Who is required to submit insurance premium payments?

Persons paying benefits to employees are required to report quarterly on accrued insurance premiums (Article 431 of the Tax Code of the Russian Federation). The absence of payments to employees does not exempt the organization from submitting a report to the inspectorate. The Ministry of Finance and the Federal Tax Service explain whether it is necessary to submit a zero calculation for insurance premiums in the absence of employees (letter of the Ministry of Finance No. 03-15-07/17273 dated March 24, 2017, letter of the Federal Tax Service No. GD-4-11 / [email protected] dated April 2, 2018) .

The need to submit calculations is not canceled, even if the duties of the general director are performed by the sole owner without concluding an employment contract, and there are no other employees in the organization yet. In insurance calculations, if one person has no accruals, section 3 provides personalized information about the general director.

Use the free instructions for filling out insurance premium calculations from ConsultantPlus. Experts told us how to fill out forms correctly in different situations.

RSV form for zero report

In the absence of activity, the established form of “Calculation of Insurance Premiums” 2022 is used. The zero reporting form is the same as for the regular Calculation: together with the Procedure for filling it out, it was approved by order dated September 18, 2019 No. ММВ-7-11 / [email protected] ( as amended on October 15, 2020). Companies and individual entrepreneurs whose staff does not exceed 10 people are allowed to report on paper; the rest must comply with the electronic format. In the absence of activity, the number of employed persons usually does not exceed the established figure, so you can choose either an electronic or paper form. In this case, not all Calculation sheets are submitted, but only some of them.

Do entrepreneurs without employees rent out the DAM?

Not only organizations, but also individual entrepreneurs are recognized as payers of social contributions. An entrepreneur has the right to hire employees, but sometimes conducts business without hiring employees. Does an individual entrepreneur need to submit the DAM if there are no employees? No, in this case tax officials have the right to demand an explanation. Explain to them in writing that you are working without hiring employees.

If an individual entrepreneur has employees, but they are not working (on leave without pay, on maternity leave), then the entrepreneur submits zero reports.

What form should I use to submit insurance premium payments?

In 2022, a new form is used, according to which it is necessary to fill out a zero DAM for the 4th quarter of 2022, approved by Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 09/18/2019 as amended by Order No. ED-7-11/ [email protected] from 10/15/2020. It also, in Appendix 2, describes in detail the rules and procedure for filling out the reporting form, including how to fill out the DAM if salaries were not accrued or paid to employees.

IMPORTANT!

Submit your reports in 2022 using the updated form. The new form was approved by Federal Tax Service Order No. ED-7-11/ [email protected] dated 10/15/2020. The main change in the structure of the DAM is the inclusion of information on the average number of employees on the title page.

The RSV is submitted to the tax office at the location of the organization. In addition to this calculation, payers of insurance premiums must submit two more reports on personalized accounting to the Pension Fund of the Russian Federation:

- monthly - SZV-M;

- annually - SZV-STAZH.

Preferential rates for insurance premiums for enterprises

The coronavirus infection that has affected our country has caused many changes in the measured life of taxpayers. Initially, it was decided to reduce the insurance premium rate to 15% for representatives of small and medium-sized businesses

Afterwards, it was decided to establish a zero tariff for insurance premiums for the second quarter of 2022. This tariff will apply to contributions for compulsory medical, pension and social insurance. A zero rate on contributions will apply to legal entities operating in industries most affected by the coronavirus pandemic.

From the above, it turns out that calculations for insurance premiums will be provided by organizations to the tax office according to three types of tariffs: regular, reduced and zero.

How to submit a zero calculation

Starting from 2022, calculations of insurance premiums are submitted to the tax office at the location of the organization. Previously, the calculation was submitted to the Pension Fund.

Here's how to fill out a zero RSV if there are no employees in the organization, and submit it to the Federal Tax Service (Article 431 of the Tax Code of the Russian Federation):

- by mail;

- in electronic form via TKS;

- during a personal visit to the tax office.

The DAM is submitted on paper only if the number of employees of the company does not exceed 10 people (clause 10 of Article 431 of the Tax Code of the Russian Federation).

Example

LLC “Company” does not operate. The company has 26 employees. All of them have been on leave without pay since 01/01/2021. The manager contacted the Federal Tax Service for clarification as to whether the calculation of insurance premiums was submitted if there was no salary accrual, and the inspector confirmed the obligation to submit a zero form.The LLC sends the payment in electronic form through the TKS operator, signing with an electronic digital signature of an authorized person. The reporting service checks how correctly the calculation is filled out. If the RSV is not unloaded after filling, you need to check the correctness.

In what cases does the DAM appear to be zero?

According to paragraph 7 of Art. 431 and paragraph 1, paragraph 1, art. 419 of the Tax Code of the Russian Federation. Calculation of insurance premiums is required to be provided by legal entities and individual entrepreneurs paying income to individuals. Taxable payments include:

- wages of employees;

- remuneration under GPC agreements.

It turns out that legal entities, in any case, are considered payers of contributions, so they are required to submit reports even in the absence of payments.

With an individual entrepreneur, the situation is different: he can conduct activities independently, alone, without involving third-party workers. Therefore, a zero payment for insurance premiums in 2022 will be required from an entrepreneur only if he has already previously declared himself as an employer, that is:

- filed the DAM in previous years;

- registered as an employer with the Social Insurance Fund;

- submitted the SZV-M form to the Pension Fund.

Individual entrepreneurs who have never hired employees or entered into GPC agreements may not submit a “Calculation of Insurance Premiums” of zero. This position is agreed, for example, by the Federal Tax Service of Russia for the Udmurt Republic, which published its clarifications on August 17, 2017 on the official website.

According to the explanations from the letter of the Federal Tax Service dated 04/03/2017 No. BS-4-11/6174, zero calculation allows you to separate contribution payers who violate the deadlines for submitting the Calculation from those who did not make payments to employees and did not accrue contributions in the corresponding period, i.e. did not actually conduct business, and therefore the tax authorities demand DAM from all policyholders, including individual entrepreneurs, who have ever made payments to individuals.

When to take the RSV

The calculation is submitted to the tax office no later than the 30th day of the month following the reporting quarter. If the last day of delivery falls on a non-working weekend or holiday, then the deadline is postponed to the next first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Deadline for submitting the zero DAM in 2022 (clause 7 of Article 431 of the Tax Code of the Russian Federation):

| Period | Last day of delivery |

| 1st quarter 2021 | 30.04.2021 |

| Half year 2021 | 30.07.2021 |

| 9 months 2021 | 01.11.2021 |

| 2021 | 31.01.2022 |

| 1st quarter 2022 | 04.05.2022 |

| Half year 2022 | 01.08.2022 |

| 9 months 2022 | 31.10.2022 |

| 2022 | 30.01.2023 |

How to submit a zero RSV in 2022

“Nulevka” for contributions is submitted within the same time frame as a regular payment - no later than the 30th day of the month after the reporting period. The reporting period is a quarter.

The DAM, including zero, for the last quarter of 2022 must be submitted by February 1, 2022.

To submit a zero calculation of insurance premiums in 2022, you must:

- fill out the calculation form (starting from the first reporting campaign of 2021, a new form will be used, approved by order No. ED-7-11 / [email protected] );

- check the correctness of the entered data;

- send the calculation to the tax authorities no later than the 30th day of the month following the end of the quarter (clause 7 of article 431 of the Tax Code of the Russian Federation).

Filling out a zero DAM is practically no different from filling out this report if there are payments to employees - the only difference is in the amount of data entered. The report will contain important information about employees: data for calculating length of service in the Pension Fund of Russia in the personalized accounting section. The basis for accruing such length of service may be unpaid leave, maternity leave, or sick leave.

In the DAM zero report, it is not necessary to fill out all pages. All you need to do is fill out the following sections:

- title page - filling it out is no different from filling out the calculation with data on the calculation of contributions for the reporting period;

- section 1: subsections 1.1 and 1.2 and appendices No. 1 and 2 - zeros are entered in them instead of accrual amounts for insurance premiums and accrual base data;

- section 3 - personalized accounting data for each individual is indicated here.

Sample of filling out the DAM zero report

Organizations and entrepreneurs submit a zero calculation to the inspectorate at the place of registration. The method of submitting the report depends on the number of individuals receiving payments and other remuneration for the current reporting period:

- 10 people or less – electronically or on paper;

- more than 10 people – strictly electronically.

It is more convenient to submit reports on taxes and contributions electronically. Connect the web service “Astral Report 5.0” and submit reports on time and without errors, even if the company’s activities are temporarily suspended. And for those who do accounting in the 1C: Enterprise programs, there is 1C-Reporting. All areas of reporting, working with electronic work records and electronic work books will become convenient additions to the functions of the accounting system.

What are the sanctions for failure to submit the DAM?

The report on insurance premiums is submitted in paper or electronic form (Article 431 of the Tax Code of the Russian Federation). If an organization violates the deadline, procedure or form of submission, tax authorities will issue a fine. The Tax Code of the Russian Federation does not directly indicate whether it is necessary to submit a zero DAM if there are no employees, but, according to legislative logic, entrepreneurs without hired employees do not submit reports. To avoid fines, send a written explanation to the territorial Federal Tax Service.

Despite the fact that a company that does not carry out activities reflects zero indicators in its reporting, tax authorities have the right to apply the following sanctions to it:

- The minimum fine for failure to submit a report is 1000 rubles. (Article 119 of the Tax Code of the Russian Federation);

- administrative fine for an official of an organization - from 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation);

- suspension of transactions on bank accounts (clause 6 of Article 6.1, clause 3.2 of Article 76 of the Tax Code of the Russian Federation);

- fine for failure to comply with the electronic form for submitting a report - 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Who surrenders the zero RSV

A report on insurance premiums is submitted by all organizations and individual entrepreneurs with hired employees, regardless of whether payments were made to employees during the reporting period. In addition, it is mandatory to submit a zero calculation for insurance premiums without employees in 2022. If the duties of the general director in a company are performed by a single founder, he still needs to submit a form to the regulatory authorities. If an individual entrepreneur concludes GPC agreements with individuals, he is obliged to provide a settlement to the Federal Tax Service.

An exception is an individual entrepreneur without employees - he submits the DAM with zero indicators at will. In fact, individual entrepreneurs without employees are not required to submit accounts to the Federal Tax Service.

ConsultantPlus experts discussed how to take the RSV. Use these instructions for free.

How to fill out the RSV correctly

Order No. ММВ-7-11/ [email protected] lists which sections of the zero DAM are mandatory for taxpayers to take:

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1;

- appendix 2 to section 1;

- section 3.

The report must indicate the name, INN and KPP of the organization, the period for which the calculation is submitted, and the tax authority code. Enter zeros in all fields with amount indicators. Section 3 indicates the data of the organization’s employees (at least the general director). Due to the lack of accruals, subsection 3.2 does not need to be filled out.

How to fill in the “zero”

The rules for filling out a zero DAM in the absence of employees do not differ from the methodology for generating calculations in the case of making payments and calculating insurance premiums. Only the volume of entered data is reduced.

Here are instructions on how to fill out the RSV if the salary has not been accrued (mandatory sections).

Title page. It indicates the main details of the legal entity, the average number of personnel and the economic activity code.

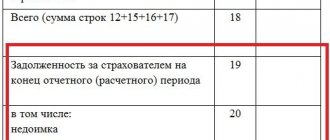

Section 1. The block reflects the generalized amounts of accrued insurance premiums for the reporting period. In cells intended for numerical indicators, you should enter “0”. In other cases, it is necessary to put a dash if the document is provided on paper. To avoid errors when submitting the form, it is recommended to fill out the lines intended for the KBK. In the zero calculation, in the “Payer type” line, enter the value “2”.

Current sample of the DAM without accrual for the 4th quarter of 2021:

Section 3. Personalized accounting data for each insured individual is entered into the block. Before filling out the section, check with the employees for their INN, SNILS, and passport details.

There is no need to attach an explanatory note to the calculation. If questions arise or discrepancies are identified, the tax office will send a corresponding request to the organization.

ConsultantPlus experts discussed how to fill out and submit to the tax authority a calculation of insurance premiums for the reporting (calculation) periods of 2022. Use these instructions for free.