Payer status in the payment slip for insurance premiums

At the beginning of 2022, when filling out a payment order for the transfer of insurance premiums, the status number became the subject of numerous disputes and disagreements between payers and the Federal Tax Service.

Some payers continued to adhere to the usual status “08”, which stands for “payer paying insurance premiums to the budget system of the Russian Federation” (Appendix No. 5 of the Order of the Ministry of Finance dated November 12, 2013 No. 107n “Rules for indicating information in the details of the transfer of funds...” ).

At the same time, the Federal Tax Service initially wanted to see the status “14” in receipts from contributions for employees, which it wrote about in a letter dated January 26, 2017 No. BS-4-11/ [email protected] /NP-30-26/947/02 -11-10/06-308-P.

However, banks did not allow payments with the specified statuses. And in the end, everyone agreed on the status “01”, meaning “taxpayer (payer of fees) - legal entity.” That is, in 2022, companies need to put it exactly on their contribution payments.

See about this:

- “Federal Tax Service - about field 101 in the payment order for contributions”;

- “The Bank of Russia spoke on filling out field “101” when paying insurance premiums».

For information on correcting errors made in the payer status, see our mini-article “KBK and payer status in the payment order - the error is not critical .

Individual entrepreneurs, notaries, lawyers, farmers, when paying insurance premiums to the Federal Tax Service from 01/01/2017 to 09/30/2021, indicate the statuses “09”, “10”, “11”, “12”, respectively, and from 10/01/2021 - the status “13” , which is for ordinary “physicists”.

We write a lot about accounting for various operations in the 1C line of programs for legal entities, and we don’t have time to talk about what the developers of the 1C company offer for individual entrepreneurs. But a very convenient assistant has been developed for them, allowing them to generate payment orders or receipts for payment of insurance premiums.

Let's consider working with fixed insurance premiums for individual entrepreneurs using the example of the simplified tax system with the tax object “Income”. An individual entrepreneur must pay fixed insurance premiums by December 31 of the current year. In this case, he chooses the frequency of payment himself: monthly, quarterly or once a year. Built into the 1C: Enterprise Accounting 8 program, ed. 3, the assistant will show the amount of contributions that must be paid in the period we have specified. This assistant is located on the Operations in the IP

In the window that opens, we see the amount of insurance premiums payable in the current quarter.

We can analyze each of these amounts. To do this, we need to left-click on the amount we are interested in and the program will open a window with a detailed analysis of the amount:

Those. the program gives us a hint that this year the fixed contribution to the Pension Fund is 23,400.00 rubles. We have already paid 11,700.00 at the moment. At the same time, we immediately see information about the payment document to the budget. In our case, we paid insurance premiums from the account twice – in March and June. The program now offers RUB 5,850.00 for payment. and the same amount will remain due, but if we wish, we can change the payment amount and pay the entire amount by the end of the year. In this case, the assistant window will look like this:

Fixed contributions to the Federal Compulsory Medical Insurance Fund can be deciphered similarly:

Now let's deal with the second line: Pension Fund from income. This is the same 1% that an individual entrepreneur must pay on income exceeding 300,000.00. This line can also be deciphered and the calculation analyzed:

Those. the program “sees” all receipts to the account and to the individual entrepreneur’s cash register and calculates the amount of contribution from income over 300,000.00. Please note that in this case, the program takes into account ALL cash receipts from the beginning of the year until the current day when you launch the assistant. Those. 982550.20 is not income for the first half of the year, but for half a year and partly for July, since I am writing an article in July. After we have analyzed and adjusted all amounts payable, we can automatically generate payment orders or expense cash orders, based on which we can print receipts. When paying from a bank account, click the corresponding button in the assistant window:

The program will create the corresponding payment orders and this fact will be immediately reflected in the assistant.

If an individual entrepreneur pays contributions by receipt, then when you click the corresponding button in the assistant window:

In this case, three expense cash orders will be generated, on the basis of which you can print a receipt for payment in the PD-4sb form:

Fixed insurance premiums in the program are automatically calculated by a regulatory operation as a result of the month-end closing procedure at the end of the year in December:

However, if an individual entrepreneur pays fixed contributions throughout the year, then at the end of each quarter, when closing the month, the program automatically takes into account these expenses to reduce the simplified tax system and then calculates the simplified tax system:

Here you can also view a report on expenses taken into account when calculating the simplified tax system. By left-clicking on the operation Calculation of expenses that reduce the simplified tax system, we will open the corresponding report:

As a result, we see the dates and numbers of payment orders for the payment of insurance premiums:

At the close of June, the program accrued an advance payment of tax in connection with the application of the simplified tax system, taking into account all contributions paid:

Of course, it is likely that the individual entrepreneur himself is not very well versed in accounting entries and is more interested in where exactly this amount to be paid came from. Similar to the previous regulatory operation, you can click on the operation Calculation of tax of the simplified tax system and open a certificate of calculation of tax of the simplified tax system:

Here is a detailed description of the amount of income received for the six months, accrued tax, the amount of insurance premiums paid, as well as the advance payment for the 1st quarter, which should have been paid before April 25, 2022. A more detailed analysis of the calculation of advance payments according to the simplified tax system can be obtained with the help of another assistant . You can find it on the initial screen page in the task list:

In the list that opens we find the simplified tax system, advance payment :

By the way, pay attention. There is also a task to pay insurance premiums for individual entrepreneurs; it will open the assistant that we talked about at the beginning of the article. And the report that interests us now provides detailed information on the calculation of the advance payment for the 2nd quarter. You can drill down into most of the indicators (everything that is a hyperlink). You can also generate a payment order or cash order to print a receipt for tax payment from here:

To ensure that all the reports, processing and assistants you need are always at hand, you can add them to your favorites. You can read how to set up the favorites panel here.

Every entrepreneur needs to be able to correctly calculate all taxes, depending on the tax system he or she has chosen. And with 1C line programs this process becomes automated, understandable and fun. Dear entrepreneurs, pay all taxes on time with the 1C: Enterprise Accounting program 8. Victoria Budanova was with you. Thank you for being with us. Successful reporting campaigns to you. Subscribe to our newsletter, join groups on social networks and stay up to date with our news.

| Head of care service Budanova Victoria |

Social buttons for Joomla

Recipient in payments for insurance premiums

In the part where information about the recipient must be entered (his name and bank details), in payment slips for insurance premiums you must enter the details of the Federal Tax Service at the location of the organization (residence of the individual entrepreneur). You can find out the details that are current on the date of making payments on contributions through the online service of the Federal Tax Service “Address and payment details of your inspection”. Finding it yourself is quite easy.

To do this, go to the main page of the Federal Tax Service website: nalog.ru. On the right we will see the “Services” button. Click it and you will be taken to a page with a list of online services of the Federal Tax Service. In order not to search for the service we need in this list, in the “Search by section” line, enter the phrase “payment details”, click the “Find” button, and the name of our service appears under the search line.

Next, check the box for the desired type of taxpayer (legal entity or individual entrepreneur) and either enter the address of your organization (IP) or select the 4-digit number of your Federal Tax Service (if it is already known).

We click on the “Next” button, and in response a window appears with the payment details of the selected Federal Tax Service Inspectorate, reliable as of the current date, which can be safely entered into the generated contribution payments.

How to fill out a payment form for contributions: general rules for companies and individual entrepreneurs

The payment order for payment of insurance premiums must be filled out according to the rules that are set out:

- in Appendices No. 1, 2 4 and 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n;

- Appendix 1 to Bank of Russia Regulation No. 762-P dated June 29, 2021.

Let us say right away that since 2022, there have been no changes in legislation regarding filling out payment orders for contributions.

The main thing is that the order for the transfer of funds to pay contributions contains information identifying:

- payer of contributions (legal entity or individual entrepreneur for himself + employees, if any);

- recipient of funds;

- payment information;

- the person who made the payment.

Also, be sure to indicate in numbers the serial number (field 3) of the payment and the date of preparation (field 4).

The paper payment must contain:

- signatures of authorized persons of the company or individual entrepreneur - in field 44;

- seal, if any - field 43.

Fields 45, 62, 71 are left blank: they will be filled in by a bank employee.

There must be a separate payment invoice for each type of contribution.

Next, let us pay attention to the general rules for filling out some fields that may cause difficulties. Unless otherwise indicated in the next section about the features for payments for individual entrepreneur contributions, the general rule for filling out the field applies.

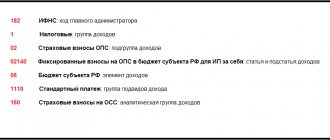

| PROPERTIES (FIELD, STRING) | HOW TO FILL OUT |

| Fields 8 – 12, 60, 101, 102 | You need to indicate the payer and his bank details - just like on a tax payment slip. An exception is field 101 “Payer status” (see below). |

| Field 101 “Payer status” | The payer status code is taken from Appendix No. 5 to the Order of the Ministry of Finance dated November 12, 2013 No. 107n:

|

| Field 102 “Checkpoint” | Indicate the checkpoint of the organization according to the same rules as in the tax payment slip |

| Fields 13 – 17, 61, 103 | These are the details of the recipient and his bank. They must be indicated depending on the type of insurance premiums. When paying contributions for compulsory medical insurance, compulsory medical insurance and VNIM to the tax authority, use the same details of the Federal Tax Service as when transferring taxes. When paying contributions for injuries to the Social Insurance Fund, please indicate:

This information can be found on the official website of your FSS branch or checked directly with its branch. |

| Payee details | You can view it on the Federal Tax Service website in the “Address and payment details of your inspection” service or at your Federal Tax Service Inspectorate |

| Fields 5 – 7, 18, 21, 22, 24, 104 – 109 | This is payment information Reflect in the same order as when paying taxes, except for a few fields:

For more details, see “New BCCs for insurance premiums in 2022.”

There are also special features when filling out fields 105 “OKTMO” and 24 “Purpose of payment”. |

| Field 22 | Indicate the UIN (unique accrual identifier) if you know it. For example, indicated in the requirements of the Federal Tax Service or the regional branch of the Social Insurance Fund. The UIN consists of 20 or 25 characters. In other cases, field 22 is “0”, including:

|

| Field 105 “OKTMO” | Indicate the eight-digit OKTMO code at the place of payment of insurance premiums. It can be clarified on the Federal Tax Service website in the “Find out OKTMO” service and in your FSS branch. |

| Field 106 “Basis of payment” | When paying contributions to compulsory medical insurance, compulsory medical insurance and VNIM - in the same order as in the tax payment. If you are transferring contributions for injuries, indicate “0”. |

| Field 107 “Period” | If you are transferring contributions for injuries, enter “0” in field 107. When paying contributions for compulsory health insurance, compulsory health insurance and VNIM, fill in this way. When paying current payments or voluntary repayment of debt (“TP” or “ZD” in field 106), indicate the period for which you are transferring them. Reflect it in the format “XX.NN.YYYY”, where:

For example, when transferring contributions to compulsory medical insurance for October 2022, in field 107, indicate “MS.10.2022”. In other cases, indicate the date of payment according to the document - the basis for payment, if any. So, if you pay contributions at the request of the Federal Tax Service (“ZD” in field 106), indicate in numbers the deadline for paying contributions upon request. For example, “10/12/2022”. |

| Field 108 “Document number” | When paying contributions for compulsory medical insurance, compulsory medical insurance and VNIM, fill out the same as in the tax payment. When paying current payments and voluntary repayment of debt (that is, not on the basis of a document from the Federal Tax Service) - “0” (zero), in other cases the number of the document justifying the payment. The first two characters of the number indicate the type of document. For example: “TP” – demand for payment, “AP” – decision on verification. Contributions for injuries – “0”. |

| Field 109 “Document date” | Contributions for compulsory medical insurance, compulsory medical insurance and VNIM - fill out in the same order as when paying taxes. Contributions for injuries – “0”. |

| Field 110 “Payment code” | Leave blank |

| Field 24 “Payment purpose” | Brief information about the payment that can identify it. In particular:

When paying contributions for injuries, you can also provide the policyholder’s registration number to the Social Insurance Fund, and when paying contributions to compulsory health insurance, the number to the Pension Fund. For example: “Insurance contributions to the Federal Social Insurance Fund of the Russian Federation for compulsory social insurance against accidents at work and occupational diseases for October 2022. Registration number in the Social Insurance Fund of the Russian Federation – 7755123456”; “Insurance contributions for compulsory pension insurance for October 2022. Registration number in the Pension Fund of Russia 087 – 456 – 789100.” The number of characters in this field should not exceed 210. |

If you incorrectly indicate the account number and name of the recipient's bank, contributions may not reach the budget. Then a debt will arise, and if payment is late, penalties will be charged.

OKTMO in payment slips for insurance premiums

If the location of the organization (residence of the individual entrepreneur) has not changed, then the OKTMO in the payment slips for contributions will remain the same. The transfer of the place of receipt of contributions from the Pension Fund of the Russian Federation to the Federal Tax Service does not affect OKTMO, since this code is assigned according to the location of the organization (place of residence of the individual entrepreneur). Our special service will help you find out it or check the correctness of the code used. Here you just need to enter your TIN if you are an individual entrepreneur or organization, or your address. The system will quickly process the request and issue the required code.

Do you want to know an interesting story about how two entrepreneur friends were looking for OKTMO? Then welcome to reading our adventure article “OKTMO in a payment order (nuances)” .

Have new BCCs been introduced for insurance premiums in 2021-2022?

The KBK lists are approved by the Ministry of Finance. These lists have been established by different orders for 2022 and 2022. But despite this, the same codes must be used in 2022 and 2022:

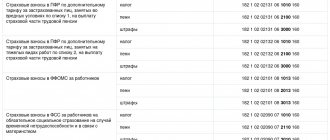

| Type of insurance premium | KBK |

| on OPS | 182 1 0210 160 |

| at VNiM | 182 1 0210 160 |

| on compulsory medical insurance | 182 1 0213 160 |

| for injuries | 393 1 0200 160 |

| on compulsory pension insurance in a fixed amount for individual entrepreneurs (including 1% contributions) | 182 1 0210 160 |

| on compulsory medical insurance in a fixed amount for individual entrepreneurs | 182 1 0213 160 |

| Additional contributions for compulsory health insurance (for employees working in hazardous conditions), if | |

| — the tariff does not depend on the special assessment | 182 1 0210 160 |

| — the tariff depends on the special estimate | 182 1 0220 160 |

| Additional contributions to compensatory pension insurance (for employees working in difficult conditions), if | |

| — the tariff does not depend on the special assessment | 182 1 0210 160 |

| — the tariff depends on the special estimate | 182 1 0220 160 |

BCC for contributions at the additional OPS tariff

The changes also affected the KBK for the pension additional tariff for “harmful” work. In 2016, the KBK of the additional tariff differed in the work performed, or more precisely, in the assignment of work to list 1 or 2 specified in Art. 30 Federal Law “On Insurance Pensions”. The amounts of contributions depending on the list were set at 6% and 9%. At the same time, the results of the labor assessment carried out for some jobs greatly influenced the size of the final contribution, but did not affect the figures in the BCC.

This made accounting and posting of payer funds inconvenient and slow. Errors in additional charges were often made, caused by a reduction in the contribution after the assessment.

The problem was solved in 2022 by introducing as mandatory 2 additional BCCs at an additional tariff - also according to lists, but taking into account the results of a special personnel assessment.

Now, if you pay an additional tariff, you should choose from the BCCs below:

| List 1 | Without employee evaluation – 6% | 182 1 0210 160 |

| After special assessment | 182 1 0220 160 | |

| List 2 | Without special employee evaluation – 9% | 182 1 0210 160 |

| After special assessment | 182 1 0220 160 |

Instructions for preparing payment documents for the transfer of insurance premiums

So, we have familiarized ourselves with the rules for entering payment details into documents for payment of contributions. Let's move on to explanations on how to fill out a payment order for insurance premiums quickly and without errors.

What errors do tax authorities most often find in payment slips, see here .

To make our further explanations more clear to you, we suggest studying a prepared example of filling out a payment slip for insurance premiums with pre-numbered parts.

Let's start with the header of our payment card.

The cells numbered “1” and “2” are intended for bank marks; fee payers do not need to fill them out.

In cell “3” we put the payment number assigned by the contribution payer.

In cell “4” enter the date the payment was generated. The date must be presented strictly according to the template: DD.MM.YY, where DD is the day, MM is the month, YY is the year.

In cell “5” we enter the payment method:

- “Electronically” - when the payment will be made electronically, for example, through a client bank;

- “Urgent” - when the payment needs to be made urgently;

- “By mail” - when making a payment by postal method.

In other cases, we leave this cell empty (for example, in the case when the payment is paid during a personal visit to the bank).

In cell “6” we indicate the status “01”.

In cells “7” and “8” we write down the payment amount in words and numbers, respectively.

In the part numbered “9”, we enter the following information about the contribution payer:

- TIN (10 digits for organizations and 12 for individual entrepreneurs);

- Checkpoint (if the payer is an individual entrepreneur, then leave the box with the checkpoint blank);

- name of the organization (IP);

- account number from which it is planned to make payment for insurance premiums;

- the name of the bank in which the payer’s account is registered, the bank’s BIC and its correspondent account.

Let's move on to the part marked "10". Here we enter information about the recipient: the tax authority to which the contribution should be transferred. In particular:

- the name of the bank where the Federal Tax Service account is registered;

- Bank BIC;

- do not fill out the correspondent account box;

- name of the tax authority and its bank account number.

Note! From 01.05.2021, when paying taxes and contributions, it is necessary to fill out field No. 15 “Account number of the recipient's bank.” From January to April 2022 is a transition period. This means that until 05/01/2021 payment orders can be filled out both according to the old rules and the new ones. See details here.

You can download the table of accounts in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

In part “11” of our payment form, fill in the following cells:

- "Type of operation." We enter “01”, which means the type of document we are generating: “Payment order”.

- "Payment order". We put “5” (clause 2 of Article 855 of the Civil Code of the Russian Federation).

- “Code” (or unique payment identifier). We put “0”.

We do not indicate anything in the remaining fields.

Fill in part numbered “12”:

- KBK.

- OKTMO.

- Basis of payment. Here we put the letter combination we need:

- From 10/01/2021 this is:

- TP - current payments;

- ZD - repayment of debt for expired tax, settlement (reporting) periods, both voluntary and forced;

- Until 30.09.2021:

- TP - current payments;

- ZD - payments for past billing periods (used for additional payments according to updated calculations);

- AP - payment according to the tax audit report;

- TR - payment at the request of the Federal Tax Service.

- MS.01.20ХХ - used for monthly payments of contributions;

- KV.01.20ХХ - used for additional payment of contributions according to updated calculations;

- ГД.00.20ХХ - applies to additional payments of contributions based on updated calculations and decisions of tax audits.

- “TR0000000000000” - number of the Federal Tax Service’s request for payment of taxes, fees, and insurance contributions;

- “AP0000000000000” - the number of the decision to prosecute for a tax offense or to refuse to prosecute.

- Document date. We also indicate “0”. But if the payment is issued based on the results of submitting an updated calculation or additional charges for inspections, then we indicate the date of submission of the updated calculation (or the date of making a decision on the inspection).

We do not fill in the last cell.

In cell “13” we enter the purpose of the payment, i.e. we indicate the premium for what type of insurance and for what period we are going to pay.

In the final cell “14” electronic or handwritten signatures of persons who have the right to sign payments are placed. If the payment is transferred to the bank on paper, then in place of the letters “M. P." you need to put the seal of the organization (IP). If the payment is sent electronically, no stamp is needed. Also, it is not placed if the organization (IP) renounced it voluntarily, guided by the provisions of the law “On the abolition of the mandatory seal...” dated 04/06/2015 No. 82-FZ (for LLCs and JSCs), clause 3 of Art. 23 of the Civil Code of the Russian Federation and FAS resolution No. F03-A51/08-2/3390 of September 12, 2008 (for individual entrepreneurs).

At this point, filling out the payment form can be considered complete.

It should be taken into account that when paying contributions to the Federal Tax Service in 2021-2022 for the same type of insurance, but for different periods, the information in the details will vary. Which ones exactly - see the two examples of payments below.

How to fill out receipts for mandatory insurance premiums for individual entrepreneurs “for yourself” in 2022?

Important information! Pay special attention to the fact that they promise to write off taxes and contributions for the second quarter of 2022 for those individual entrepreneurs who belong to the most affected areas of the economy. They also promise to reduce insurance premiums by 12,130 rubles for such individual entrepreneurs (read more at this link). Read about other measures to support individual entrepreneurs in connection with the pandemic at this link. Important update. Please note that from January 1, 2022, it is necessary to indicate new details of the Federal Treasury when paying taxes and contributions (although there will be a transition period, but read about this in the article at the link below). Moreover, there will be one more mandatory detail that will need to be filled out in the payment order.

Read more in the article:

Important: New details from 2022 when paying taxes and contributions

Good afternoon, dear individual entrepreneurs!

Let’s assume that a certain individual entrepreneur without employees decided to pay mandatory contributions “for himself” for the full year 2022. Our individual entrepreneur wants to pay mandatory contributions quarterly, in cash, through a branch of SberBank of Russia.

Also, our individual entrepreneur from the example wants to pay 1% of the amount exceeding 300,000 rubles per year at the end of 2022, but we will talk about this case at the very end of this article. Of course, individual entrepreneurs on the simplified tax system “income” with zero annual income, or less than 300,000 rubles per year should not pay this 1%.

In this case, our individual entrepreneur must pay the state for 2020:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

- Total for the full year 2022 = RUB 40,874.

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but more on that below)

A little hint. To understand where these payment amounts come from, I advise you to read the full article on individual entrepreneur contributions “for yourself” for 2022:

But back to the article... Our individual entrepreneur wants to pay quarterly in order to evenly distribute the load throughout 2022.

This means that he pays the following amounts every quarter:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

That is, our individual entrepreneur prints two receipts for payment of insurance premiums every quarter and goes with them to Sberbank to pay in cash.

Moreover, the deadlines for quarterly payments are as follows:

- For the first quarter of 2022: from January 1 to March 31

- For the second quarter of 2022: from April 1 to June 30

- For the third quarter of 2022: from July 1 to September 30

- For the fourth quarter of 2022: from October 1 to December 31

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

And an individual entrepreneur using the simplified tax system of 6% can still make deductions from advances under the simplified tax system. Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting from July 2022, control this moment. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

How to fill out receipts?

Follow the link:

https://service.nalog.ru/payment/payment.html?payer=ip#paymentEdit

We agree to the processing of personal data and click on the “Continue” button.

Select the payment method “Filling out all payment details of the document”

Since we pay as individual entrepreneurs, we check the boxes as follows:

Click on the “Next” button and you will be taken to the next step.

In the “IFTS Code” field, enter the code of your tax office. Let our individual entrepreneur live in the mountains. Ivanovo, its tax office code is 3702, and its OKTMO code is 24701000 (see screenshot below).

Of course, you will enter your tax office code and your OKTMO. If you don’t know them, you can check with your tax office.

Or try to determine the code of your tax office + OKTMO using the “Determine by address” function.

Check the box next to “Locate by address” and enter your registered address. But, nevertheless, I recommend checking this data again with your tax office if you are not completely sure.

Moreover, pay attention to two switches:

- The Federal Tax Service and OKTMO are located in the same region

- The Federal Tax Service Inspectorate and OKTMO are located in different regions

In our example, let them be in the same region, so the following setting was chosen:

If you are in doubt about what to choose, it is better to check with your tax office. The fact is that, indeed, sometimes the tax office may be located in a different region than OKTMO. This happens when one tax office registers entrepreneurs from several regions of the Russian Federation. For example, from remote villages and small settlements. It’s even better to use programs and services for maintaining accounting/tax records for individual entrepreneurs. These receipts are automatically generated in them in a few clicks.

And we press the “Next” button...

And we immediately indicate the required KBK

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we enter the BCC for 2022: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we introduce a different BCC for 2022: 18210202103081013160

Important: enter KBK WITHOUT SPACES and immediately click on the “Next” button!

That is, when you issue these two receipts for pension and health insurance, you will do this procedure twice , but at this step you will indicate different BCCs and different amounts of payments for pension and health insurance of individual entrepreneurs “for yourself.”

Let me remind you once again about the payment amounts for the full year 2022:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 32,448.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 8,426.

If you pay quarterly, the amounts will be as follows:

- Contributions to the Pension Fund: 32448: 4 = 8112 rubles.

- Contributions to the FFOMS: 8426: 4 = 2106.5 rubles.

It is clear that if the individual entrepreneur has worked for less than a full year, then you will have to recalculate the contributions yourself, taking into account the date of opening (or closure of the individual entrepreneur). Instead of paying fees for a full year.

And again click on the “Next” button.

- We select the status of the person who issued the payment as “09” - taxpayer (payer of fees) - individual entrepreneur.

- TP – current year payments

- And indicate the tax period: GY-annual payments 2020

- Enter the payment amount (of course, you may have a different amount)

And again click on the “Next” button.

Next, enter your information. Namely:

- Surname

- Name

- Surname

- TIN

- Registration address

Please note that you need to pay fees on your own behalf.

Click the “Next” button and check everything carefully again...

After making sure that the data is entered correctly, click on the “Pay” button.

If you want to pay in cash using a receipt, then select “Generate receipt” and click on the “Generate payment document” button

That's it, the receipt is ready

- Since we entered KBK 18210202140061110160 , we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs “for ourselves”.

- In order to issue a receipt for payment of the mandatory contribution for medical insurance of an individual entrepreneur “for yourself,” we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

Example of a receipt for a quarterly payment for compulsory pension insurance:

An example of a receipt for a quarterly payment for compulsory health insurance (note that the BCC in the receipt is different):

We print these receipts and go to pay at any Sberbank branch (or any other bank that accepts such payments).

Payment receipts and receipts must be kept!

Important: It is better not to delay the deadline for paying mandatory contributions “for yourself” until December 31, as the money may simply “get stuck” in the depths of the bank. It happens. Please pay at least 10 days before the due date.

How to generate a receipt for payment of 1% of an amount exceeding 300,000 rubles per year?

Indeed, those individual entrepreneurs whose annual income in 2022 will be MORE than 300,000 rubles are also required to pay 1% of the amount exceeding 300,000 rubles. In order not to repeat myself, I am sending you to read a more detailed article about individual entrepreneur contributions “for yourself” in 2020:

We are now more interested in another question: where can I get a receipt for paying this 1%?

Let me remind you once again that this payment must be made strictly before July 1, 2022 (based on the results of 2022, of course).

So here it is. Unlike 2016, there is no separate BCC for payment of 1%. This means that when it comes time to pay this 1%, you will need to generate exactly the same receipt as for paying contributions to compulsory pension insurance.

That is, when issuing a receipt for payment of 1%, indicate BCC 18210202140061110160 (but it is possible that this BCC will change in 2022. Therefore, follow the news and update your accounting programs in a timely manner).

In fact, you will receive exactly the same receipt as when paying a mandatory contribution to pension insurance. Only there will be a different payment amount, of course.

That's all, actually.

But finally, I will repeat once again that such payments need to be processed in accounting programs and services. There is no need to do everything manually in the hope of saving several thousand rubles...

For example, these two receipts can be issued in 1C. Entrepreneur" in literally three clicks. Without thoughtfully studying such boring instructions =)

Best regards, Dmitry Robionek.

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe!” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

We fill out a payment order for insurance premiums online on the Federal Tax Service website

Don’t want to waste time studying the rules for filling out payment slips for contributions and searching for a payment form? Then we suggest using online. You will be shown the picture instructions below on how to fill out a payment form for contributions using this service.

Results

In payments for the payment of insurance premiums from 2022, you must indicate the account number of the recipient's bank. Particular attention should be paid to 3 details: BCC, information about the recipient and the payer status number. The remaining details of the payment document for contributions remained the same.

If you have any questions, visit our group on VK. We are just discussing the problems of filling out the status of a payment order and sharing our experience.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for payment of fixed contributions in 2022

Insurance premiums for yourself from income up to 300,000 rubles. Individual entrepreneurs must have time to pay no later than December 31 of the current calendar year.

If the income exceeded 300,000 rubles. for the billing period, then insurance premiums are paid no later than July 1 following the expired billing period.

There is no strict requirement for quarterly payment of contributions - you can do this at any time in any amount, the main thing is to meet the deadline by December 31, 2022. Nevertheless, it is advisable to transfer contributions in advance - at least 10 days in advance, so that the payment can go through and the bank accepts it.

Conduct business according to the law - use convenient services for individual entrepreneurs and LLCs

If an individual ceases to operate as an individual entrepreneur, payment of insurance premiums is made no later than 15 calendar days from the date of deregistration with the tax authority.

An entrepreneur has the right to choose a convenient method for transferring insurance premiums: the entire amount at once for the entire year or in parts.

Insurance premiums for 2022 are paid no later than July 1, 2022.

Fill out the payment form for payment of contributions in Elba. It will automatically load the current KBK and details and indicate errors.

Try it

What day is considered the starting day for calculating contributions?

According to Letter of the Ministry of Labor of the Russian Federation dated 04/01/2014 No. 17-4 / OOG-224, the first day of registration for the calculation of contributions is not taken into account, that is, the calculation of insurance premiums should be carried out from the day following the day of state registration of the individual entrepreneur. However, some experts recommend taking it into account and starting calculations from this day in order to avoid possible disputes with the Pension Fund.