The dismissal of an employee, according to the Labor Code of the Russian Federation (Article 140), is accompanied by a full settlement with him. All amounts due must be paid on the date of termination. However, there are always many questions regarding bonus payments. At the time of dismissal, the amount of the bonus may not yet be determined. How to calculate dismissal pay in this case? Is it necessary to pay a bonus to an employee who no longer intends to work for the organization? A bonus is an incentive payment. Does it make sense to use it in this case? How to avoid breaking the law and sanctions from regulatory authorities?

Question: Is it legal to include in the organization’s remuneration regulations a condition that employees who quit voluntarily receive a bonus for the current period at the discretion of the manager? View answer

General issues of bonuses for resigning employees

Forms of remuneration in an organization, the system of this payment (SOT) can include not only payments for the performance of their duties by employees, but also be of an incentive, bonus nature. The payment of bonuses is regulated by all-Russian legislation and local regulations relating to labor relations (LRA).

The Labor Code does not consider bonus issues in detail, indicating only that in the event of controversial situations, the employer must pay the employee an undisputed amount. To avoid problematic issues, bonuses and their payment are described in detail in the organization’s regulatory documents. The procedure for calculating and paying bonuses in the organization is prescribed:

- in a collective agreement;

- in the employment contract (agreement) with the employee;

- in the Regulations on remuneration;

- in orders and regulations on individual bonuses for individual employees.

It is advisable to reflect the bonus payment procedure in the individual agreement of the parties, while at the same time specifying detailed conditions for such payments in the collective agreement or Regulations.

All bonus amounts due to the employee according to regulatory documents must be paid upon his dismissal. The amounts of accrued bonuses are included in the amount of dismissal payments (for example, compensation for unused vacation), in accordance with the current government Decree No. 922 of 12/24/07 on average earnings. According to Federal Law No. 272 and subsequent clarifications of the Ministry of Labor (see Letter No. 14-1/B-800 dated 08/23/16), payment of bonuses must be completed no later than the 15th day after the period for which it was accrued, and LNA must contain appropriate wording regarding deadlines.

How to arrange payment of a bonus to an employee after his dismissal ?

Bonus for a deceased employee

Special case - an employee died. What does labor legislation say about the payment of the due bonus?

Again, you will have to divide bonuses depending on whether they are included in wages or are an incentive. Bonuses of the first type, as well as wages unpaid by the day of death of the employee, fall under Article 141 of the Labor Code of the Russian Federation. These payments must be made to his family members or dependents upon their application. A bonus due to a deceased employee based on the results of his work and accrued after his death can also be transferred to relatives.

As for incentives, the issue of their payment is regulated by the agreement and internal regulations . In order for the employer to have grounds to pay the bonus of a deceased employee to his relatives, it is enough to state in the Regulations on Bonuses that this incentive is also due to those employees with whom the employment contract was terminated at the time of accrual. Indeed, according to Article 83 of the Labor Code of the Russian Federation, death is an unconditional basis for termination of the contract.

Taxes and fees

Let us remind you that personal income tax is calculated on the date of receipt of income, and withheld on the date of actual payment. But on the date of payment, the employee died, therefore, the employer has no obligation to withhold personal income tax.

We mentioned earlier that an agent should withhold personal income tax from the income of not only those persons with whom he has an employment contract. Does this mean that tax should be withheld from payments to a relative of a deceased employee? No, since these amounts are paid by inheritance . And in accordance with paragraph 18 of Article 217 of the Tax Code of the Russian Federation, such payments are exempt from personal income tax.

Insurance premiums from the payment of bonuses to the relatives of a deceased employee are also not calculated, because this would be contrary to logic. The purpose of social insurance is to financially support the employee in the event of an insured event. A deceased person will no longer be able to use this insurance, therefore, no premiums will be charged. This is the point of view of officials (letter of the Federal Social Insurance Fund of the Russian Federation dated 04.14.15 No. 02-09-11/06-5250, letter of the Ministry of Labor dated 02.20.13 No. 17-3/292).

In addition, there is a letter from the Ministry of Finance dated April 24, 2017 No. 03-15-06/24374, which states that payments to the relatives of a deceased employee are not made within the framework of labor relations . Therefore, there is no need to charge insurance premiums from them.

Premium accounting

Accounting for bonuses to a dismissed employee is kept in the accounts for wages, other payments and those corresponding to them. The bonus is calculated on the debit of production and similar accounts: D 20, 23, 25, 26, 44, etc. K 70.76 . Payment is made in the usual manner, through a cashier or bank: D 70, 76 K 50.51 .

Annual and quarterly bonuses are subject to personal income tax (Article 208-1 of the Tax Code of the Russian Federation) and are reflected by the posting: Dt 70, 76 Kt 68/NDFL .

On a note! There is Art. 217-7 of the Tax Code of the Russian Federation, which contains a mention of non-taxable bonuses (for example, for outstanding achievements in science or cultural activities), in addition, bonuses of 4,000 rubles or less specified in Art. 217-28 Tax Code of the Russian Federation.

The inclusion of bonus payments not specified in the LNA in the calculation of income tax to reduce the base is illegal (Article 270-21 of the Tax Code of the Russian Federation). Premiums are subject to insurance charges, according to Art. 420 Tax Code of the Russian Federation, Art. 20.1-1 Federal Law No. 125 dated July 24, 1998. Costs for them are recorded as standard: Dt 20, 23, etc. K69 (according to accounting subaccounts) .

Accounting for annual bonuses in average earnings

When calculating compensation upon dismissal, the average earnings include the annual bonus for the year preceding the payment upon dismissal (clause 15 of the Regulations, approved by Resolution on the specifics of calculating average earnings No. 922 of December 24, 2007). The date of accrual of the bonus does not matter, i.e. if the compensation is paid, but the bonus for the past year was accrued later, then the vacation compensation must be recalculated.

Example. Additional accrual of vacation compensation upon dismissal

The employee left his job on February 15, 2016. He did not use 32 days of vacation. The calculation period for calculating average earnings was from February 1, 2015 to January 31, 2016. During this time, the employee’s salary was 27,500 rubles. per month. No other accruals were made. The period has been fully completed.

The accountant calculated compensation for unused vacation:

27,500 * 12 = 330,000 rub. — income for the period;

330,000 / 12 / 29.3 = 938.57 rubles. — average earnings per day;

938.57 * 32 = 30,034.24 rub. — vacation compensation upon dismissal.

The employee was awarded an annual bonus for 2015 on February 20, 2016 in the amount of RUR 14,000. In this regard, the accountant adjusted the calculation of compensation upon dismissal:

330,000 + 14,000 = 344,000 rubles;

344,000 / 12 / 29.3 = 978.38 rubles;

978.38 * 32 = 31,308.16 rubles. — compensation for vacation taking into account the annual bonus;

31,308.16 – 30,034.24 = 1,273.92—additional amount of compensation.

You will not have to recalculate if you accrue the annual incentive on December 31 of the current year.

The employee quits, and the amount of the bonus has not yet been determined

If the size of the bonus is known at the time of dismissal, the accounting accountant does not have any problems; he includes it in the calculation of dismissal amounts. If the amount of bonuses is not determined at the time of dismissal, you should recalculate later and adjust the amount due to the former employee. It is obligatory to make an additional payment, recording its receipt by the employee in any legal way. Otherwise, there is a high probability of going to court. The timing of payment of bonuses to employees after their dismissal must be prescribed by the LNA (Article 8 of the Labor Code of the Russian Federation) - Regulations on Labor Protection, bonuses, etc. The specified position is contained in Letters of the Ministry of Finance, for example, No. 03-03-04/1/294 dated 25-10 -05, recommendations of Razgulin S.V., state adviser 3rd class, arbitration judicial practice.

How is a bonus paid to an employee after dismissal taxed ?

Payment of bonus after dismissal of an employee

Let's start with the personnel side of the issue.

The procedure for paying bonuses to employees whose employment contract was terminated at the time of accrual (transfer) of incentives is not regulated in any way by law. It is clear that if this bonus is part of the salary, then the rules of Article 140 of the Labor Code of the Russian Federation apply. It states that all amounts due to the employee must be paid on the day of his dismissal. This means that even before the employee’s dismissal day, it is necessary to decide on the accrual of a bonus to him, which is part of his salary. And if the employee has earned this bonus, then it must be paid on the day of dismissal. That is why, in relation to bonuses “tied” to certain criteria that cannot be determined before the end of the month, it is recommended to establish in the local act of the organization (for example, in the bonus regulations) the condition that in order to receive such a payment a person must work for a full month.

Although in some cases this does not provide an absolute guarantee that the company will be able to timely transfer the bonus to the resigning employee. For example, a problem may arise if certain general corporate indicators for the past month are needed to calculate the bonus, and the employee quits in the first days of the next month. No exceptions for this situation are made in Article 140 of the Labor Code of the Russian Federation. Therefore, the employer is obliged to ensure the timely receipt of the data necessary to calculate the bonus, which forms part of the resigning employee’s salary.

Calculate advance and salary taking into account all current indicators

If for one reason or another it is not possible to collect this data by the date of dismissal, the incentive must still be paid, albeit late (appellate ruling of the Khabarovsk Regional Court dated 07/09/14 No. 33-4342/2014, ruling of the Primorsky Regional Court dated 10.03. 15 No. 33-1928). In this case, interest will have to be calculated on the amount due to the employee based on the key rate of the Bank of Russia (Article 236 of the Labor Code of the Russian Federation). In addition, revealing the fact of payment of a bonus after the date of dismissal may become the basis for a fine under Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Thus, when introducing a monthly bonus in a company, which is part of the salary, you need to think in advance about the procedure for calculating bonuses for dismissed employees, so as not to become a “reluctant violator.”

Now let’s move on to bonuses and incentives (for information about what payments qualify as such bonuses and how to arrange them correctly, see “We reward employees correctly: how to issue bonuses in an organization”). Most often, it happens that on the date of dismissal of the employee, the head of the company has not yet made a decision on such a bonus, and moreover, it is not known whether it will be made at all. For example, an employee quits at the beginning of January, and in February an order is issued to pay bonuses for the past year (when the person was still working for the company).

Obviously, in this case, the norm of Article 140 of the Labor Code of the Russian Federation on the payment of amounts due to the employee on the day of dismissal does not apply. The procedure for paying bonuses and incentives after dismissal of employees is regulated exclusively by the provisions of employment contracts and local acts of the organization.

Compose HR documents using ready-made templates for free

And if, on the basis of the specified documents, such a bonus is paid, including to those employees with whom the employment contract at the time of its accrual (payment) was terminated, the employer is obliged to transfer this bonus. This conclusion is confirmed by judicial practice (appeal ruling of the Moscow City Court dated 05/18/15 No. 33-14529/2015, ruling of the Primorsky Regional Court dated 01/14/15 No. 33-319, appeal ruling of the Perm Regional Court dated 11/18/13 No. 33-10685/2013).

In conclusion of this chapter, we will dwell on the issues of taxation of production bonuses paid after dismissal, and the calculation of insurance premiums on these amounts (also see “Taxes on bonuses: we charge personal income tax and contributions, take them into account in expenses, and reflect them in reporting”).

Regardless of the type of bonus payment (a bonus as part of a salary or an incentive bonus), it is a payment made within the framework of an employment relationship. This means that it is recognized as subject to insurance premiums (subclause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases "). This position is shared by officials of the Russian Ministry of Labor (letter dated 09/02/13 No. 17-3/1450, see “The Ministry of Labor announced whether it is necessary to charge insurance premiums for remuneration paid to resigned employees”) and the Russian Ministry of Finance (letter dated 11/16/16 No. 03- 04-12/67082, see “Ministry of Finance: clarifications of the Ministry of Labor on the procedure for paying insurance premiums will be relevant in 2022”).

Production bonuses, including those paid to dismissed employees, can be taken into account as part of labor costs both under the general taxation system and under the simplified tax system (clause 2 of article 255 of the Tax Code of the Russian Federation, subclause 6, clause 1 and clause 2 Article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 25, 2005 No. 03-03-04/1/294).

And finally, when transferring any type of bonuses after the dismissal of an employee, personal income tax must be withheld. The fact is that Article 226 of the Tax Code of the Russian Federation does not in any way connect the performance of the duties of a tax agent with the presence or absence of an employment contract with the individual in whose favor the income is paid.

Calculate salary, contributions and personal income tax in the web service

Mistakes and Consequences

Errors that arise during the calculation of bonuses can be divided into 3 categories:

- arithmetic;

- arising as a result of incorrect application of established calculation rules;

- relating to tax accounting.

The latter have already been discussed: they arise, for example, if a premium that is not legally fixed is included in the calculation of the income tax base in order to reduce it. Such actions are considered by the Federal Tax Service as a reason to apply fines and sanctions when checking payments.

Accounting errors lead to incorrect payment of funds to the former employee during settlement. An underestimated amount of the bonus can be recalculated and an additional payment made, while an overestimated amount of the bonus paid represents a problem for the organization, since it can be resolved in court. According to Art. 137 of the Labor Code of the Russian Federation, the overpaid amount can be withheld from an employee, but the specified citizen is not actually an employee. In addition, the already mentioned Art. 140 of the Labor Code of the Russian Federation speaks of the possibility for an employee to challenge the amounts paid. It is therefore advisable to resolve this dispute out of court.

Errors of a different nature, in addition to arithmetic, that overstate bonus payments to a dismissed employee, are resolved only at the expense of the organization (Civil Code of the Russian Federation, Art. 1109). In any case, the court will be on the side of the dismissed citizen.

Question: Are the costs of paying a bonus to a dismissed employee taken into account for income tax purposes if the order assigning a bonus is issued and signed after the dismissal? View answer

Arbitrage practice

Judicial practice regarding the payment of bonuses after the dismissal of an employee is ambiguous.

On the one hand, the condition stated in the employment contract that only employees who have an employment relationship with the employer receive bonuses for achievements is recognized as discriminatory and contrary to the norms of the Labor Code of the Russian Federation (Decision No. 33-3855/15 of the Stavropol Regional Court of June 30, 2015).

On the other hand, it is noted that bonuses are an incentive payment for employees who continue to work, so there is no discrimination here (Appeal ruling of the Perm Regional Court dated November 18, 2013 No. 33-10685/2013).

Each employee independently decides what to do if the dismissal bonus is not paid, whether to go to court or not. It is important to remember: if the employee wins the dispute, the former employer will have to pay the required bonus, pay legal costs and compensate for possible moral damages plus interest for each day of late payment.

If the amount paid upon dismissal, in the opinion of the employer, turns out to be excess, then the former employer will have to go to court, since it is possible to seize the excess from the former employee only by a court decision.

Is it possible not to pay a bonus upon dismissal?

All grounds for which the premium is paid must be specified in local acts agreed upon by each other. If there are vague formulations or contradictions, the emergence of a conflict in the event of a refusal to pay a bonus to a resigning employee is inevitable. Thus, the wording: “The manager has the right to pay incentive payments to employees - bonuses” is not obligatory for payment, and the phrase “The manager must pay bonuses” fixes the mandatory nature of such payments.

Cases of deprivation of a bonus in the LNA must also be clearly stated. Every employee must be familiar with the labor regulations adopted by the organization. Consent must be recorded with his signature.

Failure to pay the bonus specified in the LNA to a dismissed employee on the basis of a disciplinary sanction is not recommended. If you go to court, most likely, such a decision by the organization’s management will be declared illegal.

On a note! The period for going to court is 3 months from the moment the employee became aware of a violation of his rights, i.e. from the date of receipt of settlement amounts from the organization.

Is it paid, including when leaving at your own request?

If the employee fulfills all the bonus conditions and achieves the indicators given in the local regulations of the enterprise, then the organization must pay him the bonus established by the employment contract. Bonuses based on work results for a specific reporting period (month, quarter and year) are considered incentive payments and are part of the salary (Order of the Ministry of Health and Social Development of the Russian Federation No. 818 of December 29, 2007).

The procedure for paying bonuses to employees is specified in one of the following regulations:

- collective agreement (Article 135 of the Labor Code of the Russian Federation);

- employment contract (Article 57 of the Labor Code of the Russian Federation);

- a local act adopted by the organization (for example, Regulations on bonuses (material incentives) in accordance with Article 135, Article 8 of the Labor Code of the Russian Federation);

- order for the payment of bonuses (Part 1, Article 8 of the Labor Code of the Russian Federation).

Typically, the regulatory act on bonuses reflects those situations in which the employee is not entitled to receive a bonus payment.

Each employee must familiarize himself with the contents of such a document against signature. The following are considered mandatory conditions for calculating an annual (quarterly, monthly) bonus to a dismissed employee:

- fact of work in the reporting period (quarter, year) for which the bonus was accrued;

- fulfillment of all indicators established by the relevant local act of the enterprise;

- the absence in the local regulatory act on material incentives of a condition on depreciation of dismissed workers during payment periods.

- The annual bonus is calculated for a full calendar year.

- Quarterly - for the last quarter.

- Monthly - for the last month.

When an accountant calculates such a bonus payment, he takes into account several factors:

- reasons for the employee’s dismissal (at his own request or by agreement of the parties);

- actual time worked;

- experience, etc.

If an employee dismisses at his own request, and in the absence of disciplinary offenses, reprimands or fines, he is entitled to an annual (quarterly, monthly) bonus regardless of whether he resigned or not. Such a bonus payment is accrued based on the results of the enterprise’s activities in the new reporting period - year, quarter or month, respectively (what payments are due upon dismissal of one’s own free will?).

When an employee is dismissed by agreement of the parties, a settlement document is drawn up, which indicates all payments required by law (what to expect when dismissed by agreement of the parties?).

If the employee officially quit before the bonus order was issued, this must be reflected in the agreement of the parties. This agreement must also indicate the procedure for receiving bonus payments after dismissal and its amount.

Dismissed employees are also entitled to one-time (one-time) bonuses, which are awarded in connection with various holidays (for example, before the New Year). In this case, the employer’s decision on bonuses depends on when the employee quit.

The bonus is not paid if the employee submits a letter of resignation before the holiday, and the local regulatory act of the enterprise contains a clause on depreciation of resigning persons. If on the date of the holiday the employee has not yet been officially dismissed, the bonus is paid to him.

Main

- The bonus to the dismissed employee must be paid in the vast majority of cases. Non-payment of bonuses must be recorded in the organization’s local acts relating to labor relations, otherwise legal disputes with the former employee are likely, not in favor of the organization.

- Errors made in the direction of overestimating payments to a dismissed person can be corrected at the expense of the former employee only if they are of an arithmetic nature, in court.

- Quarterly and annual premiums are subject to personal income tax, insurance premiums and are included in the calculation of income tax only if they are registered in the LNA.

- Postings reflecting bonus payments are made in a similar way to taking into account wages.

Is it possible by law not to issue it if the payment is in full?

Situations where no bonus is paid upon dismissal often arise. There may be several reasons:

- the local regulatory act on bonuses contains a clause on depreciation upon dismissal;

- there are all grounds for a bonus, but the employer does not want to reward the dismissed employee (for example, he is saving the company’s money);

- the dismissed person has one or more disciplinary offenses listed in Art. 81 of the Labor Code of the Russian Federation (for example, he showed up at work drunk, did not come to work without a good reason, etc.).

If the bonus is included in the salary, established by a local regulatory act of the enterprise (for example, a collective agreement, labor agreement, etc.) and is directly related to the employee’s performance of work duties, then in this case a bonus is necessarily provided to the dismissed employee (letter of the Ministry of Finance of the Russian Federation No. 03-03 -04/1/294 dated October 25, 2005).

You cannot deprive an employee of his bonus just because he is planning to quit. But if a local act states that the bonus is not mandatory, but an incentive payment, the employer may not pay it.

What documents should I submit?

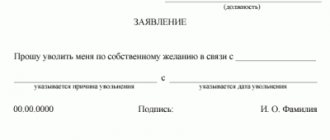

Request for payment

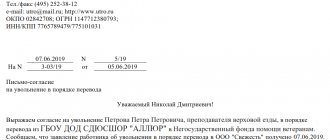

To avoid disputes, we recommend making a written request in free form, but in 2 copies. Send one to the employer, keep the other for yourself. Put a mark of acceptance on your copy (for example, from the secretary or in the human resources department). The requirement itself might look like this, for example:

You can also request payment after dismissal of your own free will by mail. To do this, send a registered letter with an inventory of the contents with acknowledgment of delivery. If there is no reaction, the dispute is resolved through court within one year from the date of violation of the employee’s rights.

Note-calculation

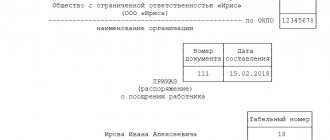

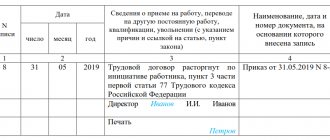

A note-calculation will help to accurately determine the amount due to the employee upon dismissal. It is drawn up on form No. T-61, approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004. The basis for filling out the form is settlement and payment documents, including statements of accruals made to the employee on various grounds (wages, allowances and bonuses, etc.). The persons responsible for the data contained in the note are the HR department employee and the accountant. The form is double-sided, the front side contains the following information:

- about the employer;

- about the employee;

- about the contract in force between them.

The reverse side is intended for calculating vacation pay. The front side is filled out by the HR employee, and the back side is filled out by the accountant.

Rules for filling out a settlement note upon dismissal:

- the name of the organization must be indicated in full and abbreviated, based on the constituent and registration documents;

- the number and current date are assigned in accordance with the rules of office work;

- the employee’s personal data is entered on the basis of his documents: personal card, contract, etc.;

- the basis for dismissal is indicated in accordance with the Labor Code of the Russian Federation, reference is made to a specific clause (“clause 3 of part one of Article 77 of the Labor Code of the Russian Federation, one’s own desire”);

- further, it is necessary to indicate in accordance with the payment documents whether the employee has unused or advance rest days;

- The document must be signed by the responsible person.

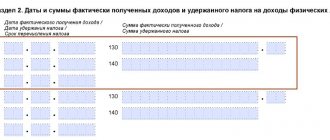

The reverse side with the determination of the amount of vacation pay is filled out on the basis of Government Decree No. 922 of December 24, 2007. First, information about the calculation period and payments made is entered, then the number of calendar days of this period and average earnings are indicated. Data on the number of days of rest is also entered. Then a calculation is made, and the result is the product of the number of calendar days actually worked during the billing period by the average daily earnings. The total amount is entered in capital letters in the required column. The signature of the employee who compiled the document is also required.

Material on the topic Calculation upon dismissal: how much and when to pay

Bonus for the year upon dismissal by agreement of the parties

This type of dismissal involves the conclusion of an agreement between the employer and employee. It can reflect the procedure for receiving incentives for the year if the employee leaves before the date of accrual. It makes sense to indicate in the document the details for transferring funds to the employee.

If the company provides an annual bonus, and the employee stops working before the bonus is accrued, the procedure for receiving it also needs to be fixed in the agreement. If it contains the phrase “I have no material claims,” then the manager has the right not to pay the bonus.