It is necessary to submit an updated calculation of insurance premiums if...

Clarification on contributions, as well as on taxes, is required when the amount payable in the transferred calculation is understated (clauses 1, 7, article 81 of the Tax Code of the Russian Federation).

There are also special rules that require adjustments to be made to the initial calculation (Clause 7, Article 431 of the Tax Code of the Russian Federation). The calculation is considered not submitted if at least one of the following indicators in subsection 3.2 is filled out incorrectly:

- the amount of payments and other remuneration for each of the last three months of the reporting or settlement period (line 210 - in the DAM for 2019, or line 140 - in the DAM 2020-2022);

- the base for calculating pension contributions within the limit for the same months (line 200 (for 2022) or 150, respectively);

- the amount of calculated pension contributions within the limit for the same months (term 210 (for 2022) or 170).

Line 061 (columns with data for months) of Appendix 1 of Section 1 of the calculation should be equal to the amounts of lines 170 (in the form for 2022 - lines 170) of Section 3 of the calculation (also by month).

An error in indicating the personal data of employees (full name, SNILS, INN) also leads to the fact that the report is recognized as not submitted, about which the tax authority must send a notification to the payer of contributions. At the same time, the Federal Tax Service issued an explanation according to which the indication in the report of outdated personal data of an individual does not prevent the acceptance of the report if it does not interfere with its identification (letter of the Federal Tax Service of the Russian Federation dated January 16, 2018 No. GD-4-11/574).

It should be noted that errors made when calculating contributions for compulsory health insurance do not lead to the recognition of the report as not submitted. If an error is discovered in this section, the tax authority will require clarification or an updated calculation (see letter of the Federal Tax Service of Russia dated February 19, 2018 No. GD-4-11 / [email protected] ).

In case of receiving a notification about clarification of the tax return (calculation) or refusal to accept the tax return (calculation) and (or) that the calculation is considered not submitted, the payer of contributions must submit an updated calculation (letter of the Federal Tax Service of Russia dated June 28, 2017 No. BS- 4-11/ [email protected] ).

When clarification is right and when it is obligatory, find out here.

Would you like to receive exclusive information about how a desk audit of insurance premium calculations is carried out? Detailed explanations about this are given by 2nd class adviser to the State Civil Service of the Russian Federation E. S. Grigorenko. You can view them in ConsultantPlus, trial access to which can be obtained for free.

Types of errors

It should be noted here that mistakes made are of two types.

An error leading to an understatement of the amount of insurance premiums payable to the budget and an error that did not lead to an underpayment of contributions. Moreover, if, after submitting the DAM calculation, the insured organization discovered that an inaccuracy or error was made, which led to an underestimation of the amount of insurance premiums payable to the budget, then in this case it must submit an updated calculation with corrected data.

In the event of an error that did not lead to underpayment of insurance premiums, in principle, there is no obligation to submit an updated calculation of the DAM in such a situation.

However, if an organization discovers an error that did not lead to underpayment of contributions, but wants everything in the calculation to be correct or receives a request from the Federal Tax Service Inspectorate to provide explanations or submit an updated DAM calculation, then it is better to submit a corrected DAM report to the Federal Tax Service Inspectorate.

Errors that do not lead to underpayment of insurance premiums

Such errors are made when reflecting personal data of employees in the DAM calculation.

The organization did not submit section 3 of the DAM calculation for employees.

If data on some employees was not included in the initial calculation at all, then you need to fill out section 3 in the updated DAM calculation for each “lost” person.

And if necessary, adjustments should also be made to section 1 of the calculation (see letter from the Federal Tax Service dated June 28, 2017 No. BS-4-11 / [email protected] (clause 2.1)).

When an employee's last name is changed, outdated information is indicated in the DAM calculation.

The employee changed his last name, and the accountant indicated outdated information in the DAM calculation. Having established an inaccuracy, you should submit an adjustment form in which changes must be made to subsections 3.1 and 3.2. At the same time, since the amounts of income and accrued contributions in the first copy of the DAM calculation are correct, no other corrections are made to the report.

Non-taxable payments are not reflected in the DAM calculation.

We emphasize that such non-taxable payments are shown first as part of the taxable object, and then as a separate line as non-taxable. And as a result, the amount of the base for contributions to compulsory health insurance, compulsory health insurance and VniM is not affected. (see Letter of the Federal Tax Service dated 08.08.2017 No. ГД-4-11/ [email protected] ; clauses 7.5, 7.6, 8.4, 8.5). For example, many payers do not reflect in their calculations benefits paid to women who are on maternity leave for up to one and a half years. Or, as part of the DAM calculation, the organization did not provide Section 3 for employees who do not receive payments, for example, for women who are on maternity leave between the ages of one and a half to 3 years, for employees who are on leave at their own expense.

Errors that led to underpayment of insurance premiums

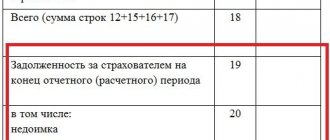

Such errors are made when reflecting total indicators in the DAM calculation.

And this happens, in particular, when:

- contributions were not accrued due to the fact that some payments were mistakenly not included in the taxable object, or section 3 was not submitted as part of the calculation for the employee receiving payments, and, as a result, his contributions did not fall into section 1;

- contributions were not calculated due to the fact that the non-taxable amounts took into account something that should not have been there. For example, non-taxable payments reflected the entire amount of daily allowance, while excess daily allowance is included in the taxable item (subclause 2, clause 1, clause 2, article 422 of the Tax Code of the Russian Federation);

- in Appendix 2, where the amount of VNiM contributions to be paid is determined, when filled out in paper form, the indicator “2” (to be reimbursed) is erroneously indicated on a monthly breakdown instead of the indicator “1” (to be paid).

Compensation for the cost of travel to the place of provision of services to the contractor, an individual not registered as an individual entrepreneur, was erroneously classified as payments subject to insurance premiums.

Has the customer organization paid compensation for the cost of travel to the place of provision of services to the contractor - an individual who is not registered as an individual entrepreneur?

The Contractor provides advertising services (sets up a stand at the exhibition in which the organization takes part). According to the contract for the provision of paid services, compensation for the cost of travel is transferred by the customer in excess of the cost of services agreed upon by the parties to the bank account of the contractor after the parties have signed the acceptance certificate for the services provided.

The compensation was classified as payments subject to insurance premiums and was reflected in the DAM calculation, which is an error based on the following provisions of current legislation:

The amount of compensation for expenses of an individual related to the provision of services under a civil contract is not subject to insurance premiums on the basis of paragraphs. 2 p. 1 art. 422 Tax Code of the Russian Federation, paragraphs. 2 p. 1 art. 20.2 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Reimbursement for the cost of utilities under a premises rental agreement concluded with an individual who is not an individual entrepreneur was erroneously classified as payments subject to insurance premiums.

The organization rents non-residential premises for production purposes.

Agreements for the provision of utility services are concluded with the relevant organizations (utility services) by the owner of the premises - the lessor.

According to the lease agreement, payment for consumed utilities is transferred by the tenant to the landlord's bank account in addition to the rent.

The amount of reimbursement for utility costs was classified as payments subject to insurance premiums and reflected in the DAM calculation, which is an error based on the following provisions of current legislation:

Since utility services are provided by specialized organizations (utility services) on the basis of relevant agreements concluded with the lessor, in this case the amounts of reimbursement for the cost of utility services paid by the tenant to the lessor (individual) do not fall within the definitions of objects subject to insurance premiums given in paragraph 1 tbsp. 420 of the Tax Code of the Russian Federation, paragraph 1 of Art. 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases.”

One-time bonuses to employees of the organization for holidays and anniversaries were not included in the taxable base of insurance premiums.

For one-time bonuses to employees for holidays and anniversaries, insurance premiums for pension, medical insurance and VNIM, according to the Ministry of Finance of Russia, should be accrued in the general manner (Letters dated 10/25/2018 N 03-15-06/76608, dated 02/07/2017 N 03 -15-05/6368).

The financiers explain their position by the fact that these premiums are not included in the list of payments not subject to insurance premiums under Art. 422 of the Tax Code of the Russian Federation.

The clarification must be submitted within the deadlines.

Payments for insurance premiums must be submitted by the 30th day of the month following the end of the quarter. An update submitted earlier than this date will mean that the calculation was submitted on the date of update, that is, on time (clause 2 of Article 81 of the Tax Code of the Russian Federation). Corrections after the reporting date may result in interest and fines if the amount of contributions has increased. To avoid being fined, you must transfer the arrears and penalties before submitting the updated calculation. As in the case of taxes, this should be done before the inspectors themselves discover the error or before an on-site audit is scheduled for the given period.

If corrections are required in section 3 of the calculation, which affects personalized accounting, the prescribed deadlines must be observed. After all, such errors make the calculation unrepresented (as discussed above).

After receiving a calculation with errors, controllers will send a notification. You have 5 days to make changes. It must be counted from the date the notification was sent electronically. If it was on paper, then the period for clarification will be 10 days (clause 7 of Article 431 of the Tax Code of the Russian Federation). The days are, as usual, working days.

Compliance with these deadlines eliminates sanctions for late submission of calculations. The reporting date will be the day the original version was submitted. Otherwise, a fine of 1,000 rubles will follow. up to 30% of the amount of contributions according to the calculation data (clause 1 of Article 119 of the Tax Code of the Russian Federation) and blocking of the account became possible.

Read more about the deadlines for submitting mandatory clarifications and their consequences here.

NOTE! The fine for an overdue ERSV is paid in three installments .

How can I clarify my insurance premiums?

To decide how to make an updated calculation of insurance premiums, first use the same form as the reporting with an error.

And from the periods of 2022, a new form of the DAM and the procedure for filling it out, approved by order of the Federal Tax Service dated September 18, 2019 No. MMV-7-11/ [email protected]

Starting from the 1st quarter of 2022, the next edition of the calculation of insurance premiums, approved by order of the Federal Tax Service of Russia dated October 6, 2021 No. ED-7-11/ [email protected]

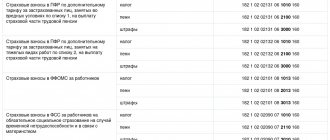

When filling out the clarification, indicate the serial number of the correction on the title page: 1,2,3…. To fill out the updated calculation, you need to transfer from the original all data that does not require correction, as well as indicators in which errors have been corrected.

The exception is section 3. When making adjustments, only those for whom errors were made are filled in with data. Information on individuals for whom all data was initially filled out correctly does not need to be resubmitted. In this case, the serial number of the “corrected” individual must be indicated the same as it was in the initial calculation (clause 1.2 of the Procedure for filling out the DAM, see also letter dated January 10, 2017 No. BS-4-11 / [email protected] ).

It should also be taken into account that the procedure for making corrections in section 3 depends on the type of error being corrected.

If there is an error in the information about the employee (TIN, SNILS or full name), in the clarification for him you need to fill out two sections 3 (clause 21.4 of the Procedure for filling out the DAM, letter of the Federal Tax Service dated 08/25/2020 No. AB-4-11/ [ email protected] ):

- in the first section 3 in field 010 you need to put 1, transfer all the data from subsection 3.1 since they were indicated with an error, in subsection 3.2 put dashes everywhere (i.e. you need to reset the contributions for the employee with the error);

- in the second section 3, a dash is placed in field 010, in subsection 3.1 the correct information about the employee is indicated, and in subsection 3.2 the data on his payments and contributions.

When correcting other errors (for example, in the amount of payments or contributions), nothing is reset, section 3 is filled out once, indicating only correct information, and a dash is placed in field 010.

ConsultantPlus experts provided step-by-step instructions for entering corrective information into Section 3 of the DAM. If you do not have access to the K+ system, get trial online access and switch to the Ready Solution for free.

See also: “RSV: error in OKTMO requires clarification?” .

How to fill out a calculation: examples

Let's look at an example of how to apply a reduced tariff when calculating pension insurance contributions and filling out the calculation.

Example 1. The base is less than the minimum wage

Let's take the case mentioned above: in February, an employee received 16,000 rubles, 5,000 of which were disability benefits.

Contributions for February need to be calculated only at the basic rate, since 16,000 - 5,000 = 11,000 ( 12,792

This means that there is an excess from which contributions are calculated at a reduced rate. Let's look at the formula that the Federal Tax Service requires to calculate contributions. The payment for compulsory pension provision amounts to 3,035.04 rubles:

12 792 × 2 × 22 % + (35 000 — 12 792 × 2) ×10 % – 3 535,04 = 5 628,48 + 941,6 — 3 535,04 = 3 035,04

In the calculation in section 3 this will be reflected as follows:

Example 3. Base limit reached

The requirement for an amount equal to the minimum wage in line 150 of subsection 3.2.1 with code NR must be fulfilled only on a basis that does not exceed the size of the limit.

Let’s assume that an employee’s monthly payments are 500,000 rubles; there are no non-taxable payments. In March, we will exceed the maximum value of the base for OPS (1,465,000 rubles). The amount exceeding the limit of 35,000 rubles:

1 500 000 — 1 465 000 = 35 000

The base, which does not exceed the limit, in March is 465,000 rubles0 > minimum wage).

Using the formula for calculating contributions using a reduced tariff, the amount payable for compulsory pension insurance for March is obtained:

38,376 × 22% + (16) ×10% + 35,000 × 10% – 103,070.08 (contributions for January–February) = 51,535.04 rubles.

The personalized information does not reflect the base exceeding the limit and contributions from it. Here's how to fill out subsection 3.2.1 in section 3 of the calculation with the HP category code:

And here is a sample of filling out subsection 3.2.1 with the MS category code:

The base in excess of the limit and contributions from it will be reflected in subsection 1.1 of Appendix 1 with code 20 in lines 051 and 062.

Results

If you find an error in the submitted contribution calculations due to which they were underpaid, please submit a clarification. It should be done on the same form as the reporting that needs to be corrected, indicating the correction number on the title page. How to submit an updated calculation of insurance premiums? The number of employees plays a role here: if there are more than the limit provided for by the Tax Code of the Russian Federation - in electronic form, if equal or less - either on paper or according to the TKS.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

- Order of the Federal Tax Service of Russia dated October 6, 2021 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What you need to do to submit your report without errors

First of all, you need to check whether all required sections are included in the form you are filling out. The DAM must include:

- Title page.

- Section 1.

- Subsections 1.1 and 1.2 of Appendix 1 to Section 1.

- Appendix 2 to section 1.

- Section 3.

Other sections and appendices to them are included in the reporting as necessary.

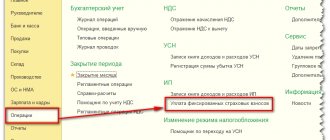

Having completed the report, it is necessary to check it against all control ratios given in Letter GD-4-11/ [email protected] Reporting will be accepted only if all ratios are met. Since the number of controlled ratios is very large, it is convenient to automate the process. For this purpose, a program is used to check the unified calculation of insurance premiums.

If the number of employees exceeds 25 people, you must remember that the report can only be submitted in electronic form.