What departments and what income are we talking about?

A separate division of an organization is considered to be one that is territorially isolated from it and has stationary jobs created for a period of more than 1 month.

A division acquires the status of a separate unit regardless of whether it is mentioned in the constituent documents and whether it is assigned powers (paragraph 21, paragraph 2, article 11 of the Tax Code of the Russian Federation). For information on how to register a separate division, read the article “Registration of a separate division - step-by-step instructions.”

Russian organizations that have separate divisions must transfer personal income tax both at the place of registration of the organization itself and at the location of the division (paragraph 2, paragraph 7, article 226 of the Tax Code of the Russian Federation). The amount of tax to be transferred by division is determined by the income accrued and paid to the employees of this division (paragraph 3, paragraph 7, article 226 of the Tax Code of the Russian Federation).

This applies to payments under both employment and civil contracts. But you need to keep the following in mind. It is necessary to pay personal income tax to the tax department provided that:

- someone working under an employment contract is considered an employee of this OP (this is directly written in the employment contract, staffing table, work book);

- the GPC agreement was concluded directly with the division (in this case, the actual location of the activity does not matter).

Where to pay personal income tax if an employee works in different departments for a month, works remotely or from home? You will find answers to these questions in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Who and how is personal income tax transferred to the budget?

Payers of income tax, according to Art.

207 of the Tax Code of the Russian Federation, individuals (residents and non-residents) who receive income from sources in the territory of the Russian Federation are recognized. The transfer of personal income tax to the budget is either carried out by them independently upon receipt of one-time or systematic revenues, or is entrusted to tax agents - the sources of payment of permanent income. The rules for calculating and paying income tax are reflected in Chapter. 23 Tax Code of the Russian Federation. Tax agents pay personal income tax for employees no later than the day following the day they actually received income in the form of wages, and no later than the last day of the month in which vacation pay and disability benefits were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Read more about these deadlines in the article “When to transfer income tax from salary?”

You can find out what details to indicate in the payment order for the payment of personal income tax to the tax agent from the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Tax payment by individual entrepreneurs and other individuals is made until July 15 of the year following the reporting year.

Due to the coronavirus in 2022, the deadline for paying personal income tax for 2022 for some individual entrepreneurs was postponed to 10/15/2020.

Innovations in the payment of personal income tax for private entrepreneurs from 2022

An organization that has several separate divisions on the territory of one municipality is now entitled to pay personal income tax (Information from the Federal Tax Service of Russia):

- at the location of one of the EP - if the parent organization is located in another municipality;

- at the location of one of the EP or at the location of the organization - if the parent company is located in the same municipality.

The department responsible for paying personal income tax must be selected by sending the appropriate notification to the tax authorities. The filing deadline is no later than the first working day of the corresponding tax period (clause 7 of article 226, clause 2 of article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated November 15, 2019 No. BS-4-11/23247). As the Federal Tax Service explains, such a notification should only be submitted to the inspectorate of the OP through which you will transfer personal income tax and submit personal income tax reporting; the inspections of other OPs will be informed about this automatically (letter dated December 16, 2019 No. BS-4-11/) .

We talked about the notification in more detail here and provided its form.

Why nothing needs to be changed

Currently, personal income tax is paid to the budget at the place where the tax agent is registered with the tax authority.

This follows from paragraph 7 of Article 226 of the Tax Code. If personal income tax is paid by a tax agent at the place of residence of individuals, the tax must be transferred in separate payments to the accounts of the Federal Tax Service of different subjects of the Russian Federation, which can lead to an increase in the volume of unidentified revenues.

In addition, tax agents will need to track and control the change of place of residence of individuals in order to transfer personal income tax to the budgets of constituent entities of the Russian Federation and municipalities. This procedure will negatively affect the work of tax agents.

If a tax agent transfers personal income tax using incorrect details, for example, in a situation where an employee changed his place of registration (residence) without notifying the tax agent, the tax will be paid for the wrong purpose, therefore, an arrear will arise, which will entail the accrual of a penalty to the tax agent .

As a result labor mobility of the population will decrease, since employers - tax agents will not be interested in hiring people living in other regions.

The tax authorities will encounter difficulties associated with monitoring the completeness and timeliness of the transfer of tax amounts both for the tax agent as a whole and for each taxpayer. Tax authorities will be required to maintain special tax accounts for each taxpayer.

At the same time, the constituent entities of the Russian Federation will have problems associated with the complication of forecasting the volume of payroll for employees in order to assess tax revenues from personal income tax.

In addition, the enrollment of personal income tax at the place of registration (residence) of individuals will not stimulate regions to create new industries and jobs in their territories.

Summarizing the above, let’s summarize all the disadvantages that the Ministry of Finance saw in this method of paying personal income tax:

- there are many payments, which means there will be more uncleared payments;

- the need to track changes in employee addresses;

- arrears and penalties due to transfer of money to the wrong region;

- the employer’s reluctance to contact non-resident employees;

- difficulty for employees of the Federal Tax Service in tax administration;

- regional officials will not be able to calculate in advance how much tax will be used in the budget;

- regions will not be interested in creating jobs.

What do you think about such an initiative?

We invite you to take part in a survey on this topic: Paying personal income tax at the place of residence of employees: is it good or bad?

Who must pay personal income tax at the location of the unit

If a separate division has a current account and the authority to pay taxes, then it can pay personal income tax independently (Article 19, paragraph 3 of Article 29 of the Tax Code of the Russian Federation). If not, the parent organization pays (clause 1, 7, article 226 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated 04/07/2015 No. BS-4-11/).

What to do if the personal income tax for a unit is included in the inspection of the head office, see here.

Where you need to pay personal income tax if separate divisions are located in the same municipality (or in the cities of Moscow, St. Petersburg, Sevastopol) in the territories of different tax authorities, you can find out from the Ready-made solution from ConsultantPlus. You can get trial access to K+ for free.

Personal income tax paid by employers for employees

Personal income tax is a tax that employees are required to pay on their income. However, in the vast majority of cases it is paid by the employer, who acts as a tax agent.

So, personal income tax must be paid for their employees:

- Russian organizations

- individual entrepreneurs

- lawyers, notaries

- divisions of foreign legal entities.

If you are a private person and hire employees, then they pay personal income tax on their own.

The tax rate is 13%. If your employee is a foreigner, then you, as a tax agent, are required to transfer personal income tax in the amount of 30% of the salary.

If you hire a person and enter into a civil law agreement (CLA) with him, then you are also obliged to pay personal income tax to the budget on the remuneration under this agreement.

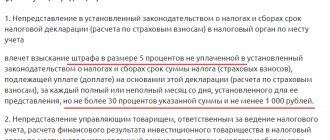

At what point do you have to pay personal income tax?

- From wages - at the time of payment. In this case, it is not necessary to pay personal income tax on the advance on the day of payment of the advance.

- For vacation and sick pay - on the last day of the month when these payments were made.

- From remuneration under the GPC agreement - at the time of payment of remuneration.

- From payments to resigning employees - on their last day of work.

What are the standard deductions?

The standard deduction is an amount that is not subject to tax. Let's say an employee's salary is 30,000 rubles, and at the same time he has a minor child. The deduction per child is 1,400 rubles. An employee has the right to receive a tax deduction, that is, personal income tax will be paid not on 30,000, but on 28,600 rubles.

There are the following deductions:

1. Children

For the first and second child, deductions are due in the amount of 1,400 rubles, for the third and subsequent children - 3,000 rubles, for a disabled child - 12,000 rubles.

One parent has the right to refuse the deduction in favor of the second parent, and then the second parent will receive a double deduction.

Deductions are made at the request of the employee.

To apply for a double deduction, the second parent must refuse to receive a tax deduction in writing. 2. Deduction in the amount of 3,000 rubles.

It is intended mainly for participants in the elimination of man-made disasters.

3. Deduction in the amount of 500 rubles.

Provided to participants of military operations in hot spots, donors, disabled people of groups I and II, etc.

The legislator establishes that a tax deduction is provided only until the employee’s annual income reaches 350,000 rubles. Accordingly, if an employee is hired in the middle of the year, in order to make tax deductions, he will have to submit a certificate in Form 2-NDFL from his previous job.

Payment order details

If the parent organization transfers personal income tax to a separate division, then the following information should be indicated in the payment order (letter of the Ministry of Finance dated May 29, 2017 No. 03-04-06/32972, Federal Tax Service dated March 12, 2014 No. BS-4-11/):

- TIN of the organization (the OP does not have its own TIN);

- Checkpoint of a separate unit;

- payer - the name of the parent organization or its OP - depending on who transfers the tax;

- recipient - details of the Federal Tax Service, where the tax is paid;

- OKTMO of the municipality where the unit is located.

When paying centralized personal income tax, the tax can be transferred in one payment order indicating OKTMO of the selected responsible person indicated in the notification (clause 3 of the Federal Tax Service letter No. BS-4-11/23247 dated November 15, 2019).

To learn about which BCCs must be indicated in payment documents for personal income tax, read the article “What are the BCCs for personal income tax for employees?”

Results

Personal income tax must be paid separately for each separate division and separately for the parent enterprise.

From 2022, it is possible in some cases to pay personal income tax centrally. Tax transfers are usually carried out by the parent company. But if the division is allocated to an independent balance sheet, then the branch has the right to transfer the tax independently. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.