Reasons why an individual entrepreneur has debts

There are two mechanisms for paying taxes by entrepreneurs.

Individual entrepreneurs pay taxes directly on business income in the same order as companies. That is, they themselves calculate the amount of tax, indicate it in the declaration and make the appropriate payment to the budget. The exception is the patent system. Under this regime, the Federal Tax Service Inspectorate calculates the amount of tax and indicates it in the patent. There is no requirement to submit declarations (Article 346.52 of the Tax Code of the Russian Federation). Submit an application for application of PSN using a new form via the Internet Submit for free

But “property” taxes (transport, land, on the property of individuals) are paid by individual entrepreneurs in the same manner as “ordinary” individuals. That is, on the basis of tax notices that the Federal Tax Service sends out to taxpayers annually.

This “duplicity” is also associated with the peculiarities of the occurrence of tax debts for individual entrepreneurs. With regard to “entrepreneurial” taxes (VAT, personal income tax, single tax under the simplified tax system, unified agricultural tax and special tax service, insurance premiums), the cause of arrears is the actions of the entrepreneur himself. He either makes a mistake when calculating the tax, underestimating its amount for one reason or another. Either, having correctly calculated the tax, he is in no hurry to transfer it to the budget or transfers it, but using incorrect details.

Fill out payment slips with current BCC, income codes and other mandatory details Fill in for free

In terms of “property” taxes, arrears can arise not only if the individual entrepreneur refused to pay the amount specified in the notification, or made a mistake when paying. The reason for non-payment of tax may be failure to receive a notice sent to an out-of-date address (this often happens after a change of “registration”). Or a situation is possible where, due to personal circumstances, the individual entrepreneur did not manage to receive the letter at the post office within a month, and therefore it was returned to the Federal Tax Service. Also, the notification letter may not be delivered due to the fault of the post office.

Method number 2. Official request to the Federal Tax Service

The most reliable option for checking whether a procurement participant has tax debts is to request information directly from the tax authority. To obtain documentary evidence that the supplier has no debts to the state, an official request is drawn up. Moreover, the document can be sent to the tax service (to find out the tax debt) both in paper and electronic form. The request is made in any form, however, you must indicate the required details:

- Name of the Federal Tax Service Inspectorate, position and full name of the head of the department.

- Name of the applicant company, full name of the manager or contract manager.

- Address, phone number and other contact information about the applicant.

- Information about the participant (full name, TIN, OGRN, or other identification information).

- Date of compilation and signature of the applicant.

IMPORTANT!

The period for preparing a response from the Federal Tax Service is at least 10 working days. Plan control activities taking into account the time for inspection.

Consequences of non-payment of taxes

Depending on the cause of the arrears, various consequences of non-payment of tax are possible.

So, if an entrepreneur made a mistake when filling out a declaration and underestimated the amount of tax, he faces not only collection of arrears and penalties, but also a fine in the amount of 20% of the underpaid tax (clause 1 of Article 122 of the Tax Code of the Russian Federation). If incorrect data was intentionally entered into the declaration, then the fine will be 40% of the arrears (clause 3 of Article 122 of the Tax Code of the Russian Federation).

Important

If the amount of tax is determined correctly, but is not included in the budget on time, no fine is imposed (clause 19 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). In such a situation, the entrepreneur will only be charged a penalty (Article of the Tax Code of the Russian Federation).

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

The situation is different with property taxes paid on the basis of notifications. There is no talk of fines here at all. And penalties can be accrued in two cases: if the notification is not received due to the fault of the individual entrepreneur, or if the notification is received, but the money is transferred after the deadline. If the notification is not received due to the fault of the tax authorities, then there will be no arrears, and therefore no penalties. Let us explain these situations.

Paragraph 4 of Article of the Tax Code of the Russian Federation states: if the amount of tax is calculated by the tax authority, the obligation to pay tax arises no earlier than the date of receipt of the tax notice. Consequently, if the tax office did not send a notification, or sent it to the wrong address, the obligation to pay tax simply will not arise. And this excludes the accrual of penalties (clause 1 of Art., clause 2 of Art. Tax Code of the Russian Federation, resolution of the Arbitration Court of the Ural District dated 04/16/18 No. F09-4130/17 in case No. A60-35305/2016).

Important

What to do if the tax office sent a notification, but late? The tax must be paid within a month, unless a longer period of time is indicated in the notification itself (clause 6 of Article of the Tax Code of the Russian Federation). In this case, despite the fact that the money will reach the budget later than the deadline established in the Tax Code, there will be no negative consequences for the individual entrepreneur. If the entrepreneur transfers the tax after the deadline specified in the notification, he will be charged a penalty.

It happens that the reason for not receiving a notification is the actions of the individual entrepreneur himself (he did not pick up the letter at the post office in time, and it was returned to the sender). This, in turn, leads to late payment of taxes. The entrepreneur incurs a debt, and penalties are charged on it.

Also, penalties will have to be paid if the individual entrepreneur received a timely notification sent by the tax authorities, but transferred payments outside the deadlines established by the Tax Code.

Advice

If the deadline for paying “property” taxes is approaching, and the notification has not been received, you need to request the document yourself. To do this, you can contact any inspection service that serves individuals, or the MFC. For more details, see “The Federal Tax Service reported how individuals can receive a notification to pay “property” taxes.”

A special situation is when the notification was not received due to the fault of the postal service (they made a mistake with the address, did not deliver the notification of the letter, etc.). On the one hand, the provision of the article of the Tax Code of the Russian Federation applies here, stating that a registered letter is considered received on the sixth day from the date of dispatch, even if this did not actually happen. This means that if the tax authorities sent a notification letter to the correct address, then if they do not receive payments within the established time frame, they have the right to charge the entrepreneur a penalty. But, on the other hand, it remains possible to defend the right not to pay penalties if it is possible to prove the fact of a postal error (resolution of the Federal Antimonopoly Service of the Ural District dated 02.08.10 No. F09-5912/10-C2 in case No. A60-3564/2010-C6).

Attention!

If an entrepreneur has a personal account on the Federal Tax Service website, then a notification for payment of taxes will be sent in electronic form. In this case, the document is considered received on the day following the day it was posted in the Personal Account (Clause 4 of Art. Tax Code of the Russian Federation). A notice will be sent on paper only if the owner of the personal account has previously stated his desire to receive documents on paper from tax authorities.

Receive an enhanced qualified electronic signature certificate in an hour

Find out about the debts of individual entrepreneurs personally at the Federal Tax Service

Directly from the inspection, an entrepreneur can request both background information on settlements with the budget and an official reconciliation report. The difference lies in the legal force of the document received: the “information” act is unilateral in nature and does not provide for any reaction on the part of the taxpayer. Whereas the official act must bear the signature of the taxpayer (the second copy of the act with the signature of the individual entrepreneur must be returned to the tax office). In this case, it is possible to sign such an act with disagreements.

To receive a reconciliation report in the order of information, it is enough to send a request to the Federal Tax Service in electronic form (via TKS via the Internet). Its form is given in the appendix to the order of the Federal Tax Service dated June 13, 2013 No. ММВ-7-6/ [email protected]

Request an electronic certificate about the status of settlements with the budget

If an official act is required, then you need to draw up an application for reconciliation of accounts with the budget (subclause 11, clause 1, article of the Tax Code of the Russian Federation). You can request such a reconciliation at any time. And the application form (KND 1165180) is given in the appendix to the letter of the Federal Tax Service dated October 28, 2020 No. AB-4-19 / [email protected] (see “The application form for the provision of a reconciliation report for calculations of taxes and contributions has been published”).

When filling out the application, please consider the following points. The maximum “depth” of reconciliation is three calendar years preceding the year of the request (clause 5 of the Temporary Procedure for Conducting Joint Reconciliation, attached to the Federal Tax Service letter dated 03/09/21 No. AB-4-19/2990; also see “The Federal Tax Service has changed the rules for reconciliation of calculations on taxes and contributions"). In this case, the desired reconciliation period must be indicated in the application. If this is not done, the Federal Tax Service will issue data for the period from January 1 of the current year to the date of receipt of the application (clause 9 of the Temporary Procedure).

Attention!

In 2022, you can request a reconciliation for your 2022, 2022, 2019, and 2022 taxes. It is impossible to obtain information about the state of settlements with the budget for earlier periods using this method.

But with the list of taxes for which reconciliation is requested, the situation is the opposite. If the application does not indicate specific BCCs, information will be provided on all taxes that the individual entrepreneur is obliged to transfer to this inspectorate (clause 10 of the Temporary Procedure).

Advice

If an individual entrepreneur is registered with several Federal Tax Service Inspectors, an application for reconciliation should be submitted to each inspectorate. Otherwise, the picture of mutual settlements with the budget may turn out to be incomplete.

The completed application can be submitted to the Federal Tax Service in person, or remotely - by mail, through TKS or the taxpayer’s personal account on the Federal Tax Service website. In addition, entrepreneurs can submit an application to the MFC (clause 1.1 of Art. Tax Code of the Russian Federation).

Request a tax reconciliation report from the Federal Tax Service via the Internet Request for free

In response, inspectors must send a report. The deadline for its preparation depends on the method of interaction with tax authorities. If the application was submitted on paper, then the report will be prepared within 5 working days (clause 15 of the Temporary Procedure). If the individual entrepreneur sent the application electronically, then the act should arrive within 3 business days (clause 20 of the Temporary Procedure).

Why is member verification needed?

The current legislation in the field of the contract system establishes that the customer is obliged to organize control of all those participants in public procurement who have submitted applications.

Moreover, there are quite a lot of requirements and principles of verification. Note that the full list of rules is enshrined in Article 31 of Law No. 44-FZ. So, paragraph 5 of Art. 31 states that a participant cannot have a debt to the budget for taxes for the last reporting year of more than 25% of the total value of its balance sheet property.

Moreover, the supplier is only obliged to declare compliance with this requirement. That is, the company that submitted the application, among other documentation, must submit a declaration of compliance with general requirements, which confirms full or partial payment of tax arrears and the absence of delays. This allows the company to participate in government procurement.

The customer has no right to require additional confirmation of this information. The contract service of the institution, or a specially appointed manager, must organize an independent audit of tax debts.

Let's figure out how to find out if there is a tax debt.

Find out the tax debt of individual entrepreneurs on the tax service website

Information on tax debts of individuals, including entrepreneurs, is posted on the Federal Tax Service website. However, this data is classified and is available only through the taxpayer’s personal account. It is impossible to check on the Federal Tax Service’s website whether an individual entrepreneur has debt, for example, using his Taxpayer Identification Number (TIN).

Reference

Currently, tax authorities publicly publish information about debt only in relation to organizations. On the Federal Tax Service website you can check whether the company has a debt and find out its amount. For more details, see “How to check the reliability of a counterparty using the TIN or OGRN or on the tax website.”

Obtain information about the tax debts of the counterparty and the taxation system it applies

As a rule, information on “property” taxes is reflected in the personal account of an individual entrepreneur. Also, tax authorities can post information there about debts for “business” taxes (letter of the Federal Tax Service dated October 28, 2020 No. AB-3-19 / [email protected] ). However, the absence of such information does not mean that the entrepreneur does not have arrears. You can pay the debt directly from the individual entrepreneur’s personal account.

If you do not transfer the arrears, tax authorities may block the bank account (Article of the Tax Code of the Russian Federation). For “entrepreneurial” taxes, the actual blocking of the account will also result from issuing collection orders to write off the debt in accordance with the article of the Tax Code of the Russian Federation (until they are executed, it will not be possible to transfer payments to counterparties). Let us note that forced collection of debt is possible only from the current accounts of individual entrepreneurs (determination of the Supreme Court of the Russian Federation dated August 23, 21 No. 307-ES21-6593; also see “The Supreme Court prohibited blocking personal accounts of individual entrepreneurs”).

Check the OKVED codes of “your” individual entrepreneur and his contractors

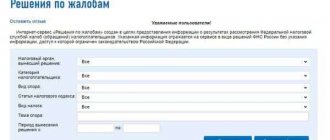

Typically, entrepreneurs learn about blocking accounts from tax authorities or banks. But you can use the service on the Federal Tax Service website. On the page https://service.nalog.ru/bi.do you need to select the option “Request for current decisions on suspension”, then enter the entrepreneur’s TIN and BIC of the bank in which the account being verified is opened. For more details, see “Blocking a tax account in 2022: how to check it on the Federal Tax Service website and what to do.”

Online tax check

Tax debts can be found out online; there are official services of government agencies for this purpose.

1. The easiest way to check the taxes of an individual entrepreneur or LLC using the TIN online is in the taxpayer’s personal account on the website of the Federal Tax Service.

Access to the office must be obtained in advance. For organizations, access to the personal account is possible only on the basis of a qualified digital signature issued to the manager or a person who has a power of attorney with full authority. Individual entrepreneurs can use not only an electronic signature for access, but also a password issued to the individual’s account, or an account for the Government Services Portal.

2. On the Government Services Portal you can find out the tax debt of an individual entrepreneur, but you can only log in here as an individual. Considering that the entrepreneur bears full property responsibility, his tax debts are reflected in the TIN, like an ordinary citizen.

However, the Portal does not allow you to find out the taxes of legal entities by TIN online. To do this, you need to make a request through the electronic reporting system or in the legal entity’s personal account on the website nalog.ru.

3. This service is worth using if you want to check the integrity of a possible counterparty. True, you can only find out online by TIN about tax debts of legal entities, not individual entrepreneurs.

You will not see the exact amount of debts; the service will only reflect the presence of arrears from the counterparty if it exceeds 1,000 rubles. In addition, the service reflects data on organizations that have not submitted tax reports for more than a year. Entering into cooperation with such partners is risky, because the Federal Tax Service may not recognize expenses for such transactions.

4. On the website of the Federal Bailiff Service (FSSP) you can obtain information about tax debts for which enforcement proceedings have already begun. The search is possible for individual entrepreneurs and legal entities. You just need to indicate not the TIN, but the full name of the individual entrepreneur or the name of the organization.

Find out about debt on the bailiffs website

On the website of the Bailiff Service (www.fssprus.ru) you can find out information only about the tax debt in respect of which enforcement proceedings have already been initiated. That is, about those debts of an individual entrepreneur that are confirmed by a court decision (including a court order) or a decision of the tax authority to foreclose on the property of an entrepreneur (Article of the Tax Code of the Russian Federation).

To search, you need to go to the “Services” section and then to the “Data Bank of Enforcement Proceedings”. Unfortunately, this service does not provide information on TIN or OGRNIP. You must enter information about the individual (full name and date of birth) and region. You can also search by the number of the enforcement proceeding or the writ of execution (if known).

Risks of online payments

Speaking about the convenience of paying off tax debts via the Internet, one cannot help but mention the associated risks. The Federal Tax Service warns taxpayers about the possibility of Internet fraud.

The scheme of illegal actions is simple: you are asked to follow a link from an advertisement or a banner, and then the taxpayer is taken to a form page where you are required to enter your Taxpayer Identification Number (TIN). Next, the entrepreneur sees the amount of taxes allegedly accrued to him for payment, which is false and, as a rule, inflated. The commission for making such a payment can reach 70%.

A long-standing fraud, which the Federal Tax Service again reminded us of, is “letters from the tax office” to an entrepreneur’s email demanding payment of taxes. The links they contain lead to fraudulent sites, the purpose of which is to obtain the personal data of the taxpayer in order to illegally withdraw money. The Federal Tax Service does not send messages to the personal mail of individual entrepreneurs, as well as other taxpayers.

Results

- An individual entrepreneur can pay taxes for himself and as a tax agent, without opening a current account. For this he can use his personal account. It is also permissible for other legal entities and individuals to pay off an entrepreneur’s tax debt.

- In addition to cash payments through the cash desk of any bank using a receipt from the tax office, there are many options for paying off the budget.

- The most convenient are online payments through a banking application, payment from a card through the website of the Federal Tax Service, government services, scanning a receipt through a bank terminal using a special code printed on the document. There are other ways to pay tax as an individual entrepreneur without a current account.

- The Federal Tax Service warns about the emergence of fraudulent sites and recommends that entrepreneurs use the official addresses of government agencies and credit institutions.