A sample letter to extend the deadline for submitting documents to the tax office will greatly simplify interaction with tax authorities. However, the document must be sent very quickly. According to existing regulations, the very next day after a request for documentation, a message of this type must be signed and sent to the tax service.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

When to provide

According to the Tax Code (namely paragraph 6 of Article 6.1 and paragraph 3 of Article 93), documentation must be provided:

- For on-site and desk checks – no later than 10 days.

- For counter verification – no later than 5 days.

It is also worth keeping in mind that if the requested papers are completely missing, then a message about this must be sent no later than 5 days from the date of the request. This is stated in paragraph 5 of article 93.1 of the Tax Code.

When to send a Notice

A notification must be sent to the inspectorate when the taxpayer requires a delay in the provision of documents (information).

There are different deadlines for providing documents for different reasons.

If documents are requested as part of a desk or field audit, the taxpayer must submit them within 10 working days from the date of receipt of the request (clause 3 of Article 93 of the Tax Code of the Russian Federation).

If the Federal Tax Service Inspectorate has requested documents as part of a “counter” check, then 5 working days are allotted for submitting documents from the date of receipt of the request. Information on a specific transaction must be submitted within 10 working days from the date of receipt of the request (Clause 5, Article 93.1 of the Tax Code of the Russian Federation).

The period begins to run on the day following the day the request is received and expires on the last day of the period. The date of receipt of the request is considered to be:

- date of delivery (when submitting the claim to the taxpayer in person);

- 6th working day from the date of sending the request by registered mail;

- the day following the day the document was posted in your personal account;

- the day the receipt of receipt of the claim is sent in electronic form when transmitted via TKS.

The notification must be submitted to the Federal Tax Service within the day following the day the request was received. This can be done in person, through a representative, or electronically. Those who are not required to report electronically may provide notice by mail.

In turn, inspectors must make a decision within two days: to extend the deadline for submitting the requested documents or to refuse it.

If you do not have time or cannot fulfill the requirement

If an organization or individual entrepreneur understands that it will not be possible to submit documents to the Federal Tax Service within the deadline (10 days), then a special notice must be submitted to the tax office to extend the deadline for submitting them.

At the same time, we will immediately say that there is no exhaustive list of reasons for the inability to submit documents. Therefore, please cite any circumstances that prevent the company from submitting documents on time. For example, vacation or sick leave for the chief accountant. You can also indicate the following as a reason for renewal:

- requesting a very large amount of information (it is impossible to quickly make all copies);

- the need for additional time to deliver documents from a branch of the organization;

- business trip of the general director.

Notification of the impossibility of submitting documents on time must be submitted to the Federal Tax Service within the day following the day of receipt of the request for their submission. Only in this case will they be able to satisfy him. If you are late, then most likely your request for an extension will not be considered.

Please keep in mind that the notification must indicate the exact date by which the taxpayer will deliver the documents to the Federal Tax Service.

Standard form

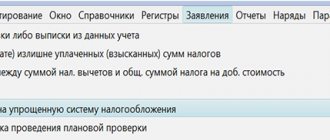

In order for the interaction to be most competently organized, Federal Tax Service Order No. ММВ-7-2\34 dated January 25, 2022 was issued for this case.

It has a special application in the form of a notification, that is, a letter. Only in this form will the Federal Tax Service pay any attention to the message.

The likelihood of a request made in a letter being granted will depend on the reason for the delay in providing the documents, as well as the reason why they are being delayed.

It is interesting that the same form is used if it is impossible to provide the requested documents in principle, in their absence.

What to do if you cannot provide documents

| Why are there no documents? | What need to do |

| Lost | Explain the circumstances surrounding the loss of documents |

| Not received (not compiled) | Describe in free form which documents were not received (not compiled) |

| Were transferred to an audit organization (individual auditor) | Provide information about the audit organization (individual auditor) |

| Were handed over to law enforcement agencies (seized by law enforcement agencies) | Provide the name and address of the law enforcement agency |

| Previously submitted to the tax authority | Indicate the name of the Federal Tax Service request file, tax return or other document with which you sent the requested documents. You also need to indicate the name of the file for the inventory of documents previously sent in response to a request or as an attachment to another document; date of receipt of the document (from the receipt) and file name of the document transmitted as an xml file or scanned image. |

| You are asking for a deferment | Specify the justification and duration of the deferment |

Attach scans of documents that confirm that the requested documents cannot be submitted on time. Compile and attach a list of documents requested in the request that cannot be provided, and a mandatory text description of each document.

What should be in the letter

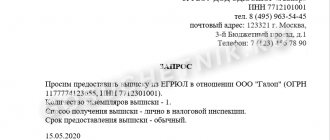

A letter to extend the deadline for providing documents is drawn up in the same way as any business correspondence. It must contain the details of the organization whose employees compose it. To do this, it is better to print on the company’s letterhead. If there is none, then at the very top of the page you must indicate the basic data: name, TIN, checkpoint.

It is also a mandatory requirement to indicate the full name of the Federal Tax Service, position, surname and initials of the employee of this institution to whom the letter is addressed.

In the provided sample document, these two points are in the upper right corner. First - to whom the message is intended, then - from whom. Indicating the details.

Please note that there is no need to indicate the full name of the head of the organization at the very beginning. To register a letter, the date and city are also placed in the header.

Body of the letter

In order to express the contents of the message as accurately and concisely as possible, it is necessary to indicate in the main text after the header:

- Requirements and his data, which came from the tax office. They include: its number, date of preparation and receipt. If necessary, you need to briefly retell the topic. For example: “In relation to the supplier.”

- Within what time period must documents be submitted to a specific division of the Federal Tax Service?

- A valid reason why the data cannot be provided within the specified time frame. For example, the sheer volume of documentation. Sometimes all the requested papers can amount to thousands of sheets, and the company has only a few accountants on staff, or the chief accountant has gone on sick leave (with sick leave provided). In short, the reason must be compelling and clearly stated. Only in this case does the chance of satisfying the request increase.

- Link to paragraph 5 of Article 93.1 of the Tax Code of the Russian Federation. It talks about the possibility in principle of such a postponement due to extraordinary reasons.

- Request for a deferment for an indefinite period of time. The shorter this period (subject to a good reason), the more favorably the tax authorities will react to the message.

- When all requested documents have been provided.

The letter ends with the signatures of the head of the organization and the chief accountant. Through this document you can show your readiness for constructive cooperation with the Federal Tax Service.

In order to increase the likelihood of a favorable attitude towards the request on the part of the Federal Tax Service, it is recommended to provide those documents that are still possible.

Letter of refusal to participate in the event

When writing a letter of refusal to participate in an event, use the guidelines above for a letter of refusal to cooperate. Everything in the letter is standard, but mandatory: information about the sender and addressee, then the appeal, the refusal itself with a mention of the received proposal to participate in the event and an obligatory indication of the circumstances that served as the reason for the negative response, then the signature and date.

Answer

According to existing laws, the Federal Tax Service inspector to whom the letter is addressed is obliged to respond to it within two working days. If no response is received (but there is evidence of receipt), then this is a reason for a claim on the part of the sender.

In general, time is a fundamentally important point when conducting tax audits. All documents must be provided within five days.

But it is worth considering that the answer will not necessarily satisfy the sender. The Federal Tax Service has the right to refuse a deferment, so there is a possibility that you will have to meet the originally stipulated deadlines.

Response to a tax claim

During inspections, the Federal Tax Service reveals quite a few violations, including those related to the payment of taxes. But there are often cases when the requirement is erroneous. An organization that received such a request, but at the same time paid taxes regularly, is bewildered. Of course, there is no need to pay a debt that does not exist.

But in such a situation, it will still be necessary to give an answer. In which you must indicate what you disagree with and the reasons. This must be supported by documents: receipts, account statements, notifications. In the letter, please indicate the list of attached documents. There is no need to describe everything in great detail, thereby lengthening the text. Everything must be to the point and with evidence. The answer can be sent by registered mail or delivered in person. Also, if the company has an electronic signature, it can be sent through your personal account on the website nalog.ru.

If, however, you have an arrears, then of course, upon receipt of the request, it must be paid within eight days from the date of receipt of the letter. Proof of payment must be attached to the response, which will indicate the amount of payment, for what period and details of the payment document.

Applications

In order to give specificity to the message, various documents may be attached to it explaining the reasons for the delay. They may be:

- Sick leaves.

- Copies of notifications.

- Extracts from the organization's regulations. For example, if the documents, according to it, are stored in one of the separate divisions of the company.

- Leave orders.

- Extracts from the staffing table, etc.

The attachments, of course, must correspond to those specified in the letter about extending the deadline for providing documentation for tax reasons. This is the only way to correctly prepare this document.

When a letter is written to provide information or documents

Request letters are intended to obtain additional information and documentation needed in life and business situations. They are addressed to:

- legislative and executive bodies of state power, their territorial divisions;

- business partners;

- counterparties;

- parent company and subordinate organization;

- subsidiary company;

- a separate division;

- corporate governance bodies;

- suppliers of goods, works and services to the population.

A letter of request is a document that has legal force, so it:

- must have all the necessary details;

- drawn up in accordance with state regulations, if addressed to government agencies.

IMPORTANT!

Using a request for information, you cannot obtain information containing someone else’s personal data, state or commercial secrets.

| What do government agencies ask for? | Commercial and consumer requests |

|

|

Some information is not disclosed. For example, when checking a counterparty, you will not be provided with all the requested documents, but they can be replaced.