Who must pay transport tax

Payers of transport tax are legal entities and citizens (including individual entrepreneurs) on which transport is registered (passenger or truck, special equipment, bus, motorcycle, boat, etc.)

Important! If you own a trailer, you do not have to pay transport tax on it, even if it is equipped with a motor. The Ministry of Finance outlined this position in Letter dated February 16, 2011 No. 03-05-05-04/03.

If a subject evades vehicle registration, this does not relieve him of responsibility for paying tax. This is stated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/07/2012 No. 14341/11.

Transport tax changes in 2022

In 2022, changes to the transport tax affected a number of serious issues.

Application for benefits

Taxpayers must now notify the tax office of the tax benefits they have. For such notification, the form regulated by the Order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected]

Before 2022, such notice did not need to be filed because information about the benefits was contained in the tax return. Tax officials explained that this document should be submitted only for tax periods starting from 2022. For past years, the notification is not submitted, and it does not need to be submitted during 2022 (if the legal entity is reorganized or liquidated). The Federal Tax Service noted this point in Letter dated September 12, 2019 No. BS-4-21/ [email protected]

Important! The deadline for filing a notice of benefits is not established by law. The company can transfer it to the Federal Tax Service both before the date of payment of the tax (the first advance payment) and after the tax authorities transmit a message about the amount of the calculated transport tax. The Federal Tax Service explained this situation in Letter dated December 3, 2019 No. BS-4-21/ [email protected]

Transport tax declaration

Changes in 2022 regarding the transport tax also affected the declaration form for it. Its new form is regulated by Order of the Federal Tax Service dated November 26, 2018 No. ММВ-7-21/ [email protected] It was used to submit the declaration for 2022, as well as to transmit corrective information.

As for the declaration for 2022, it is no longer necessary to submit it, since such an obligation has been canceled on the basis of Federal Law No. 63-FZ dated April 15, 2019. It is precisely because the transport declaration has been cancelled, companies need to submit an application for benefits to the Federal Tax Service.

Important! There was no requirement for individual entrepreneurs to submit a transport tax return.

New list of expensive cars

When calculating the tax, it is now necessary to take into account the updated list of vehicles classified as expensive. Increased odds are applied to them. This list included both premium cars and popular brands - Honda Pilot, Mazda CX-9 and Subaru Outback.

Sample of filling out a tax return for transport tax

The TN declaration consists of 3 parts:

- Title page;

- Section 1;

- Section 2.

The procedure for filling out the declaration is specified in the Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] We provided a link to it above. Remember to use the new format in 2022.

How to fill out a transport tax return for 2022 using an example:

1Title page.

Section III of the Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] . How to fill it out:

- At the top of the page, indicate the TIN and KPP of the organization. The numbers are duplicated on each sheet of the declaration.

- Correction number - write “0—” if the document is being submitted for the first time. If you are resubmitting it with corrections, write “1—“.

- Tax period - if you are reporting for the year, write "34". If for the last tax period (for example, in case of liquidation) - “50”.

- Indicate the number of the tax authority to which you are sending the declaration;

- Code by location (registration) - write “260” if you are declaring the vehicle registration number at the location of the car;

- Write the full name of the organization in the “Taxpayer” block.

- The OKVED code should be specified in accordance with OK 029-2014

- Write the number of pages of the declaration and attached documents.

- In the lower left block, put the number 1 if you are the head of the company, or 2 if you are its representative, and write your full name.

- Put the date and signature.

The block on the right is filled out by a tax employee. Leave it blank.

2Section 2

The second section is about calculating your tax amount, so fill it out next. Let's figure out what should be written in each line of the section:

- 020 - OKTMO according to OK 033-2013.

- 030 — type of vehicle (see Appendix No. 5 of the Order);

- 040 — VIN code of the car (look in the STS or PTS);

- 050 - brand;

- 060 - state number;

- 070 — vehicle registration date;

- 080 - date of deregistration (only if the car was deregistered this year);

- 090 - number of horsepower;

- 100 is the code for hp. - “251”;

- 110 - environmental class;

- 120 - number of years from the date of manufacture of the car (only if this indicator is needed to calculate tax in your region);

- 130 - year of manufacture of the car (look in the PTS);

- 140 — number of full months of vehicle ownership;

- 150 - share of ownership of the vehicle (if the car belongs entirely to the company, write 1/1);

- 160 - divide the number of complete months of car ownership by 12 and write the result as a decimal fraction.

- 170 is the tax rate in your region;

- 180 - if the car costs more than 3 million rubles, indicate the Kp coefficient.

- 190 - the amount of car tax - multiply the indicators of lines 090, 150, 160, 170 and 180 and write down the result.

- 300 - if the car is not covered by benefits, duplicate the result of line 190 here.

The tax should be calculated for each vehicle separately. So, if 3 cars are registered to a company, then this section will consist of 3 pages.

3Section 1

The first section provides the final results of the car tax calculations. Example of filling out this section:

- 010 - KBK should be clarified on the Federal Tax Service website, as the code changes from time to time (See here)

- 020 - write the OKTMO code;

- 021 — add the values of lines “300” of the second section of all vehicles with the same OKTMO code and write the result.

- 023, 025, 027, - If in your region organizations are required to pay an advance, indicate the amount of advances for each period.

- 030 - subtract all advances from the number in line 021 and write down the result.

- Write your last name and date at the bottom of the document.

When filing a declaration, adhere to the following rules:

- If there is free space left on the line, put a dash in each cell.

- Write in capital letters only. Stick to the print style;

- Use dark blue, purple or black ink.

- All payments must be made in full rubles. Amounts of 50 kopecks and above are rounded to the nearest ruble.

- Secure declaration pages only in ways that do not damage the paper.

Checking the 1C database for errors with a 50% discount

We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions.

More details Order

Who calculates the amount of transport tax

For individuals, the amount of transport tax is calculated by tax authorities based on the information available to them. As for legal entities, they themselves calculate the amount of the advance and the final amount of tax at the end of the year and pay these amounts to the budget.

From 2022, the Federal Tax Service will determine the amount of tax taking into account available information and send companies messages about its payment in the form regulated by Federal Tax Service Order No. ММВ-7-21 dated 07/05/2019 / [email protected] The message will be sent to the company on time no later than 6 months. after the date of payment of the transport tax.

The company has the right to challenge the amount of tax if it considers it incorrect. In this case, she will need to send her disagreement to the tax authorities, provide appropriate explanations and documents to confirm her position.

Increasing coefficient in different regions

The increasing coefficient for all regions of the Russian Federation is the same, but the transport tax may differ from region to region. This is due to the fact that transport tax is a regional tax regulated by local governments. Considering the differences between regions in terms of transport tax, the final amount of transport tax, taking into account the increasing coefficient, will also be slightly different.

In this regard, before you start calculating the transport tax on an expensive passenger car, you need to contact the local tax authorities to clarify the tax rate and regional benefits. If the Federal Tax Service makes a calculation for individuals and notifies them of payment, then legal entities must independently calculate the transport tax in order to pay advance payments and tax at the end of the tax period.

Transport tax rates

The legislation does not establish a specific tariff for transport tax. The fact is that this tax is regional, and therefore tariffs are set by the constituent entities of Russia, but they should not be more than 10 times compared to the rates according to the Tax Code of the Russian Federation.

In addition, tax rates depend on other conditions - the type of vehicle, whether it has a motor, and the power of that motor.

Information on transport tax rates in a specific region can be found on the Federal Tax Service website. In the fields of the search form, information about the tax period, the subject of the Russian Federation and the name of the municipality is indicated. After this, you need to click the “Find” button and follow the “More details” hyperlink.

Another search option is to enter information about a specific law in force in the region regarding transport tax.

Calculation of transport tax taking into account the increasing coefficient

The calculation formula remains virtually unchanged. First, the total payment amount is calculated. To do this, the tax base is multiplied by the rate in force in the region. Then the resulting amount is multiplied by the increasing factor for the TN.

If a citizen did not own the car for a full period, then the formula will change slightly.

Nk = (Nb × C × Km / Chm) × Pk, where:

- Nk - tax;

- Nb - tax base;

- C—regional rate;

- Km - the number of months during which the citizen owned the car;

- Chm - number of months in the tax period;

- Pk - increasing rate.

Increasing coefficients for transport tax

If the taxpayer owns an expensive car, the tax is determined taking into account a multiplying factor. This point is established by clause 2 of Art. 362 Tax Code of the Russian Federation.

The increasing factor is:

- 1.1 - for passenger cars for 3-5 million rubles. and year of manufacture no more than 3 years;

- 2 - for passenger cars for 5-10 million rubles. and the year of manufacture is no more than 5 years old;

- 3 - for passenger cars for 10-15 million rubles. and year of manufacture no more than 10 years, as well as for passenger cars from 15 million rubles. and the year of manufacture is no more than 20 years old.

The list of vehicles for which the tax must be calculated taking into account the increased coefficient is contained on the website of the Ministry of Industry and Trade.

How to calculate how many years have passed since the release of a vehicle? There are two ways to do this:

- based on Letter of the Federal Tax Service of the Russian Federation dated March 2, 2015 No. BS-4-11/ [email protected]

The letter states that when calculating the transport tax for 2014 for a car produced in 2011. the number of years since its release is 4 years. Accordingly, the number of years is set in complete years, and the year of issue itself is also considered as a whole.

For example, a vehicle was released in 2022, so a full 1 year has passed since the year of its release. This means that he is included in the group “from 1 to 2 years”, and an increasing coefficient is used for him.

- based on Letter of the Ministry of Finance dated June 11, 2014 No. 03-05-04-01/28303

The letter states that when calculating the transport tax for 2014 for a car produced in 2014. the number of years from the date of its release is not more than 1 year.

For example, a vehicle was released in 2022, so no more than 1 year has passed since the year of its release. This means that he is not included in the group “from 1 to 2 years”, and an increasing coefficient is not used for him.

There is no judicial practice to determine the life of a vehicle from the moment of its release. Therefore, the taxpayer independently decides which method he will use for calculation. He can contact the tax authorities and request the procedure for calculating transport tax in relation to a specific vehicle. Based on the written explanation provided, the subject will calculate the tax, relieve himself of responsibility and protect himself from the accrual of penalties.

Preferential provisions for transport tax

Transport tax benefits are regulated by the legislation of the constituent entities of the Russian Federation. In Art. 361.1 of the Tax Code of the Russian Federation establishes only a general procedure for their application. For example, to use transport tax benefits, a company submits a special application to the tax office.

Important! To use the benefit, the company must submit an application. If this is not done, the benefit will not be provided even if it is mentioned in regional legislation.

This point does not apply to individuals and individual entrepreneurs - the benefit is provided by tax authorities independently based on the information they have. At the same time, entrepreneurs pay transport tax in the same way as citizens - based on a notification from the Federal Tax Service.

Based on clause 2 of Art. 358 of the Tax Code of the Russian Federation, in relation to some vehicles, no tax is paid at all - they are excluded from the object of taxation. In this case, there is no need to apply for the benefit, since the exemption is automatic.

For example, transport tax is not paid if the car is wanted. The fact of theft is confirmed by documents issued by the State Traffic Safety Inspectorate or on the basis of information received by tax authorities through interdepartmental information exchange.

In addition, some vehicles are not subject to tax because they are used in special areas of activity - agriculture, sea and river fishing, transport and cargo transportation by sea, river or air.

How much tax should I pay?

The amount of transport tax is calculated as the product of the tax base and the tax rate (clause 2 of Article 362 of the Tax Code of the Russian Federation). In this case, the tax base is determined separately for each vehicle (Article 359 of the Tax Code of the Russian Federation):

- in relation to vehicles with engines, with the exception of air vehicles for which the thrust of a jet engine is determined, as the vehicle engine power in horsepower;

- in relation to air vehicles for which the thrust of a jet engine is determined - as the nameplate static thrust of the jet engine (the total nameplate static thrust of all jet engines) of the aircraft at take-off mode in terrestrial conditions in kilograms of force;

- in relation to non-self-propelled (towed) water vehicles, for which gross tonnage is determined - as gross tonnage in registered tons.

- In relation to water and air vehicles not mentioned above, the tax base for transport tax is determined as a unit of vehicle separately from other vehicles.

The basic rates of transport tax are established in paragraph 1 of Article 361 of the Tax Code of the Russian Federation.

But constituent entities of the Russian Federation can set their own transport tax rates. In any case, deviations in the transport tax rate established by the constituent entities of the Russian Federation should not differ from the base rates by 10 times. This restriction was introduced by paragraph 2 of Article 361 of the Tax Code of the Russian Federation. However, this restriction does not apply to passenger cars with an engine power (per horsepower) of up to 150 hp. (up to 110.33 kW) inclusive. For such vehicles, tax rates can be reduced by the laws of the constituent entities of the Russian Federation by more than 10 times. This relaxation was made to encourage the purchase of low-power vehicles. Since such vehicles are less harmful to the environment.

Also, the tax rate may be different for each category of vehicle. In addition, the transport tax rate may depend on the number of years that have passed since the year of manufacture of the vehicles and (or) their environmental class.

The calculation of the number of years that have passed since the year of manufacture of the vehicle is made from the year following the year of manufacture of the vehicle. The number of years is determined as of January 1 of the current year in calendar years.

Basic rates of transport tax are applied if tax rates are not determined by the laws of the constituent entities of the Russian Federation.

How is transport tax calculated in 2022?

Transport tax is calculated only for those months in which the taxpayer owned the vehicle. The calculation is made in full months, and registration can be on any day of the month, i.e. not from the beginning.

In connection with this situation, the rules for calculating transport tax are as follows:

- if the vehicle was registered from the 1st to the 15th of the month, it is considered complete;

- if registration was from the 16th to the last day of the month, then the month is not included in the calculation.

The opposite situation is observed when a vehicle is deregistered:

- if the withdrawal took place from the 1st to the 15th of the month, then the month is not included in the calculation;

- if the withdrawal was from the 16th to the last day of the month, it is considered complete.

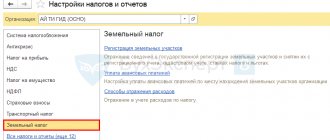

Transport tax in 1C Accounting 8.3 is calculated and accrued automatically at the end of the year when performing the routine operation “Closing the month”.

Transport tax 2021: why they want to cancel it, who should pay it and what will happen if you don’t pay

From the beginning of 2022, changes have been introduced to the Tax Code that also apply to transport tax. Read the article about what transport tax is, who is obliged to pay it, how to save money when paying it, and what will happen if you don’t pay it.

What is the transport tax used for and why do they want to abolish it?

Vehicle tax is a tax levied on owners of registered vehicles. A transport tax was introduced in Russia in 2003 instead of a road tax. It is transferred to regional budgets.

However, if the road tax was spent on the maintenance and repair of roads, then the transport tax can be spent on other needs, for example, on the construction of schools, hospitals, or even on the governor’s salary.

It cannot be spent only on maternity capital, the army or on a pension paid for long service.

The money that motorists pay for the excise tax on fuel goes directly to the repair and maintenance of roads.

When this excise tax was introduced, it was assumed that the transport tax would be abolished, and car owners would pay only for driving: how much you drove, that’s how much you would pay.

It so happens that Russians pay transport tax twice, if not with

Deadlines for transferring transport tax

Based on regional legislation, deadlines are established according to which companies must pay transport tax in full or in advance payments. As for federal legislation, it has only one limitation - according to paragraph 1 of Art. 363 of the Tax Code of the Russian Federation, the deadline for payment of transport tax according to regional legislation cannot be earlier than February 1 of the next year.

In 2022, the payment deadline for companies will change: it will shift by 1 month and will be valid throughout Russia. Thus, transport tax will need to be paid before March 1 of the next year. This point is indicated in paragraph 68 of Art. 2 of the Federal Law of September 29, 2019 No. 325-FZ.

Important! Individual entrepreneurs will pay tax according to the previous rules - according to the notification received from the Federal Tax Service and no later than December 1 of the next year.

As for advance payments, they are also established by the legislation of the constituent entities of the Russian Federation. In this situation, at the end of each quarter, the taxpayer must pay an amount based on 1/4 of the product of the tax base and the tax rate (taking into account the increasing coefficient).

Advances are paid only by those companies that are located in the constituent entities of the Russian Federation that have established these payments at the regional level. From 2021, the timing of advance payments will be uniform throughout Russia - no later than the last day of the month following the reporting period.

Average car cost

To determine the exact amount of transport tax, in addition to the age of the car, you will also need to determine its average cost. The calculation of the average cost is carried out on the basis of Order No. 316 of the Ministry of Industry and Trade of Russia, according to which the average cost of a car can be calculated:

- manufactured in the Russian Federation (or if there is an authorized representative of the manufacturer in the Russian Federation);

- manufactured outside the Russian Federation (there is no authorized representative of the manufacturer in the Russian Federation).

| Vehicle manufactured in Russia | The vehicle was not produced in the Russian Federation |

| Average cost of a car Recommended retail price of a car as of July 1 Recommended retail price of a car as of December 1 | Average cost of a car Maximum car sale price as of December 31 of the tax period Minimum car sale price as of December 31 of the tax period Coefficient of reduction of the catalog value of a car in rubles Recycling fee and import customs duty for this vehicle Foreign currency exchange rate to the ruble as of January 1 of the year of production of the car Foreign currency exchange rate to the ruble as of December 31 of the year of production of the car |

Features of transport tax during the coronavirus period

If companies or individual entrepreneurs operate in industries most affected by the coronavirus, and at the same time they are included in the SME register before March 1, 2022, they have the right to pay an advance for 1 sq. m. 2022 for transport tax until 10/30/2020

In addition, such taxpayers have the right not to pay tax and advances on it for the period of ownership of transport from April 1 to June 30, 2020. This point applies to vehicles used in business or statutory activities.

Do you have any questions or need help calculating transport tax in 1C? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter