Accounting entries

The receipt of materials into the organization is carried out under supply contracts, by manufacturing materials by the organization, making a contribution to the authorized (share) capital of the organization, receiving the organization free of charge (including a gift agreement). Materials include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, containers, spare parts, construction and other materials.

The following are accounting entries reflecting the receipt of materials into the organization.

- Accounting for receipt of materials under a supply agreement. Accounting entries

- Accounting for receipt of materials based on advance reports. Accounting entries

- Accounting for the receipt of materials under an exchange agreement. Accounting entries

- Accounting for receipt of materials under constituent agreements. Accounting entries

- Accounting for free receipt of materials. Accounting entries

- Accounting for the receipt of materials produced in-house

How to create a new posting

In the interface of the 1C 8.3 program, this document is located on the “Purchases” tab, item “Receipts (acts, invoices)”:

After this we get to the list of documents that have ever been entered. To create a new receipt, you need to click on the “Receipt” button, where a menu for selecting the desired type of operation will appear:

Where:

- Goods (invoice) - a document is created only for goods with an accounting account - 41.01

- Services (act) - reflects only services

- Goods, services, commission - a universal type of transaction that allows you to reflect commission trade and the receipt of returnable packaging

- Materials for processing - a special type of operation for accounting for tolling scheme; in postings, such receipt will be reflected in off-balance sheet accounts

- Equipment and Construction Objects - to reflect the receipt of fixed assets on accounts 08.03 and 08.04

- Leasing services - generates postings to account 76

Let us consider in detail the receipt of goods and services.

List of accounts involved in accounting entries:

|

|

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting the accounting for the supply of materials with payment to the supplier after receipt of the materials | ||||

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 51 | The fact of repayment of accounts payable to the supplier for previously received materials is reflected. | Purchase price of goods | Bank statementPayment order |

| Postings for accounting for the supply of materials on prepayment | ||||

| 60.02 | 51 | Prepayment to the supplier for materials is reflected | Advance payment amount | Bank statementPayment order |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 60.02 | The previously transferred prepayment is offset against the debt for the materials received. | Purchase cost of materials | Accounting certificate-calculation |

How to register the receipt of goods in 1C?

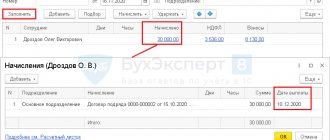

The procedure will be considered using the example of goods being received into a warehouse from a supplier. He has already received an advance payment and is now transferring the goods to the warehouse.

To formalize this process in the program, the user selects the “Products/Services/Commission” set of options from the drop-down menu.

You will definitely need to fill out the fields that ask you to indicate the name of the organization and details of the supplier. If you are keeping records of only one organization, you will not need to enter its name manually: it will be selected automatically.

In addition, you will need to fill out the “Warehouse” field. To do this, you will need to activate it by selecting “Use multiple warehouses” in the settings and check the box next to it. This field should be made available and filled in only if the previously selected operation involves not only the purchase of goods and materials, but also the registration of services.

The program provides that after filling out the table with the subheading “Products”, the line “Warehouse” instantly becomes mandatory.

This is important because in order to proceed to the next stage of the registration procedure, you only need to fill in the required fields.

The completed document independently generates postings for the receipt of goods at the warehouse. This process is reflected throughout the entire accounting system.

The receipt document will certainly reflect the prepayment made to the supplier. This operation in the table above will be titled as Dt 60.01, Ct 60.02.

You can make the program do this automatically, enter the parameters for setting off the advance manually, clarify the settlement and advance accounts, and also change the way VAT is included in the price using links. Just find them in the “Calculations” block and click on the ones you are interested in.

This is all that needs to be done to reflect the admission process in the system. The only thing that has not yet been said is that the entire process will need to be reflected in the invoice. To do this, you can use an existing document.

Accounting for receipt of materials based on advance reports. Accounting entries

Below are accounting entries reflecting the accounting of receipt of materials from accountable persons on the basis of advance reports and the primary documents attached to them (delivery notes, invoices).

The receipt of materials from an accountable person can be reflected in two options:

- In the first option, a standard posting scheme is considered, reflecting the receipt of materials from account 71 “Settlements with accountable persons”. The disadvantage of this option is that the accounting does not reflect the supplier from whom the materials were received and for which VAT was refunded.

- In the second option, the receipt of materials is reflected in correspondence with account 60 “Settlements with suppliers and contractors” and further, the debt to the supplier is closed in correspondence with account 71 “Settlements with accountable persons”. With this reflection option, there is an additional opportunity to analyze supplies by supplier

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to the standard scheme | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 71 | The receipt of materials from the accountable person to the organization's warehouse is reflected on the basis of primary documents attached to the advance report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) Advance report |

| 19.3 | 71 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to a scheme using a accounts payable account | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected on the basis of primary documents attached to the expense report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 71 | Reflects payment to the supplier by the accountable person for materials received | Purchase cost of materials | Accounting certificate-calculationAdvance report |

Accounting for the receipt of materials under an exchange agreement. Accounting entries

The legal basis that determines the procedure for forming an exchange agreement is defined in Chapter 31 “Barter” of the Civil Code of the Russian Federation. The methodology for reflecting supply transactions under an exchange agreement is discussed in more detail in the article “Accounting for the purchase and sale of goods under an exchange agreement”

The cost of materials to be transferred is established based on the price at which, in comparable circumstances, the organization determines the cost of similar materials.

Below are accounting entries reflecting the accounting for the receipt of materials from suppliers under an exchange agreement with the usual procedure for transferring ownership of materials, in accordance with Article 223 “Moment of the emergence of the acquirer’s right of ownership under the agreement” of the Civil Code of the Russian Federation and Article 224 “Transfer of a thing” of the Civil Code of the Russian Federation.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 60.01 | The receipt of materials from the supplier under an exchange agreement is reflected. Subaccount 10 is determined by the type of materials received | Market value of materials excluding VAT | Invoice (TMF No. M-15) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Invoice (TMF No. M-15) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | InvoicePurchase book |

| 62.01 | 91.1 | The transfer of exchanged materials to the supplier under the exchange agreement is reflected | Market value of transferred materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 10 | The write-off of transferred materials from the organization’s balance sheet is reflected. Subaccount of account 10 is determined by the type of materials transferred | Cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT accrued on the transferred materials is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 60.01 | 62.01 | The debt of the second party under the exchange agreement is offset | Cost of materials | Accounting certificate-calculation |

Accounting: admission

In accounting, goods can be capitalized after their acceptance and verification of quantity has been completed (clause 2.1.13 of the Methodological Recommendations, approved by letter of the RF Committee on Trade dated July 10, 1996 No. 1-794/32-5).

The procedure for reflecting received goods in accounting depends on:

- method of receiving the goods;

- terms of the contract governing the procedure for transferring ownership of the goods from the seller to the buyer;

- the applied taxation system;

- methods of accounting for goods enshrined in the accounting policy for accounting purposes.

The accounting policy of the organization must include, at a minimum, the following points:

- the method of forming the cost of goods (including or without the costs of their acquisition);

- method of reflecting the cost of goods in accounting;

- method of accounting for trade margins.

If there is a need to keep records of goods according to a specially developed nomenclature, also indicate this in the organization’s accounting policy for accounting purposes. Note that the names of goods in receipt documents and accounting registers used in the organization may not match, and describe the technology for processing accounting information that comes from suppliers of goods. The legitimacy of this approach is confirmed by the letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-03-06/1/670.

Situation: how to reflect in accounting the receipt of goods and materials, some of which are intended for resale, and some for use in production? The amount of inventory items that will be used in different types of activities is unknown in advance.

If inventory items are purchased for further sale, then they must be credited to account 41 “Goods”. If inventory items were purchased for use in production (administrative activities), then they must be capitalized on account 10 “Materials”.

However, regardless of the account in which inventory items are capitalized, in the future the organization will be able to either write them off for production or sell them.

If all received goods and materials are capitalized as goods, then when using them further as materials, make the following posting:

Debit 10 Credit 41

– part of the goods has been capitalized for use as materials.

If all received goods and materials are capitalized as materials, then upon further resale of these goods and materials, the appearance of other income and expenses must be reflected in accounting (paragraph 6, paragraph 7, PBU 9/99, paragraph 5, paragraph 11, PBU 10/99). In accounting, reflect the sale of materials with the following entries:

Debit 62 (76, 73...) Credit 91-1

– sales of materials are reflected (as of the date of transfer of ownership);

Debit 91-2 Credit 10

– the cost of materials sold is written off;

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on sales (if the transaction is subject to this tax).

For more information on how to sell excess materials, see How to record the sale of materials in accounting.

Accounting for receipt of materials under constituent agreements. Accounting entries

According to the constituent agreement, the founders (participants) contribute various types of property, including materials, to the authorized (share) capital of the organization. According to clause 8 of PBU 5/01 “Accounting for inventories”, the actual cost of inventories (materials) contributed to the contribution to the authorized (share) capital of the organization is determined based on their monetary value, agreed upon by the founders (participants) of the organization .

Based on the above provisions, the receipt of materials under the constituent agreement can be reflected in the accounting below with the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 75.1 | We reflect the receipt of materials under the constituent agreement. Subaccount 10 is determined by the type of materials received | Estimated cost of materials agreed upon by the founders | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

| 19 | 83 | If the founder transferring materials to the authorized capital of the organization, in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation, restores VAT, the receiving party must make this posting | The amount of VAT restored by the founder | InvoiceAct of acceptance of transfer of materials |

Receipt of services

This time, when creating a document, select the type of operation “Services (act)”. We will not consider filling out this document in detail due to the fact that everything here is similar to the previous method. Only here item items with the “Service” type are added.

We attributed our lawn mowing service to account 26 and indicated the cost item “Other costs.”

Next, we will post the document and issue an invoice in the manner described in the previous example. This time, one transaction was generated, since VAT was included in the price.

In the case when you need to immediately reflect the receipt of both goods and services, use the “Goods, services, commission” transaction type.

Accounting for free receipt of materials. Accounting entries

In accounting, according to clause 16 of PBU 9/99 “Income of the organization,” income in the form of gratuitous receipt of property is recognized “as it is generated (identified).”

In tax accounting, according to paragraphs. 1 clause 4 of Article 271 “Procedure for recognizing income under the accrual method” of the Tax Code of the Russian Federation, income in the form of gratuitous receipt of property is recognized on the date the parties sign the property acceptance and transfer act.

According to clause 9 of PBU 5/01 “Accounting for inventories”, “the actual cost of inventories received by an organization under a gift agreement or free of charge ... is determined based on their current market value as of the date of acceptance for accounting.”

Based on the above provisions, the gratuitous receipt of materials can be reflected in the accounting below using the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 91.1 | We reflect the free receipt of materials. Subaccount 10 is determined by the type of materials received | Market value of materials on the date of acceptance for accounting | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

Receipt under a purchase and sale agreement

If the organization received the goods under a purchase and sale agreement, then the actual cost of the goods consists of the amount paid to the seller and the costs associated with the acquisition (delivery, commissions to intermediaries, etc.). Such rules are established by paragraph 6 of PBU 5/01.

Typically, ownership of a product passes from the seller to the buyer at the time of its acceptance and delivery. At this point, reflect the receipt of goods in accounting by posting:

Debit 41 (15) Credit 60 (76...)

– goods have been received under paid contracts.

This procedure is established by the Instructions for the chart of accounts (accounts 60, 76).

Situation: can a trade organization include in the cost of purchased goods the costs of their packaging and pre-sale preparation?

Maybe. The legislation allows two options for accounting for the costs of packaging goods:

– reflected in sales costs;

– include in the initial cost of goods.

Prepackaging (packing) of goods purchased for resale is one of the mandatory elements of trading activities. This follows from the provisions of Article 481 of the Civil Code of the Russian Federation. In addition, when selling certain goods, a trading organization must carry out pre-sale preparation. The list of works that can be carried out as part of pre-sale preparation depends on the type of product and is established by the relevant sections of the Rules approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55.

Thus, costs associated with packaging (packing) and pre-sale preparation of goods affect the financial result of a trading organization. However, the accounting procedure for these expenses is not regulated by law.

On the one hand, after purchasing (posting) goods, their actual cost cannot be changed (clause 12 of PBU 5/01). Packaging (packing) and pre-sale preparation of goods occurs after they have been accepted for accounting. Based on this, the costs of packaging (packaging) and pre-sale preparation of goods should be reflected in account 44 “Sales expenses”.

On the other hand, paragraph 6 of PBU 5/01 provides for the inclusion in the actual cost of inventories of expenses for their processing, packaging, and improvement of technical characteristics. Consequently, for both materials and goods, an increase in their cost by the amount of such costs is possible (clauses 68, 71, 224 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

Since the legislation allows two accounting options, the organization has the right to choose one of them. Fix the selected option in the accounting policy for accounting purposes (clause 7 of PBU 1/2008).

An example of reflecting in accounting the receipt of goods under a purchase and sale (supply) agreement. The cost of goods is formed on account 41

JSC "Proizvodstvennaya" received goods worth 118,000 rubles. (including VAT – 18,000 rubles). Costs for delivery of goods amounted to 59,000 rubles. (including VAT – 9000 rubles). The organization records goods on account 41 at actual cost (without using accounts 15 and 16).

The Master's accountant made the following entries in the accounting:

Debit 41 Credit 60 – 150,000 rub. (RUB 100,000 + RUB 50,000) – reflects the receipt of goods (including delivery costs);

Debit 19 Credit 60 – 27,000 rub. (RUB 18,000 + RUB 9,000) – “input” VAT is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 27,000 rub. – accepted for VAT deduction;

Debit 60 Credit 51 – 177,000 rub. (RUB 118,000 + RUB 59,000) – goods paid for (including delivery costs).

Accounting for the receipt of materials produced in-house

According to the methodological instructions, materials are accepted for accounting at actual cost. The actual cost of materials when manufactured by the organization is determined based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials are carried out by the organization in the manner established for determining the cost of relevant types of products. Those. The procedure for reflecting materials produced in-house in accounting depends on the methodology for calculating the cost of products used in the organization.

Currently, the following types of assessment of finished products are used:

- At actual production cost. This method of assessing finished products (manufactured materials) is used relatively rarely, as a rule, in single and small-scale production, as well as in the production of mass products of a small range.

- Based on the incomplete (reduced) production cost of products (manufactured materials), calculated based on actual costs without general business expenses. Can be used in the same industries where the first method of product evaluation is used.

- At standard (planned) cost. It is advisable to use in industries with mass and serial production and a large range of products.

- For other types of prices.

Below we will consider two options for recording the receipt of materials produced in-house in accounting.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for materials at standard (planned) cost. | ||||

| 10 | 40 | The release (manufacturing) of materials is reflected at the planned cost | Planned cost | Receipt order (TMF No. M-4) |

| 40 | 20 | The actual production cost is reflected | Actual cost of manufactured materials | Accounting certificate-calculation |

| 10 | 40 | The write-off of deviations between the cost of materials at actual cost and their cost at standard (planned) cost is reflected. | The amount of deviation is “black” or “red” depending on the balance of the deviation | Accounting certificate-calculation |

| Accounting for materials at actual cost. | ||||

| 10 | 20 | The release (manufacturing) of materials is reflected at actual cost | Actual production cost | Receipt order (TMF No. M-4) |