Quarterly property tax reporting has been cancelled.

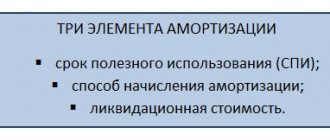

The law made three changes to the procedure for calculating property taxes.

1. The obligation to submit quarterly property tax payments has been cancelled. Thus, organizations will only have to prepare an annual declaration based on the results of the tax period. The form of the declaration, as well as the procedure and format for its submission, were approved by Order of the Federal Tax Service of the Russian Federation dated August 14, 2019 No. SA-7-21/ [email protected]

2. It has become possible to submit a single tax return from 01/01/2020. Taxpayers who own real estate have the right to use it:

- taxable solely on the average annual value;

- located on the territory of one subject of the Russian Federation, but registered in different inspectorates.

The right to submit a single declaration is granted after sending a notification to the regional Federal Tax Service.

Owners of such property will be able to report on it to one tax authority of their choice. Applicants for a single tax return must submit a notification to the Federal Tax Service for the entity where the organization’s property is located before the end of the reporting campaign for the first quarter, that is, no later than 03/02/2020.

The possibility of filing a single declaration does not apply if regional legislation provides for tax deductions to local budgets.

3. The procedure for determining the tax base has been changed: from 2022, advances for the year in which the cadastral value changed are calculated at the new value. That is, from paragraphs. 1 clause 12 art. 378.2 of the Tax Code of the Russian Federation, as amended, effective from 01/01/2020, excluded the indication that in order to calculate the advance payment, the cadastral value must be taken exactly as of January 1 of the current year.

FEDERAL LAW No. 63-FZ dated April 15, 2019 “On amendments to part two of the Tax Code of the Russian Federation and Article 9 of the Federal Law “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation on taxes and fees”

Title page

Options for filling out the title page by Russian organizations that are NOT major taxpayers:

- at the location of the organization - code 214

; - at the location of the OP on its balance sheet - code 281

; - at the location of the property - code 281

; - at the location of the legal successor - code 215

(Procedure for filling out the declaration, approved by Order of the Federal Tax Service of August 14, 2019 N CA-7-21 / [email protected] ).

If the object is not located at the place of registration of the organization, but is registered with another tax office with its own checkpoint, which checkpoint should be indicated on the title page of the declaration, which checkpoints and tax authority codes should be filled out in other places of the declaration?

The Federal Tax Service and Checkpoint code is indicated only on the title page of the declaration:

- Federal Tax Service Inspectorate - code of the inspection where the declaration is submitted, i.e. at the location of the property (clause 3.2.6 of the Procedure);

- KPP – code at the location of the organization (clause 3.2.1 of the Procedure).

On other sheets of the declaration, for each object its own OKTMO is indicated - at the location of the property (clause 2, clause 4.2 of the Procedure, Article 385 of the Tax Code of the Russian Federation).

An organization located in Moscow (IFTS 7719) has taxable objects:

- at the location of the organization;

- in the municipal district of Zhukovsky (IFTS 5040).

At the location of the organization - code 214

:

- Checkpoint - at the location of the organization;

- Federal Tax Service Inspectorate - at the location of the organization.

At the location of the OP or property - code 281

:

- Checkpoint - at the location of the organization;

- Federal Tax Service Inspectorate - at the location of the OP (property).

The organization (IFTS 7731) was reorganized in the form of affiliation. The legal successor is Granit LLC (IFTS No. 7719), which is not one of the largest taxpayers. For property taxes for 2022, the legal successor reports for the reorganized entity.

At the location of the legal successor - code 215

:

- Checkpoint - at the location of the successor organization;

- Federal Tax Service Inspectorate - at the location of the successor organization.

The company was transformed from LLC to JSC. The reorganization was completed on April 20, 2020, but due to the coronavirus, all objects in the Unified State Register were only re-registered in August. From what month should property tax be calculated for the new organization - from April or from August?

Property tax on all transferred real estate should be calculated for the new organization from the date of registration in the Unified State Register of Legal Entities, i.e. from April, since the successor inherits from the reorganized company:

- right of ownership of property (clause 2 of article 218 of the Civil Code of the Russian Federation);

- obligations to pay taxes (clause 9 of article 50 of the Tax Code of the Russian Federation).

To access the section, log in to the site.

Property tax return updated

Updating the form was required due to innovations introduced by Law No. 63-FZ, in particular, in connection with the abolition of quarterly reports.

Please note: the form is subject to use from the tax period of 2022, that is, the next submission of reports must take place on a new form. There are few changes compared to the previous form:

- in section 1, four new lines appeared - 021, 023, 025 and 027. They will need to reflect the calculated amount of tax that must be paid to the budget for the tax period, and advance payments for each reporting period;

- The line with the amount of advance payments has been removed from sections 2 and 3.

In sections 2 and 3, a new line will appear: “Calculated amount of tax to be paid to the budget for the tax period (in rubles).”

ORDER of the Federal Tax Service of the Russian Federation dated August 14, 2019 No. SA-7-21/ [email protected] “On approval of the form and format for submitting a tax return for the property tax of organizations in electronic form and the procedure for filling it out, as well as on the recognition of orders of the Federal Tax Service as invalid dated 03/31/2017 No. ММВ-7-21/ [email protected] and dated 10/04/2018 No. ММВ-7-21/ [email protected] »

Section 2.1

Section 2.1

is intended to provide information about property taxed at the average annual value from Section 2 (clause 6.1 of the Procedure for filling out the declaration, approved by Order of the Federal Tax Service of August 14, 2019 N SA-7-21/ [email protected] ).

Filling procedure

- Group of lines of Section 1 - separate sheet of Section 2 and 2.1

- page 050

Filling out lines 010-040

Owners of land and vehicles will have a new obligation

Law No. 325-FZ made the most changes to the procedure for calculating property taxes.

Land tax:

- starting from 01/01/2021, companies are required to inform inspectors about taxable areas that were not taken into account by the Federal Tax Service when calculating tax. The message must be accompanied by documents confirming ownership of the land plot and the message must be sent once, before December 31 of the year following the expired tax period. If an organization does not comply with this requirement, it may be fined 20 percent of the unpaid tax amount (Article 129.1 of the Tax Code of the Russian Federation);

- the application of a preferential rate of 0.3 percent is limited. From 01.01.2020, in relation to land plots of the housing stock, this rate cannot be applied to plots for individual housing construction used in business activities;

- the rule establishing for individuals the start date of tax calculation from the date of opening of the inheritance will also apply to legal entities from 01/01/2020;

- the possibility of establishing differentiated rates depending on the types of territorial zones within the boundaries of which the site is located is excluded;

- a procedure has been established for identifying areas not used for agricultural purposes. From 07/01/2020, the body exercising state land supervision is obliged, within 10 days from the date of issuing an order to eliminate the identified violation of the requirements of land legislation, to submit to the tax authority of the constituent entity of the Russian Federation information about the non-use of the site for its intended purpose. If the responsible body establishes that the said violation has been eliminated or if the order is canceled, information about this is also submitted to the tax authority of the constituent entity of the Russian Federation within 10 days;

- From 01/01/2021, municipalities are excluded from the procedure for establishing deadlines for payment of land tax by organizations. Thus, the representative bodies of municipalities will lose the right to set deadlines for paying land tax;

- The deadline for payment of land tax is established - no later than March 1 of the next year, and advance payments - no later than the last day of the month following the reporting period. The changes apply starting with 2022 tax payments.

Transport tax

For vehicle owners, in accordance with paragraph “a”, paragraph 3 of Art. 1 of the law, from 01/01/2021, the obligation to inform the Federal Tax Service about their availability has been established. This is the same rule that regulates notification of the availability of land plots, discussed above. It is necessary to report a vehicle if:

- they are objects of taxation;

- are not eligible for the benefit;

- The vehicle has never received a message about the calculated amount of tax.

In addition, copies of documents confirming vehicle registration must be attached to the notification.

It is enough to do this once before December 31 of the year following the expired tax period. Documents can be sent to any convenient Federal Tax Service. The reason for the innovation is the abolition of declarations. For 2022, inspectors themselves will send messages about the calculated tax. Therefore, if an organization purchases a vehicle in 2022 and does not receive a tax notice from the inspectorate in 2022, it will need to notify the tax authorities about the acquisition by December 31, 2022.

The sanctions previously provided for individuals in accordance with paragraphs. “a” clause 49 art. 1 of the law also applies to legal entities. So, starting from 01/01/2021, a company for failure to submit a report will be punished with a fine of 20 percent of the unpaid tax amount.

By analogy with land tax, paragraph 63 of Art. 2 of the law excluded, from January 1, 2021, from the powers of the regions the establishment of deadlines for payment of transport tax by organizations.

Clause 68 of Art. 2 of the law sets a deadline for paying taxes. According to the new edition of paragraph 1 of Art. 363 of the Tax Code of the Russian Federation, transport tax is payable by taxpayer organizations no later than March 1 of the year following the expired tax period. Advance tax payments must be made by taxpayer organizations no later than the last day of the month following the expired reporting period (I, II and III quarters). The innovation applies starting with the payment of transport tax for the tax period 2022.

Organizational property tax

From 01.01.2020 clause 1 art. 374 of the Tax Code of the Russian Federation classifies as objects of taxation at cadastral value not only fixed assets, but also any real estate owned by organizations under the right of ownership or right of economic management. Thus, it will not matter whether real estate is taken into account as a fixed asset or not - you will still have to charge and pay tax according to the cadastre. True, unless the region decides otherwise.

Previously, if objects were not registered as fixed assets, cadastral valuation tax was not paid on them. This follows from the explanations of the Ministry of Finance set out in letter dated June 30, 2017 No. 03-05-05-01/41582. Exception according to paragraphs. 4 paragraphs 1 art. 378.2 of the Tax Code of the Russian Federation - residential buildings. If they are a fixed asset, then the tax is paid based on the average annual value, and if they are not, based on the cadastral value. That is, from the new year, owners of such real estate will bear an increased tax burden.

The list of objects taxed at cadastral value, from 01/01/2020, includes other real estate subject to property tax for individuals, that is, residential buildings, apartments, rooms, garages and parking spaces, unified real estate complexes, unfinished construction projects and other objects. The list of taxable “other” objects was specified by Law No. 379-FZ.

FEDERAL LAW No. 325-FZ dated September 29, 2019 “On amendments to parts one and two of the Tax Code of the Russian Federation”

What do we tax?

Real estate reflected on the balance sheet as a fixed asset, if the tax base for it is determined as the average annual cost. Among other things (unobvious cases) of taxation:

- real estate is transferred to other persons for temporary possession, use, disposal;

- transferred to trust management (except for mutual funds);

- included in joint activities;

- received under a concession agreement;

- received by you as a mutual fund management company.

Tax is also imposed on real estate that is located in Russia and belongs to an organization under the right of ownership, economic management, or received under a concession agreement, if the tax base in respect of it is determined as the cadastral value.

The object of taxation is not any movable property, as well as real estate such as land and reservoirs, listed in paragraph 4 of Art. 374 Tax Code of the Russian Federation.

We are not taxed, but are reflected in the declaration as a preferential benefit:

- property used in the main activities of religious organizations, organizations of the penal system, pharmaceutical or public organizations of people with disabilities;

- property of prosthetic and orthopedic enterprises, bar associations, law offices, legal consultations, management companies and participants of the Skolkovo project, INTC, participants, residents or managers of special economic zones;

- federal highways, newly introduced energy-efficient real estate, real estate for hydrocarbon production

The full list of federal benefits is in Art. 381 Tax Code of the Russian Federation. Each region can independently decide what benefits to introduce on its territory, who can apply them and for what property (Article 372 of the Tax Code of the Russian Federation). To find out what benefits apply in your region, contact the inspectorate or look at the official website of the Federal Tax Service.

The list of objects subject to cadastre taxation has been specified

Law No. 325-FZ brought confusion to the business environment, leaving open the list of real estate taxed by legal entities at cadastral value. But at the end of November, a law was published that clarified this list. So, from 01/01/2020, according to clause 2 of Art. 1 of the law, tax will need to be paid:

- from residential premises;

- unfinished construction projects;

- garages;

- parking spaces;

- residential buildings, garden houses, outbuildings and structures that are located on plots for personal farming, gardening, horticulture or individual housing construction.

FEDERAL LAW No. 379-FZ dated November 28, 2019 “On amendments to Articles 333.33 and 378.2 of Part Two of the Tax Code of the Russian Federation”

Organizations must report benefits separately

Amendments have been made to the procedure for calculating land tax, according to which not only individuals, but also legal entities are required to report available benefits from 01/01/2020.

FEDERAL LAW No. 63-FZ dated April 15, 2019 “On amendments to part two of the Tax Code of the Russian Federation and Article 9 of the Federal Law “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation on taxes and fees”

How to claim benefits for land and transport

Starting from 01/01/2020, in order to take advantage of benefits on land and transport taxes, you must submit an application to the inspectorate.

A new form was needed due to the cancellation of filing tax returns for the specified taxes for 2022 with the Federal Tax Service. Therefore, if a company applies for benefits, then in 2022 it is necessary to submit an application to the Federal Tax Service for their provision. The fact is that the availability of benefits before the cancellation of declarations was confirmed in the declaration form itself in the special detail “Tax benefit code”.

To submit an application, a single form is used, which is called “Application of a taxpayer-organization for a tax benefit for transport tax and (or) land tax.”

The form consists of three sections: a title page and one section each for transport and land taxes.

The procedure for filling out the application indicates that if an organization claims only a land tax benefit, the blank sheet with fields for transport tax does not need to be submitted. However, this issue needs to be clarified with your inspection.

When claiming a land tax benefit, you must indicate:

- cadastral number of the plot;

- the duration of the benefit and its code;

- information about the municipal act that establishes the benefit;

- information about documents confirming the benefit.

Benefit codes are also given in the appendix to the procedure for filling out the application.

Please note that some land tax benefits are established not at the municipal level, but at the federal level - in the Tax Code of the Russian Federation. In this case, the fields intended for information about the local legal entity are not filled in. We are talking, for example, about benefits for areas under public roads. For transport tax benefits you must indicate:

- type of vehicle, its make (model) and license plate number;

- the period for granting the benefit;

- information about documents confirming the benefit;

- benefit code and details of regional law.

In the appendix to the procedure for filling out the application, only four codes are indicated: one for benefits under an international treaty and three for regional benefits (exemption from payment, reduced rate and reduced tax amount). Let us remind you that currently benefits for organizations are established only in the laws of the constituent entities of the Russian Federation. For example, in Moscow, SEZ residents do not pay transport tax, in the Sverdlovsk region, public organizations of disabled people pay only 35 percent of the calculated tax amount, and in Bashkiria, agricultural producers apply rates that are halved.

ORDER of the Federal Tax Service of the Russian Federation dated July 25, 2019 No. ММВ-7-21/ [email protected] “On approval of the application form of a taxpayer-organization for the provision of a tax benefit for transport tax and (or) land tax, the procedure for filling it out and the format for submitting the specified application in electronic form"