A payment order is a document from the account owner that tells the bank where and how much money needs to be transferred. The transaction is carried out on the basis of this document. If previously payment orders existed only in paper form, now, with the development of online payments, there are also electronic versions of the document.

A payment order to the bank is issued when an individual entrepreneur or legal entity performs a transaction from its current account. This can be settlements with any counterparties, transfers to individuals, sending budget payments - anything.

What is a payment order

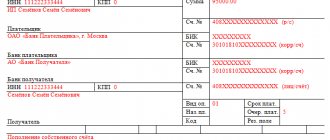

This is a document of the established form, the content of which is regulated by law, namely, Bank of Russia Regulation No. 762-P On the rules for making transfers. What does the payment order contain:

- order number, date of its preparation;

- type of payment and its amount in words and figures;

- the name of the payer, his account number and the name of the servicing bank;

- recipient's details: bank, BIC, account number, recipient's name;

- type of operation;

- payment deadline and priority;

- purpose of payment. For example, you can indicate that this is payment for delivery to such and such an agreement;

- signatures and seals of the payer and recipient;

- bank notes: receipt, date of placement in the file cabinet, order number and date, information about partial payment, etc.

Today, entrepreneurs more often issue payment orders online in Internet banking or in accounting programs. All you have to do is enter the data, and the system will create the document itself. All that remains is to sign it with an electronic signature.

If a standard paper payment order is drawn up, it is printed in triplicate. One is kept in the sending bank, the second in the receiving bank, the third is also sent to the receiving bank, but is returned back with a mark of execution. There may be more copies, it all depends on the situation.

How long is a payment order valid?

The payment order is valid for 10 days. This period is determined according to the following rules:

- The validity period is calculated in calendar days, that is, it includes weekends and holidays;

- The countdown starts from the day following the date indicated in the payment order.

This procedure is determined by the Regulations on the rules for transferring funds, which was approved by the Bank of Russia No. 383-P dated June 19, 2012.

This means that the organization does not need to send the payment order to the bank immediately after it is drawn up. She has the opportunity to do this within the above 10 days. But at the same time, you need to take into account that if the 10th day falls on a weekend or holiday, it will not be transferred to the next working day and, accordingly, the document must be sent earlier.

The company can also send the order to the bank immediately on the day it is drawn up. Even though it is not included in the validity period.

If the payment order is overdue, the bank will refuse to accept it.

If an expired document is identified, there are two options for solving the problem:

- Correct the order date. But this method is only possible if the next payment orders have a date of preparation that has not yet passed 10 days, or are missing altogether. Otherwise, there will be a discrepancy in the numbering of documents, which may raise questions during verification.

- Leave the financial document unexecuted and make a duplicate of it with a different date. Put a mark on the document that the validity period has expired, this will serve as an excuse for verification.

The entire order should be withdrawn only when the number assigned to it can be entered into another document.

FAQ

What happens if there is no money in the account?

If, when sending a transfer, it turns out that there are not enough funds in the client’s account, the payment order is placed in a queue. As soon as the required amount of money appears in the account, the transfer will be executed.

How to send a payment order to Alfa-Bank?

It is created in the Alfa-Bank client account - the “Payment” section. The payment order is created using a template; you need to fill in the fields provided by the system. The completed order is signed with a code sent to the client’s phone. Then click the “Send to bank” button.

Is it possible to make a deferred payment?

You can create a payment order at the bank today and select a different date for its execution. But no more than 10 days after creation.

Is it possible to revoke a payment?

Each bank approaches the issue individually. If the payment is being processed, in queue, that is, for execution, it can be canceled through banking or by contacting the bank.

How to issue a payment order online?

It can be generated and sent through the Internet banking of the servicing bank or through the online accounting service. A client's electronic signature may be required.

Sources:

- Banki.ru: Payment order.

- Tinkoff Magazine: How to fill out a payment order.

- Consultant Plus: Bank of Russia Regulations dated June 29, 2021 N 762-P “On the rules for transferring funds.”

- Wikipedia: Payment order in Russia.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Execution period

In order to understand how a credit institution fulfills clients’ requests for financial transfers, you need to know the differences between:

- The established deadline for execution of the payment order.

- The period during which such an order is valid.

So, the deadline for executing a payment order is the time during which the payer’s funds are transferred. This period is determined by Article 31 of the Federal Law of 1990 “On Banks and Banking Activities”.

Also see “Rules for putting the date of a document in a payment order (field 109).”

The credit institution executes the order no later than one business day after the day it was received. Moreover, the bank determines the length of the operating day independently. If the order is not executed on time, the bank is obliged to pay interest.

Please note that this period does not coincide with the time period during which the order is valid. This time is determined based on other legislative norms, which we will consider further.

Please note that the time for execution of tax orders is also regulated by separate rules. According to Article 60 of the Tax Code of the Russian Federation, such a payment must be made within one business day. But if it is untimely, Articles 133 of the Tax Code of the Russian Federation and 15.8 of the Code of Administrative Offenses of the Russian Federation come into force. And the responsibility for them is completely different than just paying interest.

Having received a client request, the bank takes the following actions:

- approves the sender's right to use funds;

- analyzes the integrity of the payment order;

- analyzes the correctness of payment details;

- determines whether there are enough funds in the account to make the transfer.

If the transfer has not yet arrived at the account - that is, the irrevocability period has not expired - the payer has the right to cancel the order.

Also see “Filling out a payment order in 2022: sample.”

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Central Bank Instruction 2-P

Until 2012, all operations related to non-cash payments in the Russian Federation were regulated by Regulations of the Central Bank of the Russian Federation No. 2-P dated October 3, 2002 “Regulations on non-cash payments in the Russian Federation.” Since the release of a number of documents, namely Regulation No. 383-P On the rules for transferring funds dated June 19, 2012, Regulations on the payment system of the Bank of Russia No. 384-P dated June 29, 2016. Regulation No. 2-P gradually lost its significance. July 21, 2012 Regulation No. 2-P was finally abolished.

How to issue a payment order

The payer completes the PP independently, indicating the necessary data in the columns. At the same time, the design of paper and electronic versions differs significantly. Filling it out on paper takes a lot of time and effort. Previously, PP forms stood on counters at the bank, and some clients stood in line with the tellers while others copied payment documents.

What and how to fill out:

- The payment number is indicated by numbers from 1 to 6 (for example, No. 222111);

- Date in numeric format with dots (for example, 09/19/2019);

- The type of payment is indicated by a code (for example, code 1 means urgency)

- The amount is entered in numbers in the ruble-kopeck format (23500-25) and in words with a capital letter, kopecks - in numbers (Twenty-three thousand five hundred rubles 25 kopecks);

- Name of the payer (for example, Moscow Windows OJSC, Individual Entrepreneur Sidor Sidorovich Kozlov);

- Address next to the payer's name. For legal entities this is the location of the company, for individuals it is the place of registration;

- Account numbers of the payer and sender (20 digits);

- Purpose of payment (for example, payment for design services according to agreement No. 123);

- The presence or absence of VAT (for example, without VAT);

- TIN (individual taxpayer number);

- Correspondent account numbers of the sender and recipient;

- Payer's bank - name and full address;

- BIC - bank identification code (9 digits);

- Signature stamp.

Under the payment slip, the operator puts the bank's stamp and the date of payment. When registering, data must be entered without errors or corrections (especially when indicating accounts and amounts). Payment documents refer to strict reporting forms. If two errors are made, the document will not be accepted.

When to use a payment order

For money transfers between counterparties, non-cash payments are used.

In order to transfer funds to a counterparty, the account holder is required to notify the bank of his intention by providing it with a payment order (hereinafter referred to as the PP). With its help, the bank is given an order to transfer money using the specified details. The procedure for settlements by payment orders is strictly regulated by Art. 863 of the Civil Code of the Russian Federation. The form has a unified form under number 0401060.

See also “Sample of filling out a payment order”.

Regarding the processing time of payment orders, credit organizations and the Central Bank of the Russian Federation distinguish the following types of terms:

- payment deadline;

- the deadline for executing an order transaction.

Bank payers sometimes confuse these terms. But it is important to know that they are not related to each other.

Payment order validity period

Payment order is an instruction related to the transfer of financial resources between citizens or commercial entities. It is issued by the owner of the current account to the banking organization.

All relationships formed between the client side and the bank require mandatory documentation . If it is necessary to transfer funds from an account, the client sends a special order to the service organization, and filling is carried out on the basis of the current instructions.

Nuances of transferring funds

You can carry out a set of measures to transfer money based on the PP:

- in the form of settlement transactions for commodity items and services;

- in the form of full prepayment or partial advance;

- in order to compensate for accounts payable arising in fact.

You can also act on the basis of calculations associated with non-commodity transactions. These are the following directions :

- payment contributions to the budget and extra-budgetary funds;

- settlement activities for bank loans;

- payment of penalties and fines.

Details for registration

In the process of generating this document, it is necessary to fill out a number of details :

- document number and date;

- its current status in terms of urgency;

- monetary value to be transferred;

- signature confirming the currency units of payment;

- payer information;

- the number value of its balance;

- name of the paying company and code;

- name of the recipient bank with code;

- information about the beneficiary;

- materials related to the purpose of payment;

- account number of the payer and recipient of the amount;

- priority for payment transactions;

- signatures belonging to official parties.

If necessary, additional information may be required about the banking organization that is the correspondent, the specifics of payment of commissions, and other expenses.

Number of copies of payment order

To provide documentation to the bank, you need to fill out a payment order in four copies :

- one remains in the banking organization and acts as the basis for writing off money from the client account;

- the other is the direct basis for the purpose of crediting funds to the recipient’s bank balance;

- the third goes to the beneficiary as confirmation of the receipt of money on his account balance;

- the fourth will be returned with a note that the payment has been completed.

The bank accepts payment orders for execution regardless of the presence of money on the PC.

How long is the validity period of a payment order?

To understand how a credit institution fulfills client requirements, it is necessary to distinguish between the established deadline for execution and the time period during which the document is considered valid.

The first parameter represents the time period for which funds are transferred. It is defined within the framework of Federal Law No. 395-1 “On Banks and Banking Activities” of 1990.

On the part of the bank, the execution of the order is carried out no later than one business day from the moment of receipt, while the duration is subject to independent determination . If the order is not executed on time, the financial institution pays interest.

Please also take into account the fact that the time interval for the execution of orders for taxes and fees is also subject to regulation and regulation through separate rules. In accordance with Art. 60 of the Tax Code of the Russian Federation, such a payment must be made within one business day.

But if it does not pass on time, then other articles come into play. In particular, this is Art. 133 of the Tax Code of the Russian Federation and Art. 15.8 Code of Administrative Offenses of the Russian Federation. The level of liability for them will differ from the classical payment of interest.

After receiving a request from a client, the financial institution takes the following actions :

- approval of senders' rights to use financial resources;

- analysis of the integrity of orders related to payment;

- assessing the correctness of the details;

- determining the degree of sufficiency of funds in the account to carry out transfer actions.

If the transfer has not yet arrived at the account, i.e. the period has not expired, the payer has the right to cancel the order . This can be done in just a few steps by contacting the banking organization in person.

Case Study

Now it’s worth familiarizing yourself with the time interval during which the payment order associated with the transfer of funds is valid. According to clause 5.5 of the Rules for the transfer of funds approved by the Central Bank on June 19, 2012, the validity period of the payment order is 10 calendar days .

But the concepts of working day and calendar day should not be confused. Now it remains to consider the principle of operation of this system using a specific practical example.

Let's assume that the payment order was generated on May 15, 2022. To determine the time of its validity, you need to count 10 days; this process begins on May 16, 2022. The desired date in this case is May 25 of the same annual period.

This suggests the conclusion that the presentation of an order to a credit institution can be carried out no later than May 25, 2022 inclusive. If you present this document a little later, there is a risk that the financial and credit institution will refuse to execute it due to the expiration of the operational period.

Knowing the nuance that the payment order is valid for 10 days , it will be quite easy and simple for the payer to make calculations based on the date of presentation of this document to the credit institution. Therefore, taking into account the permissible period, it is possible to competently plan your own time and visit the bank on any day, and not immediately after the payment order is drawn up. This provides the service user with additional convenience and comfort during transactions.

Thus, the valid period of operation of a payment order currently, in accordance with the norms of current legislation, is 10 days . Calculation begins immediately after the document is generated and submitted to the required address.

The law establishes several key requirements that the document must comply with. If these norms are neglected, there is a possibility of refusal to provide banking services. Although in practice this phenomenon occurs quite rarely.

A tutorial on how to fill out a payment order is presented below.

What happens if the payment is late?

The bank simply will not accept it, and you will need to either change the date of the order or draw up a new document.

The first option is ideal if there were no others after the late payment. Then the chronology will not go astray. If a document whose submission deadline to the bank has passed has already been executed by the bank, we recommend leaving this document unexecuted and drawing up a new one. If necessary, the presence of an unrecorded document can easily be explained by the expiration of its validity period.

Settlements using payment orders

The scheme for settlements by payment orders in paper form is as follows:

- First, the buyer - payer of funds provides his bank with a payment order in four (or five) copies and receives a fourth copy from the bank as a bank receipt;

- Next, the buyer’s bank, based on the first copy of the payment order, withdraws funds from the buyer’s account;

- After this, the bank servicing the buyer sends two copies of the payment order and funds in the amount specified in the payment order to the seller’s bank;

- Then the seller’s bank, having received the second copy of the payment order, credits the funds to the account of the seller - the recipient of the funds;

- Finally, after settlement transactions, the buyer’s and seller’s banks issue their clients with statements from current accounts confirming the transfer of funds by the buyer, the payer of the funds, and the receipt of funds by the seller, the recipient of the funds.

Deadline for execution of the order by the bank

When transferring funds, it is important to take into account the deadline for executing the payment order. According to Art. 31 of the Law “On Banks and Banking Activities” dated December 2, 1990 No. 395-1, the credit institution is obliged to credit funds to the account specified in the payment order no later than the business day following the day of receipt of the form from the client, unless the law provides for other situations. These include transferring money between banks within our country or international transfers. In such cases, crediting funds may take up to 3–7 days. Intrabank transfers are made within one day.

IMPORTANT! The credit institution reserves the right to independently determine the length of the operating day.

There are two ways to instruct the bank to transfer money:

- personally provide the payment;

- send the order to the bank electronically.

If you don’t have enough time to visit the bank in person, then electronic resources become a serious help. Online banks help clients fill out details and provide indispensable tips.

See also “How to upload a payment order from 1C to a client bank.”

After receiving the payment, the bank checks the correctness of filling out the form and analyzes the balance of funds in the client’s account from which the transfer was requested. If the required amount is available, the bank executes the order.

IMPORTANT! Until the transfer is made, the account owner has the right to refuse the transfer by canceling the order.

What is the maximum period

When talking about the maximum period of a payment order, you need to take into account the validity period of the document, that is, ten days from the day following the date of preparation.

That is, you can submit a payment to the bank on the tenth day and the bank is obliged to accept it. As for the maximum period for executing the document, the bank is obliged to execute the transfer of funds no later than the second business day from the date of receipt.

Provided that there is a sufficient amount in the payer’s account. When accepting a payment order, the bank enters the deadline for receipt of the document in field 62. Field 71 indicates the date of debiting funds from the client’s account.

Photo: sample payment order

What happens to late payments? First of all, it is worth understanding what an expired payment order is. When creating a payment order, the date of its creation is indicated.

It is from this moment that the period of validity of the document begins to count, during which you can submit an order to the bank.

If the deadline is violated, the bank simply will not accept the document. You will need to change the date or make a new payment.

Details for generating a payment order

When generating a payment document, it is mandatory to fill in the following details:

- date and payment number;

- document urgency status;

- the amount of money to be transferred;

- currency unit of payment;

- information about the payer;

- balance number;

- payer's company name, code;

- name of the receiving bank, code;

- beneficiary information;

- information about the purpose of payment;

- account number of the payer, payee;

- order of payment transactions;

- signature of the official.

If necessary, you may additionally need to provide information about the correspondent bank, the specifics of paying commissions and other expenses . The bank, for its part, also puts a mark confirming the fact of the payment. Corrections, erasures and blank fields in a payment order are not acceptable; the bank will not accept such a document.