Can a business trip fall on a weekend?

The key purpose of business trips is to perform work functions and tasks outside the territory where the employee’s main workplace is located.

The employer has the right to send his subordinates on a business trip outside the office to resolve professional and business issues. Another question is whether a business trip can occur on a non-working day or holiday. Labor legislation does not contain specific restrictions. This means that the employer has the right to send a subordinate on a business trip on any day.

There are several options for business trips on non-working days and holidays:

- A long trip, when the deadline for completing a task stretches over several weeks. Saturday and Sunday are automatically included in the business trip period. This is relevant when the employee’s return to his main place of residence on non-working days is impossible or economically impractical.

- The purpose of the trip or event has a specific date, so the employee has to travel in advance. For example, when a deal is scheduled for Monday at 9 am. The employee will have to leave on Saturday or Sunday to arrive on time. The date of the transaction should be found out and agreed upon in advance.

- The task can only be completed on a non-working day. When on a business trip, the employer immediately stipulates with the subordinate that he will have to work on holidays or Saturday-Sunday, because it is impossible to solve the problem during working hours. For example, equipment maintenance can only be carried out on Saturday, when office workers have a rest.

The issue of paying for a business trip on a non-working date according to the schedule is decided depending on several factors.

Business trips and weekends: what to do with payment

The Labor Code guarantees payment of travel expenses to a specialist during non-working hours if he:

- performed an official task;

- was on the way;

- was in downtime (for example, the flight was delayed or rescheduled);

- set out on this day;

- arrived from a work trip.

If these periods fall on non-working days, then payment for a business trip on a day off in 2022 is made according to different rules. They are set out in Art. 153 Labor Code of the Russian Federation. The seconded specialist will be paid for this non-working day:

- In double the amount (or more), if the worker has not asked the employer for an additional day of rest in exchange for working on non-working days.

- In the usual amount, if a seconded employee of the institution asked for additional rest time for work outside working hours.

Payment for non-working days on a business trip can be made in increased amounts, that is, more than double the amount. Additional payments are made at the expense of the institution and are subject to mandatory enshrinement in the local regulations of the organization. For example, in the regulation on sending employees on business trips or in a separate order.

Responsibility for non-payment of business trip on weekends

The law provides for administrative liability for violation of the Labor Code of the Russian Federation by organizations and officials. In order not to receive a fine, you must respect and know all the rights of the employee, pay in full for work on weekends and holidays and provide the employee with additional days of rest.

Having trouble keeping track of travel expenses? In the cloud service Kontur.Accounting it is convenient to keep track of expenses, pay salaries, calculate and pay taxes and send reports. Experience the benefits of the service for free with a 14-day trial period.

Try for free

Weekends within a business trip

If an employee is sent on a multi-day trip, then the issue of payment for Saturday and Sunday is easily resolved. If a specialist worked on a non-working day and, for example, solved assigned tasks, then the time will have to be paid. To understand the situation, let's look at an example.

Let’s say a specialist was sent on a business trip for two weeks to another region. It is not advisable to return, but the employee should not work on Saturday and Sunday. What must the employer pay?

| Paid | Not paid |

|

|

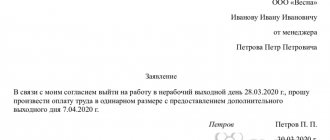

The procedure for registering a business trip on a day off

To send an employee on a business trip on weekends or holidays, you must obtain his consent. The employer issues an order, to which the employee provides written consent. However, if the business trip lasts more than a week and includes days off for rest, written confirmation is not required.

There are the following cases when business trips include weekends and holidays:

- the business trip is long, more than a week, while the employee spends the weekend on a business trip and does not do work;

- the business trip is long, and on weekends the employee performs work duties;

- The time of departure or arrival from a business trip coincides with weekends or holidays.

If the return or departure falls on a weekend

There are many situations when employees have to go on a business trip on a non-working day. As does the need to return home on Saturday or Sunday. Leaving or returning from a business trip on a day off is considered to involve an employee working outside of working hours. The norms are enshrined in Art. 153, 166 of the Labor Code of the Russian Federation, clauses 4, 5 of the Regulations on business trips (Government Decree No. 749), Letter of the Ministry of Labor of Russia dated October 13, 2017 No. 14-2 / B-921. It follows from this that the employee’s work on this day must be paid taking into account the time actually worked, i.e., the time spent on the road. Payment when returning from a business trip on a day off is calculated taking into account the following conditions:

- No less than a single amount if the employee requested time off.

- No less than double the amount if time off was not granted.

Payment amounts may be greater than those stipulated in the Labor Code of the Russian Federation. That's not news. The management's decision is disclosed in detail in a separate local act.

There are features for summarized recording of working hours. Here is how such employees are paid for business trips on weekends:

- If a non-working day falls within the monthly norm, then no less than a single rate.

- If a non-working day is outside the working norm per month, then at least twice the daily (hourly) rate.

Labor wars: are days off paid on a business trip?

The employee demanded that the employer pay him double for all days off spent on business trips. The employer refused to pay for these days, citing the fact that the employee was not involved in work on weekends. In this regard, the employee filed a claim in court to recover wages from the employer for days off during business trips.

On the agenda

: Determination of the Second Cassation Court of General Jurisdiction dated October 1, 2020 No. 8G-12582/2020.

Background

: the employee demanded that the employer pay him double for all days off spent on business trips. The employer refused to pay for these days, citing the fact that the employee was not involved in work on weekends. In this regard, the employee filed a claim in court to recover wages from the employer for days off during business trips.

Standards involved

: Art. Art. 113 and 167 of the Labor Code of the Russian Federation.

What were they arguing about?

: 122,125 rubles.

In support of the stated requirements, the employee indicated that all the time spent on a business trip is working time. This, in his opinion, is justified by the fact that a posted employee cannot use weekends at his own discretion as rest time. Therefore, weekends during a business trip are working days and are subject to double payment.

The court found the employee's arguments unfounded and refused to satisfy the claims. The court noted that a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. When an employee is sent on a business trip, he is guaranteed to retain his job and average earnings, as well as reimbursement of expenses associated with the business trip (Article 167 of the Labor Code of the Russian Federation). In particular, the employer is obliged to reimburse the employee for travel expenses, for renting accommodation, additional expenses associated with living outside the place of permanent residence (daily allowance), as well as other expenses incurred by the employee with the knowledge of the employer.

In this case, wages to employees on a business trip are paid on a general basis. Including work on weekends and non-working holidays.

Work on a weekend or non-working holiday is paid at least double the amount. Piece workers are paid for work on a day off at no less than double piece rates, and workers whose work is paid at daily and hourly tariff rates are paid at least double the daily or hourly tariff rate (Article 153 of the Labor Code of the Russian Federation).

Specific amounts of payment for work on a day off may be established by a collective or labor agreement. Increased payment is made to all employees for hours actually worked on a day off. If part of the working day falls on a day off, then the hours actually worked on that day off are paid at an increased rate.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

Moreover, in all cases, employees are hired to work on weekends and non-working holidays by written order of the employer (Article 113 of the Labor Code of the Russian Federation).

In the controversial case, the fact that the employee worked on weekends that fell during the business trip was not proven. The employer did not issue any orders requiring the employee to work on weekends, and the employer did not impose an obligation to work outside of working days on the employee.

Consequently, the court concluded, days off spent by an employee on a business trip are not subject to payment.

How to calculate daily allowance correctly

Seconded specialists are guaranteed:

- maintaining a job;

- maintaining average earnings;

- reimbursement of travel expenses;

- reimbursement of rental housing expenses;

- payment of other expenses agreed upon with management;

- payment of daily allowances or expenses to compensate for the inconveniences associated with living away from home.

Consequently, daily allowances for weekends are paid for all days of stay on a business trip, in accordance with paragraph. 3 clause 11 of Government Decree No. 749 of October 13, 2008. Days of downtime, time spent in transit, and days of departure and return are paid for the entire designated time.

IMPORTANT!

The employer must pay the daily allowance for the entire duration of the trip. For example, if an employee went on a trip late on Saturday evening, then the daily allowance will still have to be accrued for that day.

Question

The organization has an employee who has a traveling nature of work throughout the Russian Federation (position: electrician-fitter, specificity of the enterprise: production of equipment for railways). The specifics of the enterprise’s activities determine the territory for traveling in nature - the entire territory of the Russian Federation. For the special nature of the work, the employee is provided with:

- surcharge for traveling;

- payment of daily allowances;

- reimbursement of travel and rental expenses.

How can such an employee be paid for days off while on a business trip (not a business trip!), for example, in Tyumen, if in fact he does not work on these days and is in a hotel?

Principles and procedure of payment

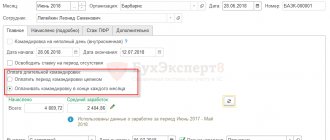

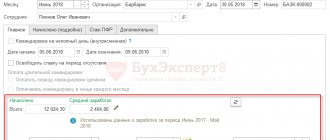

If the business trip falls on a non-working day, then calculate the accruals in accordance with Art. 153 Labor Code of the Russian Federation. Thus, the employer is obliged to accrue and pay:

- For an employee working on a piece-rate wage system, no less than twice the established piece rate or rate.

- For specialists working on a time-based system, the daily or hourly rate is calculated at double the rate.

- For employees on summarized working time records.

IMPORTANT!

If an employee requests leave for work on Saturday, Sunday or a holiday, then double payment is not due. In this case, the holiday (day off) is paid in a single (regular) amount and a rest period is provided.

To avoid confusion when calculating payments, use this reminder.

Frequent difficulties and mistakes

Let us define a number of controversial situations:

- Taxation. Payments for work during non-working hours are subject to taxation. Personal income tax must be withheld from the amount due and insurance premiums must be charged. These costs of the institution can be taken into account as part of labor costs in tax accounting under the general taxation system and the simplified tax system “income minus expenses.”

- From daily allowances exceeding the limit under Art. 217 of the Tax Code of the Russian Federation, calculate insurance premiums and withhold personal income tax.

- Working time tracking. In the timesheet, if the employee was on a business trip on a holiday or Saturday-Sunday, indicate the letter code “РВ” or the digital designation “03”.

- The posted employee did not work on the holiday. In this case, the employer must pay only daily allowance; no other money is required by law. The norms are enshrined in paragraphs 9, 11 of Resolution No. 749.

When preparing tax reporting, for example, when generating a certificate of income for an employee in Form 2-NDFL, reflect payments for work during non-working hours using code 2000.

Business trip documents

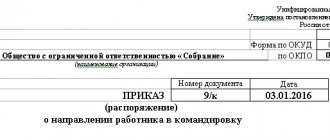

1. We issue an order.

To send an employee on a business trip, you can issue an order using the unified T-9 form (T-9a for sending a group of employees) or using a form developed and approved by the organization itself. Since the need to draw up a work assignment and a travel certificate has disappeared, it is in the order to send on a business trip that the official assignment must be spelled out in as much detail as possible, that is, the purpose of the trip, as well as the deadlines for completing the assignment. The order is signed by the head of the organization (or another authorized person) and the employee is introduced to this document against signature.

| Limited Liability Company "Romashka" (Romashka LLC) Order No. 49 about sending an employee on a business trip April 15, 2016 Yaroslavl Send legal adviser Alexey Ivanovich Shmatov on a business trip to the First Arbitration Court of Appeal, located in Vladimir, for a period of two days from April 17 to 18, 2016 to participate in a court hearing on the consideration of a case to collect arrears of payment for goods supplied from Vasilek LLC " Grounds: determination to accept the appeal for proceedings dated 04/11/2016, agreement to work on a day off dated 04/12/2016 No. 11 and order to engage A.I. Shmatov to work on a day off dated 04/13/2016 No. 37-k. Director Tsarev L. N. Tsarev I have read the order. Shmatov, 04/15/2016 |

2. We issue an advance.

On the basis of clause 10 of the Regulations, when an employee is sent on a business trip, he is given a cash advance to pay for travel expenses and rental accommodation and additional expenses associated with living outside his place of permanent residence (daily allowance). For your information

Previously, employers were required to keep records of employees leaving for business trips and arriving at the organization to which they were posted. In connection with the adoption of Decree of the Government of the Russian Federation dated July 29, 2015 No. 771 “On amendments to the Regulations on the specifics of sending workers on business trips and invalidating subparagraph “b” of paragraph 72 of the changes that are made to acts of the Government of the Russian Federation on the activities of the Ministry of Labor and social protection of the Russian Federation, approved by Decree of the Government of the Russian Federation of March 25, 2013 No. 257”, this obligation has been cancelled.

3. Fill out the work time sheet. Based on Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee. This means that the time spent on a business trip must be recorded in the time sheet. Let us remind you that working time is recorded in a timesheet and the employer has the right to use both the unified form T-13 from the Resolution of the State Statistics Committee of the Russian Federation dated January 05, 2014 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment,” and the timesheet form developed independently.

For your information

How to determine the actual length of stay on a business trip is explained in clause 7 of the Regulations. In particular, it is determined by travel documents presented by the employee upon returning from a business trip. If an employee goes on a business trip on official or personal transport (based on a written order from the employer), the actual length of stay at the place of business trip is indicated in a memo, which is submitted by the employee upon returning from the trip. Such a note must be accompanied by documents confirming the use of the specified transport for travel (waybills, route sheets, invoices, receipts, cash receipts and other documents confirming the transport route). In the absence of travel documents, the employee confirms the actual length of stay on a business trip with documents for renting residential premises at the place of business trip. And if there is no last document, then the period of stay on a business trip is determined by the employee’s memo containing confirmation of the party receiving the employee (organization or official) about the date of his arrival (departure) to the place of business trip (from the place of business trip).

Days of absence of an employee from the workplace due to a business trip are indicated by code “K” (or “06” - “business trip”), while the number of hours worked is not entered.

And since the day of departure for a business trip falls on a weekend, this must also be reflected in the timesheet - with the letter code “РВ” or the numeric “03”. It is best to do this through a fraction, for example “K/RV”.

Everything that we have listed, except for filling out the time sheet, must be done before the day of departure on a business trip, so that the employee can safely go on a trip on his day off, having the entire package of documents.