How to reflect an increase in the cadastral value of a land plot in 1C:BGU 8?

Cadastral value of the land plot,

which is held by the institution on a permanent right of use may change up or down. The financial result from such an operation is recorded in account 0 401 10 176.

Increasing the cadastral value of a land plot in “1C:BGU 8 1.0” for budgetary and autonomous institutions

1. Increasing the cadastral value of a land plot

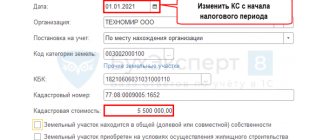

1.1. An increase in the cadastral value of a land plot is formalized by the document Change in the value of legal acts from the menu OS, Intangible Legal Entities, Legal Entities -> Accounting for non-produced assets.

1.2. In the header of the document, select Operation – Change in value (103-401.10), Income Account – 401.10.176.

In the tabular part of the document, a plot is selected and its new cadastral value is indicated in the Cost column.

1.3. After posting the document, you can print the Accounting Certificate (f. 0504833) by clicking on the corresponding button or the Print button.

1.4. In order to check the correctness of the reflection of changes in value, you can generate, for example, the report Balance sheet for account 103.11.

2. Reflection of settlements with the founder

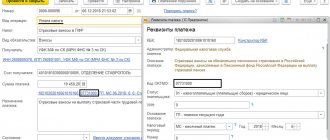

2.1. Settlements with the founder are formalized using the document Adjustment of settlements with the founder from the menu Accounting -> Regular operations for the end of reporting periods.

2.2. For the correct formation of an accounting entry, the header of the document indicates the Account of settlements with the founder - 210.06, the Depreciation Account of OCI - OCI.

The tabular part of the document is filled in using the Fill button. To create an accounting entry, you must indicate the KPS of the founder’s account - type GKBK, Account 401.10 - 401.10.172, KPS of account 401.10 - type KDB.

After posting the document, you can generate a Notice (f. 0504805) and print an Accounting Certificate (f. 0504833).

Increasing the cadastral value of a land plot in “1C:BGU 8 2.0” for budgetary and autonomous institutions

1. Increasing the cadastral value of a land plot

1.1. An increase in the cadastral value of a land plot is documented in the document Change in value, depreciation, depreciation of fixed assets, intangible assets, legal acts from the menu OS, intangible assets, legal acts.

1.2. In the document, select Type of operation: Change in value (101, 102, 103 - 106, 401.10). On the Fixed Assets tab, add a fixed asset and enter a new book value amount.

On the Accounting transaction tab, select Standard transaction: Change in value, depreciation and Account: 401.10.176.

1.3. After posting the document, you can print the Accounting Certificate (f. 0504833) by clicking the Print button.

1.4. To check the correctness of the reflection of changes in value, you can generate, for example, the report Balance sheet for account 103.11.

2. Reflection of settlements with the founder

2.1. Settlements with the founder are documented using the document Adjustment of settlements with the founder from the Accounting and Reporting menu.

2.2. For the correct formation of an accounting entry, the header of the document indicates Settlements with the founder - 210.06, Income of the current financial year - 401.10.

The tabular part of the document is filled in using the Fill button. To generate an accounting entry, you must indicate the KPS of account 210.06 - type of city bookkeeping account, KPS of the income account - type of KDB.

Typical operation: Adjustment of settlements with the founder.

After posting the document, you can print the Accounting Certificate (f. 0504833).

Increasing the cadastral value of a land plot in “1C:BGU 8 1.0” for government institutions

1. An increase in the cadastral value of a land plot is documented in the document Change in the value of legal acts from the menu OS, Intangible Legal Entities, Legal Entities -> Accounting for non-produced assets.

2. In the header of the document, select Operation – Change in value (103-401.10), Income Account – 401.10.176.

In the tabular part of the document, a plot is selected and its new cadastral value is indicated in the Cost column.

3. After posting the document, you can print the Accounting Certificate (f. 0504833) by clicking on the corresponding button or the Print button.

4. In order to check the correctness of the reflection of changes in value, you can generate, for example, the report Balance sheet for account 103.11.

Increasing the cadastral value of a land plot in “1C:BGU 8 2.0” for government institutions

1. An increase in the cadastral value of a land plot is documented in the document Change in value, depreciation, depreciation of fixed assets, intangible assets, legal acts from the menu OS, intangible assets, legal acts.

2. In the document, select Type of operation: Change in value (101, 102, 103 - 106, 401.10). On the Fixed Assets tab, add a fixed asset and enter a new book value amount.

On the Accounting transaction tab, select Standard transaction: Change in value, depreciation and Account: 401.10.176.

3. After posting the document, you can print the Accounting Certificate (f. 0504833) by clicking on the corresponding button or the Print button.

4. In order to check the correctness of the reflection of changes in value, you can generate, for example, the report Balance sheet for account 103.11.

Revaluation of property: accounting and taxation of results

End of example Registration of revaluation results

In accounting, revaluation results are documented in an accounting certificate. It is drawn up according to the rules established by Article 9 of the Law “On Accounting”. In addition to the required details, the certificate must contain a calculation of the residual value of the objects as a result of revaluation. The certificate is accompanied by documents confirming the market value of the objects.

The results of the revaluation carried out as of January 1, 2003 are subject to reflection in accounting separately (paragraph 4 of clause 15 of PBU 6/01).

This means that they are not reflected in the financial statements for 2002. The results of the revaluation are reflected in the accounting records in January

2003 and are taken into account in the financial statements when compiling data

at the beginning of 2003

(clause 20 of the Methodological Recommendations on the procedure for generating indicators for the financial statements of an organization, approved by order of the Ministry of Finance of Russia dated June 28, 2000 No. 60n).

At the same time, the balance sheet shows the residual value of fixed assets as of January 1, 2003, taking into account the results of revaluation. In this regard, the question arises: how should the results of revaluation be reflected in accounting so that there is no contradiction between accounting and reporting data, on the one hand, and reporting indicators are reliable and correctly disclosed, on the other? First of all, we note that changes in the value of objects as a result of revaluation should be reflected in the analytical accounting of fixed assets. In other words, for each object that has been revalued, the following amounts must be reflected: - revaluation (depreciation) of the original (replacement) cost; - changed depreciation. In addition, the corresponding source of write-off of the revaluation result must be reflected. This is necessary for the purposes of accounting for subsequent revaluations and disposal of fixed assets. Separating the accounting for revaluation results means that all transactions associated with this operation must be separated into a separate group and reflected in a special consolidated register. It is advisable to enter separate subaccounts on all accounts involved in revaluation transactions. Due to the discrepancy between the initial balances of the accounts on which changes in the value of fixed assets are taken into account in accounting and reporting, there is a need to create a document that would reflect the amounts of changes in the balance at the beginning of the reporting year under the items of accounting for the cost of fixed assets, additional capital, as well as retained earnings (uncovered losses). This document is drawn up in the form of an accounting certificate based on the revaluation statement and links the balances of the relevant accounting accounts and reporting items at the beginning of the reporting year. The accounting procedure for the results of revaluation of fixed assets is determined by paragraph 15 of PBU 6/01. It states that the amount of revaluation of an object of fixed assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an item of fixed assets, equal to the amount of its depreciation carried out in previous reporting periods and charged to the profit and loss account as operating expenses, is charged to the profit and loss account of the reporting period as income. Let's consider the procedure for reflecting the results of revaluation in accounting. Example 2

Let's use the conditions of example 1 and assume that the object in question has not previously been revalued.

For the purpose of accounting for the results of revaluation, the organization opened a separate sub-account for account 01 “Fixed Assets” called “Change in the value of fixed assets as a result of revaluation.” In accounting, the results of the revaluation are reflected in the following entries: Debit 01 subaccount “Fixed assets in operation” Credit 01 subaccount “Change in the value of fixed assets as a result of revaluation”

- 6,000 rubles.

— the initial cost of the object was increased to the market price; Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation” Credit 02 “Depreciation of fixed assets”

- 3600 rubles.

(21,600 - 18,000) - the amount of accrued depreciation was increased due to revaluation; Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation” Credit 83

- 2400 rub.

(6000 - 3600) - reflects the amount of additional valuation of the object due to additional capital. End of the example

Now let's look at the procedure for accounting for the amount of revaluation of an object if there was a depreciation in the previous year, the amount of which was charged to the profit and loss account.

Example 3

Let us again use the conditions of example 1, but assume that as a result of revaluation in the previous reporting period, the original cost of the object was reduced by 4,000 rubles, the amount of depreciation as a result of the markdown changed by 1,700 rubles.

A loss in the amount of 2,300 rubles was reflected in the profit and loss account. (4000 - 1700). In this case, the results of the revaluation carried out as of January 1, 2003 are reflected in the following entries: Debit 01 subaccount “Fixed assets in operation” Credit “Change in the value of fixed assets as a result of revaluation”

- 6,000 rubles.

— the initial cost of the object was increased to the market price; Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation” Credit 02 “Depreciation of fixed assets”

- 3600 rubles.

(21,600 - 18,000) - the amount of accrued depreciation was increased due to revaluation; Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation” Credit 99

- 2300 rub.

— the amount of additional valuation due to profits and losses is reflected; Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation” Credit 83

- 100 rubles.

— reflects the amount of additional valuation of the object due to additional capital. End of example

In practice, such an option is also possible when in the previous reporting period the value of the object was increased as a result of revaluation and, accordingly, was charged to additional capital.

And as a result of revaluation as of January 1, 2003, the value of the object decreased. Then the amount of the markdown is credited to additional capital within the amount of the revaluation, and the amount of excess is credited to the account of retained earnings (uncovered loss) of the reporting period. Example 4

In previous years, as a result of the revaluation of fixed assets, the amount of 1,500 rubles was formed in account 83 “Additional capital”.

In the reporting period, the initial cost of the object during revaluation decreased by 5,000 rubles, and accordingly, the amount of accrued depreciation decreased by 3,000 rubles. In accounting, the results of the revaluation are reflected in the following entries: Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation” Credit 01 subaccount “Fixed assets in operation”

- 5,000 rubles.

— the initial cost of the object was reduced to the market price; Debit 02 Credit Debit 01 subaccount “Change in the value of fixed assets as a result of revaluation”

- 3000 rubles.

— the amount of accrued depreciation was reduced; Debit 83 Credit 01 subaccount “Change in the value of fixed assets as a result of revaluation”

- 1,500 rubles.

— the amount of markdown due to additional capital is reflected; Debit 84 “Retained earnings (uncovered loss)” Credit 01 subaccount “Change in the value of fixed assets as a result of revaluation”

- 500 rubles.

— reflects the amount of markdown due to retained earnings. End of example

The amount of depreciation of fixed assets attributed to retained earnings (uncovered loss) must be disclosed in the organization’s financial statements. When an item of fixed assets is disposed of, the amount of its revaluation is transferred from the organization's additional capital to the organization's retained earnings. For tax accounting purposes, the results of the revaluation of fixed assets carried out as of January 1, 2003 are not accepted. This means that revaluation amounts are not included in income, and depreciation amounts are not included in expenses. The initial (replacement) cost of depreciable fixed assets is not subject to change. However, the replacement cost of fixed assets that were revalued before January 1, 2002 is accepted for tax purposes taking into account the revaluations. The procedure for determining the replacement cost of such objects is set out in Article 257 of the Tax Code of the Russian Federation. When determining the replacement cost of depreciable fixed assets, the revaluation of fixed assets carried out as of January 1, 2002 and reflected in the accounting records of the taxpayer after January 1, 2002 is taken into account. The specified revaluation is accepted for tax purposes in an amount not exceeding 30% of the replacement cost of the corresponding fixed assets reflected in the taxpayer’s accounting records as of January 1, 2001 (taking into account the revaluation as of January 1, 2001). In this case, the amount of revaluation (discount) as of January 1, 2002, reflected by the taxpayer in 2002, is not recognized as income (expense) of the taxpayer for tax purposes. In a similar manner, a corresponding revaluation of depreciation amounts is accepted for tax purposes.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Revaluation of the cadastral value of all lands can significantly increase taxes

Residents of the Novosibirsk region were the first to try out revaluation. In 2022, a cadastral revaluation of agricultural land took place there. Since this year, the cost of some plots, and, accordingly, land taxes on them, has increased 25-30 times , as reported by Moskovsky Komsomolets. This was a pilot project, only agricultural land was assessed.

Pavel Berezin, editor-in-chief of the agricultural magazine “Chairman” (Novosibirsk), says: “We only learned about this at the beginning of this year, when we accidentally went to the Rosreestr website and gasped. In some places, the cadastral value of land plots has even decreased. But basically, since this year it has increased 5-6 times. Although there are other examples. A small farm plot, located 450 kilometers from the regional center, suddenly rose in price from 800 thousand rubles to 60 million. Accordingly, the farmer must pay a tax for it not 6 thousand rubles, as before, but 200 thousand.”

At the same time, Rosreestr reported that notifications were sent to district municipalities and village councils so that all land users were notified of the cadastral revaluation. And so that land users themselves take the initiative: get in touch and send reliable information about their land plots.

How about: “The cadastral valuation was carried out using old cadastral maps and some certificates from local authorities. Even the village council, the closest authority to the people on earth, knows little about the condition of the plots, transport accessibility and other indicators on the basis of which the territory is assessed. So it turned out that, say, a 300-hectare field, which is officially listed as fertile, has long been covered with ravines and landfills. But with old cards it gives a considerable profit - which means we should pay more to the budget.”

What is the way out of this situation? Just challenge the cadastral value on an individual basis.

Therefore, residents of Novosibirsk are urged to be vigilant and prepared for such a situation. Since citizens still remember when, in 2015-2016, many summer residents in different regions of the country began to receive notifications about paying land tax for fantastic amounts (instead of 3-5 thousand rubles per year - 100-200 thousand rubles).

So don't be lazy. Go to the public map of Rosreestr and monitor the cadastral value of your site in order to challenge it in time!

In addition, we recommend that you read our articles: “High property taxes? Try to challenge the cadastral value.”

Photo: iStock.com

Advertising material was created with the support of the “Center for Entrepreneurship of the Orenburg Region”.