount of 5 to 30 thousand rubles.

2. Judicial authority. If, despite the intervention of the State Tax Inspectorate, the document was never issued by the employer, or the citizen is not satisfied with the results of the check carried out by the State Tax Inspectorate, he can apply to the judicial authorities with a demand to oblige the employer to issue the required paper.

The employee has the right to apply to the judicial authorities directly without submitting an application to the commission. The application period is 3 months from the date when the employee was refused to issue the document.

In this case, it is necessary to provide the judge with evidence of the fact that the citizen made attempts to obtain a certificate, and it was not issued due to the fault of the employer.

You should not delay applying to the court for too long, since if you miss the deadline, the citizen will have to provide evidence that he did not file the application on time for valid reasons.