What forms of payment are there?

The state contract must necessarily contain the following conditions: the form, terms and procedure for payment for goods, works, services under 44-FZ (Article 34 44-FZ). The form of payment determines whether the money will be transferred to the government customer's counterparty by non-cash means, for example to a bank account, or paid in cash. The payment procedure involves one of the following options:

- full one-time transfer of funds;

- advance;

- staged payment as the contract is fulfilled.

The terms and conditions of payment by the customer are mandatory; their absence in the text or inconsistency makes the agreement invalid.

Use free instructions from ConsultantPlus experts to correctly fill out all the essential and non-essential terms in the draft contract.

What are the terms of payment for the contract under 44-FZ?

Decree of the Government of the Russian Federation dated September 18, 2019 No. 1205 reduced the maximum payment period for supplied GWS from 30 calendar days to 15 working days.

This rule applies to auctions in which:

- Participants are included in the list indicated in Part 5 of Art. 3 Federal Law “On the procurement of goods, works, services by certain types of legal entities”, or are small and medium-sized businesses;

- all performers are SMEs;

- the customer requires the involvement of subcontractors that are SMEs in carrying out the work.

This resolution came into force on 01/01/2020 and applies to purchases carried out after this date.

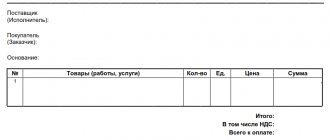

Based on what documents is the contract paid?

In order for payment for goods under 44-FZ to take place at the Treasury, the customer must have both an expert opinion, a certificate of completion of work and a delivery note, if provided for by the terms of the agreement.

| Document | When is it issued? |

| Acceptance certificate for work performed and services provided | Issued at the time of acceptance of GWS. Money is transferred after acceptance of the delivered goods, work performed or services rendered |

| Expert opinion | Acceptance is preceded by an examination, which is carried out by specialists of the state customer and invited experts and expert organizations. Based on its results, a conclusion is drawn up on the compliance or non-compliance of the result of the government contract with its conditions |

| Packing list | Draws up if the subject of the contract is the supply of goods |

How to pay in full

A full one-time payment is established by agreement, when the customer’s counterparty does not need an advance payment to execute the government contract, and the agreement does not provide for intermediate stages of execution. With a one-time payment, the government customer's counterparty fulfills its obligations in full, the customer accepts the result of the performance and, if the result does not raise any questions and is accepted, pays for it in full.

According to the general rule from Part 13.1 of Art. 34 44-FZ, payment terms for work under 44-FZ in 2022 are no more than 30 days from the date the parties sign the acceptance documents. A downward change is permissible: the state customer has the right to pay before the expiration of the month given to him. The 30-day period cannot be extended.

In May 2022, government decree No. 667 dated April 28, 2021 was published. RF PP No. 667 indicates how many days federal customers are allotted for payment under a contract under Federal Law 44 - 10 working days. According to the new rule, all recipients of federal budget funds are required to pay for the supply of goods, performance of work, and provision of services within 10 working days after signing the acceptance documents.

Read more: “Where to register electronic acceptance: clarifications from the Ministry of Finance.”

These are not all innovations. Resolution No. 667 explains the time frame within which the customer is obliged to pay the supplier’s fulfilled obligations under December contracts: if the execution of a government contract falls on the 1st-20th of December, then payment is made no later than 1 business day before the end of the financial year with mandatory compliance with the limits of budget obligations. If the government contract is executed from December 21 to December 31, that is, in the second half of December, the obligations are paid in the next financial year within the limits of the next year’s LBO. The new rules apply to all December government contracts, with the exception of agreements:

- on defense and state security of the country;

- for the supply of goods, works and services in accordance with paragraphs. “c”, “d”, “l” clause 11 of the provisions from the RF PP No. 1496 of 12/09/2017;

- for the supply of goods, works and services under clauses 20, 40, 41, 46, 52 and 56 of Part 1 of Art. 93 44-FZ;

- for security, rent, utilities and other payments for building maintenance, which are concluded to meet the needs of customers for a period up to December 31 inclusive.

IMPORTANT!

Government Decree No. 1034 of June 28, 2021 establishes the rules for mutual settlements under contracts that federal customers will conclude from 2022 to 2024. For payment of agreements in the period from 01/01/2022 to 12/31/2022, 15 working days are allotted in normal cases and 10 when working with SMP and SONKO. Starting from 01/01/2023, the deadlines will change again. Fulfilled obligations will have to be paid within 10 working days. Payments to SMP and SONKO should be made earlier - within 7 working days from the date of signing the delivery and acceptance documents.

Experts' opinion

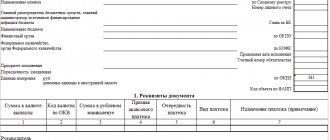

Let's look at an example. The company only has an invoice for the provision of services. It contains these provisions: name, quantity sold, cost, availability of payment order. Can this invoice serve as confirmation of the execution of a supply agreement? Yes, if the following conditions are met:

- The document is addressed to a specific person.

- From the invoice you can understand who exactly issued it.

If all these conditions are met, then the check is analogous to the execution of a supply agreement in a simple form. How is this conclusion justified? Let's look at it in detail. There are two definitions of a contract from a legal point of view:

- A contract is a transaction that fixes the will of several people or firms (Article 153-154 of the Civil Code of the Russian Federation).

- An agreement is a document fixing the conditions for the occurrence of obligations.

Paragraph 1 of Article 161 of the Civil Code of the Russian Federation states that transactions are carried out in writing. But drawing up an agreement is not the only method of completing a transaction. An agreement, on the basis of paragraph 2 of Article 432 of the Civil Code of the Russian Federation, can be concluded through the submission of an offer. An offer is a proposal to conclude an agreement. One participant makes an offer, and the other accepts this offer. Paragraph 2 of Article 434 of the Civil Code of the Russian Federation also states that an agreement can be concluded through an exchange of papers. Another way to conclude an agreement is to fulfill the terms of the transaction (clause 3 of Article 434, clause 3 of Article 438 of the Civil Code of the Russian Federation). For example, this could be the shipment of goods, the execution of services.

The considered methods of concluding an agreement are used if the law does not have specific requirements for the transaction being made (Article 434, 550 of the Civil Code of the Russian Federation). For example, if it is not a real estate transaction. That is, if the offer contains all the essential conditions, it replaces the contract. Payment by check is an acceptance, implying the conclusion of a contract. In this case, there is no document signed by the buyer and seller. But it does not matter. This conclusion is confirmed by these regulations:

- Government Decree VAS No. 981/98 of October 6, 1998.

- Resolution of the Federal Antimonopoly Service of the North-Western District No. A44-80/2008 dated May 4, 2009.

- By FAS Resolution No. Ф09-1968/09-С5 of April 13, 2009.

Why even raise the question of whether a check can be a contract? This becomes relevant when conflict situations arise. This is especially important in the context of litigation. Let's look at an example. The company began to cooperate with the supplier. She orders products from the latter for a certain amount. There was a need to return the product due to the fact that a defect was discovered. It is the receipt that is the basis for the return. In addition, it serves as confirmation of the transaction.

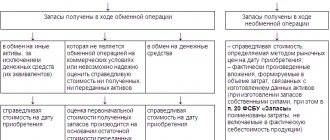

How to pay in stages

Phased transfer of the amount by agreement is permissible in government contracts, where there is a breakdown into stages of work, which are accepted separately as they are completed. For example, in construction agreements.

Based on the results of each stage, the parties accept the results, draw up and sign documents closing the stage. The contract stipulates the timing of payment of remuneration for a separate stage of work. Payment for each stage is made within 30 days after acceptance and within 10 working days for federal customers.

Consequences of violation of 44-FZ on contract payment

Delay in payment by the customer under contract 44-FZ entails administrative liability.

If the customer finds himself in a similar situation for the first time, his official will be fined 30–50 thousand rubles. Repeated late payment under the 44-FZ contract may lead to the suspension of the customer’s official from work for 1-2 years.

According to Part 13.1 of Art. 34 The beginning of the payment period is the date of signing the papers on acceptance of the work. This rule does not depend on the characteristics of the GWS.

As an example, we can cite the decision of the Tambov OFAS dated 09/06/2017 No. RZ-332/17. The subject of the auction in this case was the repair of a highway. Under the terms of the agreement, the contractor was to receive funds for work according to the following scheme:

- payment for the stage - within 30 days after signing the acceptance documents, namely the KS-2 certificate and the KS-3 certificate;

- final payment no longer than 30 days from the date of putting the road into operation.

The controllers noted that the payment period cannot be counted from the moment the facility is put into operation.

How to pay if there is an advance

An advance is a payment made by the customer in favor of the counterparty before he completes and delivers the result of the work to him. The amount of the advance is deducted from the total amount of the contract, therefore, after its execution, the customer’s payment is made in the amount of the agreement minus the already transferred advance. The latest edition of payment terms under 44-FZ on procurement does not introduce any special rules regarding the terms of advance payment. The law does not establish general requirements for the amount of the advance. We accept any advance amount, up to 100%.

Here is an example of a contract with advance payment.

But there is government decree No. 1496 dated December 9, 2017 on measures to ensure the execution of the federal budget. It regulates the conclusion and execution of certain types of government contracts. It established limits on advance payments. For example, in relation to agreements for construction, reconstruction and major repairs.

Federal Law No. 44-FZ prohibits paying advances to suppliers to whom anti-dumping measures were applied when concluding contracts, that is, to those who, at the stage of participation in the tender, offered a contract price significantly lower than the NMCC.

Special deadlines for SMP

There are exceptions to the general rule. They relate to government contracts concluded as a result of procurement carried out among SMP and SONCO. They are provided with payment under the government contract under 44-FZ - 15 days (working days) after the goods or services have been accepted.

Sometimes the rules for paying money are established in special laws. For example, the government, in order to ensure the defense capability and security of the state, has the right to establish a special deadline for payment of emergency services under 44-FZ (Part 8 of Article 30 of 44-FZ, RF PP No. 1205 of September 18, 2019). This possibility is stipulated in Part 13.1 of Art. 34 44-FZ. We remind you that the period for paying for SMP and SONKO in 2022-2024 will be reduced: in 2022 we pay within 10, and in 2023-2024 - within 7 working days after signing the acceptance documents.

Liability for delay

Payment terms are strictly established by law: 30 calendar days - in the usual case, 15 working days - for SMP and SONKO, 10 working days - for federal customers. If the government customer transfers money later, he faces:

- payment of penalties in accordance with Part 5 of Art. 34 44-FZ - in the amount of 1/300 of the key rate of the Central Bank of the Russian Federation for each day of delay. The penalty depends on the unpaid amount. If the customer has partially fulfilled his obligations, the amount that he has already transferred for calculation is not taken into account;

- administrative liability for an official of the customer who was late. Responsibility arises under Art. 7.32.5 of the Code of Administrative Offenses of the Russian Federation and consists of a fine of 30,000 to 50,000 rubles. Repeated violations result in disqualification for a period of 1 to 2 years.

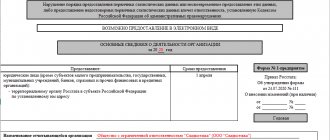

Latest changes in contract payment terms under 44-FZ

Such an important condition as the terms of payment for the contract under 44-FZ has been subject to changes since 2022. At that time, the period was 30 calendar days for any bidders other than SMP or SONKO. For the latter, it was reduced by half, that is, no more than 15 working days.

After the amendments made in 2022, the payment terms did not change, but a new condition appeared in the law. Now, if another legal act establishes deadlines that differ from 44-FZ, payment must be made in accordance with the norms of a special regulatory legal act. Therefore, customers are advised not to rush to include a standard payment phrase in the draft contract, but to study the regulations related to the subject of the agreement.

Explanations on the topic

| Main points | Document details | Download |

| In 44-FZ there are no exceptions to the payment period for purchases from a single supplier, which are specified in Part 15 of Art. 34 44-FZ | Letter of the Ministry of Finance No. 24-03-07/77518 dated November 16, 2017 |

About the author of this article

Polina GoltsovaLawyer My initial specialty was lawyer, legal consultant. For the first two years of practical activity, she worked in the general legal department of the organization, where she provided comprehensive legal support to the employer’s activities.

However, since 2013, government procurement has become the main focus of my practical activity. I worked in the contract services of several large budgetary institutions at the federal and regional levels and a commercial organization whose activities are related to government procurement. She was involved in legal support of government procurement, contractual and claims work, represented the interests of employers in arbitration courts and the Federal Antimonopoly Service.

For the last three years I have been creating legal content, writing popular articles on current issues of law enforcement for several information portals.

Other publications by the author

- 2022.03.04News and changesA bill on measures to support suppliers under sanctions was introduced to the State Duma

- 2022.03.03 State Defense Order The duties of the authorized bank accompanying transactions under the state defense order have changed

- 2022.03.03News and changesA sudden jump in prices will not protect against RNP: opinion of the courts

- 2022.02.28 Procurement control The Treasury explained the features of processing acceptance documents in electronic form