Decision-making

Liquidation of a joint stock company can be initiated by an arbitration court (based on a decision) or be voluntary. Article 61 (clause 2) of the Civil Code of the Russian Federation contains a list of reasons allowing for voluntary termination of activities:

- if the period for which the organization was created has expired;

- if the goal for which society exists is achieved.

Voluntary liquidation is also possible in other cases, for example, when the purpose of creating a joint-stock company cannot be achieved.

The decision to hold a meeting at which the issue of voluntary closure of the Joint Stock Company will be considered contains:

- Indication of the date, time, location of the event; postal address, if voting is provided, for sending completed ballots; closing date for receiving ballots, postal address if the meeting is an absentee vote.

- Information about the start time of registration of participants.

- Information regarding the form of the upcoming meeting (can be held in the form of absentee voting or with the joint presence of shareholders).

- The date of formation of the list of shareholders admitted to the general meeting.

- Agenda.

- Data on the procedure for notifying participants about the general meeting and delivering ballots to them.

- Information for shareholders of the company indicating the procedure for providing materials.

- A clear structure (form, sample text) of ballots when used in voting.

- List of explanations on the procedure for collecting votes.

- List of types of securities (preferred shares) that give their owners the right to participate in voting on the issue put on the agenda.

When a general meeting is held, the issue of liquidating a JSC is considered resolved if a qualified majority of participants (three quarters) owning voting shares are in favor of closure.

Reasons

Voluntary liquidation involves making a decision in advance. The legislator established the following circumstances for the completion of the work of the JSC:

- The end of the company's life is established in advance when registering the business. If a decision is made to continue the company’s activities, its founders will take care of documenting the extension of the organization’s operating time.

- Achieving the goals for which society was created. For example, an enterprise was opened for construction work. After their completion, the organization is subject to closure or reorientation by introducing appropriate changes to the statutory documents.

- The end of the period for which a license is issued to perform a certain type of activity. In this case, the shareholders decide in what period it is necessary to liquidate the company.

Basics of voluntary liquidation of a joint stock company

If shareholders decide on voluntary liquidation, a liquidation commission is also appointed at the general meeting, and the procedure and timing of the procedure are approved. The liquidation commission receives a full range of managerial powers and represents the liquidated company in court.

After the mandatory notification is sent to the tax office, the latter initiates an on-site audit, since it acts as a potential creditor in case of underpayment of mandatory payments. If the need arises, officials authorized by the tax authorities to conduct an audit have the opportunity to inspect retail, warehouse, industrial and other premises and territories through which the taxpayer generates income or maintains taxable objects. They can also carry out inventory.

From the moment the registration authority makes an entry about the beginning of the liquidation process in the Unified State Register of Legal Entities, the Company is deprived of the opportunity to:

- change the content of constituent documents;

- act as a founder of new legal entities;

- register legal entities, the emergence of which is the result of the reorganization of a liquidated joint-stock company.

A written notification is sent to the Pension Fund and the Federal Social Insurance Fund of the Russian Federation. The organization has 3 days to do this from the moment the shareholders make a decision on voluntary closure.

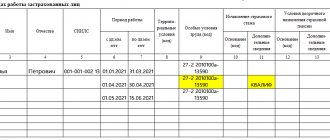

Personnel-related documentation submitted by:

- personal cards;

- personal accounts of employees;

- salary calculations (accrual, payment), etc.

Liquidation of JSC and payment of tax

As for the taxation of a legal entity being liquidated, one should take into account the fact that the tax service, as a rule, receives a notification from the court stating that the JSC is being closed. In a situation where a legal entity has a debt on the mandatory payment of state duty, a visiting commission is sent to the debtor. A conversation is underway, as a result of which both parties are looking for a mutual solution on how to pay off the existing debt as soon as possible. The tax service, like other legislative bodies, must be aware of the reason for the liquidation of an OJSC. An on-site inspection by tax officials is carried out for a relatively short period of time (for 2 months).

Step-by-step plan for liquidation of JSC

Step-by-step instructions for the voluntary liquidation of a JSC include:

- Submission by the board of directors (supervisory board) for consideration of the issue of terminating the activities of the joint-stock company.

- Holding a general meeting of owners of voting shares, during which the participants confirm the liquidation of the company by a majority vote, and appoint a liquidation commission. If part of the securities belongs to the state or municipality, the liquidation commission cannot be formed without a representative of these institutions (the relevant property committee, property fund, local government body are involved). Failure to comply with this requirement entails the refusal of the state registration authority of the liquidated JSC to approve the composition of the commission.

- The placement by the liquidation commission in printed publications that publish information about legal entities, their registration, of a message that confirms the liquidation of the organization, contains information for creditors that determines the procedure and timing for filing claims. If 2 months have not passed since the publication of the message, creditors do not have the right to present their claims. The absence of credit obligations serves as the basis for the distribution of the property of a liquidated joint-stock company between shareholders on a priority basis, and participants in the next priority cannot receive the property until it is distributed among the participants in the previous priority.

- The liquidation commission develops an action plan aimed at identifying creditors and collecting debts from debtors. Also at this stage, creditors are notified in writing of the termination of the joint-stock company's activities.

- Drawing up an interim liquidation balance sheet. The document is generated when the period during which creditors can present claims ends, and describes the composition of the organization’s property, the claims made for loans, and the results of interaction with creditors.

- Approval of the interim liquidation balance sheet, agreed upon with the body that registered the liquidated JSC, at the general meeting of shareholders.

- Public auctions for the sale of property, which are organized and conducted by the liquidation commission, if the available funds cannot satisfy the demands of creditors, i.e. their number is not enough.

- Organization of loan payments. The procedure is carried out by the liquidation commission on the basis of the approved interim liquidation balance sheet. The order of repayment of accounts payable: 1. First in line are citizens to whom the organization is obliged to compensate for harm caused to their health and life. In this case, the corresponding time payments are capitalized. 2. The second priority includes severance pay, wages of persons with whom an employment agreement or contract was concluded; remuneration provided for in copyright agreements. 3. Next, obligations to creditors are fulfilled, where the collateral is the property of the liquidated company. 4. The fourth stage is formed by mandatory payments - repayment of debts to the budget, extra-budgetary funds. 5. Other creditors receive the last payments, and only one month after the adoption of the interim liquidation balance sheet.

- Drawing up a liquidation balance sheet. The document describes the assets remaining at the disposal of the JSC at the time of termination of activity. The information reflects the state of the Company before fulfilling its obligations to shareholders. The commission begins work on the liquidation balance sheet after repayment of accounts payable.

- Approval of the liquidation balance sheet agreed with the registration authority at the general meeting of shareholders.

- Completion of the JSC liquidation procedure. A joint stock company ceases to exist when the registration authority makes a corresponding entry in the Unified State Register of Legal Entities. The issuance of a certificate of termination of activity is carried out by the tax office. To complete this operation, 5 days are allotted from the date of submission of the package of documents for liquidation.

Closing a division

Liquidation of JSC branches can be carried out in 2 ways:

- through voluntary closure;

- by decision of the judicial authorities.

Voluntary termination of the activities of a branch of a joint stock company is initiated by the management body. Liquidation is carried out in stages:

- first, a decision is made using a method that depends on the form of ownership of the Company, a liquidation commission is appointed and begins to work, and responsibilities are distributed within it;

- the next stage is related to the introduction of amendments and changes to the text of the relevant constituent documents;

- further – notification of the Unified State Register of Legal Entities and timely notification of the tax authority for the latter to carry out the necessary checks.

If a branch of a JSC is liquidated based on a decision of the judicial authorities, the procedure is as follows:

- A liquidation commission is appointed and its composition is determined.

- Issues related to property are resolved. Based on the identified debts, a queue for payments is formed: payments to the budget and funds are made first, then the JSC pays off loans and pays off debts to branch employees. The remaining funds can be used by the company for its own purposes or distributed by the court. The leased property is returned to the person to whom it belongs.

- A written notice of closure is sent to the tax authorities, after which the branch is deregistered, and the corresponding entry is made in the Unified State Register of Legal Entities, and the liquidation is considered completed.

- Documentation is transferred to employees of the state archive at the location of the unit for storage.

Liquidation of an OJSC as a mandatory procedure

The mandatory liquidation procedure can also be called forced. There may be many reasons for the judiciary to make such a decision. Let's look at some of them. First of all, legal entities that during their activities have made serious mistakes, violating the provisions of the current legislation, are subject to forced liquidation of an OJSC. It is important to note that in this case, the closure of the JSC occurs if the misconduct was really serious and it was not possible to correct them.

In addition to this reason, there are others, for example, the legal entity did not have a license during its activities. This fact is a violation of the legislation of the Russian Federation. In a situation where the license has expired, it must be renewed, otherwise the liquidation procedure of the legal entity is inevitable. We should not forget that if one of the representatives of a particular OJSC carried out illegal activities that are contrary to the law and the Constitution, a decision to close it will also be made.

The peculiarities of liquidation also lie in the fact that it is impossible to close an OJSC if the owner committed minor violations, which were eventually eliminated. If a decision is made to liquidate a legal entity, this issue must be considered in court. During the court hearing, the primary reasons why liquidation should be carried out are identified. Among these reasons may be bankruptcy.

Redemption of shares

Article 23 of the law regulating the activities of joint-stock companies contains a list of rules determining the procedure for distributing property between shareholders.

- The transfer of property to shareholders begins after repayment of accounts payable.

- Funds are distributed in order of priority: amounts for shares subject to redemption are paid first;

- second priority – preferred shares, namely accrued but not paid dividends, liquidation value specified in the charter;

- third stage - property is distributed between holders of ordinary shares, as well as holders of preferred group shares.

- liquidation value is paid in order of priority of securities, but without disturbing the main priority;