Common types of leave and the current legislative framework

The following types of annual leave are distinguished:

- standard - 28 days (Article 115);

- extended - depend on age, position, specifics of work (for example, this category of vacationers includes military personnel, teachers, etc.);

- additional - in the presence of dangerous, harmful working conditions, etc. (Art. 116).

Vacation can be divided (Labor Code, RF, Art. 125), and in some situations, postponed or extended (Labor Code of the Russian Federation, Art. 124). The next paid leave, which falls on different months or reporting periods, is called rolling (hereinafter referred to as PO). Calculation, features of payment of software, calculation of personal income tax, insurance premiums on it, as well as the application of preferential deductions are carried out in accordance with the generally accepted rules of the Labor Code of the Russian Federation. Read also the article: → “The procedure for dividing vacation into parts, calculating payments.”

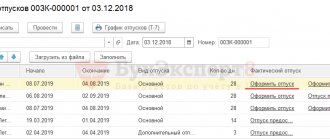

Preliminary preparation of the system

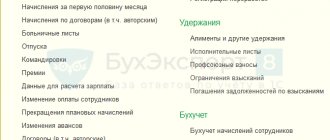

Initial setup is necessary for convenience when using personnel documentation and documents on accruals to employees. To do this, go to the section called “Administration” and click on the “Accounting Settings” hyperlink.

In the menu that opens, select “Salary Settings”.

Next, a settings window will be displayed, in it you need to note the intentions for maintaining personnel records and payroll records in the specified program. Also in the “Payroll calculation” submenu you should put o.

If you do not make this setting, then the interface will not be able to create appropriate documentation.

Some principles for accounting for rolling leave

Calculated insurance premiums (or premiums), as well as taxes and other fees, are included in expenses for the period in which they were credited. FSSO, PFR, FFOMS contributions are calculated and paid for the software. Insurance fees are most often not distributed between months. For example, if an employee went on vacation in June and returned in July 2017, then insurance payments for vacation pay are taken into account in June 2022. Expenses are fully reflected in the declaration for the second quarter of 2017.

However, if, for example, the vacation began in December of one year and ended in the month of another year, accounting is kept differently. Vacation money is an expense included in wages. These software amounts are distributed in proportion to vacation days. They need to be included as expenses every month.

When calculating the single tax, expenses take into account: the software itself minus personal income tax (on the date this amount is issued to the vacationer), the insurance fee for the software (on the day of deduction to the funds).

Under the simplified tax system (Income), the single tax is reduced by the amount of insurance premiums in the period when they were transferred to the fund. However, there is a limit of no more than 50%. Vacation pay themselves do not affect the single tax, because no expenses are taken into account under such a taxation object.

Under the simplified tax system (income - expenses), the obligated person has the right to reduce his income by the amount of expenses for wages. Vacation pay (and in relation to software) is considered an expense at the time of issue. As for insurance premiums, they also reduce the tax base when paying a single tax on the date of payment.

In practice, the vacation pay reserve can be calculated approximately

Unfortunately, it is almost impossible to accurately calculate the amount of the reserve for each employee. Firstly, this will require incredible effort from the accountant and will take a lot of time. Secondly, the amount of money that a person actually receives before the vacation will most likely differ from the reserve due to unplanned bonuses, sick leave, etc.

In our opinion, it is not at all necessary to create a reserve for each employee and strive at all costs to “guess” the exact amount of future vacation pay. It is enough to determine the approximate size of the reserve, and it is permissible to conduct analytics not by employees, but by departments, sectors, etc.

Example 2

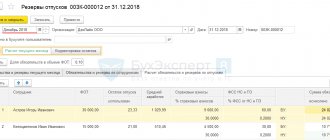

The accounting policy of a production organization stipulates that approximate values are included in the reserve for upcoming vacation pay expenses, and analytics are carried out by department.

The accounting policy also specifies the methodology by which the amounts forming the reserve are calculated. According to the methodology, at the end of each month, the accountant takes the department's payroll, divides it by the number of calendar days of the given month and multiplies by 2.33 days.

In January 2011, the wage fund of the assembly department amounted to 300,000 rubles.

The accountant created the posting:

DEBIT 20 CREDIT 96 - 22,548 rubles (300,000 rubles: 31 days * 2.33 days) - a reserve has been formed for upcoming expenses for vacation pay in the assembly department for January 2011

If it turns out that the actual amount of vacation pay exceeds the reserve, the debit balance on account 96 does not need to be shown. Instead, you should make two entries. The first - on the debit of account 96 and the credit of account 70 for the amount of the reserve. The second - by debiting the “cost” account and crediting account 70 for the excess amount.

If the actual amount of vacation pay is less than the reserve, then the difference does not need to be written off. In this case, there will be a credit balance on account 96, which will decrease as money is paid out for vacation. It will be necessary to reset the credit balance to zero only before closing or before reorganizing the company. To do this, the unspent reserve must be attributed to other income, that is, credited to account 91.

Benefits in the form of deductions applied during rolling leave

The software is subject to standard tax deductions for the vacationer and his children (Tax Code of the Russian Federation, Article 216). The only caveat is that this benefit applies only for one month, and not for both (that is, even when the vacation begins in one month and ends in another). This means that the deductions due to the vacationer are not distributed between months, but are recognized in the generally accepted manner for the current month. It is noteworthy that such benefits can be used both in vacation pay and wages.

| Deduction option | Conditions for providing benefits in the form of a deduction | Base |

| On your children | For each minor child, until the end of the year in which he turns 18; for full-time students up to 24 years of age | Tax Code of the Russian Federation, art. 218, clause 1, sub. 4; Letters of the Ministry of Finance No. 03-04-05/53291 dated October 22, 2014 and No. 03-04-05/8-1251 dated November 6, 2012 |

| To myself | The benefit is provided to participants and victims of the Chernobyl Nuclear Power Plant, participants and disabled people of the Second World War, former prisoners of concentration camps, heroes of the USSR and the Russian Federation, disabled people from childhood and groups 1 and 2, as well as other categories of persons specified in the Tax Code of the Russian Federation | Tax Code of the Russian Federation, art. 218 |

The legislation provides the opportunity for the hotel category of vacationers to receive a double deduction for their children (single parent, guardian, adoptive parent, etc.).

To exercise his right to a benefit, an employee must contact the employer (tax agent) with an application for the provision of this type of benefit and attach to it proper documentary evidence of the right to a deduction, such as: a copy of the certificate of a WWII veteran, a participant in the liquidation of the consequences of the Chernobyl nuclear power plant, etc.

Now “carryover” vacation pay cannot be attributed to RBP

Since 2011, the situation has changed radically, and there are two reasons for this.

The first is amendments to paragraph 65 of the Accounting Regulations**. According to them, costs related to future periods must be written off in the manner established for writing off the value of assets of this type. From this we can conclude that account 97 is not intended for all values without exception that cannot be included in current expenses. In particular, “carrying over” vacation pay should not be included in the RBP.

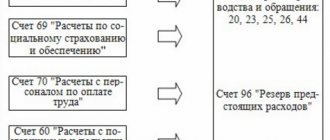

The second reason is the appearance of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”. Based on its content, vacation pay that has not yet been accrued, but which is likely to be issued this year, represents an estimated liability. And it must be reflected in accounting as a reserve for future expenses. This accounting scheme does not imply that account 97 is somehow involved in recording vacation pay. (For more information about PBU 8/2010 and its application, see “When and how to apply the new PBU on contingent and estimated liabilities and contingent assets”).

The procedure for calculating the amount due and issuing money to the vacationer

Calculation of annual paid leave (and rolling over) is carried out taking into account the requirements of Government Decree of the Russian Federation No. 922 dated December 24, 2007. Vacation payment is made in advance. Regardless of when the period begins and ends, the employer must pay the amount due to the employee three days before the start of the vacation (Labor Code of the Russian Federation, Article 136, Part 9). In the month when the money was issued, personal income tax is calculated from it.

Calculation is made according to the formula: PO = GD / 12 (months) / 29.4 (days) * BH, where PO is rolling leave, GD is annual income, BH is the number of days of vacation. The billing period is the previous 12 calendar months (Government Decree No. 922 12/24/2007, clause 4). Calendar month is the period from the first to the last day of the month.

For example, a citizen of the Russian Federation has worked for 2 years and goes on another paid leave from August 21, 2022 for 14 calendar days. The vacation is rolling: it starts in August and ends in September. The employer is obliged to calculate and pay the amount due 3 days before 08/21/2017 (before the start of the program). The employee did not have sick leaves, swearing. assistance, bonuses and allowances were not accrued; the billing period was fully exhausted.

| Data for calculation | Sequential software counting | Calculation results |

| Salary 23,000 rub. for the previous 12 months; number of vacation days - 14; multiplier of the average number of days worked - 29.4 | Annual income: 23,000 * 12 = 276,000 rubles; PO without calculating personal income tax according to the formula GD/ 12/29.4* BH: 276,000/12/29.4 * 14 = 10,952 rubles; Personal income tax on vacation pay, formula - PO * 13%: 10952 * 13 / 100 = 1,424 rubles; Amount of software to be paid minus personal income tax (13%): 10952 - 1424 = 9,528 rubles. | Annual income - 276 rubles; Software - 10,962 rubles; Personal income tax - 1424 rubles. Payable - RUB 9,528. |

Based on the calculation results, the software is issued (9,528 rubles) three days before 08/21/2017, and the tax on personal income is transferred no later than 08/31/2017.

Results

To account for vacation, entries are generated that are similar to accounting for an employee’s salary. By debit, vacation pay is displayed as an expense, and by credit - on the account of settlements with employees for salaries. But if the company is large and makes monthly contributions to the reserve for vacation pay, then the vacation accounting algorithm is different.

Be the first to know about legislative changes in the calculation of vacation with our “Vacation and Rest Time” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Standard 6-NDFL and display of software in it

6-NDFL is a model standard approved by Order of the Federal Tax Service N MMV-7-11/ [email protected] dated 10/14/2015. Valid since 2016, applied by all tax agents every quarter. The current form 6-NDFL consists of 2 sections. The first includes the latest income and personal income tax data for the organization as a whole. The second section contains detailed information on each individual transaction that appears when withholding income tax.

Carrying holiday pay is displayed in accordance with uniform rules, i.e. depending on the date of their payment and taking into account the deadline for payment of personal income tax. The deadline for making tax payments is the last day of the month. Therefore, in the appropriate column 6-NDFL, the date of the last working day of the month in which vacation pay was paid is entered. If the deadline falls on a weekend, then the first working day of the next month is entered in the form.

An example of reflecting rolling leave in 6-NDFL

Example 1. Deadline for transferring personal income tax from the rolling leave of employee P.N. Leonidova.

Vacation P.N. Leonidova lasts from 07/11/2017 to 08/3/2017. It starts in July and ends in August, which means it is a rolling vacation. The organization paid its employee the money for the software on time - 07/10/2017 (no later than 3 days before the start of the vacation period).

Tax deductions depend on the actual date of payment of money, i.e. taking into account the date 07/10/2017. From the above it follows that the deadline for transferring personal income tax from employee P.N. Leonidov’s vacation pay in this case will be on the deadline of July - 07/31/2017, Monday, working day.

Example 2. Calculation of income tax for individuals with two employees and display of the appropriate amounts in 6-NDFL

The accounting department of Vasilek LLC paid vacation money to its employees I.A. Romashova (06/14/2017 - 23,000 rubles) and T.P. Lorina (06/30/2017 - 13,000 rubles) in June 2022. The tax calculation for the income of individuals (13% rate) is as follows:

- From vacation pay of employee I.A. Romashova: 23,000 * 13% = 2,990 rubles;

- From the vacation pay of employee T.P. Lorina: 13,000 * 13% = 1,690 rubles.

The tax was transferred in a single payment for both employees on June 30, 2017. Vacationers received money in their hands minus personal income tax. Standard 6-NDFL (six-year period) is filled out like this. The first section: information about vacations is entered in columns 020, 040, 070. In the second section, columns 100-140 are filled in:

- 100 14.06.17 130 23000;

- 110 14.06.17 140 2990;

- 120 30.06.17

- 100 30.06.17 130 13000;

- 110 30.06.17 140 1690;

- 120 30.06.17.

What to do if a vacation pay reserve was not formed in 2011

During this year, not all organizations formed a reserve for upcoming vacation pay expenses. To correct the situation, such companies will have to create a reserve as of December 31.

The amount of the reserve will be equal (or approximately equal) to the amount of vacation pay based on rest days earned but not used by all employees. In other words, this is a certain equivalent of the compensation that the employer would have to pay if all employees quit starting next year.

In conclusion, we would like to add that the Russian Ministry of Finance plans to approve a new accounting standard for personnel remuneration. The draft of this document also provides for the creation of reserves for vacation pay. Thus, the above rules for accounting for vacation pay will most likely not be canceled in the near future.

* The chart of accounts for the financial and economic activities of organizations and instructions for its application were approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

** Regulations on maintaining accounting records and financial statements in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).