In 2022, the details for paying taxes and contributions to the budget have changed. And from 2022, personal income tax payments will need to be processed in a new way. We will tell you about all the changes in detail.

Since 2022, the Federal Tax Service has switched to a system of treasury services for budget revenues.

Therefore, in payment slips we now indicate two accounts, as well as new BICs (Treasury Order No. 15n dated 04/01/2020).

The letter of the Federal Tax Service dated October 8, 2020 No. KCh-4-8/ [email protected] contains all the necessary details for payments to tax regions. The attachment to the letter states:

- Bank name - 13th field of the payment order.

- Bank BIC - 14th field.

- Bank account number (included in the single treasury account (UTA)) - field 15.

- The treasury account number of a specific Federal Tax Service is field 17.

You can see the location of the fields in the picture below.

The changes affected not only the details, other fields of payment slips also need to be filled out in a new way according to Order of the Ministry of Finance of the Russian Federation dated September 14, 2020 No. 199N. But let's look at each field and the rules for filling them out in order.

Open an account with Ak Bars Bank. You will have the details within 5 minutes after submitting your application. A personal consultant is always in touch, it’s easy to create payments both from a computer and from a phone. Convenient reference books and system tips will help you quickly create a payment order.

Apply for opening an account

Fields 3 and 4

The document number (field 3) is filled in in accordance with the numbering established in the organization or individual entrepreneur, and the length of the number cannot be more than 6 characters.

Payment bills are numbered consecutively, starting from each year.

For example, if you graduated in 2022 with number 322, then on January 10th the first payment order will be number 1, not 323.

Field 4 indicates the date. Standard format: DD.MM.YYYY, for example, if you transfer on the last day of the VAT deadline for the 4th quarter of 2021, then the date will be: 01/25/2022.

Field 8

In field 8 indicate the payer.

You must specify:

- The name of the legal entity (it is acceptable to indicate both the full name, for example, Limited Liability Company "Romashka", and the abbreviated name - LLC "Romashka").

- For individual entrepreneurs - last name, first name and patronymic in full and status.

Examples:

Individual entrepreneur Ivanov Petr Ivanovich

IP Ivanov Petr Ivanovich

Ivanov Petr Ivanovich (IP)

- For representatives of private practice - full name and legal status.

Example:

Sergeev Andrey Vasilievich (lawyer)

If the recipient's bank or another participating in the settlements is a foreign bank , then in addition to the name or full name of the individual entrepreneur, it is necessary to add information in fields 8 or 16. Additionally, you must indicate the address of the place of residence (registration, stay) of the individual or the legal address of the organization. This is required by paragraph 1.1 of Article 7.2 of Law No. 115-FZ of 07.08. 2001.

Ak Bars Business Drive is the top 3 most effective online banks for small and medium-sized businesses according to Markswebb. All the best for entrepreneurs, managers and chief accountants:

- Accounting directly in the ban’s personal account.

- Analysis of the risks of suspension of operations from the “Inspector” service.

- Acquiring.

- Currency calendar for working with foreign trade activities - you will not miss the deadlines for currency control.

- Formation of documents for counterparties: accounts, acts, invoices, etc.

Benefits of online creation

Many services have tips that help with the filling process.

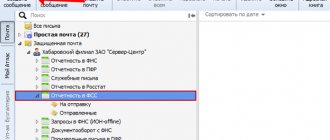

Tax website

The website nalog.ru has a service that allows you to create a payment slip and print it out immediately. There will be no difficulties in filling it out; the interface can be understood intuitively.

The online form has the following sections:

- Federal Tax Service and OKATO codes;

- details for filling out payment documents;

- details for personal identification.

Using Sberbank online

To do this you will have to register in the system. Next, log in using your details. After logging in, go to the RKO section for ruble transactions. You need to fill out the form that appears.

Some fields will be filled in automatically using the data specified earlier. The system will calculate certain values itself, based on the values entered. When everything is entered, it is enough to check all the data for correctness of entry. After all this, you can send the finished payment to the bank, it will be assigned the “Delivered” status.

To the Pension Fund

On the official website www.pfrf.ru it is possible to make a payment order online. Individual entrepreneurs can create receipts for payment in “cash”; employers create a payment order for payment without cash.

The document is created like this:

- status and period are indicated;

- select the type of payment;

- personal data is entered.

Fields 9, 10, 11, 12

In these four fields you need to indicate the bank details of the payer:

- current and correspondent accounts;

- BIC;

- Name of the bank.

Usually, when opening an account, the bank immediately sends you the full details, but if you are not sure of their relevance, request them through the client-bank system, in the bank’s online service or in the application.

Of course, if you constantly use the account to receive payments and transfers, you will notice changes, but if the account is used infrequently, then not necessarily. In electronic form, as a rule, a payment order with your details will be filled out immediately and correctly.

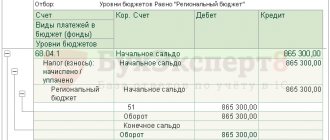

Information about the details of treasury accounts

Information on the details of treasury accounts of the Federal Treasury and details of accounts included in the single treasury account

| p/p | Name of the territorial body of the Federal Treasury | Details of the recipient of the order to transfer funds for payment of payments to the budget system of the Russian Federation | Number of the current bank account opened by TOFK in the divisions of the Bank of Russia on balance sheet account No. 40101 | |||

| (14) BIC of the recipient's bank (BIC TOFK) | (13) Name of the recipient's bank | (15) Bank account number of the recipient of funds (number of the bank account included in the single treasury account (STA)) | (17) Beneficiary account number (treasury account number) | |||

| 1 | Interregional Operations Department of the Federal Treasury | 024501901 | OPERATIONS DEPARTMENT OF THE BANK OF RUSSIA//Interregional Operations Department of the Federal Treasury, Moscow | 40102810045370000002 | 03100643000000019500 | 40101810500000001901 |

| 2 | Federal Treasury Department for the Altai Territory | 010173001 | BARNAUL BRANCH OF THE BANK OF RUSSIA//UFK for the Altai Territory, Barnaul | 40102810045370000009 | 03100643000000011700 | 40101810350041010001 |

| 3 | Federal Treasury Department for the Amur Region | 011012100 | BRANCH OF BLAGOVESCHENSK BANK OF RUSSIA//UFK for the Amur Region, Blagoveshchensk | 40102810245370000015 | 03100643000000012300 | 40101810000000010003 |

| 4 | Federal Treasury Department for the Arkhangelsk Region and the Nenets Autonomous Okrug (Arkhangelsk Region) | 011117401 | BRANCH OF ARKHANGELSK BANK OF RUSSIA//UFK for the Arkhangelsk region and the Nenets Autonomous Okrug, Arkhangelsk | 40102810045370000016 | 03100643000000012400 | 40101810500000010003 |

| 5 | Federal Treasury Department for the Astrakhan Region | 011203901 | ASTRAKHAN BRANCH OF THE BANK OF RUSSIA//UFK for the Astrakhan region, Astrakhan | 40102810445370000017 | 03100643000000012500 | 40101810400000010009 |

| 6 | Federal Treasury Department for the Belgorod Region | 011403102 | BELGOROD BRANCH OF THE BANK OF RUSSIA//UFK for the Belgorod region, Belgorod | 40102810745370000018 | 03100643000000012600 | 40101810300000010002 |

| 7 | Federal Treasury Department for the Bryansk Region | 011501101 | BRANCH BRANCH OF THE BANK OF RUSSIA//UFK in the Bryansk region, Bryansk | 40102810245370000019 | 03100643000000012700 | 40101810300000010008 |

| 8 | Federal Treasury Department for the Vladimir Region | 011708377 | BRANCH OF VLADIMIR BANK OF RUSSIA//UFK for the Vladimir region, Vladimir | 40102810945370000020 | 03100643000000012800 | 40101810800000010002 |

| 9 | Federal Treasury Department for the Volgograd Region | 011806101 | VOLGOGRAD BRANCH OF THE BANK OF RUSSIA//UFK for the Volgograd region, Volgograd | 40102810445370000021 | 03100643000000012900 | 40101810300000010003 |

| 10 | Federal Treasury Department for the Vologda Region | 011909101 | VOLOGDA BRANCH OF THE BANK OF RUSSIA//UFK for the Vologda region, Vologda | 40102810445370000022 | 03100643000000013000 | 40101810700000010002 |

| 11 | Federal Treasury Department for the Voronezh Region | 012007084 | VORONEZH BRANCH OF THE BANK OF RUSSIA//UFK for the Voronezh region, Voronezh | 40102810945370000023 | 03100643000000013100 | 40101810500000010004 |

| 12 | Department of the Federal Treasury for Moscow | 004525988 | GU BANK OF RUSSIA FOR THE Central Federal District//UFK FOR MOSCOW Moscow | 40102810545370000003 | 03100643000000017300 | 40101810045250010041 |

| 13 | Federal Treasury Department for St. Petersburg | 014030106 | NORTH-WEST GUIDE OF THE BANK OF RUSSIA//UFK for St. Petersburg St. Petersburg | 40102810945370000005 | 03100643000000017200 | 40101810200000010001 |

| 14 | Federal Treasury Department for Sevastopol | 016711001 | SEVASTOPOL BRANCH OF THE BANK OF RUSSIA//UFK for the city of Sevastopol Sevastopol | 40102810045370000056 | 03100643000000017400 | 40101810167110000001 |

| 15 | Federal Treasury Department for the Jewish Autonomous Region | 019923923 | BIROBIDZHAN BRANCH OF THE BANK OF RUSSIA//UFK for the Jewish Autonomous Region of Birobidzhan | 40102810445370000086 | 03100643000000017800 | 40101810700000011023 |

| 16 | Federal Treasury Department for the Trans-Baikal Territory | 017601329 | CHITA BRANCH OF THE BANK OF RUSSIA//UFK for the Trans-Baikal Territory, Chita | 40102810945370000063 | 03100643000000019100 | 40101810750042010001 |

| 17 | Federal Treasury Department for the Ivanovo Region | 012406500 | IVANOVO BRANCH OF THE BANK OF RUSSIA//UFK IN THE IVANOVSK REGION, Ivanovo | 40102810645370000025 | 03100643000000013300 | 40101810700000010001 |

| 18 | Federal Treasury Department for the Irkutsk Region | 012520101 | IRKUTSK BRANCH OF BANK OF RUSSIA//UFC FOR THE IRKUTSK REGION, Irkutsk | 40102810145370000026 | 03100643000000013400 | 40101810250048010001 |

| 19 | Federal Treasury Department for the Kabardino-Balkarian Republic | 018327106 | BRANCH-NB KABARDINO-BALKAR REPUBLIC BANK OF RUSSIA//UFK for the Kabardino-Balkarian Republic Nalchik | 40102810145370000070 | 03100643000000010400 | 40101810100000010017 |

| 20 | Federal Treasury Department for the Kaliningrad Region | 012748051 | KALININGRAD BRANCH OF THE BANK OF RUSSIA//UFK for the Kaliningrad region, Kaliningrad | 40102810545370000028 | 03100643000000013500 | 40101810000000010002 |

| 21 | Federal Treasury Department for the Kaluga Region | 012908002 | KALUGA BRANCH OF THE BANK OF RUSSIA//UFK for the Kaluga region, Kaluga | 40102810045370000030 | 03100643000000013700 | 40101810500000010001 |

| 22 | Federal Treasury Department for the Kamchatka Territory | 013002402 | BRANCH OF PETROPAVLOVSK-KAMCHATSKY BANK OF RUSSIA//UFK for the Kamchatka Territory, Petropavlovsk-Kamchatsky | 40102810945370000031 | 03100643000000013800 | 40101810905070010003 |

| 23 | Federal Treasury Department for the Karachay-Cherkess Republic | 019133001 | BRANCH-NB KARACHAY-CHERKASSIAN REPUBLIC BANK OF RUSSIA//UFK for the Karachay-Cherkess Republic, Cherkessk | 40102810245370000078 | 03100643000000017900 | 40101810803490010006 |

| 24 | Department of the Federal Treasury for the Kemerovo Region - Kuzbass | 013207212 | KEMEROVO BRANCH OF THE BANK OF RUSSIA//UFK for the Kemerovo region - Kuzbass, Kemerovo | 40102810745370000032 | 03100643000000013900 | 40101810400000010007 |

| 25 | Federal Treasury Department for the Kirov Region | 013304182 | KIROV BRANCH OF THE BANK OF RUSSIA//UFK for the Kirov region, Kirov | 40102810345370000033 | 03100643000000014000 | 40101810222020011001 |

| 26 | Federal Treasury Department for the Kostroma Region | 013469126 | KOSTROMA BRANCH OF THE BANK OF RUSSIA//UFK FOR THE KOstroma REGION, Kostroma | 40102810945370000034 | 03100643000000014100 | 40101810700000010006 |

| 27 | Federal Treasury Department for the Krasnodar Territory | 010349101 | SOUTHERN GUIDE OF BANK OF RUSSIA//UFK for the Krasnodar Territory, Krasnodar | 40102810945370000010 | 03100643000000011800 | 40101810300000010013 |

| 28 | Department of the Federal Treasury for the Krasnoyarsk Territory | 010407105 | KRASNOYARSK BRANCH OF THE BANK OF RUSSIA//UFK for the Krasnoyarsk Territory, Krasnoyarsk | 40102810245370000011 | 03100643000000011900 | 40101810600000010001 |

| 29 | Department of the Federal Treasury for the Kurgan Region | 013735150 | KURGAN BRANCH OF THE BANK OF RUSSIA//UFK for the Kurgan region, Kurgan | 40102810345370000037 | 03100643000000014300 | 40101810065770110002 |

| 30 | Department of the Federal Treasury for the Kursk Region | 013807906 | KURSK BRANCH OF THE BANK OF RUSSIA//UFK IN THE KURSK REGION, Kursk | 40102810545370000038 | 03100643000000014400 | 40101810445250010003 |

| 31 | Federal Treasury Department for the Leningrad Region | 014106101 | LENINGRAD BRANCH OF THE BANK OF RUSSIA//UFK for the Leningrad region, St. Petersburg | 40102810745370000006 | 03100643000000014500 | 40101810200000010022 |

| 32 | Department of the Federal Treasury for the Lipetsk Region | 014206212 | BRANCH OF LIPETSK BANK OF RUSSIA//UFK FOR LIPETSK REGION Lipetsk | 40102810945370000039 | 03100643000000014600 | 40101810200000010006 |

| 33 | Federal Treasury Department for the Magadan Region | 014442501 | MAGADAN BRANCH OF THE BANK OF RUSSIA//UFK for the Magadan region, Magadan | 40102810945370000040 | 03100643000000014700 | 40101810505070010001 |

| 34 | Federal Treasury Department for the Moscow Region | 004525987 | GU BANK OF RUSSIA FOR THE Central Federal District//UFK FOR THE MOSCOW REGION, Moscow | 40102810845370000004 | 03100643000000014800 | 40101810845250010102 |

| 35 | Federal Treasury Department for the Murmansk Region | 014705901 | MURMANSK BRANCH OF THE BANK OF RUSSIA//UFK for the Murmansk region, Murmansk | 40102810745370000041 | 03100643000000014900 | 40101810040300017001 |

| 36 | Federal Treasury Department for the Nizhny Novgorod Region | 012202102 | VOLGO-VYATSKY GUARD OF THE BANK OF RUSSIA//UFK for the Nizhny Novgorod region, Nizhny Novgorod | 40102810745370000024 | 03100643000000013200 | 40101810400000010002 |

| 37 | Federal Treasury Department for the Novgorod Region | 014959900 | NOVGOROD BRANCH OF THE BANK OF RUSSIA//UFK FOR THE NOVGOROD REGION, Veliky Novgorod | 40102810145370000042 | 03100643000000015000 | 40101810440300018001 |

| 38 | Federal Treasury Department for the Novosibirsk Region | 015004950 | SIBERIAN GU BANK OF RUSSIA//UFK for the Novosibirsk region, Novosibirsk | 40102810445370000043 | 03100643000000015100 | 40101810900000010001 |

| 39 | Federal Treasury Department for the Omsk Region | 015209001 | OMSK BRANCH OF THE BANK OF RUSSIA//UFK for the Omsk region, Omsk | 40102810245370000044 | 03100643000000015200 | 40101810100000010000 |

| 40 | Federal Treasury Department for the Orenburg Region | 015354008 | ORENBURG BRANCH OF THE BANK OF RUSSIA//UFK for the Orenburg region, Orenburg | 40102810545370000045 | 03100643000000015300 | 40101810200000010010 |

| 41 | Federal Treasury Department for the Oryol Region | 015402901 | OREL BRANCH OF THE BANK OF RUSSIA//UFK for the Oryol region, Orel | 40102810545370000046 | 03100643000000015400 | 40101810845250010006 |

| 42 | Federal Treasury Department for the Penza Region | 015655003 | PENZA BRANCH OF THE BANK OF RUSSIA//UFK for the Penza region, Penza | 40102810045370000047 | 03100643000000015500 | 40101810222020013001 |

| 43 | Federal Treasury Department for the Perm Territory | 015773997 | PERM BRANCH OF THE BANK OF RUSSIA//UFK for the Perm region, Perm | 40102810145370000048 | 03100643000000015600 | 40101810700000010003 |

| 44 | Federal Treasury Department for Primorsky Krai | 010507002 | FAR EASTERN GUIDE OF THE BANK OF RUSSIA//UFK for the Primorsky Territory, Vladivostok | 40102810545370000012 | 03100643000000012000 | 40101810900000010002 |

| 45 | Federal Treasury Department for the Pskov Region | 015805002 | PSKOV BRANCH OF THE BANK OF RUSSIA//UFK for the Pskov region, Pskov | 40102810145370000049 | 03100643000000015700 | 40101810400001010002 |

| 46 | Federal Treasury Department for the Republic of Adygea (Adygea) | 017908101 | BRANCH-NB REPUBLIC OF ADYGEA BANK OF RUSSIA//UFK for the Republic of Adygea, Maykop | 40102810145370000066 | 03100643000000017600 | 40101810803490010004 |

| 47 | Federal Treasury Department for the Altai Republic | 018405033 | BRANCH-NB ALTAI REPUBLIC//UFK for the Altai Republic, Gorno-Altaisk | 40102810045370000071 | 03100643000000017700 | 40101810500000010000 |

| 48 | Federal Treasury Department for the Republic of Bashkortostan | 018073401 | BRANCH-NB REPUBLIC OF BASHKORTOSTAN BANK OF RUSSIA//UFK for the Republic of Bashkortostan, Ufa | 40102810045370000067 | 03100643000000010100 | 40101810100000010001 |

| 49 | Federal Treasury Department for the Republic of Buryatia | 018142016 | BRANCH-NB REPUBLIC OF BURYATIA BANK OF RUSSIA//UFK for the Republic of Buryatia, Ulan-Ude | 40102810545370000068 | 03100643000000010200 | 40101810600000010002 |

| 50 | Federal Treasury Department for the Republic of Dagestan | 018209001 | BRANCH-NB REPUBLIC OF DAGESTAN BANK OF RUSSIA//UFK for the Republic of Dagestan, Makhachkala | 40102810945370000069 | 03100643000000010300 | 40101810600000010021 |

| 51 | Federal Treasury Department for the Republic of Ingushetia | 012618001 | BRANCH-NB REPUBLIC OF INGUSHETIA BANK OF RUSSIA//UFK for the Republic of Ingushetia, Magas | 40102810345370000027 | 03100643000000011400 | 40101810700000010004 |

| 52 | Federal Treasury Department for the Republic of Kalmykia | 018580010 | BRANCH-NB REPUBLIC OF KALMYKIA BANK OF RUSSIA//UFK for the Republic of Kalmykia, Elista | 40102810245370000072 | 03100643000000010500 | 40101810303490010005 |

| 53 | Federal Treasury Department for the Republic of Karelia | 018602104 | BRANCH-NB REPUBLIC OF KARELIA BANK OF RUSSIA//UFK for the Republic of Karelia Petrozavodsk | 40102810945370000073 | 03100643000000010600 | 40101810600000010006 |

| 54 | Federal Treasury Department for the Komi Republic | 018702501 | BRANCH-NB REPUBLIC KOMI BANK OF RUSSIA//UFK for the Komi Republic, Syktyvkar | 40102810245370000074 | 03100643000000010700 | 40101810000000010004 |

| 55 | Federal Treasury Department for the Republic of Crimea | 013510002 | BRANCH OF THE REPUBLIC OF CRIMEA BANK OF RUSSIA//UFK for the Republic of Crimea, Simferopol | 40102810645370000035 | 03100643000000017500 | 40101810335100010001 |

| 56 | Federal Treasury Department for the Republic of Mari El | 018860003 | BRANCH-NB REPUBLIC MARI EL BANK OF RUSSIA//UFK for the Republic of Mari El Yoshkar-Ola | 40102810545370000075 | 03100643000000010800 | 40101810922020016001 |

| 57 | Federal Treasury Department for the Republic of Mordovia | 018952501 | BRANCH-NB REPUBLIC OF MORDOVIA BANK OF RUSSIA//UFK for the Republic of Mordovia Saransk | 40102810345370000076 | 03100643000000010900 | 40101810022020017002 |

| 58 | Federal Treasury Department for the Republic of Sakha (Yakutia) | 019805001 | BRANCH-NB REPUBLIC OF SAKHA (YAKUTIA) OF THE BANK OF RUSSIA // Department of Financial Management for the Republic of Sakha (Yakutia) Yakutsk | 40102810345370000085 | 03100643000000011600 | 40101810100000010002 |

| 59 | Federal Treasury Department for the Republic of North Ossetia - Alania | 019033100 | DEPARTMENT-NB RESP. NORTH OSETIA-ALANIA BANK OF RUSSIA//UFK for the Republic of North Ossetia-Alania, Vladikavkaz | 40102810945370000077 | 03100643000000011000 | 40101810100000010005 |

| 60 | Federal Treasury Department for the Republic of Tatarstan | 019205400 | BRANCH-NB REPUBLIC OF TATARSTAN BANK OF RUSSIA//UFK for the Republic of Tatarstan, Kazan | 40102810445370000079 | 03100643000000011100 | 40101810800000010001 |

| 61 | Federal Treasury Department for the Republic of Tyva | 019304100 | BRANCH-NB REPUBLIC OF TUVA BANK OF RUSSIA//UFK for the REPUBLIC OF TUVA Kyzyl | 40102810945370000080 | 03100643000000011200 | 40101810050049510001 |

| 62 | Federal Treasury Department for the Republic of Khakassia | 019514901 | BRANCH-NB REPUBLIC OF KHAKASSIA BANK OF RUSSIA//UFK for the Republic of Khakassia, Abakan | 40102810845370000082 | 03100643000000018000 | 40101810150045510001 |

| 63 | Federal Treasury Department for the Rostov Region | 016015102 | ROSTOV-ON-DON BRANCH OF THE BANK OF RUSSIA//UFK for the Rostov region, Rostov-on-Don | 40102810845370000050 | 03100643000000015800 | 40101810303490010007 |

| 64 | Federal Treasury Department for the Ryazan Region | 016126031 | RYAZAN BRANCH OF THE BANK OF RUSSIA//UFK for the Ryazan region, Ryazan | 40102810345370000051 | 03100643000000015900 | 40101810400000010008 |

| 65 | Federal Treasury Department for the Samara Region | 013601205 | SAMARA BRANCH OF BANK OF RUSSIA//UFK for the Samara region, Samara | 40102810545370000036 | 03100643000000014200 | 40101810822020012001 |

| 66 | Federal Treasury Department for the Saratov Region | 016311121 | SARATOV BRANCH OF THE BANK OF RUSSIA//UFK for the Saratov region, Saratov | 40102810845370000052 | 03100643000000016000 | 40101810300000010010 |

| 67 | Federal Treasury Department for the Sakhalin Region | 016401800 | BRANCH OF YUZHNO-SAKHALINSK BANK OF RUSSIA//UFK for the Sakhalin region, Yuzhno-Sakhalinsk | 40102810845370000053 | 03100643000000016100 | 40101810900000010000 |

| 68 | Federal Treasury Department for the Sverdlovsk Region | 016577551 | URAL GUIDE OF THE BANK OF RUSSIA//UFK for the Sverdlovsk region, Ekaterinburg | 40102810645370000054 | 03100643000000016200 | 40101810500000010010 |

| 69 | Federal Treasury Department for the Smolensk Region | 016614901 | BRANCH OF SMOLENSK BANK OF RUSSIA//UFK for the Smolensk region, Smolensk | 40102810445370000055 | 03100643000000016300 | 40101810545250000005 |

| 70 | Federal Treasury Department for the Stavropol Territory | 010702101 | STAVROPOL BRANCH OF THE BANK OF RUSSIA//UFK for the Stavropol Territory, Stavropol | 40102810345370000013 | 03100643000000012100 | 40101810300000010005 |

| 71 | Federal Treasury Department for the Tambov Region | 016850200 | TAMBOV BRANCH OF THE BANK OF RUSSIA//UFK for the Tambov region, Tambov | 40102810645370000057 | 03100643000000016400 | 40101810000000010005 |

| 72 | Federal Treasury Department for the Tver Region | 012809106 | TVER BRANCH OF THE BANK OF RUSSIA//UFK for the Tver region, Tver | 40102810545370000029 | 03100643000000013600 | 40101810600000010005 |

| 73 | Federal Treasury Department for the Tomsk Region | 016902004 | BRANCH OF TOMSK BANK OF RUSSIA//UFK for the Tomsk region, Tomsk | 40102810245370000058 | 03100643000000016500 | 40101810900000010007 |

| 74 | Federal Treasury Department for the Tula Region | 017003983 | TULA BRANCH OF THE BANK OF RUSSIA//UFK for the Tula region, Tula | 40102810445370000059 | 03100643000000016600 | 40101810700000010107 |

| 75 | Federal Treasury Department for the Tyumen Region | 017102101 | TYUMEN BRANCH OF THE BANK OF RUSSIA//UFK for the Tyumen region, Tyumen | 40102810945370000060 | 03100643000000016700 | 40101810965770510005 |

| 76 | Federal Treasury Department for the Udmurt Republic | 019401100 | BRANCH-NB UDMURT REPUBLIC BANK OF RUSSIA//UFK for the Udmurt Republic Izhevsk | 40102810545370000081 | 03100643000000011300 | 40101810922020019001 |

| 77 | Federal Treasury Department for the Ulyanovsk Region | 017308101 | ULYANOVSK BRANCH OF THE BANK OF RUSSIA//UFK for the Ulyanovsk region, Ulyanovsk | 40102810645370000061 | 03100643000000016800 | 40101810100000010003 |

| 78 | Federal Treasury Department for Khabarovsk Territory | 010813050 | KHABAROVSK BRANCH OF THE BANK OF RUSSIA//UFK for the Khabarovsk Territory, Khabarovsk | 40102810845370000014 | 03100643000000012200 | 40101810300000010001 |

| 79 | Federal Treasury Department for the Khanty-Mansiysk Autonomous Okrug - Ugra | 007162163 | RCC KHANTY-MANSIYSK//UFK for the Khanty-Mansiysk Autonomous Okrug-Ugra, Khanty-Mansiysk | 40102810245370000007 | 03100643000000018700 | 40101810565770510001 |

| 80 | Federal Treasury Department for the Chelyabinsk Region | 017501500 | CHELYABINSK BRANCH OF THE BANK OF RUSSIA//UFK for the Chelyabinsk region, Chelyabinsk | 40102810645370000062 | 03100643000000016900 | 40101810400000010801 |

| 81 | Federal Treasury Department for the Chechen Republic | 019690001 | BRANCH-NB CHECHEN REPUBLIC BANK OF RUSSIA//UFK for the Chechen Republic, Grozny | 40102810945370000083 | 03100643000000019400 | 40101810200001000001 |

| 82 | Federal Treasury Department for the Chuvash Republic | 019706900 | BRANCH-NB CHUVASH REPUBLIC BANK OF RUSSIA//UFK for the Chuvash Republic, Cheboksary | 40102810945370000084 | 03100643000000011500 | 40101810900000010005 |

| 83 | Federal Treasury Department for the Chukotka Autonomous Okrug | 017719101 | ANADYR BRANCH OF THE BANK OF RUSSIA//UFK FOR THE CHUKOTKA AUTONOMOUS DISTRICT Anadyr | 40102810745370000064 | 03100643000000018800 | 40101810400000010000 |

| 84 | Federal Treasury Department for the Yamalo-Nenets Autonomous Okrug | 007182108 | RCC SALEKHARD//UFK FOR THE YAMAL-NENETS AUTONOMOUS DISTRICT Salekhard | 40102810145370000008 | 03100643000000019000 | 40101810465770510002 |

| 85 | Federal Treasury Department for the Yaroslavl Region | 017888102 | YAROSLAVL BRANCH OF THE BANK OF RUSSIA//UFK for the Yaroslavl region, Yaroslavl | 40102810245370000065 | 03100643000000017100 | 40101810700000010010 |

Fields 13, 14, 15, 16, 17, 61 and 103

We have already written about some of them above - here you need to indicate the recipient’s details.

In addition to the Federal Tax Service letter No. KCh-4-8/ [email protected], the necessary data can be found on the website of the tax service, or rather obtained through a special service.

To do this, you need to indicate the Federal Tax Service code or the address of the organization, individual entrepreneur or place of business (depending on the type of tax that needs to be paid, for example, if you received one patent at the place of registration, and another in another region, then you will have to pay to two different inspectorates ).

You can find out the details for transferring payments to the Social Insurance Fund (insurance contributions against industrial accidents, penalties and fines) on the fund’s regional websites. The easiest way to find them is in the lists on the main site:

- Branches in the republics.

- Branches in territories and regions.

- Branches in Moscow, St. Petersburg and Sevastopol.

- Branches in autonomous okrugs and regions.

Details for payment to the Pension Fund can be found using the online service. It is enough to select the type of payer, region and type of payment.

You can transfer fines directly to the Pension Fund of the Russian Federation for individual entrepreneurs and organizations, and entrepreneurs and self-employed individuals can also transfer insurance premiums for voluntary insurance.

Fields 61 and 103 are the recipient’s TIN and KPP; they can also be found using the methods indicated above.

OKTMO

Elba will fill in the OKTMO code and the department code of the Federal Tax Service, Pension Fund or Social Insurance Fund automatically according to the data from the “Details” section. But it wouldn’t hurt to check them with the codes that are indicated in the request or other document from which you learned about the fine or penalties. It is especially important to check your details if you have recently changed your registration address or are paying personal income tax to different inspectorates.

For some payments you need to specify the taxation system. Elba will fill it out automatically according to the data in the “Details” section. Please check this field if you have recently changed your tax system. It is possible that the details already indicate a new taxation system, but the request came under the old one.

Fields 18, 19, 20, 21, 22, 23

They indicate payment information.

Field 18 “View. op"

For a payment order, code 01 is indicated.

Field 19 “Payment due date.”

By default, there is no checkmark in the field.

Field 20 “Name. pl.”

According to the Central Bank Regulation No. 762-P dated June 29, 2021, this field is filled in for payments of wages and other income to individuals; for budget payments the code is not indicated.

Field 21 “Essay. payment."

The order of payment is set in accordance with Article 855 of the Civil Code. If you have sent several payment orders to the bank, for example, for taxes, transfer of payment for goods to a supplier, payment of wages, and there are enough funds in the account to pay them all, then the bank will execute the payments one by one. First the first one received, then the second one, etc.

If it turns out that there is not enough money in the account to transfer all payments at once, then the bank will focus on the order of payment:

- 1st stage - alimony and writs of execution for compensation for harm caused to life or health;

- 2nd stage - executive documents on payment of severance pay and wages;

- 3rd stage - current salary and transfer of taxes, contributions based on the requirements of control authorities (PFR, Federal Tax Service, Social Insurance Fund);

- 4th stage - other executive documents;

- 5th stage - remaining payments.

As you can see, if you pay taxes or contributions yourself, then they fall into the 5th line.

How to create a payment order in Ak Bars Bank from a computer:

Field 22 “Code”

This is a special field in which you need to specify a unique payment identifier or UIN. It is generated by the tax authority, for example, such a number is indicated in the payment document that is attached to the patent for an individual entrepreneur or is indicated in the request.

Field 23 “Res. field"

Additional field, usually no marks are placed here.

Why use the online service from the tax office?

The main function of the Federal Tax Service online service - generating a ready-made payment order for a tax or contribution - is useful simply because in many cases it is not included in the range of standard functions of online banking systems. And if payment of premiums is available only through an offline bank office, then it is extremely unlikely that bank specialists will show an uncontrollable desire to prepare a payment slip for the policyholder. If only because its preparation requires quite a lot of initial data, sometimes completely unknown not only to bank employees, but also to the taxpayer himself.

In turn, the online service on the Federal Tax Service website allows, firstly, to find out a significant part of the necessary information, and secondly, to integrate it into the structure of the payment order as required by established banking standards.

Let's take a closer look at what information may be available to the payer when creating a receipt for payment of insurance premiums online (and what information he will have to provide independently).

Field 24

The “ Payment purpose ” field does not have strict requirements; the main thing is to reflect the essence of the operation being carried out in it.

For example, indicate the number and date of the contract for which payment is made (materials, electricity, consulting services, etc.). It is also worth entering in it the numbers and dates of invoices, acts or invoices. In addition, if payment is made according to a writ of execution or demand, their details must also be indicated in this field.

Be sure to indicate information about VAT ; if the amount does not include it, then make the entry “Without VAT” or “No VAT”. Banking systems often give an error if you do not specify VAT information in the payment purpose.

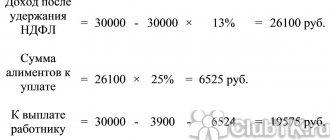

In some cases, you need to fill out this field in a special way, for example, when transferring alimony from an employee’s income according to a writ of execution. Then you need to fill out the field according to this scheme:

// “VZS” (amount collected) // amount in numbers //

Rubles are separated from kopecks by the symbol “-” (dash); if the amount is a whole amount, without kopecks, then after the “-” (dash) symbol “00” is indicated.

When transferring contributions, it is recommended to also indicate the registration number of the policyholder in this field. You can take it either from the information letters sent by the Pension Fund of Russia and the Social Insurance Fund, or from an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

Example : excerpt from an extract from Lenta LLC (OGRN 1037832048605, hypermarket chain).

Fields 101, 104, 105, 106, 107, 108, 109, 110

These are the most important fields when making budget payments.

Field 101 “Taxpayer status”

The main statuses used by individual entrepreneurs and organizations:

01 - legal entity, for paying taxes for yourself and when paying for a third party, read below on how to register it, as well as when transferring contributions for employees to the Federal Tax Service;

02 - tax agent, the status is used when transferring personal income tax withheld from employees for VAT, when, for example, an organization rents municipal real estate and acts as a VAT agent;

08 - applied when individual entrepreneurs or organizations transfer insurance premiums from accidents to the Social Insurance Fund or when paying fines to the Pension Fund of the Russian Federation;

13 - this new status appeared in October 2022, it must be indicated to individual entrepreneurs, notaries, lawyers, farmers and other individuals who transfer taxes to the budget for themselves.

Field 104 “Budget classification code”

BCC for 2022 was approved in Order of the Ministry of Finance of Russia dated 06/08/2021 No. 75n.

Pay special attention to the KBK for personal income tax. In 2022, it is necessary to divide the tax on income up to and more than 5 million rubles and depending on the type of income.

For example:

- KBK 18210102010011000110 - personal income tax, which is withheld from the income of an individual by a tax agent.

- KBK 18210102020011000110 - personal income tax on the income of an individual entrepreneur, notary, lawyer, etc. when receiving income from business activities (private practice).

- KBK 18210102080011000110 - personal income tax on income amounts over 5 million rubles.

- KBK 18210102120011000110 - personal income tax on income over 5 million rubles, provided that the tax is transferred on the basis of a tax notice.

This is not a complete list of codes for personal income tax.

Field 105 "OKTMO"

Filled out according to the classifier of municipal territories (approved by order of Rosstandart dated June 14, 2013 No. 159-ST). All-Russian classifier of municipal territories (approved by order of Rosstandart dated June 14, 2013 No. 159-ST).

May contain 8 characters (as a rule) or 11 (if taxes and fees paid are distributed between settlements included in municipalities).

Note ! The OKTMO that you indicate in the payment order must match the OKTMO in the declaration. For example, if you indicated OKTMO 45367000 (Mitino municipal district) in your VAT return, then when transferring tax on this return, indicate the same code in the payment slip.

Field 106 “Basis of payment”

The number of codes in the field has been greatly reduced. Basically you will need two:

TP - current payments, for example, transfer of VAT for the 1st quarter of 2022 or personal income tax for employees for January 2022.

ZD - repayment of debt for previous periods (and it does not matter whether you pay a tax or contribution just like that, in the general order, upon request, according to a writ of execution, etc.). For example, payment on January 25, 2022 for VAT for the 4th quarter of 2021 means that you need a tax code.

Field 107 “Tax period”

Here you must indicate the period or date of tax payment.

Periods:

- month (MS);

- quarter (KB);

- half-year (PL);

- year (YY).

Here are examples of filling out field 107:

- MS.01.2022 (payment for January 2022);

- KV.01.2022 (payment for the 1st quarter of 2022);

- PL.02.2022 (payment for the second half of 2022);

- GD.00.2022 (payment for 2022);

- 02/01/2022 (a specific date for payment, this could be, for example, the date set by the Federal Tax Service for repayment of the debt, do not confuse it with the date of the request ).

By the way, if you transfer tax in advance, then enter the tax period for which you make the payment (future period).

Field 108 “Document number - grounds for payment”

Typically, this field is filled in when they receive some document from the Federal Tax Service: a demand, a decision to prosecute, or a document from the bailiffs.

Accordingly, if you have the ZD code in field 106, then you most likely need to indicate the document on the basis of which the debt is repaid. Moreover, despite the fact that only one designation is put in field 106, in field 108 you will have to put different letter codes before the document number (Order of the Ministry of Finance dated September 14, 2020 No. 199n).

It looks like this (let's take specific examples):

- TP154 - payment on request No. 154;

- AP964/875 - payment according to the decision to prosecute for tax offense No. 964/875;

- AR6541237-22 - transfer according to writ of execution No. 6541237-22.

The maximum number of characters in the field is 15; if your case does not fit those listed above (for example, you are paying in accordance with the decision of the Federal Tax Service to defer payment), then simply indicate the document number without the letter code.

Field 109 “Document date - grounds for payment”

Here, everything is clear - above we explained how to indicate the document number, and in field 109 you just need to indicate its date in the format XX.XX.XXXX.

For example: 02/01/2022 for a claim dated February 1, 2022.

Field 110 “Payment type”

Not filled in.

Sometimes, when filling out a tax payment, a banking service may require you to put some marks in fields 108,109,110 if you left them blank. In this case, you can simply put zeros there.

How to create a payment order in Ak Bars Bank from your phone:

How to apply a payment order on the Federal Tax Service website

So, in order to generate a payment slip for the payment of insurance premiums using the online service in question from the Federal Tax Service, you need to:

- Having chosen the type of taxpayer, mark on the page that a payment order will be drawn up.

If the taxpayer is a legal entity, such a choice will not be needed, since the alternative, a payment document, is available only to individuals and individual entrepreneurs. The fundamental difference between a payment document and a payment order is the greater versatility of the first: it can either be presented to the bank after printing, or used in the established format to pay fees online. However, a payment order is a more standardized document. It must comply with the requirements established by the Bank of Russia Regulation No. 383-P dated June 19, 2012. - Consistently enter all the required data on the online service page.

After entering all the data, the “Generate payment order” button will appear on the screen. After clicking it, the document will automatically appear on the screen. It can be printed immediately or downloaded to your computer in PDF format.

You can make a payment:

- take it to the bank and deposit funds into a current account opened in this bank through the cash register;

- use as a sample for filling out an online payment in the Bank-Client system (or in an electronic payment system that supports payment of payments to the budget).

All the necessary details will be filled in on it - and this is the convenience of the service from the Federal Tax Service.

Generating a receipt for payment of insurance premiums on the Federal Tax Service website is characterized by the fact that the service provides a significant part of the information automatically. But the taxpayer, as noted above, still needs to enter (indicate) some data independently, without prompting from the service. This information includes the type of payment.