In practice, most entrepreneurs, especially beginners, have many questions about the process of searching and checking contractors: what tools should be used, are there free opportunities for this, what information needs to be analyzed, etc. Moreover, there are no standard rules and criteria for such verification . All actions that need to be taken are usually developed by companies independently through the analysis process and taking into account risks.

In general, the process of verifying counterparties rests on three pillars:

- Trustworthiness - the company's intentions and its relationship with the government and other business partners;

- assessment - identifying the main assessment criteria and objective information;

- knowledge - understanding what information is worth considering and what is not.

In this article we will consider the following questions:

- Why check counterparties?

- Quick search for a counterparty on the Federal Tax Service website

- Internet sources for finding additional information about the counterparty

- Checklist for checking a counterparty

- How to interpret received information about a counterparty

- Contour.Focus: opportunities for checking the counterparty

- Offline verification of the counterparty, identification of suspicious signs

Why check counterparties?

Verifying a counterparty is a comprehensive and not one-time job, as many may think. But it is necessary, because the company’s money and reputation are at stake. It is not for nothing that the tax authorities warn that responsibility for choosing a counterparty lies entirely with the company. Therefore, it should be interested in assessing the risks and tax consequences that may arise as a result of cooperation with dubious counterparties. If the tax office has claims against one of your counterparties, it is likely that you will unwittingly find yourself in trouble.

Verification of new counterparties is also necessary taking into account such a concept as “unjustified tax benefit”, which is supposed to be received by those entrepreneurs who minimize taxation by evading taxes.

The Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53 lists all the cases when a tax benefit is recognized as unjustified, but in general they all come down to two theses. A tax benefit is considered unjustified if:

- the taxpayer acted without due diligence, as he should have known about the violations committed by the counterparty;

- if the taxpayer, his interdependent or affiliated persons carry out transactions related to tax benefits, mainly with counterparties who do not fulfill tax obligations (clause 10 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53).

And if the second case is an example of the taxpayer’s conscious actions, then the first implies that the taxpayer still has the ability to prevent problems.

In addition to tax risks, when working with a counterparty, financial risks may also arise: missed delivery deadlines, delivery of low-quality goods, etc. It’s good if the problem can be resolved through negotiations and the supplier is ready to replace the defective product or provide a discount on the next batch of goods in case of delays in delivery. But it may turn out that the counterparty’s irresponsible behavior is the norm, and then you will lose money.

To see the true face of a counterparty, you need to take several steps to make sure that you are dealing with a valid legal entity and that your counterparty does not look like a shell company.

Documents to be requested from the counterparty

At a minimum, it is important to check the following documents:

- a copy of the organization's charter;

- a copy of the state registration certificate;

- a copy of the certificate of registration with the tax authority;

- accounting records for the year preceding the year of the transaction;

- a copy of the passport of the head of the organization.

Authentication of TIN and OGRNIP

The main details proving the identity of an individual entrepreneur are TIN and OGRNIP. Their role in identifying an entrepreneur can be compared to the role of a passport in establishing the identity of a citizen of the Russian Federation. Therefore, determining the authenticity of the TIN and OGRNIP is one of the key points for establishing the reliability of the entrepreneur himself.

Each individual entrepreneur has a unique INN and OGRNIP, which are assigned to him once and for all. There are simple mathematical methods by which you can verify their authenticity without resorting to obtaining an extract from the Unified State Register of Individual Entrepreneurs.

TIN verification

The Individual Taxpayer Number (TIN) consists of twelve digits. The first two digits represent the region where the number was issued. For example, for the Smolensk region it is “67”, and for St. Petersburg - “78”, “98”.

TIN is assigned to individual entrepreneurs upon tax registration

The next two digits indicate the Federal Tax Service code, and then six digits follow, indicating the number of a particular entrepreneur under which he is registered with tax and other authorities. The last two digits are called control digits. They are needed to verify the correctness of the number.

The system for verifying the authenticity of the last check digits is both simple and clever. To do this, you need to use a special table, where the digits of the number are designated as n1, n2, n3, n4 and so on. Therefore, the last two digits are called n11 and n12. In the table, each digit of the number is assigned its own coefficient m.

If there is such a table, the following arithmetic operations are performed to verify the authenticity of the n12 check digit:

- Each digit of the number is multiplied by the corresponding coefficient m.

- The ten numbers obtained after multiplication are added.

- The sum is divided by 11. The result is a number with a decimal fraction.

- The integer part of the number is multiplied by 11.

- The result of action “4” is subtracted from the result of action “2”.

If the TIN is genuine, then the result of the fifth step should be equal to the check digit n12.

Table: coefficients for control calculation of TIN correctness

| m1 | m2 | m3 | m4 | m5 | m6 | m7 | m8 | m9 | m10 | |

| Calculation n12 | 7 | 2 | 4 | 10 | 3 | 5 | 9 | 4 | 6 | 8 |

| Calculation n11 | 3 | 7 | 2 | 4 | 10 | 3 | 5 | 9 | 4 | 6 |

An example of checking an entrepreneur's TIN

For example, let’s take a deliberately incorrect TIN with the regional code of the Smolensk region (67) - 671234567891. We carry out the indicated arithmetic calculations:

- 1st and 2nd actions - [(6*7)+(7*2)+(1*4)+(2*10)+(3*3)+(4*5)+(5*9)+(6 *4)+(7*6)+(8*8)]=248.

- Act 3 - 248:11=22.5455.

- Act 4 - 22*11=242.

- Act 5 - 248–242=6.

The resulting number “6” does not coincide with the control “1”. Thus, calculations confirm that the given TIN is fictitious.

The check number n11 is checked in a similar way.

Checking OGRNIP

The main state registration number of an individual entrepreneur (OGRNIP) is a fifteen-digit number.

Verifying the authenticity of the number is even easier than for the TIN. For this purpose, you need to perform the following sequential arithmetic operations:

- Multiply the first fourteen digits of a number by each other. Write down the work and use it for action 5.

- Add the first fourteen digits of the number.

- Divide the resulting amount by 13.

- Multiply the integer part of the number obtained after the third step by 13.

- Subtract from the result of action 4 the amount obtained as a result of action 1.

As a result, if the OGRNIP number is reliable, then the number obtained as a result of our arithmetic must coincide with its last digit. It should be noted that when the result of the calculations is the number “10”, then the correct OGRNIP number is “0”.

Although these calculations will take a little time, they will serve as important information for determining the veracity of a business partner and, therefore, his reliability.

Quick search for a counterparty on the Federal Tax Service website

On the Federal Tax Service website, entrepreneurs can use several online services for free to collect important information about the counterparty.

The simplest thing you can do is to search for a counterparty using the TIN on the Federal Tax Service website. To do this, you need to select the “Legal Entity” tab and enter the OGRN or TIN of the legal entity or indicate the name and (optionally) region of location. If you need information about an individual entrepreneur or a peasant (farm) enterprise, then select the “Individual entrepreneur/peasant farm” tab, enter the OGRNIP/TIN or enter the full name and region of residence.

On the Federal Tax Service website you can find other information about the counterparty for free by name, address and other criteria.

| Information | Source |

| Information from the Unified State Register of Legal Entities | https://egrul.nalog.ru |

| Tax arrears, failure to submit tax reports for more than a year | https://service.nalog.ru/zd.do |

| Mass registration addresses | https://service.nalog.ru/addrfind.do |

| Registration of changes made to constituent documents or information contained in the Unified State Register of Legal Entities | https://service.nalog.ru/uwsfind.do |

| Disqualified persons | https://service.nalog.ru/disqualified.do |

| Legal entity whose executive bodies include disqualified persons | https://service.nalog.ru/disfind.do |

| Decisions of registration authorities on the upcoming exclusion of inactive legal entities from the Unified State Register of Legal Entities | https://www.vestnik-gosreg.ru |

| Persons in respect of whom the fact of impossibility of exercising leadership has been established (confirmed) in court | https://service.nalog.ru/svl.do |

| Individuals who are managers or founders of several legal entities | https://service.nalog.ru/mru.do |

| Legal entities created under the laws of Ukraine, information about which is included in the Unified State Register of Legal Entities | https://www.nalog.ru/rn77/related_activities/registration_ip_yl/#t5 |

Several years ago, the tax office launched the “Transparent Service” service, which simplifies the procedure for checking new counterparties, protects companies from cooperation with dubious partners and helps to identify one-day transactions.

According to Art. 102 of the Tax Code (“Tax Secrecy”), information about a company can become public only with its consent. The entry into force of Federal Law No. 134-FZ of May 1, 2016 made it possible to make changes: the list of data that does not represent a tax secret was expanded.

Collect the most important information about the counterparty in one window

The following information about legal entities is now open (they are updated annually):

- income and expenses for one calendar year;

- average headcount of the company for one calendar year;

- information about taxes and fees paid;

- information about tax violations;

- debts, fines, penalties, etc.

Organizations will be able to obtain this information via the Internet for free.

Basic methods of searching for information about individual entrepreneurs

Methods for clarifying information about individual entrepreneurs can be divided into online and offline checks.

Online check

Searching for information about an entrepreneur online is carried out on the website of the Federal Tax Service. Search algorithm:

- Go to the page “Information on state registration of legal entities, individual entrepreneurs, peasant (farm) farms.”

- In the search criteria, click on “IP/peasant farm”.

- Select one of the suggested search directions:

- by full name and region name;

- according to OGRNIP/INN.

The search for individual entrepreneurs can be specified by OGRNIP/TIN or by full name

- Enter the verification code from the picture.

- Click the “Find” button.

When searching by the criterion Full Name, you first need to select the desired region from the drop-down list, and then fill in the lines “Last Name”, “First Name” and “Patronymic”.

For the search option by OGRNIP/TIN, you need to know at least one of the values, that is, a fifteen-digit number for OGRNIP or a twelve-digit number for TIN. When you dial any of these numbers, you will be able to download a file in PDF format, which is an extract from the Unified State Register and contains the following items:

- Last name.

- Name.

- Surname.

- Floor.

- OGRNIP.

- Main activity.

- Additional activities.

The attached file contains data about the found IP

The specified information is provided in accordance with paragraph 1 of Art. 7 of Law No. 129-FZ of 08.08.2001 in the form of an electronic document certified by an enhanced electronic signature. Moreover, the person at whose request the certificate is issued does not require any electronic signature to receive it.

It should be noted that although the certificate is provided in electronic form, it is a document that has full legal force, on par with a similar certificate from the Federal Tax Service received in paper form.

Video: checking the counterparty on the website of the Federal Tax Service of the Russian Federation

Offline check

An offline check consists of obtaining an extract from the Unified State Register of Individual Entrepreneurs by contacting the tax office directly.

To receive a properly executed and signed extract from the Unified State Register of Individual Entrepreneurs, an application is submitted to the tax office. There are two variants of its spelling. Both of them are compiled in free form.

The first option involves submitting an application to obtain an extract for yourself.

To obtain an extract from the Unified State Register of Individual Entrepreneurs for yourself, you currently need to pay a state fee of 200 rubles

In the second option, any individual can request such a certificate for another individual entrepreneur.

Any individual has the right to submit an application for an extract from the Unified State Register of Individual Entrepreneurs

Until August 18, 2015, a certificate from the Unified State Register of Individual Entrepreneurs for oneself was free for individual entrepreneurs. However, starting from this date, you have to pay a state fee for it in the same amount as for a certificate for another entrepreneur. Currently, the state duty in both cases is 200 rubles. According to Government Decree No. 809 of 08/06/2015, the deadline for providing an extract is calculated five days from the date of receipt of the application.

The time for obtaining a certificate can be reduced to one day. To do this, it is enough to indicate in the application that the certificate is required urgently. However, such an extract will cost the applicant twice as much - 400 rubles.

You can also order an extract from the Unified State Register of Individual Entrepreneurs from a third party. Such a service exists in Moscow and some other cities. To apply for an extract through an intermediary, the applicant only needs to fill out a special form on its website. After paying for the order, the statement is delivered in Moscow to the metro station closest to the client within one day.

True, such express delivery will cost a thousand rubles, which includes payment of state duty and the cost of delivery itself. Even more will have to be paid if the applicant wants the document to be brought “to the door”. In this case, the delivery cost is agreed upon separately, based on specific circumstances.

Internet sources for finding additional information about the counterparty

Registers of unscrupulous suppliers

Such a register is available on the FAS website. Also, if necessary, you can study the Register of Unscrupulous Suppliers in the Unified Procurement Information System.

File of arbitration cases

The file cabinet contains millions of cases. To get information about a case, you need to fill in any fields in the search filter and click the “Find” button. If you do not know the case number, then look for information using other parameters.

The card includes brief information about the case, information about the participants in the case, the chronology of the consideration of the case in each of the instances, and the final judicial acts adopted in them.

Data Bank of Enforcement Proceedings

The service provides information about the existence of enforcement proceedings, its subject and the amount payable in relation to any individual or legal entity.

Working with the bank is based on simple steps: choosing a search by individuals or legal entities, indicating the region, last name and first name, or the name of the enterprise.

Unified Federal Register of legally significant information on the facts of the activities of legal entities, individual entrepreneurs and other economic entities

The resource allows you to familiarize yourself with information about the activities of economic entities. To check a legal entity, enter the name of the enterprise, code (TIN, OGRN) and address in the search form. The search for individual entrepreneurs is carried out using the full name and code (TIN, OGRNIP).

License registers

If your company plans to enter into a transaction with a counterparty as part of a licensed activity, then it would be wise to check in advance whether it has the necessary license. Such information is contained on the websites of licensing authorities.

For example, the Register of licenses is on the website of Rosprirodnadzor. Roskomnadzor on its official website publishes the Register of licenses in the field of communications, the Register of operators occupying a significant position in the public communications network, etc.

Checking against the list of invalid Russian passports

Since the service of the Main Directorate for Migration Issues of the Ministry of Internal Affairs of Russia is updated with information about invalid passports on a daily basis, the information in it is always up-to-date.

When should companies use this online tool? For example, to check the head of a company with which a deal is to be concluded. After all, many limit themselves to requesting a copy of the order to assume a position or an extract from the Unified State Register of Legal Entities, which indicates the name and position of the person. But checking your passport will never be superfluous.

In addition, pay attention to the term of office of the counterparty’s representative - has it expired? The period is specified in the organization's charter or power of attorney. The charter can also reveal another important criterion for assessing the counterparty - limiting the authority of the manager to conclude transactions whose amount exceeds a certain value.

Government contracts

The facts of repeated conclusion of government contracts are an undoubted advantage of the counterparty. They may indicate its reliability, especially if all obligations were fulfilled on time.

Unified register of inspections

On the website of the Prosecutor General's Office you can find information about scheduled and unscheduled inspections of both legal entities and individual entrepreneurs. The search is carried out according to the approved annual consolidated plan for conducting scheduled inspections and the results of unscheduled inspections.

Membership in the Chamber of Commerce and Industry of the Russian Federation

Enter the OGRN or INN into the search form on the website of the RF CCI - and you will find out whether the legal entity or individual entrepreneur is a member of the chamber. If a company or entrepreneur is there, it means that economic activity is being carried out.

Yandex.Maps and Google Maps

If to check a counterparty you need a panorama of the building in which the legal entity is registered, use Yandex or Google maps.

Contractor's website

The company's official website can tell you a lot about it. This is a very useful tool for identifying important information about a business partner. As a rule, the company’s clients are always indicated on it. You can contact them and find out their opinion about the counterparty. It is possible that negative comments will come up in conversation. Or it will generally turn out that someone else’s logo on the counterparty’s website was published for status purposes, but in fact no partnership relations exist between the companies.

Internet search

Enter the name of the company and the full name of its director into a search engine and see in what context they are mentioned.

How to find out the TIN from your passport?

You can find out the TIN certificate number from your passport in three simple ways. Use one of the simple services on our website, on the tax office portal, or the service of Tinkoff Bank. All methods give the same result, the data is provided free of charge.

Description of our service

We have launched a simple service on our website that allows you to quickly find out the TIN from your passport. The data is processed on the servers of the Federal Tax Service, and the result comes from there. To find out the TIN, use the instructions:

- Go to the main page and find the email request form.

- Enter your date of birth in the format DD.MM.YYYY - enter manually or select from the calendar by clicking on the icon.

- Enter the series and passport number.

- Click Find out TIN to send a request.

The result will appear on the same page after 2-3 seconds.

Go to service

Please note that the service does not transfer personal data to third parties and organizations. We do not store or process the entered data, sending it exclusively to the servers of the Federal Tax Service.

There are no results - it means that the taxpayer is not registered, or the initial data is indicated with an error. Carefully check your passport details; you may have made a mistake in writing the series and passport number. It also wouldn’t hurt to check the taxpayer’s full name, where an error could also occur.

This form was created only for citizens of the Russian Federation. It will not be possible to find out the TIN from the passport of a citizen of another state. It will also not be possible to use any other document confirming the taxpayer’s identity.

Data via the Federal Tax Service website

The second method will allow you to find out the TIN from your passport on the website of the Federal Tax Service. The service is available not only for Russian citizens, but also for foreign citizens - just select the appropriate type of passport. To check your TIN number, follow the instructions:

- Go to the official website of the Federal Tax Service of Russia.

- Find the Services block and click on the link Information about the TIN of an individual.

- The next page provides information on the processing of personal data - read it and check the box confirming your consent. Otherwise, you will not be able to use the service.

- Go to the next page and start filling out the form - start with your full name and date of birth (if you don’t have a middle name, check the No middle name box).

- If necessary, enter your place of birth - this field is optional.

- Select the type of identification document - passport of a citizen of the Russian Federation (document code 21) or passport of a foreign citizen (document code 10).

- Indicate the series and number of the passport in the next field, then enter the date of issue of the documents in the format DD.MM.YYYY.

- Click Send request and wait for the result - it will appear after a couple of seconds at the top of the page.

The message TIN information not found appears - check that the entered data is correct. An error in one letter or one number is enough for this message to appear.

Information from the Tinkoff Bank website

The third way is to use third-party services. For example, one of them works on the website of Tinkoff Bank. Enter the full name of the taxpayer you are looking for, enter the date of birth and passport details, send the request and get the result.

If the TIN is not visible in any service, it means that an error was made in the personal data stored on the servers of the Federal Tax Service. To correct the error, contact the nearest branch of the Federal Tax Service and ask for a form to correct the document details. You need to have your passport with you.

You can also fix the error yourself:

- Log in to your personal account on the website of the Federal Tax Service (you can use your State Services portal account).

- Go to the Life Situations section and select the electronic service Change of personal data.

- Double-check all the specified data, find and correct the error, and upload a scan of the document with the correct data as confirmation.

- Double-check all the data again and send a request to the tax authority (it is selected by the service independently).

Data will be checked and updated within a few business days (requests are usually processed much faster).

Checklist for checking a counterparty

Any taxpayer can use the recommendations of the Federal Tax Service as a guide for action. The department shares them in its letters.

So, for example, in the Letter of the Federal Tax Service of Russia dated July 13, 2017 No. ED-4-2 / [email protected] you can find the following control questions about the integrity of counterparties, which tax authorities use when checking:

- Do you personally know the head of the counterparty organization, under what circumstances, when did you meet?

- What relationships (friendships, business) unite you?

- What work (services) did the counterparty organization perform for you, what goods did it supply?

- Has this organization previously provided similar services for you, performed work, or supplied goods?

- What actions did you take to establish the business reputation of the counterparty organization?

How to interpret received information about a counterparty

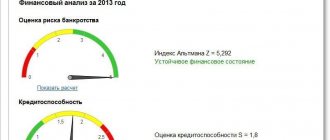

The obtained information about the counterparty can be conditionally combined into three large blocks:

- arbitration cases;

- financial condition;

- counterparty potential.

The analysis of the counterparty should be carried out at the intersection of these blocks: - existing disputes, volumes of activity and emerging risks. It is important to pay attention to the financial condition - is the company growing or stagnating? And try to independently assess the potential of the counterparty, based on the information contained on its website, the company’s business connections and other criteria.

When you do not understand what kind of reporting a company has, you see unclear arbitrations and cannot assess the company’s potential, it is better not to get involved with such a counterparty.

Find out how to check a counterparty in 5 minutes:

Contour.Focus: opportunities for checking the counterparty

Based on the number of sources described, we can conclude that finding a counterparty and checking its reliability is an extremely difficult job. But this work can literally be minimized to one click using a service such as Contour.Focus.

Why the service is convenient:

- The search for a company or individual entrepreneur is carried out by name, address, full name, tax identification number and other parameters. The relevance and reliability of information is guaranteed through access to official government open sources.

- In addition to the latest extracts from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, the user receives data from the Card Index of the Supreme Arbitration Court, the Federal Bailiff Service, the Federal Treasury State Contract Database, the Unified Federal Register of Bankruptcy Information, and the Rosstat Organizations Accounting Database.

- The company card, in addition to all other necessary information, includes a selection of links with mentions of the company on the Internet, which allows you to speed up the process of collecting facts by aggregating information from the media, from forums with reviews, from the website of the company itself and the websites of its partners, suppliers and clients, from the issuer's information disclosure page, from news resources.

- The service user can put 1000 companies under surveillance. Upon learning of changes in data, Contour.Focus will notify the user about them by email.

- The service is able to analyze organizations according to criteria preset by the user.

Learn more about all the capabilities of the Contour.Focus service.

Ways to find information about the registration address of an individual entrepreneur

Knowing the registration address of an individual entrepreneur is a necessary part of guaranteeing that when collaborating with this businessman, complications will not arise, such as his sudden disappearance in an unknown direction. For example, if this individual entrepreneur delivered low-quality goods or did not pay under the contract within the specified time frame, then knowing his registration address, you can try to negotiate with him or, at worst, turn to law enforcement agencies for help. And also, if the address indicated by him does not coincide with the verified registration address, one can speak of the entrepreneur’s dishonesty and, on this basis, terminate any further cooperation with him.

You can find the address of an individual entrepreneur by personally contacting the tax office with your passport. There you will need to write an application requesting an extract from the Unified State Register of Individual Entrepreneurs with information about the entrepreneur’s place of residence. It contains the personal information of the applicant.

The waiting period for a certificate is about five days. As a result, you will have an official document with the signature and seal of the Federal Tax Service.

An extract from the Unified State Register of Individual Entrepreneurs with the individual entrepreneur's registration address is issued only upon personal request

Offline verification of the counterparty, identification of suspicious signs

Armed with all sorts of free online verification tools, don't forget about offline investigation.

Check the following details:

The actual location of the company at the address indicated in the documents

Verifying the actual location is especially important in cases where you are negotiating, for example, with a manufacturing company whose activities require warehouses and production facilities. Unscrupulous counterparties may indicate non-existent addresses.

Meet the Guide

When discussing the terms of cooperation and concluding deals, it is important to get to know the company’s management personally.

Evidence that the company is ready to fulfill the terms of the transaction

This can only be understood during negotiations, observing the behavior of management. You should be wary if the counterparty is in a hurry and wants to quickly agree on payment, while luring in with low prices and unrealistic conditions.

How to find out your TIN by last name without a passport?

You won’t be able to do without a passport - requests to clarify the TIN are sent to the website of the Federal Tax Service, and the software requires the mandatory entry of passport data. And this is quite logical - TIN refers to personal data, they are protected by Russian legislation, so it is impossible to find out the document number only by full name. Some people don’t like it, but there is nothing good in the public availability of document details - scammers are not asleep, using the personal data of Russians for their own purposes.

There is a small clarification - to find out the TIN, you do not need to have a passport. It is enough to remember your passport details by heart - series, number and date of issue. Use one of the instructions above and get a document number. Do not indicate document data and personal information on sites that promise to find out the TIN by last name without a passport - it is impossible to do without it.