Purpose and content of the document

An invoice for payment is a recommendation document, not a mandatory one. Its main goal is to fix the obligation to reimburse funds for the goods taken and the amount of the required payment.

There is no set writing regulation. When checking out, information about the product and the parties to the agreement is displayed. In special cases, the time period during which the obligation must be fulfilled is additionally noted.

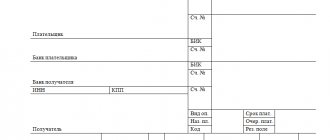

Regardless of the situation, the document should display the following information:

- Information about the seller: full name, legal address, checkpoint and tax identification number;

- Buyer information: similar to the previous paragraph;

- List of goods or services provided, indicating their final cost;

- Total amount to be paid;

- Details for crediting funds;

- Date of document creation.

How to prepare an invoice for payment

It is exhibited by the seller. Payment is the responsibility of the buyer or his representative.

It is completed both before and after the purchase of a product or service - everything will depend on the agreements between the participants. The completed sample is sent to the customer.

Who issues invoices for payment?

The accountant is in charge of the preparation. The form is then submitted to the director of the company for approval.

Two copies are made: one for each participant. It is printed on plain paper or on the company’s letterhead (this option is better because it eliminates the need to write down the company’s details each time). Corrections are not allowed.

When to exhibit

If there is a cooperation agreement between the participants, then the terms of delivery and payment are usually specified in the text.

When parties work together only periodically, and the size and cost of supplies differ, each transaction is shown separately. The contract is concluded later; only general provisions are stated in its text. This happens if delivery is required urgently.

In a situation where the buyer only needs a one-time purchase of goods, there is no agreement between the companies - there is simply no need for it. The invoice for the provision of services is issued in the usual manner.

Note: if no agreement has been concluded between the counterparties, then the document can act as a public offer, provided that it contains all the required terms of the agreement (based on Article 435 of the Civil Code of the Russian Federation). Making payment is acceptance of the offer (Article 438, paragraph 3 of the Civil Code of the Russian Federation). And the paper itself, with confirmation of the sending of funds, will be evidence of a completed transaction between its participants (Article 434, paragraph 3 of the Civil Code of the Russian Federation). This will be a “plus” in the event of a possible trial.

Required details

Before you begin directly filling out payment documents, you need to figure out what details are needed to issue an invoice. Thus, the balance sheet cannot be classified as mandatory accounting documentation. And you might think that there are no special requirements for the document. However, it is not.

Please note that in some cases the payment plan can be classified as a separate type of primary documentation. Consequently, the following mandatory requirements apply to the details of such paper:

- Date of document creation.

- The number of the center is filled in chronologically.

- Validity period, if such is established by the terms of the contract.

- Name and address of the parties: recipient and payer of funds on the account.

- TIN and checkpoint of the parties.

- Bank details of the recipient organization, that is, where to send the funds.

- Name of the product, work or service for which payment is being made.

- Quantity, volume, unit of measurement, price per unit, total cost separately for each item of goods, work and services.

- The total amount calculated arithmetically.

- VAT reference. Indicate the tax rate and amount if the organization is a VAT payer. Or indicate that no tax applies (excluding VAT).

- Name of the position of the responsible employee, his signature and transcript.

Additionally, you can specify the details of the contract if the payment document is issued on the basis of a concluded contract.

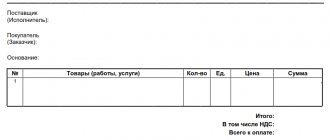

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Read also: Software for accounting

There are no other fundamental differences.

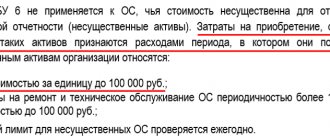

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia;

- organizations - paragraph 3 of this regulatory act.

Note: if a buyer operating under a preferential tax regime is issued an invoice with VAT, then the entire amount must be paid, but then o.

List of forms for issuing an invoice for payment

There are several known options, which can sometimes lead to confusion.

What are the features of each type:

- Invoice-agreement is identical to the “usual” one, but additionally contains contract details. This type records the terms of delivery and payment (prepayment or postpayment, cash or non-cash payment), the procedure for complaints, exchanges, and other issues. Usually it replaces the standard agreement (if the transaction amount is small).

- Invoice - indicates the fact of purchase of goods (services), records the presence of VAT. Used by individual entrepreneurs and companies operating under the general taxation regime.

Samples of filling out invoices

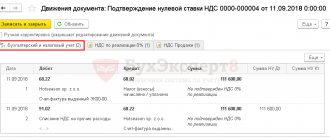

Example 1—filling inclusive of tax.

Example 1 - with VAT

Example 2 - without taking into account.

Example 2 - without taking into account

Instructions for preparing an invoice for payment

There are no clear rules for writing.

However, a specific order of completion is usually followed. At the top are the buyer and seller details. Below are recorded:

- Bank data;

- form number (numbering starts from January 1 of the current year);

- date of issue;

- a list of goods (works, services), fixing their quantity, price and final cost, including or excluding VAT;

- upon request - other conditions.

The signature of the authorized person is placed below.

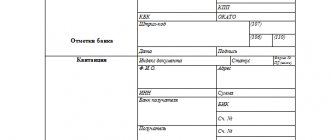

Requisites

This section is required when completed. What is indicated:

- name of the participants (for example, individual entrepreneur Svetlana Igorevna Minina, Stroyservis LLC);

- TIN for individual entrepreneurs, for companies - TIN and KPP;

- bank data (for example, Sberbank of Russia OJSC Anapa, BIC 1234567, account No. 454773777, account No. 57585998696);

- addresses of participants (individual entrepreneurs indicate the actual address). For example: 353440, Anapa, st. Astrakhanskaya, house 12, tel.;

- signatures (position, full name, transcript).

Important: if a representative signs instead of an individual entrepreneur, then the details of the power of attorney must also be indicated.

Invoice registration

It is allowed not to register, since all expenses are taken into account using invoices, and income – based on the actual crediting of funds.

Only invoices are subject to registration - they are entered in the “sales book” or “purchase book”. Only those companies that operate under the OSN are required to do this.

Firms operating under the simplified tax system do not pay VAT, but they cannot claim its reimbursement from budget funds.

The need for certification with a seal

Since 2016, having a seal is not a mandatory attribute. This rule applies to individual entrepreneurs and organizations. To certify the invoice, the signature of the responsible person is sufficient.

In what cases is it necessary to issue an invoice to the buyer?

Companies that carry out transactions subject to VAT, including those exempt from paying this tax, as well as organizations that have received advances from their buyers (customers), must issue invoices (Article 145, paragraphs 1, 3 of Article 168 , clause 3 of article 169 of the Tax Code of the Russian Federation).

In addition to these organizations, invoices must also be issued by companies that sell goods (work, services) on their behalf under an intermediary agreement. Of course, provided that the principal (principal) applies the OSNO (clause 1 of Article 169 of the Tax Code of the Russian Federation, clause 20 of Section II of Appendix 5 to Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137).

In practice, situations arise when, in addition to primary invoices, organizations should issue adjustment invoices. For example, such documents must be provided to buyers if there has been a shortage of goods or the cost of shipped goods (work, services) has changed in the concluded contract (clause 3 of Article 168 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48 , dated March 12, 2012 No. 03-07-09/22).

Attention

If the buyer (customer) is not a VAT payer or is exempt from paying this tax, then the seller (executor) may not issue him invoices, provided that an agreement on non-issuance of invoices has been signed between them. This conclusion was reached by the Ministry of Finance (clause 3 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-07-09/13808).

Also, an invoice does not need to be issued if the seller (executor), who is an interdependent person with his buyer (customer), increases the price of goods (work, services), while adjusting the VAT tax base. This is explained by the fact that with such an adjustment of the tax base, the amount of VAT is not presented to the buyer (customer), and therefore there are no grounds for issuing invoices with the adjusted tax base and tax amount (letter of the Ministry of Finance of Russia dated March 1, 2013 No. 03-07- 11/6175).

An invoice can be issued to the buyer (customer) both on paper and in electronic form (Resolution of the Government of the Russian Federation dated December 26, 2011 No. 1137, order of the Ministry of Finance of Russia dated April 25, 2011 No. 50n, order of the Federal Tax Service of Russia dated March 4, 2015 No. MMV- 7-6/93). Moreover, the buyer needs to issue an electronic invoice through an authorized organization - an electronic document management operator (clause 1.3 of the Procedure, approved by order of the Ministry of Finance of Russia dated April 25, 2011 No. 50n). The list of such operators is published on the official website of the Federal Tax Service of Russia www.nalog.ru.

Please note that it is possible to issue an invoice in electronic form only if the buyer agrees (clause 1 of Article 169 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 01.08.2011 No. 03-07-09/26).

As for the timing, the invoice must be issued to the buyer (customer) no later than 5 calendar days from the date of shipment of goods (work, services) or receipt of an advance payment for upcoming deliveries (clause 3 of Article 168 of the Tax Code of the Russian Federation). Moreover, the calculation of the period begins from the next day after shipment (receipt of the advance payment) (clause 6.1 of the Tax Code of the Russian Federation).

Diadoc is easy to customize to suit your business processes.

Generate documents and send them to contractors or colleagues. Connect

Does the payer need the original invoice?

Nowadays, electronic documentation is mainly used.

Scanned copies of the papers are sent to the counterparty by fax or mail. Read also: Corporate property tax in 2022

If there is a need to transfer originals, then use a courier service or mail. The original copy of the invoice is handed over to the VAT payer (required for tax deduction). Therefore, two copies are prepared, one of which remains with the seller, the second is sent to the buyer.

Important: VAT payers can also use an electronic version of the invoice, but it must have a digital signature. Other options for document endorsement are unacceptable.

How to issue an invoice for payment by bank transfer

Federal Law No. 161 “On the National Payment System” states that all payments made by non-cash form can only be carried out with the consent of the client.

The procedure for filling out the document is identical to that used for other types of payment.

How to reflect VAT on an invoice

If a businessman is a VAT payer, then the amount of the contribution must be displayed in payment documents. You can do it like this:

- The tax is included in the final cost, but is highlighted as a separate line for clarity.

- The cost of the service (product) is shown excluding tax, then its size is calculated. The final price is formed as the sum of these two quantities.

Important: it is recommended to always enter the tax amount on a separate line - this will avoid possible errors in calculations.

When should you indicate the due date on your invoice?

The money must arrive to the seller within the period stipulated by the agreement. It is indicated in the text of the contract, or on the payment document itself. Changing the deposit period is not allowed.

Note: if funds were deposited by bank transfer and inaccuracies in the details were discovered, the supplier must be notified of the error as soon as possible. This is done in writing. This procedure will increase the payment period.

If the invoice is issued before the contract

If the agreement between the parties does not provide for invoicing, then issuing an invoice on a date earlier than the date of conclusion of the agreement is not an error. In this case, payment is made according to the contract, and not according to the invoice.

If an invoice for payment is issued earlier than the agreement is concluded, it is necessary to indicate in the agreement that the validity of this agreement also applies to this invoice, which was issued from an earlier date. In this case, it is recommended to draw up a reconciliation report, which will indicate that the amount received was received as an advance payment under this agreement.

You can find more complete information on the topic in ConsultantPlus.

Free access to the system for 2 days.

We issue invoices in English

We are talking about invoices used when working with foreign counterparties. Invoices must contain information:

- outgoing and incoming document number;

- data of counterparties, their contacts;

- date of discharge;

- taxation system in the companies participating in the transaction;

- date of dispatch of the goods, its receipt;

- information allowing the parties to the contract to track the status of the order;

- total transaction amount;

- payment terms;

- other necessary information - for example, return conditions, a description of penalties for violation of the contract, etc.

You need to take into account everything, even the smallest details, since the legislation under which foreign partners work differs from the Russian one.

Why is an account convenient?

An invoice is a payment document by which the buyer pays for the services of the supplier. It always contains the following information:

- details of the recipient's bank;

- Full name, TIN, current account of the recipient;

- payer data;

- name of works or services;

- amount to be paid;

- information about the presence or absence of VAT.

Entrepreneurs sign the document themselves and transfer it to the buyer in any convenient way - in person, by mail, electronically.

Thus, the buyer receives a paper that states how much to pay, to whom exactly and for what services. If there are no discrepancies, then you can immediately transfer funds via the Internet - there are details for this. Or give the payment to the bank cash desk and pay in cash. This is the main convenience of the account - you don’t need to look up the contract and look for the personal and bank details of the contractor. In addition, the document is a reminder that the entrepreneur has fulfilled or is ready to fulfill his obligations and is waiting for payment.