No one was paid anything - is reporting on contributions necessary?

If your company does not conduct actual activities, does not have employees and does not organize work under civil law contracts (civil contracts), it does not need to pay individuals for work performed.

In such a situation, there is nothing to fill out the calculation with - the necessary data is missing. Find out how to file a zero VAT return here.

You won’t be able to completely refuse to complete the report; in this case, you will need to fill out a zero calculation for insurance premiums.

If you need a sample of the ERSV for 2022, use the sample from ConsultantPlus experts. This can be done for free by getting trial online access to the system.

Do not ignore the opinion of controllers, as this may result:

- account blocking (Article 76 of the Tax Code of the Russian Federation);

- fine 1000 rub. (Article 119 of the Tax Code of the Russian Federation).

If you were unable to avoid the fine, use the following algorithm when paying it:

- distribute its amount to the budgets of three state extra-budgetary funds;

- issue 3 payment orders;

- transfer each part of the fine to your KBK (letter of the Federal Tax Service dated 05/05/2017 No. PA-4-11/8641).

Find out more about the procedure for transferring the fine by following the link.

In the zero calculation you only need to fill out the required sheets:

- title page;

- Section 1 indicating code 2 in the “Payer Type” field - without any attachments to it;

- section 3.

Read more here.

In this case, use the following algorithm:

- Fill in the cells for sum and quantity values with zeros;

- Cross out the remaining blank spaces.

ConsultantPlus experts provided more detailed explanations on filling out the zero ERSV. Get a free online trial of K+ and follow the instructions right now.

To avoid technical difficulties with generating a calculation file and sending it via electronic communication channels, it is better to fill out the cells for the BCC.

The nuances of connecting to an electronic reporting system are discussed in the material “How to connect electronic reporting for an LLC?”.

Subsection 1.1 of Appendix 1 to Section 1

This part of the DAM form contains the calculation of pension insurance contributions.

When filling it out for a “zero” DAM, the following should be taken into account:

- Line 001 contains the payer's tariff code, selected from Appendix 5 to the Procedure. In the absence of special features (special tax regimes, preferential contribution rates), code 01 is used.

- Line 010 indicates the number of insured persons. The indicator in it should not be zero. Even if there is no activity, the company must have at least one insured person - the director.

- Lines 020 and 021 should already contain zero indicators, because they contain information about individuals who receive payments (including excess payments).

- Lines 030 to 062 reflect information about the amounts of income and accrued contributions (for the period as a whole and the last three months). They are also filled with zeros.

How to submit a zero unified calculation for insurance premiums to the tax office

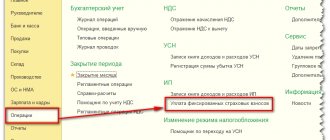

To pass the zero calculation of insurance premiums in 2021 , you will need:

- fill out the calculation form - download it here for reporting from the 1st quarter of 2022 to reporting for 9 months or here (since starting from the first reporting campaign of 2022, you need to use a new form, approved by order No. ED dated 10/15/2020 -7-11/ [email protected] );

- check the correctness of the entered data (which program is best to do this, see here);

- send the calculation to the tax authorities no later than the 30th day of the month following the end of the quarter (clause 7 of article 431 of the Tax Code of the Russian Federation).

Before filling out the report, please check in advance:

- passport data, full name, SNILS and TIN of the insured persons;

- when entering a surname, pay attention to the presence of the letters “e” and “e” (Soloviev, Vorobyov) - in them, “e” cannot be replaced with “e”, otherwise the inspectors will not accept the calculation.

The scheme of working with zero calculation is practically no different from filling out this report if there are payments to employees - the differences are only in the amount of data entered.

Example and sample of zero DAM for 9 months of 2018

Let's take a closer look at the mechanism for forming a zero DAM for 9 months of 2022:

Title page

It contains general data about the economic entity:

- Name,

- TIN and checkpoint,

- OKVED code,

- telephone number for contact and full name of the manager or his legal representative,

- the period and year for which the document is being drawn up (in our situation we will put “33” and “2018” respectively),

- number of the adjustment calculation (0 is indicated when submitting the document initially),

- code of the Federal Tax Service for which the report is intended.

Example of filling out a title page:

Summary data on the obligations of the payer of insurance premiums (section 1)

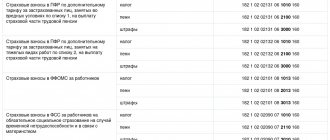

At the very top of the sheet, by analogy with the title page, you should put down the TIN and KPP of the business entity, then the OKTMO code (page 010 of the calculation). Then you need to enter the budget classification code (KBK). Moreover, in each part of Sect. 1, the BCC must be entered in accordance with the direction of insurance:

- 18210202010061010160 - for pension contributions (line 020);

- 18210202101081013160 - for medical contributions (page 040);

- 18210202090071010160 - for social contributions during disability and in connection with maternity (p. 100).

For each type of contribution, you should fill in the lines relating to the months of the reporting quarter (July, August, September), and also indicate the total amount of contributions for the quarter.

Example of filling out section. 1 (for contributions to pension and health insurance):

Example of filling out section. 1 (for social insurance contributions):

Calculation of the amounts of insurance contributions for compulsory pension insurance (subsection 1.1 appendix 1 to section 1)

This sheet displays detailed data on which tariff is used to calculate insurance premiums in accordance with the applicable taxation system: for example, 01 - OSNO, 02 - simplified tax system, 03 - UTII.

In addition, the following information is entered:

- number of employees subject to insurance (for the billing period with a monthly breakdown);

- the number of employees from whose wages insurance premiums are calculated, including when the maximum size of the base is exceeded;

- amounts of accrued payments and rewards;

- amounts not subject to insurance premiums;

- the basis for calculating contributions, including when the maximum amount is exceeded;

- the amount of calculated contributions.

An example of filling out a sheet for contributions to pension insurance:

Calculation of the amounts of insurance premiums for compulsory health insurance (subsection 1.2 appendix 1 to section 1)

This sheet contains information similar to what we filled out for pension insurance contributions:

- number of employees subject to insurance;

- the number of employees from whose wages contributions are accrued;

- amounts of calculated salaries and benefits;

- amounts that are not subject to insurance premiums;

- basis for determining contributions;

- the amount of calculated contributions.

An example of filling out a sheet for health insurance contributions:

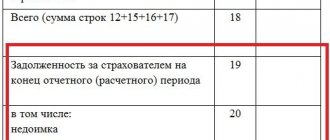

Calculation of the amounts of insurance contributions for compulsory social insurance (Appendix 2 to Section 1)

This sheet records information about the payment attribute, which can be: 01 - direct payments or 02 - offset system. This point depends on who exactly pays benefits of a social nature (for illness or maternity).

If the company is located in a constituent entity of the Russian Federation, where a pilot project with direct payments through the Social Insurance Fund is used, code 01 must be entered. If benefits are initially issued through the employer and then reimbursed from the Social Insurance Fund, code 02 must be entered.

In addition, the section should display:

- number of employees subject to social insurance;

- amounts of calculated salaries and benefits;

- amounts not subject to insurance premiums;

- basis for determining contributions;

- the amount of calculated contributions;

- how much expenses were incurred to pay out insurance coverage;

- how much the FSS reimbursed expenses for paying insurance coverage;

- amount of contributions to be paid.

An example of filling out sheets for social insurance contributions:

Personalized information about insured persons (section 3)

This section contains specific information for each employee, so the number of sheets in section. 3 must match the number of employees. For each individual it is necessary to reflect:

- TIN and SNILS,

- FULL NAME,

- date of birth,

- citizenship,

- floor,

- passport details,

- sign of an insured person in the insurance system (by type): 1, if the employee is covered by insurance, 2 - if not.

An example of filling out a sheet about personalized information of employees:

Next, you need to fill out the continuation of section 3, related to the calculation of payments and rewards for each employee. For a zero calculation, all values here will be 0.

An example of filling out a sheet for employee payments and rewards:

Example of zero insurance calculation

Let's look at an example of how to fill out the calculation of insurance premiums in 2022 with zero reporting.

Development LLC was formed at the end of 2022. Its only founder is P.P. Petrov. — I planned to use this company to install plastic windows that were produced by another company.

All companies were under a single leadership, accounting and reporting were carried out by a joint accounting department, the staff of which belonged to.

It was impractical to maintain separate accounting personnel at Razvitie LLC due to the lack of activity at the initial stage.

The process of recruiting window assemblers and other technical personnel was delayed, and the first employees on the staff of Razvitie LLC appeared after January 1, 2022.

The accountant who keeps records for all companies of the founder of Razvvitie LLC filled out the first zero insurance report for this company using the following scheme:

- to design the title card, he used the registration documents of Razvitie LLC;

- for the cells of sections and applications, he used “0” and “–” (except for the TIN and KPP at the top of each completed page and cells with BCC).

- to draw up section 3, he used the personal data of the sole founder-general director (recognized as the insured person).

How he did this, see the example of a zero calculation for insurance premiums for 2022 from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free using the link below:

Do I need to submit a zero RSV?

The calculation of insurance premiums contains information about the insurance premiums calculated and paid for employees during the reporting period. The DAM, both zero and with accruals, is surrendered in relation to:

- employees with whom employment contracts have been concluded;

- citizens working under civil law contracts;

- individuals with whom agreements have been concluded on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, as well as license agreements on granting the right to use the results of intellectual activity;

- authors of works within the framework of an author's order agreement.

Persons required to submit the DAM include:

- organizations - regardless of the presence of employees;

- separate divisions of Russian companies (OP) - if they independently transfer salaries to their employees and pay insurance premiums from them;

- OP of foreign companies - if they operate on the territory of the Russian Federation;

- Individual entrepreneur - if there are employees;

- heads of peasant farms - regardless of the presence of employees;

- individuals without individual entrepreneur status - if they have employees.

The fact of payment of income to employees and payment of insurance premiums from it does not matter for the delivery of a zero RSV. The report is always submitted when there are employees. If contributions from income have not been paid, you need to submit a zero RSV to the Federal Tax Service.

Results

Filling out a zero calculation for insurance premiums is mandatory even if there are no indicators. To fill out the cover sheet for calculating insurance premiums in 2022 with zero reporting, standard data about the company is sufficient. Place zeros in the cells of sections 1 and 3, intended for summary and quantitative indicators, and cross out the remaining empty spaces.

It is better to fill in the fields for the BCC, otherwise difficulties may arise with the generation of an electronic insurance report.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What sheets are included in the zero RSV

Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ regulates the form of the DAM, the rules for its execution and presentation in electronic format via telecommunication channels. The zero calculation for the 3rd quarter of 2022 is formed in abbreviated form by filling out the following sheets:

- title (sheet 1);

- summary data on the obligations of the insurance premium payer (section 1);

- calculating the amounts of contributions for compulsory pension insurance (subsection 1.1 appendix 1 to section 1);

- calculation of the amounts of insurance premiums for compulsory medical insurance (subsection 1.2 appendix 1 to section 1);

- calculating the amount of insurance contributions for compulsory social insurance (Appendix 2 to Section 1);

- personalized information about insured persons (section 3).

In these sheets it is necessary to enter values equal to zero if there are no quantitative or total indicators for any column. In addition, in other familiar places (text columns), dashes are placed in the corresponding fields (for a paper document) or empty cells are left (for an electronic document).

Features of filling out the RSV

When filling out a settlement document, it is important to take into account all the nuances of its formation:

- submission of the document in electronic form is mandatory for enterprises where the number of workers exceeds 25 people or they have just been created, and the number of employees does not matter;

- delivery at the choice of the taxpayer, if the number of workers has not reached 25 people.

Important: generating a reporting document on a computer allows for the absence of dashes in empty columns and frames.

It should be remembered that submitting a blank report to the tax office is unacceptable; at least several columns must be filled in.

Since 2022, reporting information on the RVS-1 form has ceased to be provided; now this report is submitted to the tax office using the 2016 form. Moreover, this form, with the exception of injuries, combined all insurance options.

Here you will read what the RSV-2 form is and where it is used.

Responsibility

The business owner is obliged to submit reports under any circumstances at work, regardless of whether there was activity or not, if he has at least one subordinate. And an enterprise, even if there is no staff, is required to submit reporting documents.

Otherwise, liability arises for the taxpayer who decides to ignore his obligations:

- As a blocking of a current account, this measure is not entirely beneficial for both the taxpayer and the state. In addition, the Ministry of Finance is also against its use, and therefore a letter was sent to the branches of the Federal Tax Service regarding the ban on blocking accounts for taxpayers who were late in payments.

- Based on Art. 119 of the Tax Code of the Russian Federation for taxpayers who have not provided a zero report, a minimum fine of 1,000 rubles is provided. Of course, this amount is small and fixed, since there is no relationship with the number of unsubmitted sheets, but it can be avoided by submitting the report on time.