Can dividends be paid with property?

The company can pay dividends with property if it fulfills all the conditions necessary for such operations.

The rules for paying dividends in LLCs are regulated by the Federal Law on Limited Liability Companies dated 02/08/98 No. 14-FZ. The law does not stipulate in what form dividends must be paid, and there are no prohibitions on paying profits in non-monetary form.

Accordingly, LLC participants can receive not only money as dividends, but also other property. For example, fixed assets, securities, goods for resale, products of own production.

Before paying dividends with property, check that the charter does not prohibit the payment of dividends in this form (Article 28 of Law No. 14-FZ). And if you want to avoid disputes with the tax authorities, then fix this method of distribution of profits between the company’s participants in the charter or approve this method of payments in a decision at the general meeting of participants.

Then the tax authorities will not be able to insist that the main purpose of the transfer of property was not the distribution of profits, but, for example, the withdrawal of property from the company in order to avoid the consequences of an on-site tax audit. We will tell you further how to draw up and make a decision on the payment of dividends with property, so that there are no unnecessary questions from inspectors.

Possibility of payment

The law guarantees company owners almost complete freedom of entrepreneurial activity, including when determining the procedure and amount of dividend payments. Here are the rules of this procedure recorded in the Civil Code of the Russian Federation and relevant regulations:

- the standard form of profit distribution is to approve the amount of dividends and pay them in monetary terms;

- the founders of the company may provide for the opportunity to receive part of the profit in the form of property assets - for this, the corresponding clause must be included in the constituent documents in advance;

- The property assets that can be transferred as dividends include things, immovable objects, vehicles and other items that are not excluded from circulation.

Thus, receiving property during annual distribution will be a legal procedure if such a clause is contained in the charter of the enterprise.

The need to use this option for paying dividends may lie in the lack of available funds at the enterprise, when all of them are invested in a long production process. Obviously, the extraction of working capital can negatively affect the results of operations - in this case, the owners will be able to obtain free property.

- The basis for this form of payment of dividends will be the decision of the general meeting of the company's participants , the results of which are documented in the form of minutes.

- If the company has only one owner, he will make the sole decision .

Any form of dividend payment will be reflected in the accounting documents and is also subject to taxation.

Decision on payment of dividends with property

The decision on the payment of dividends with property is made by the company's participants at the general meeting. (Clause 1, Article 28 of Law No. 14-FZ). The form in which the LLC will distribute profits can be discussed both at a separate meeting and simultaneously with other current issues of the company.

According to general rules, an LLC pays dividends once per quarter, half year or year. At the same time, the decision on the distribution of profit is a right, and not an obligation, of LLC participants, who, even if there is net profit, are not obliged to distribute it among themselves.

There are also cases when it is impossible to distribute profits in an LLC between participants, since this is prohibited by law.

Dividends cannot be paid when:

- for the current year, instead of profit, the company has losses;

- the company's participants have not paid the authorized capital in full;

- the participant left the organization, and the LLC has not yet paid him the value of the share;

- payment of dividends will lead to bankruptcy of the organization or the company has already been declared bankrupt.

If restrictions on the payment of dividends are not applicable to the organization, then based on the results of the general meeting, the founders draw up a decision in the form of a protocol with a detailed description of the issues discussed. The document reflects the following information:

- number, date and place of decision;

- a list of persons participating in the meeting and the procedure for distributing shares of profit between them;

- agenda;

- the results of the discussion and decision on each issue.

Regarding the payment of dividends, the meeting must determine and reflect in the decision:

- for what period dividends will be paid;

- the total amount allocated for this purpose;

- form and timing of payments.

If the LLC has a single founder, then he independently makes a decision on the payment of dividends, drawing it up in a standard form, indicating the date of preparation and the essence of the issue on which the decision is being made.

invites you to a free webinar “Taxes of individuals: fines, inspections, law enforcement practice” on September 29. Do not miss!

To pay dividends with property, indicate in the decision that the profit will be paid in non-monetary form, for example, with fixed assets. Also include information that will help to individualize the property that the company will transfer to the participants, and provide information about the timing and procedure for transferring the property to the new owner.

It is important to take into account that the period for transferring property as dividends by decision of the LLC participants cannot be more than 60 days (Clause 3, Article 28 of Law No. 14-FZ). If the decision or charter of the LLC does not provide for a different period for paying dividends, then they must also be paid no later than 60 days from the date of signing the protocol.

Based on the protocol on the payment of dividends with property, an order for the payment of dividends and an act of acceptance and transfer of property are drawn up. We will tell you more about the procedure for transferring property as dividends and taxation of such payments below.

How to reflect them

The law considers the payment of dividends in property form as a sale, so the company must take this transaction into account in its accounting and tax reporting. However, judicial practice gives a different interpretation - the transfer of property as part of dividends is not a sale, since it is not aimed at generating profit from business activities. If the Federal Tax Service insists on taxation of such a transaction, the inspector’s actions can be appealed.

The procedure for recording payments in accounting is as follows:

- the debit of account 84 reflects retained earnings (if the enterprise has any);

- Code 75-2 reflects calculations for accrued dividends;

- the credit of account 68 reflects calculations for taxes and fees withheld upon transfer of property to the founders.

The property transferred to the founders will be written off from the balance sheet of the enterprise, about which a commission act will be drawn up.

Is it necessary to recover VAT from the residual value when paying dividends using company property? Watch the video below:

Procedure for transferring property as dividends

The procedure for paying dividends as property is determined by the owners of the company. Typically, dividends in a company are distributed based on the results of the past year after the formation of financial statements.

At the same time, the law does not prohibit paying dividends quarterly, semi-annually, or within the periods listed in the organization’s charter.

According to the general rules, dividends are issued to LLC participants as follows.

Step 1. The amount of net profit is determined according to the financial statements.

Dividends are paid only from the organization’s net profit, that is, remaining after taxation (clause 2 of Article 42 of Law No. 208-FZ of December 26, 1995, clause 1 of Article 28 of Law No. 14-FZ).

The tax office recommends taking data from the statement of financial results on the line corresponding to the line of this form of financial statements (letter of the Ministry of Taxation dated March 31, 2004 No. 22-1-15/597, UMTS for Moscow dated October 8, 2004 No. 21-09/64877) .

Step 2. A decision is made on the payment of dividends at the general meeting of participants.

If there is only one founder, then he makes the decision alone. We talked about the nuances of preparing this document in the previous paragraph.

Step 3. Distribution of profits between LLC participants.

Typically, profits are distributed in proportion to contributions to the authorized capital, but the charter may have other rules (Article 28 of Law No. 14-FZ).

In a typical case, distribution occurs according to the following formula: amount of dividends for a participant = distributed amount of profit x percentage of participation in the authorized capital.

When paying dividends with property, LLC participants first determine the amount of dividends. Next, having transferred the property against them, the proceeds are determined as in the case of sale. The proceeds are then counted towards the repayment of obligations to the participants. And at the very end, as with the sale, the value of the property is written off.

At the same time, the amount of income of an LLC participant when transferring property as dividends is determined based on market prices for the assets that were transferred (letter of the Ministry of Finance of the Russian Federation dated August 25, 2017 No. 03-03-06/1/54596).

Assessing the value of property transferred as dividends is not an easy task, since the legislation does not contain rules on how to conduct a market valuation of property when distributing company profits. Therefore, property can be assessed according to accounting data or determined independently by the participants of the company.

However, transactions involving the payment of dividends with property valued below its book value or market value will certainly be of interest to tax authorities. Therefore, if difficulties arise in determining the price of property, then the safest option would be to contact an independent appraiser.

In addition, due to the payment of dividends with property, consequences will arise that do not exist when paying dividends in money. Firstly, since tax authorities consider such an operation to be the sale of property, then, in their opinion, it is subject to VAT, income tax or a single tax if the company uses the simplified tax system. Secondly, the recipient will most likely pay personal income tax on dividends in non-cash form. We'll tell you more about this later.

Agreement for management services with an individual entrepreneur or self-employed

The director does not have to be a full-time employee of the company. The organization has the right to enter into an agreement with an external manager (Article 42 of Law No. 14-FZ). Such a manager can work in the status of an individual entrepreneur, and in this case it is convenient to use the “simplified” approach with the “Income” object.

For the “Income” object, tax is charged on revenue at a rate of 6%, and for the “Revenue minus expenses” object - on profit at a rate of 15%. If an individual entrepreneur operates without employees and provides management services, then he will not have any significant costs and the profit will hardly differ from revenue. In this case, it is more profitable to pay 6% of revenue than 15% of profit, which will be almost equal to revenue.

Also, an external manager can be self-employed. Art. 6 of Law No. 422-FZ does not prohibit the self-employed from activities related to the usual day-to-day management of the company. Only arbitration management activities within the framework of bankruptcy proceedings are prohibited.

There is one more restriction for the self-employed: they cannot enter into contracts with their former employers for two years. Therefore, if the owner was previously a full-time director or held another position in the company, he will be able to become a self-employed manager only after two years.

Both for individual entrepreneurs using the simplified tax system “Income” and for self-employed people who work with legal entities, the tax rate is 6%.

Entrepreneurs must also pay insurance contributions for themselves to pension and medical funds. But an individual entrepreneur without employees can deduct these contributions from the “simplified” tax without restrictions (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). Therefore, if contributions are equal to or greater than the tax, you will not have to pay it.

In 2022, the total amount of contributions “for yourself” is 40,874 rubles plus 1% of annual income exceeding 300 thousand rubles.

Let’s imagine that the manager’s remuneration is 30 thousand rubles per month, that is, his annual income is 360 thousand rubles.

STS = 360,000×6% = 21,600 rubles

The contributions will be:

B = 40,874 + (360,000 - 300,000) x 1% = 41,474 rubles

Contributions are more than tax - you do not need to pay it. But contributions amount to about 11% of annual income. If they were less than the tax, you would have to pay an amount equal to 6% of income - that is, as if there was only one tax without contributions. This becomes possible when the income is equal to 800 thousand rubles per year or exceeds it.

With an income of 800 thousand rubles per year, the amount of the simplified tax system will be equal to:

STS = 800,000×6% = 48,000 rubles

The contributions will be:

B = 40,874 + (800,000 - 300,000) x 1% = 45,874 rubles

The tax is greater than the contributions, so after deducting the contributions from the tax amount, there will be 2,126 rubles left to pay. Together with contributions, they will amount to 48 thousand rubles - the same as the simplified tax system of 6%.

Thus, with an annual income of individual entrepreneurs from 800 thousand rubles, the minimum tax burden will be set at 6% and will be the same as for the self-employed at any level of annual income.

And for an enterprise that pays remuneration to an individual entrepreneur or self-employed person, the payment amount is an expense. Therefore, a company can reduce its income tax or simplified tax system.

| General tax system | USN “Income minus expenses” | |

| Profit before taxes | 200.0 thousand rubles | 200.0 thousand rubles |

| Amount for withdrawal "in hand" | 100.0 thousand rubles | 100.0 thousand rubles |

| Rate of the simplified tax system / NPD for the manager | 6% | 6% |

| The amount of the simplified tax system / NPD of the manager, which corresponds to the amount “in hand” | 6.4 thousand rubles | 6.4 thousand rubles |

| The amount of the manager's remuneration taking into account the simplified taxation system / NAP | 106.4 thousand rubles | 106.4 thousand rubles |

| Taxable profit / simplified tax system less manager's remuneration | 93.6 thousand rubles | 93.6 thousand rubles |

| Income tax rate / simplified tax system | 20% | 15% |

| Income tax / simplified tax system | 18.7 thousand rubles | 14.0 thousand rubles |

| Total tax burden | 25.1 thousand rubles | 20.4 thousand rubles |

| Will remain with the company for development | 74.9 thousand rubles | 79.6 thousand rubles |

Settlements with the manager of an individual entrepreneur or self-employed person with a remuneration of 100 thousand rubles

Let's consider an example for the general tax system.

In order for a business owner in the status of an external manager to have 100 thousand rubles left after paying tax, he needs to accrue 106.4 thousand rubles in remuneration. Then, minus 6% tax (106.4 × 6% = 6.4 thousand rubles), he will have exactly 100 thousand rubles left.

The entire amount of remuneration accrued to the manager (106.4 thousand rubles) is the company’s expenses. Therefore, the organization can reduce taxable profit by this amount. As a result, the income tax will be equal to:

NPR = (200 - 106.4) x 20% = 18.7 thousand rubles

The total tax burden when withdrawing funds through a manager will be more than two times lower compared to paying dividends or issuing salaries:

H = 6.4 + 18.7 = 25.1 thousand rubles

For development in the company there will be:

P = 200 - 100 - 25.1 = 74.9 thousand rubles

But tax specialists know this scheme no worse than businessmen. During the inspection, inspectors will strive to prove that the contract with the manager is fictitious and that in reality there is an employment relationship.

If they succeed, the company will have to pay personal income tax, insurance premiums, as well as fines and penalties for the entire duration of the agreement. In addition, the organization will be fined under clause 4 of Art. 5.27 of the Code of Administrative Offenses in the amount of up to 100 thousand rubles.

To protect yourself, approach paperwork responsibly. Describe in detail in the contract and monthly reports the manager’s responsibilities and the procedure for setting prices for his services.

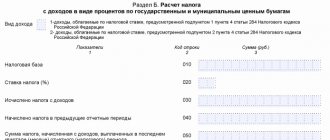

Personal income tax when paying dividends using company property

According to the general rules, a company that pays dividends to individuals is recognized as a tax agent for personal income tax, and therefore must withhold the amount of tax directly from income when paying dividends and transfer it to the budget.

However, if the founders do not receive income other than in kind from the LLC, then the obligation to transfer the calculated amount falls on the individual and not on the organization.

In this case, notify the tax office within a month that you were unable to withhold income tax. Report this to two Federal Tax Service Inspectors: at the place of registration of the recipient of the dividends and to the one in which you are registered.

Submit notification of the impossibility of withholding tax for 2022 and subsequent periods in the form of Appendix 1 “Certificate of income and tax amounts of an individual” (replacement of 2-NDFL) to the annual calculation of 6-NDFL (clause 2 of Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 No. ED -7-11/ [email protected] , clause 1.18 of the procedure approved by Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 No. ED-7-11/ [email protected] ).

The inspectorate will send a tax notice to the individual. The tax will need to be paid no later than December 1 of the year following the year of payment of dividends (clause 6 of Article 228 of the Tax Code of the Russian Federation). That is, if, for example, dividends are paid in 2022, then personal income tax, upon notification from the Federal Tax Service, will have to be paid no later than December 1, 2022. In this case, there is no need to submit a 3-NDFL declaration.

VAT on payment of dividends with property

The issue of VAT calculation in case of payment of dividends in kind is controversial. According to the explanations of the official bodies, VAT must be accrued, but according to the position of arbitration courts (including at the level of the RF Armed Forces), VAT should not be accrued.

Tax authorities require that VAT be charged on the date of transfer of property, since when dividends are paid in the form of property, ownership of it passes to the participants. This means that this transaction is recognized as a sale. (letter from the Federal Tax Service of Russia for the city of Moscow dated 02/05/08 No. 19-11/010126).

In this case, the value of the disposal of property is recognized as the amount of dividends determined by the decision of the general meeting (letter of the Ministry of Finance of the Russian Federation dated March 26, 2010 No. 03-03-06/1/198). It includes VAT on the transferred property. Therefore, the amount of this tax can be allocated by applying an estimated rate.

However, the courts come to the conclusion that the object of VAT taxation does not arise in this case (resolutions of the Federal Antimonopoly Service of the Ural District dated 03.10.06 No. F09-8779/06-S2 and dated 23.05.11 No. F09-1246/11-S2).

Since the transfer of property, and not money, to a company participant based on the results of the distribution of net profit cannot be considered as a sale. Due to the form of payment, the essence does not change. Income does not cease to be income. This payment is not subject to VAT.

Tax authorities continue to insist on their position, so using this method of transferring property to a company participant is associated with the risk of tax disputes in court. If you are not ready to argue with the tax authorities, it is safer to reflect the income from sales.

To minimize VAT risks when paying dividends, stipulate in the charter the possibility of paying dividends in kind. Please note that tax authorities will certainly have questions if you decide to deduct VAT when purchasing property that is subsequently transferred as dividends to the founders. After all, in fact it is not used for activities subject to VAT. In this case, it is safer to include the amount of input VAT in its price.

What are dividends

These are payments of part of the company’s profit at the end of the period to participants who have a share in the business. The calculation takes into account any income remaining after taxes are paid. This is enshrined in paragraph 1 of Art. 43 Tax Code of the Russian Federation. They are paid to the founders and shareholders, including employees who have shares in the company for which they work. The size is directly proportional to the share in the authorized capital as a percentage. Transfers can be made at the end of a quarter, half a year, or year. But they do not necessarily have to be paid regularly. Such a decision is usually made by the meeting if production development is favorable and financial results are stable. Otherwise, profits can be distributed to business development without paying dividends. Dividends are not paid in the following cases:

- financially unstable state of the organization;

- if the authorized capital is not fully contributed;

- if a loss is incurred.

Question: Is it necessary to enter a cash receipt when paying dividends to the founder in the form of property (apartment)? View answer