Hello! In this article we will talk about what kind of reporting an individual entrepreneur provides to Rosstat.

Today you will learn:

- What data does the individual entrepreneur submit to Rosstat?

- What reporting deadlines exist;

- Where and how to find out what reports need to be submitted.

Content

- Regulatory reporting

- Do individual entrepreneurs need to submit reports to statistics?

- How to find out when you need to submit a report

- How reports are submitted

- What kind of reporting does the individual entrepreneur submit to statistics?

- Contents of reporting forms

- How to fill out reports correctly

- Reporting of an individual entrepreneur with no employees

- More details about deadlines

- Penalties

- Conclusion

Every year, Rosstat collects and analyzes data on the activities of companies in the Russian Federation. Therefore, entrepreneurs provide information about the results of their work. But this is not everyone’s responsibility; the final decision is made by Rosstat. Whether your company needs to do this and how reporting is done, we’ll talk today.

What does continuous observation mean?

Continuous statistical observation is carried out in Russia once every 5 years. At the same time, statistical bodies collect information on the activities of economic entities, regardless of their size. This includes information about the production of goods (works, services), employment, wages, and financial results.

Monitoring is also carried out in relation to small enterprises on the basis of Art. 5 of the Law of July 24, 2007 No. 209-FZ.

The purpose of collecting information is to form a real picture of the state of small and medium-sized businesses in Russia. Based on the results of the monitoring, officials decide whether it is necessary to introduce additional support measures for SMEs.

The report must be submitted before April 1, 2022, and if it is submitted through the State Services website, then before May 1, 2022. The report form is contained in Rosstat Order No. 469 dated August 17, 2020.

The report must contain information for 2022. In this case, the report is generated by individual entrepreneurs on the basis of NAP, micro-enterprises, small and medium-sized enterprises, consumer cooperatives (listed in the Unified State Register of Legal Entities), heads of peasant farms (registered as individual entrepreneurs), and economic partnerships.

If a company temporarily did not operate in 2022, then it submits a statistical report on a general basis.

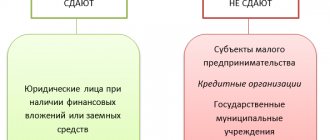

Do individual entrepreneurs need to submit reports to statistics?

Individual entrepreneurs provide statistical reporting only in two cases:

- All small enterprises, and therefore individual entrepreneurs, must report once every 5 years;

- If Rosstat requests information from an entrepreneur.

Every year, only those who are representatives of large and medium-sized businesses (those with more than 100 employees) submit reports to statistics.

If you are on the Rosstat list, then the obligation to submit reports must be fulfilled monthly, quarterly or every year. It depends on what your company's turnover is.

Fines for failure to submit reports to Rosstat

If, as part of continuous monitoring, organizations and individual entrepreneurs do not submit the above reports to Rosstat by April 1, 2021, they will be held administratively liable under Art. 13.19 Code of Administrative Offenses of the Russian Federation.

Failure to submit or untimely submission of primary statistical data is subject to fines in the following amounts:

- from 10,000 to 20,000 rubles – for officials of organizations responsible for submitting information to Rosstat, and individual entrepreneurs;

- from 20,000 to 70,000 rubles - for organizations.

The same fines will follow for organizations and individual entrepreneurs for providing unreliable primary statistical data as part of continuous observation.

Moreover, repeated failure to submit reports to Rosstat will entail the imposition of administrative fines in increased amounts:

- from 30,000 to 50,000 rubles – for officials of organizations responsible for submitting information to Rosstat, and individual entrepreneurs;

- from 100,000 to 150,000 rubles – for organizations.

What kind of reporting does the individual entrepreneur submit to statistics?

The following reporting forms must be submitted:

- MP (micro) - nature “Information about the production of products.” Annual. Available until 25.01 of the year following the reporting year;

- MP (micro) “Information on key performance indicators.” Annual. Available until 05.02 of the year following the reporting year;

- PM-prom “Information on production of products” . Available for rent if your business is a small business. Menstruation. The due date is the 4th day of the month following the reporting month;

- 1-IP “Information about the activities of individual entrepreneurs . All entrepreneurs whose field of activity is not related to agriculture report on it. Annual. Must be submitted by 02.03 of the year following the reporting year;

- 1-IP “Information on the activities of individual entrepreneurs in retail trade . Annual. You report if you provide services to the population or sell anything at retail. Deadline: until 17.10 each year;

- 1-IP (months) “Information on the production of IP products.” Menstruation. Due date: 4 working days following the reporting month;

- 1-IP (. Annual. Rented until 02.03 of the year following the reporting year.

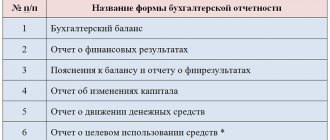

Also, statistical authorities are provided with an annual balance sheet and financial report if the business is run by an LLC.

For a complete list of mandatory reporting, please check with the statistical authorities in your region.

Reporting to Rosstat for organizations

As part of continuous monitoring, small and medium-sized business organizations submit to Rosstat Form No. MP-SP “Information on the main performance indicators of a small enterprise for 2022,” approved. by order of Rosstat dated August 17, 2020 No. 469 (Appendix 1).

The form includes information about the organization as a whole. That is, for all branches and structural divisions, regardless of their location. The form also includes information on foreign branches of organizations operating outside the Russian Federation.

In section 1 of the form, the organization indicates the number of months in 2020 during which it carried out its activities. Moreover, this includes even those months during which the organization carried out its activities for at least one full working day.

It also indicates the applicable taxation systems and the address of the place of activity where the greatest revenue from the sale of goods, works and services for 2022 was. If the revenue in all places of activity was the same, then the address of the place of activity where there was the largest number of employees is indicated.

If the activity was carried out without reference to a specific address, then the reporting simply indicates the registration address of the organization.

Section 2 of the report indicates the average number of employees and cash payments accrued to employees for 2022, taking into account personal income tax and other deductions. The total number of employees includes employees who worked under an employment contract for at least one day or more, as well as working owners of enterprises who received a salary.

Employees who worked under civil contracts, self-employed people, as well as employees who were on vacation throughout 2020 are not indicated in the reporting.

Along with information about employees and the wage fund, in Section 2 of the report, it is necessary to indicate revenue from the sale of goods, works and services for 2022 for the organization as a whole and for each type of economic activity actually carried out.

In section 3 of the report, organizations disclose information about the fixed assets they have (indicating their value) and investments in fixed capital by type of fixed assets.

It reveals the cost of existing real estate, equipment, vehicles, as well as the costs of constructing operating systems, purchasing transport, industrial and household equipment.

For fixed assets, both their full accounting value (initial cost, taking into account its changes as a result of revaluation, completion and modernization) and the residual book value are indicated. Residual value is defined as the difference between the total cost and accumulated depreciation from the beginning of operation.

The last table of the report contains the date of its preparation, contact information of the organization (telephone number and email address), as well as the full name of the official responsible for the presentation of primary statistical data and his signature.

If any errors were made when filling out the form, you are allowed to correct them. To do this, you will need to cross out the erroneous entry and write the already corrected indicator on top.

Contents of reporting forms

The form contains the following sections:

- The title sheet;

- The first section is where you provide information about your company;

- The second section, which contains characteristics of the activity;

- You will fill out the third section only if your business received government support measures. In it you will need to clarify: do you know that the state provides support to individual entrepreneurs, if you have used it, indicate in what form it was provided: financial, informational or other.

As soon as you answer all the questions, sign, decipher your signature, indicate the date and contacts where you can be contacted if any questions arise.

Why are statistics codes needed?

Obtaining statistics codes is not a mandatory procedure, and the notification itself is for informational and reference purposes only. However, you may need statistics codes:

- when preparing reports (declaration, KUDIR, PKO, RKO, etc.);

- when preparing payment orders or receipts for payment of taxes and insurance premiums;

- when opening a bank account;

- when opening a branch of the organization;

- when changing the place of registration of an individual entrepreneur or the address of the organization’s location (legal address);

- when changing the full name of an individual entrepreneur or the name of an organization;

- as well as in other cases.

How to fill out reports correctly

There are key requirements for filling out information, violation of which is strictly not recommended:

- Do not connect sheets of forms together with paper clips or a stapler;

- Do not confuse the fields to fill out: enter all information in the appropriate lines;

- Write the numbers as required by the presented sample;

- If you made a mistake and discovered it yourself, correct it in the manner indicated in the report form;

- Do not use strokes or correctors;

- Do not use paper to cover marks.

How to submit reports to statistical authorities?

The 1-entrepreneur report can be filled out electronically in the 1C: Mobile Accounting mobile application - on a phone or tablet. The application is convenient for individual entrepreneurs and self-employed people who do not use accounting programs, but need to keep records and generate reports.

Features of 1C:Mobile Accounting:

- calculation of taxes (USN, PSN) and insurance premiums, as well as reminders about the deadlines for their payment;

- preparing and sending payments to the bank;

- filling out reports (STS, PSN) and reminders about the deadlines for sending them;

- sending invoices, acts, invoices to clients.

The application can be downloaded from Google Play, App Store or Windows Phone. When working on a computer, access can be obtained through 1C: BusinessStart.

Electronic reports can also be sent via:

- State Services website. An individual entrepreneur must have a confirmed account, and a legal entity must have not only a record, but also an electronic digital signature;

- Rosstat website - you need to have an electronic signature;

- EDF operator.

SMEs can also submit a report in paper form - when visiting a statistical office or through Russian Post. However, it is planned that from 2022 paper statistical reporting will be abolished.

More details about deadlines

We have already mentioned reporting deadlines in today's conversation. Let us dwell on them in more detail, and also consider what the entrepreneur faces if they violate them.

So, when and what we hand over:

Ready:

- MP (micro) - in kind: until 25.01 of the year following the reporting year ();

- MP (micro): until 05.02 following the reporting year (Download form);

- 1-IP “Information on the activities of individual entrepreneurs”: until 02.03 of the year following the reporting year (Download form);

- 1-IP (services): until 02.03 of the year following the reporting year (Download form);

- 1-IP trade: until 17.10 of the year following the reporting year (forms).

Period:

- PM-prom: until the 4th day of the month following the reporting month (Download form);

- 1-IP: until the 4th day of the month following the reporting month (forms).

If you are late by at least a day, a fine will be generated immediately. If the deadline for submitting one of the reports is a weekend or non-working holiday, the deadline will be moved to the first working day.

What to report to entrepreneurs in statistics

Individual entrepreneurs fill out form No. 1-entrepreneur for Rosstat, “Information on the activities of an individual entrepreneur for 2022” (see Rosstat Order No. 469 dated August 17, 2020).

The reporting itself, with a number of exceptions, is similar to that presented by organizations.

Section 1.

We indicate the number of months in 2022 during which the individual entrepreneur conducted business, and the address of the place of business. If the individual entrepreneur conducted activities without being tied to a specific address, indicate the address of registration as an individual entrepreneur.

In the average number of employees, we take into account not only hired workers, but also all family members who help the individual entrepreneur, including the individual entrepreneur himself. To do this, add up the number of people who worked with individual entrepreneurs in each calendar month, including those temporarily absent, and divide by 12.

Section 2.

We indicate revenue from the sale of goods, works, and services in general for all types of business activities, as well as for each of them separately, taking into account VAT, excise taxes and other similar payments. And here we mean entrepreneurial activity. Income from other activities is not indicated in the report.

If payment for goods, work, or services was not received in cash, then determine revenue based on the transaction price. If the transaction price is not determined, be guided by the market prices of the goods received.

Individual entrepreneurs on NPD determine their revenue based on the amount of checks issued for 2020.

Section 3

- for fixed assets that an individual entrepreneur uses in whole or in part for business activities and that belong to him or his family members.

Individual entrepreneurs are not indicated in the report:

- items that last 1 year or less, regardless of their cost;

- items costing less than RUB 40,000. regardless of service life;

- residential buildings and non-business vehicles;

- land;

- vehicles not designed for the carriage of goods, and passenger cars, including taxis and company vehicles. The report only includes trucks, pickups and passenger vans.

Among the “exotic” assets that do not need to be specified:

- animals raised for slaughter, including poultry, perennial plants grown in nurseries as planting material, trees grown for timber;

- plantings and animals, the cultivation of which has not been completed and they are not yet ready for sale or sale.

At the end of the report there are standard details: the date of its preparation, the signature of the individual entrepreneur, his contact information - telephone number and email address.

How to get statistics codes

Find out the statistics codes by TIN yourself online

In 2022, you can find out statistics codes using a special service on the official website of Rosstat. To do this, you just need to indicate your INN, OGRNIP or OGRN, or OKPO.

Independently in the territorial body of Rosstat

You can receive a notification with statistics codes without an application from the territorial office of the Federal State Statistics Service (here you can find the address and telephone number of your branch).

To receive a document with statistics codes, you must provide the following documents to the territorial body of Rosstat (they may not require anything at all):

Documents (uncertified copies) for obtaining statistics codes for individual entrepreneurs

- copy of the OGRNIP certificate;

- copy of TIN certificate;

- a copy of an extract from the Unified State Register of Individual Entrepreneurs;

- copy of the passport.

Documents (uncertified copies) for obtaining statistics codes for LLC

- copy of the OGRN certificate;

- copy of TIN certificate;

- a copy of an extract from the Unified State Register of Legal Entities;

- copy of the Charter;

- passport details of the head of the organization.

To obtain more accurate information, please call your territorial Rosstat office.

At the tax office upon receipt of registration documents

If your tax authority operates a “one-window” principle, then in addition to the main documents, you will immediately receive notifications about registration with extra-budgetary funds, as well as a notification with statistics codes from Rosstat.

With the help of specialized law firms

The advantage of this method is its convenience, because The order can be made online, and the courier will deliver the printed statistics codes to a place convenient for you. The cost of this service is approximately from 500 to 1,500 rubles.

Required Forms

There are a number of forms that almost all legal entities are required to fill out, with the exception of small businesses. You can find out whether your specific organization needs to submit this form at the territorial office of Rosstat.

- Information about the movement of funds

- Basic information about the organization

- Financial data

- Data on the number and salary of employees

- Information about employee movement

From small enterprises, Rosstat requests data on key performance indicators, manufactured products and innovation activities. As a rule, reporting forms for small businesses are quite simple and filling them out does not take much time.