Hello! In this article we will talk about excise taxes on alcohol.

Today you will learn:

- What is excise duty called and what types is it divided into?

- Who pays excise taxes on alcohol;

- What is the procedure for calculating and paying excise tax?

The rates for 2022 for a number of positions are brought into compliance with Law No. 301-FZ of 08/03/2018. For alcoholic products it remained at the 2022 level. We’ll talk about this, as well as the terms and procedures for payment today.

Content

- Excise tax on alcohol: the essence of the concept and why it is needed

- What is subject to excise tax

- Who pays excise taxes

- How is it different from VAT?

- Types of excise tax rates

- Excise tax rates on alcohol

- Level of increase in alcohol prices

- Calculation and payment of excise taxes

- Timing and procedure

- Goods exempt from excise duty

- The situation with other excisable products

- Labeling of alcoholic beverages

- Consequences of non-payment

- Conclusion

Kinds

Labeling varies depending on the strength of the alcoholic beverages and their varieties. In general format it looks like this:

- Strong - from 9% to 25%. These are alcoholic beverages, with the exception of grape, fruit, sparkling, and liqueur wines. Yellow sticker.

- Varieties with an alcohol content above 25%, usually cognac. Additionally, information about the volume is provided - from 0.5 l to 1 l. Drawing in green tones.

Certain types of alcohol are labeled separately. Types of excise stamp codes for alcohol (wine products):

- Sparkling. Weak - up to 15%. Separate size markings - up to 0.375 l, up to 0.75 l, up to 1.5 l. Drawing in raspberry shades.

- Grape. The ethyl alcohol content varies from 4.5% to 16.5%. This category does not include fruity or sparkling liquids. Displacement is the same as the previous point. The mark has a purple background.

- Liquor. Degree - from 15% to 22%. The volume is the same as that of other wine varieties. Brown-blue sticker.

- Fruity. Weak - from 6% to 15%. Same nominal volumes. Drawing in red and green color.

- Wine drinks. Strength - from 1.5% to 22%. Sign in blue and yellow colors.

New and old brands

The sticker is:

- old light blue sample, 20 mm;

- new light green format, 18 mm;

- light purple from importing companies 20 or 18 mm.

Excise tax on alcohol: the essence of the concept and why it is needed

Excise tax is a duty established by the state for producers of alcoholic beverages, tobacco products and a number of other goods. But today we will dwell in more detail only on the tax for alcohol producers. This tax is called internal, operating within the borders of the state.

In addition, excise taxes in Russia are included in the price of goods, which means that the consumer pays for them. If excisable products are sold at retail, the amount of excise tax is not allocated.

So why are excise taxes needed? The answer is simple: so that the state receives profit from the manufacture of products that are popular among the population. And also, according to experts, increasing excise taxes is an effective measure in the fight against excessive alcohol consumption.

Negative sides:

- Increase in volumes of illegally imported alcohol;

- The risk of increasing sales of obviously low-quality alcoholic beverages.

How to punish for counterfeiting and selling counterfeit goods

Since 2014, administrative and criminal liability for attempting to falsify the label of alcoholic products has been tightened. In accordance with Article 327.1 of the Criminal Code of the Russian Federation, there is prosecution for creating homemade signs for sale.

The production and sale of counterfeit state signs is punishable by:

- fine from 100 to 1 million rubles, the amount depends on the volume of counterfeit;

- remuneration for a period from one year to 3 years;

- community service for up to 5 years;

- imprisonment or restriction thereof for 8 years.

All capable citizens over 16 years of age will be held responsible for their actions. This applies only to individuals. The action is considered completed immediately after obviously false marks are applied to the bottles.

If an enterprise is engaged in the sale of a surrogate, then the regulatory authorities have the right to deprive it of its license and also impose an additional penalty in the amount of 200 to 300 thousand rubles. An official involved in storage or sale is subject to a fine of 10 to 15 thousand rubles. The seller will also be sanctioned - from 4 to 5 thousand rubles. The entire batch of counterfeit goods is eliminated.

It is worth remembering that if a store sells alcohol, then alcohol excise tax checks will be frequent, but what is it? To answer the question, employees of regulatory authorities visit the establishment, take any copy from the shelf and scan it.

There is a special service for control called "". Any business with a sales license can access the site. It is enough to check the information on the bottle and on the screen to find out whether the sale of this product is legal.

It is important to remember these forms of liability after obtaining a trading license. It is worth contacting Cleverens to select high-quality equipment and software with which you can check the legality of a batch and optimize business processes within an establishment or in a warehouse.

How is it different from VAT?

VAT, like excise tax, is an indirect tax. But there are fundamental differences between them, which we will discuss in more detail.

- VAT is charged on a much larger volume of goods. It also applies to services provided by the payer. In turn, excise taxes are established only on goods;

- The next difference is that excise tax is a real burden on the entrepreneur, and when paying VAT, if you use deductions wisely, the burden can be significantly reduced;

- It is not always possible to compensate for the excise tax rate using a deduction;

- Excise taxes, unlike VAT, have a serious impact on the profitability of the company.

Excise taxes in Russia began to operate in 1991. The main elements from which the excise tax is formed are the base, object and tax rate.

The difference between the excise stamp and the federal special stamp

Both types of markings are carriers of information and also confirm the registration of the batch in the Unified State Automated Information System. The difference is that the federal tax is applied to everything that is produced in Russia, and the excise tax is applied to everything that is imported from abroad. The presence of this sign verifies the fact that taxes have been paid and the products have been legally sold.

What are they?

Once you have an understanding of where this or that mark is placed, you can decide on the requirements for them. Only a registered manufacturer or importer can obtain the mark. To complete the documents, manufacturers need to contact Rosalkogolregulirovanie, and the supplying company goes to the Federal Customs Service to pick up the papers.

The documentation must contain:

- Product Name;

- volume of one unit;

- type, alcohol concentration;

- manufacturer's name, legal address and place of production;

- if the consignment was imported from abroad, then the details of the importer are indicated;

- the state in which the product is manufactured;

- mandatory confirmation of compliance with quality requirements.

What does an alcohol excise stamp look like: why do you need a series and number?

This is a graphic design printed on thick rectangular self-adhesive paper. To protect against counterfeiting, special elements are used - translucent threads, signs, color changes in the sun.

These symbols are constantly being refined and changed, supplemented with new means. They can only be obtained in Moscow or Perm at Gosznak.

The old stickers were light blue, the new ones are light green. If the excise tax is genuine, then the inscription “РВ” will alternate on the holographic part of the foil with a double-headed eagle.

The name on the label and the displacement must completely coincide with what is indicated on the stamp. If you look at it at an angle, you will notice streaks of pink and gray appearing.

Types of excise tax rates

- Specific;

- Combined;

- Ad valorem.

Specific

Presented in a fixed amount for 1 unit of goods. Most often used.

Ad valorem

It is uniform for the entire country and is set as a percentage of excisable goods. Its weakness is that each time you need to calculate the customs value of the product.

Combined

Combines specific and ad valorem rates.

Excise tax rates on alcohol

Next, we will consider the amount of excise taxes on alcoholic products, presenting the information in table form. And then we’ll do a little comparative analysis.

Excise taxes on alcohol in 2022:

| Product type | Tax rate 2021 | Tax rate 2021 | Tax rate 2022 (from 01.01.) |

| Ethyl. alcohol, which is sold by companies involved in the production of cosmetics. or perfume. products | 1 liter / 0 rub. | 1 liter / 0 rub. | 1 liter / 0 rub. |

| Ethyl. alcohol sold by companies that do not pay advance excise taxes | 1 liter – 107 rub. | 1 liter – 107 rub. | 1 liter – 107 rub. |

| Alcohol containing more than 9% alcohol (excluding beer and sparkling wine) | 1 liter – 523 rub. | 1 liter – 523 rub. | 1 liter – 523 rub. |

| Alcohol containing less than 9% alcohol (excluding beer and sparkling wine) | 1 liter – 418 rub. | 1 liter – 418 rub. | 1 liter – 418 rub. |

| Wine, excluding sparkling wine | 1 liter – 5 rub. | 1 liter – 5 rub. | 1 liter – 5 rub. |

| Sparkling wine | 1 liter – 36 rub. | 1 liter – 36 rub. | 1 liter – 27 rub. |

| Beer with up to 0.5% alcohol | 1 liter – 0 rub. | 1 liter – 0 rub. | 1 liter – 0 rub. |

| Beer containing from 0.5% to 8.6% alcohol | 1 liter – 21 rub. | 1 liter – 21 rub. | 1 liter – 21 rub. |

| Beer with more than 8.6% | 1 liter – 39 rub. | 1 liter – 39 rub. | 1 liter – 39 rub. |

The excise tax on alcohol brings the highest income to the state when compared with other taxes. And tax rates on vodka are much higher than on other alcohol. This is an argument in favor of reducing the production of such a drink.

Ethyl alcohol is the main source of profit from the use of excise duties. The excise duty on alcohol brings the highest income to the state when compared with other taxes. And tax rates on vodka are much higher than on other alcohol. This is an argument in favor of reducing the production of such a drink.

Comparing rates over several years, we see that in 2022 they remained almost at the 2022 level.

Let’s see below how this affected alcohol prices in various retail chains.

Happy New Year - and new taxes

In Russia, excise taxes will increase from January 1. In addition, for the first time you will have to pay taxes on income from deposits, and property taxes will also increase

Photo: Kirill Kukhmar/TASS

From January 1, the state, as usual, increases excise taxes. And the average consumer first of all feels this when buying cigarettes, alcohol and refueling the car.

Tobacco

In 2022, there was a fairly significant increase in tobacco excise taxes; they increased by 20%. This did not mean that the cost of cigarettes would change by the same amount. From personal experience, the price of a pack has increased by about 10% over the year. This did not happen immediately, but over the course of a year. From 2022, excise taxes will be increased again, this time by 4%. Anton Voronov, a member of the federal presidium of the Small-Format Trade Association and tobacco industry expert, discusses how the cost of cigarettes may change:

Anton Voronov, member of the federal presidium of the Small-Format Trade Association, tobacco industry expert “The price never changes abruptly or from January 1. Basically, it's always a creeping increase throughout the year. It’s just that the increase in excise taxes from the new year is included in prices. Of course, all manufacturers increase prices gradually throughout the year so that this does not come as a shock to the consumer. Some 10-15 rubles can be expected.”

Thus, a pack of middle-segment cigarettes, which currently costs around 180-190 rubles, may rise in price to about 200. The minimum cost of a pack is also changing - from January 1, it will not be cheaper than 112 rubles.

Alcohol

As reported with reference to RIA Novosti experts, from the new year the excise tax will increase by an average of 4-5%. The cost of alcohol has many other components, in particular, vodka has wheat, which has risen in price on world markets since last year. And producers warned that because of this, the price of alcohol could rise by 15%. Director of the Center for Research of Federal and Regional Alcohol Markets (CIFRRA) Vadim Drobiz continues:

Vadim Drobiz Director of the Center for Research of Federal and Regional Alcohol Markets (CIFRRA) “The excise tax rate on strong alcohol is growing, and Russian strong alcohol should rise in price by at least 5%. But there are a number of other factors that influence this, which are related to inflation and everything else. After all, a bottle of vodka, it seems, for all its simplicity, is a combination of a number of other products: this is a bottle, and a label, and a cork, and logistics, and workers’ wages, and the price of alcohol, which is also growing, and water, and various ingredients, etc.”

Fuel

From the beginning of the year, fuel excise taxes will increase: 4% on diesel and almost 7% on gasoline. According to the agreement that the largest oil companies entered into with the government back in 2018, domestic fuel prices should rise within the limits of official inflation. When world oil prices are high, the authorities pay compensation to businesses; when global oil prices are low, when the domestic market becomes premium, companies pay money to the state. This mechanism helps keep prices down. Inflation, according to preliminary data from Rosstat, will be 8.4% in 2022. Accordingly, fuel prices may rise within these limits. President of the Independent Fuel Union Pavel Bazhenov comments:

Pavel Bazhenov, President of the Independent Fuel Union “As for retail prices, they will be kept within inflation limits by all means, maybe a little higher than inflation. There is no need to say that there will be some kind of sharp jump in January. Growth will certainly continue. But in general, we can definitely guarantee that 2022 will most likely be just as difficult, that we will communicate with you very often and that we will not run out of fuel.”

In addition, in 2022, Russians will have to pay new taxes on income from deposits for the first time. The non-taxable amount of interest income is 42.5 thousand; for everything above, you will need to pay a tax of 13%. And in 2022, another revaluation of real estate took place in Moscow. Due to rising housing prices, its cadastral value increased by more than 20%. Accordingly, property taxes will increase. But these “chain letters” are still a long way off. Taxes on income from deposits and on property will need to be paid before December 1, 2022. So there is still time to think about it.

Add BFM.ru to your news sources?

Level of increase in alcohol prices

Excise taxes on alcohol are planned to increase only in 2021. on the:

- Products containing ethyl alcohol over 9% up to 544 rubles, the excise tax is now 523 rubles.

- Products containing ethyl alcohol less than 9% up to 435 rubles, against 418 rubles, the current rate for 2022.

- Wine – the excise tax rate will be 19 rubles. per liter, now it is 18 rubles.

- Ethyl alcohol sold by companies that do not pay advance excise tax payments up to 111 rubles. per liter Now the excise tax rate is 107 rubles. per liter

Increase in excise taxes on tobacco and alcohol is guaranteed until 2024

Thus, the document introduces amendments to the Tax Code of the Russian Federation, including regarding the indexation of excise rates until 2024, taking into account inflation at the level of 4 percent.

According to the amendments, the excise tax rate on cigarettes and cigarettes from January 1 to December 31, 2022 will be 2,454 rubles plus 16% of the estimated cost, calculated based on the maximum retail price, but not less than 3,333 rubles.

From January 1 to December 31, 2023, the rate will be 2,552 rubles per 1 thousand pieces plus 16% of the estimated cost, calculated based on the maximum retail price, but not less than 3,467 rubles per 1 thousand pieces.

In 2024, the excise tax rate is set at 2,654 rubles per 1 thousand pieces plus 16% of the estimated cost, calculated on the basis of the maximum retail price of 3,606 per 1 thousand pieces.

The excise tax on electronic cigarettes and vapes in 2023 will be 64 rubles, on cigars - 278 rubles per piece, on cigarillos, kreteks and bidis - 3965 rubles per 1 thousand pieces. In 2024 - 67, 289 and 4124, respectively.

In 2023-2024, excise taxes on alcoholic beverages will increase. Thus, in 2023, the excise tax on wine materials, fruit and grape must will be 34 rubles per liter, in 2024 - 35 rubles.

The excise tax on wines and fruit wines will be 34 rubles per liter in 2023, on sparkling wines - 45 rubles per liter, on mead, cider, poire, as well as beer containing less than 8.6% ethyl alcohol - 25 rubles per liter, beer containing more than 8.6% ethyl alcohol - 47 rubles per 1 liter. On wine drinks that are produced without the addition of rectified ethyl alcohol, the excise tax will be 45 rubles per 1 liter.

In 2024, the excise tax on wines will increase by 1 ruble, sparkling wines - by 2 rubles, mead, cider, poiret, and also beer (less than 8.6%) - by 1 ruble to 26 rubles per liter, strong beer - up to 49 rubles .

The excise tax on strong alcoholic drinks with a volume fraction of ethyl alcohol over 9 percent in 2023 will be 613 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods, in 2024 - 638 rubles.

The same products with a volume fraction of ethyl alcohol less than 9% in 2023 will be subject to excise tax at a rate of 490 rubles per 1 liter of anhydrous ethyl alcohol contained in an excisable product, in 2024 - 510 rubles.

Excise taxes on gasoline will also increase: in 2023, the excise tax on gasoline that does not comply with class 5 will be 14,736 rubles per ton, in 2024 - 15,335 rubles.

On class 5 gasoline, the excise tax will increase in 2023 to 14,345 rubles per 1 ton, in 2024 - 14,919 rubles. For diesel fuel - 9,938 rubles per 1 ton and 10,336 per ton, respectively.

On motor oils for diesel and (or) carburetor (injection) engines in 2023, the excise tax will be 6,318 rubles per 1 ton, in 2024 - 6,571 rubles.

Calculation and payment of excise taxes

In this part of our conversation, we will give an example of how excise tax is calculated, for example, at a fixed rate.

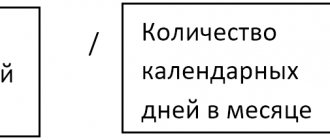

For this, the following calculation formula is used:

A = Nb * Tc, where A is the accrued amount of excise duty, Nb is the tax base (the number of goods sold), Tc is the fixed rate.

So, Company S. produced and sold 700 liters of beer, which is strong. This means that she will have to pay: 700 * 21 = 14,700 rubles.

The combined rate is calculated using the following formula:

A = Nb * Tc + O + Ac /100%, where A is the amount of excise duty, Nb is the tax base, Tc is a fixed rate, O is the amount that will be received upon the sale of Nb, Ac is the percentage rate.