Why do you need a checkpoint?

KPP is one of the identification codes by which a specific taxpayer is identified. It is no coincidence that it is requested when filling out declarations and reports, drawing up payment documents, opening a current account, concluding contracts, etc.

If, for example, you look at the simplified taxation system declaration form, you can see that separate cells are intended for checkpoints at the top of each sheet. How do I find out this code and where can I get it?

Free accounting services from 1C

Basic codes

When the registration of an OP has occurred, it may be assigned special codes. But the parent organization and all its divisions will still have the same TIN. This is due to the fact that the OP is not a legal entity.

Thus, find out the checkpoint of a separate division using the TIN of the main enterprise by applying for an extract from the Unified State Register of Legal Entities.

The judgment that there is no need to obtain a separate TIN is based on an analysis of the regulatory document regulating the procedure for obtaining, using and changing the TIN (approved by order of the Ministry of Taxes of Russia dated 03.03.2004 No. BG-3-09/178). And it is valid only when registering or deregistering legal entities and individuals.

A TIN can only be assigned to the organization itself. None of its divisions, including separate ones, have the right to receive their own TIN. Only upon initial registration with the Federal Tax Service does the organization receive its TIN at the place of registration.

Where can I find a checkpoint?

Let us say right away that the checkpoint is assigned only to legal entities; individual entrepreneurs do not need it. And although individual entrepreneurs and organizations fill out the same reporting forms, they indicate their checkpoint only for the company, and entrepreneurs put dashes in the appropriate fields.

This procedure was approved by order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/ [email protected] In accordance with it, the checkpoint is an addition to the identification code of a legal entity. This abbreviation stands for the reason for registration.

The checkpoint along with the Taxpayer Identification Number (TIN) is indicated in the organization’s registration certificate. These two details are written side by side, separated by a fraction. And to identify an individual taxpayer, only the TIN is used.

Sometimes the counterparty, when concluding an agreement, insists that both parties indicate their checkpoint. Then it is necessary to explain that, on the basis of Federal Tax Service order No. ММВ-7-6/ [email protected], this requisite is not assigned to individual entrepreneurs in principle. In the case of an individual entrepreneur, the party to the contract can be identified by the INN and OGRNIP.

How to find out the checkpoint of a separate division by TIN?

The division's checkpoint differs from the code assigned to the parent organization - which means that most methods for determining the checkpoint by the organization's TIN cannot be used in this case. So how can you find out the checkpoint of a branch of an organization if you have its TIN?

To do this you need to do the following:

- Determine the exact name of the organization using the tax service service located at: egrul.nalog.ru. To obtain the necessary information, simply enter the TIN of the legal entity in the window that opens.

- Create a request for an extract from the Unified State Register of Legal Entities using one of the following methods:

- using the service offered by the Federal Tax Service and order an extract from the Unified State Register of Legal Entities in electronic form absolutely free of charge (the document is generated within a day from the date of submission of the request and is available for downloading within 5 days).

- by personally visiting the territorial office of the Federal Tax Service and leaving a request for the preparation of a document.

In addition, on the Internet you can find a considerable number of services that provide services for online determination of checkpoints by TIN for a fee. At the same time, free and demo versions, as a rule, allow you to find out the checkpoint only of the parent organization (such information can also be obtained on the official website of the tax service). Only some versions of specialized commercial software have the option to determine the checkpoint of a separate unit.

Another way to determine the checkpoint is to create a query in a search engine indicating the organization’s TIN. As a rule, the pages that appear in the results contain the required information, but it is worth remembering that the information on them is not updated with the same frequency as the tax service databases, so the information found may not be current.

What can you find out from the checkpoint?

Considering that entrepreneurs will come across this code of partner organizations more than once in their activities, it is worth understanding what the checkpoint is in the details.

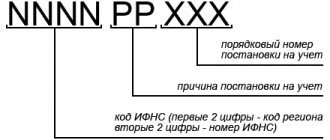

The registration reason code consists of nine characters, by which you can find out the following information:

- the first four characters are the code of the Federal Tax Service, which registered the organization;

- the next two signs indicate the reason for registration. If the signs are from 01 to 50, this indicates that the organization is Russian, and the values from 51 to 99 indicate a foreign company. In addition to numbers, signs can use letters of the Latin alphabet;

- the last three characters are the serial number of registration.

Order No. ММВ-7-6/ [email protected] lists the reasons for registering an organization. The most common of them is the initial registration of a legal entity, during which TIN and OGRN codes are also assigned.

For example, the checkpoint of Sberbank is 773601001. This means that the bank is registered with the 36th Tax Inspectorate of Moscow at the declared legal address. The last three characters (001) show that the organization was registered for the first time and has not changed its location since then.

But an organization can be registered with the Federal Tax Service on the following grounds:

- creation of a separate division, for example, a branch;

- availability of real estate and/or transport;

- change of legal address, which involves a transfer to another inspection.

That is, unlike the TIN of a legal entity, its checkpoint can change in the course of its activities. And if an organization opens branches or registers real estate and transport at a location other than its legal address, then there may be several checkpoint codes.

Another interesting fact is that registration codes for different companies may be the same. After all, if organizations are registered in the same Federal Tax Service, on the same basis and with the same serial number, then their checkpoints are the same.

For example, AVICOM TRADE LLC has the same checkpoint as Sberbank. This limited liability company is also registered with the 36th Federal Tax Service Inspectorate of Moscow and has not changed its legal address since the date of registration.

Thus, to identify a taxpayer - a legal entity, his checkpoint alone is not enough. You need to focus on the partner’s TIN and OGRN. And the registration reason code has only an additional function.

What is a separate division

In civil legislation, there are two types of separate divisions:

- a branch that has a different location than the organization and performs a number of functions or all of its functions (Clause 2 of Article 55 of the Civil Code of the Russian Federation);

- a representative office that represents and protects the interests of a legal entity in another region (Clause 1, Article 55 of the Civil Code of the Russian Federation).

Neither a branch nor a representative office are recognized as legal entities.

Tax legislation uses a broader definition: this is any territorially isolated unit equipped with at least one stationary (created for a period of more than one month) workplace (Clause 2 of Article 11 of the Tax Code of the Russian Federation). The tax service may recognize workplaces as a separate division, regardless of whether its creation is reflected in the legal entity’s charter or other organizational and administrative documents.

Where does it appear?

The checkpoint must be indicated as part of the details of the legal entity in all official papers and forms of the organization. It must be reflected in the texts of contracts, various letters and powers of attorney.

There are a number of forms in which checkpoints are a mandatory element. For example, checkpoint in the invoice of a separate division . It is indicated when the OP sells something through himself.

EXAMPLE The sale of goods produced by the parent organization is carried out by its separate division. Then the checkpoint is written on the invoice not of the main office, but of the OP that makes the transaction. The same rule applies if goods are purchased by a separate division.

But the TIN is indicated to the parent organization, since the OP does not have its own.

What is checkpoint

When filling out various documents, for example, employment contracts with employees, invoices, contracts with counterparties, organizations and entrepreneurs (IP) must indicate their details.

These include many different codes:

- OGRN;

- TIN;

- checkpoint;

- OKVED, etc.

KPP is a letter abbreviation that indicates the reasons for registering a legal entity as a taxpayer with the Federal Tax Service of the Russian Federation. It is assigned by tax service specialists. All organizations, enterprises, and firms that have a stamp have such a code.

When registering an individual entrepreneur, only a taxpayer identification number is issued; a checkpoint is not issued. To conduct the activities of an individual entrepreneur, only a TIN is enough.

In many documents for conducting business activities there is a column with a checkpoint mark. Since most documents have certain forms established by law, when filling them out, the individual entrepreneur often faces the question “what should I enter in this column?”

The entrepreneur should not fill out the column with the value of the checkpoint, since there is none. He can put a dash or zeros. These could be documents for the Federal Tax Service, any reporting, payment orders.

Results

The registration reason code, or briefly KPP, is assigned during registration exclusively to legal entities, which is why individual entrepreneurs do not have a KPP, and you should not go through the registration documents of the entrepreneur, looking for this value.

In documents providing for the reflection of checkpoints, entrepreneurs either put dashes where this detail is indicated or leave it blank. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to find out bank details

Despite the fact that the information from the Unified State Register of Legal Entities is quite extensive, the account number of the organization or individual entrepreneur is not there. But there is a name that will help you check the counterparty number.

There are several ways to find out the BIC of an organization by TIN, its current account and correspondent bank account:

- Enter the company name into any online search engine (Yandex, Google). Many organizations have official websites, and bank details are usually written there. Look in the sections “General information”, “Contacts”, “How to find us” or at the bottom of the page.

- If the website has the company name, address and contacts, but there is no current account, then call the phone number indicated to contact the organization. Say you want to pay or transfer funds and they will tell you your bank details.

- Check all available (open and closed) company accounts through State Services.

If you have already worked with this company, then check the invoice in a simpler way - look in the contract, in the last section “Details of the parties”. All the necessary information is included in the payment orders. If you require up-to-date information for mutual settlements, then send a written request to the counterparty.