Hello, Vasily Zhdanov is here, in this article we will look at the operating profit of an enterprise. In economic theory, operating profit (OP) is understood as the profit received by an enterprise from its core activities (OA). It is calculated as the difference between gross profit (GP) and expenses for core activities. Please note that:

- According to RAS, in terms of terminology, OP is actually equated to profit from sales. Therefore, it is often called the result (income, loss) from sales, which is also associated with the display of OP in financial statements.

- OP and earnings before taxes, interest (=EBIT) are largely similar, but essentially different from each other.

Important! EBIT, unlike OP, includes, among other things, non-operating income. That is, those incomes and expenses that do not relate to normal, core activities. If they are absent, then OP coincides with EBIT.

The OP indicator appears in the financial statements of the enterprise and is used in analyzing its profitability and in assessing the effectiveness of the enterprise’s OD. For example, with his participation, return on sales (ROS) is calculated to find out what percentage of OP the company receives from a specific sales volume. ROS is calculated using the generally used formula:

Take our proprietary course on choosing stocks on the stock market → training course

The OP indicator is crucial for investors and is important even for a small business entity. activities.

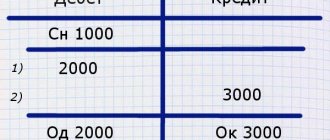

Composition, display, increase in operating profit

OP includes 3 components: cost and volume of products sold, as well as its range. An OP is formed on the account. 90, and at the end of the month is written off to the financial result (DT 90.9 KT99). It is displayed in the financial results report (OKUD 0710002, Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010) on line 2200. This line is called, literally: “Profit (loss) from sales.” For comparison, EBIT, as is customary, is shown on page 2300.

In addition to EBIT, it is worth noting a number of analytical indicators that are in one way or another related to operating profit. First of all, these are OIBDA, EBITDA, EBI.

| Characteristics of indicators | ||

| EBITDA | OIBDA | EBI |

| Definition: EBITDA is the amount of profit before withholding expenses for taxes with interest, as well as depreciation with already accrued depreciation. Application: in conjunction with EBIT, it serves to assess the profitability and efficiency of an enterprise without taking into account depreciation transfers and regardless of debts | Definition: OIBDA is operating income together with depreciation of fixed assets and assets, which is calculated with the participation of operating profit. Application: it is recognized as the largest indicator of profitability than EBITDA, because, according to economists, non-operating expenses with income distort EBITDA | Definition: EBI is the difference between EBIT and interest accrued on the use of debt capital. Application: this is one of the key indicators of operating profit (NOP - net operating profit) |

It should be noted that some enterprises do not calculate OP. Nevertheless, it is a very productive, useful indicator, since it clearly shows the profitability of the enterprise, taking into account specific expenses made.

A positive result is an increase in the OP indicator. This indicates that the company's income exceeds its expenses. Overall, profit growth confirms intensive development. A similar effect is achieved through complex measures and actions aimed at at least reducing variable expenses.

Renewal, modernization of equipment, intensive labor, reduction of management costs, consumable standards of materials are a few components of the process that allows you to reduce the cost of 1 unit. goods. Along the way, they usually increase sales volumes, lowering product prices and thereby attracting buyers.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Operating profit according to the financial results report: determination of indicators in the report lines

The number in line 2100 (indicator F2100 in the formula) corresponds to the difference between the indicators in lines 2110 and 2120 of the report. In turn, line 2110 corresponds to the difference between the balance CT 90 (subaccount “Revenue”) and the balance Dt 90 (subaccount “VAT”), and line 2120 corresponds to the balance Dt 90 (subaccount “Cost of sales”).

The figure in line 2210 (indicator F2210) corresponds to the balance Dt 90 (subaccount “Sales expenses”).

The indicator in line 2220 (indicator F2200) corresponds to the balance of Dt 90 (subaccount “Administrative expenses”).

You can get acquainted with other nuances of the formation of indicators in the financial results report (its traditional name is the profit and loss statement) in the article “Profit and loss report - form No. 2 (form and sample)” .

What formula is used to calculate operating profit?

As mentioned above, OP is the difference between VP and OD expenses (or operating expenses). Therefore, the general formula for calculating OP will be as follows:

If we detail this formula taking into account the lines of the financial report. results, you get a slightly different calculation option:

Gross profit is an indicator of the profitability of an enterprise; it means the difference between revenue and the cost of goods (services) sold. At the same time, the cost of goods sold is calculated differently for manufacturers and trade.

As for operating expenses, they include: wages, transportation costs, rent and other daily expenses of the enterprise necessary for carrying out activities and producing products.

Thus, to calculate OP, it is enough to know the value of VP and operating expenses (OT). Let's say VP = 300,000 RUR. rub., and OT = 120,000 RUR. rub. This implies OP = 180,000 (300,000 - 120,000). The result is positive. If the calculation shows a negative result, this will indicate an operating loss.

Composition of operating expenses

The current accounting plan 10/99 in paragraph 11 of Chapter 3 provides a complete list of the enterprise’s expenses classified as operating. These include:

- assets provided for rent or other form of temporary use or ownership for a fee;

- intellectual property rights leased out for temporary use;

- contributions to the authorized capital of other LLCs;

- all forms of alienation of one’s property, including products (sale, lease, write-off);

- created monetary reserve funds;

- commissions and interest paid to banking organizations.

NOTE! These expenses will be recognized as operating expenses only if they do not relate to the main activities of the organization, in which case they should be considered ordinary.

Operating expenses classified as other

These include expenses not included in the previous list:

- payment of fines for violation of the conditions specified in the contract;

- compensation for losses caused by the fault of the company;

- losses from financial obligations that can no longer be recovered;

- the size of the difference in exchange rates;

- amounts from the write-off of discounted assets.

Example 1. OP for selling watches

The store purchases watches from the manufacturer and displays them in its windows for sale. Buyers come to the store and buy the products offered. Let's assume that during the reporting period the store sold watches worth RUR 300,000. rub. This is the money that buyers paid for the watch. The actual cost of the watch sold (i.e. the price for which the store bought this watch from the manufacturer) is 150,000 rubles. rub.

It follows that gross profit (GP) = 150,000 RUR. rub. (300,000 – 150,000). This is the profit that the store received directly after selling the watch. Nothing has been deducted from it yet.

Meanwhile, the store was making expenses: on renting premises (Russian rubles 25,000), staff salaries (Russian rubles 45,000). Accrued depreciation and depreciation (for display cases, cash register) in the amount of RUR 3,000. RUR. Other utility expenses amounted to RUR 2,000. rub.

If all the listed expenses are subtracted from the VP, you get the OP: 150,000 – 25,000 – 45,000 – 3,000 – 2,000 = 75,000 RUS. rub. This is the profit received by the store from trading operations.

Explanation and description of EBITDA

In the speeches of financial analysts, you can hear a lot of obscure terms, including EBITDA. In English, the decoding of this abbreviation sounds like earnings before interest, taxes, depreciation and amortization (earnings before interest, taxes, depreciation and amortization). Actually, this is the answer to the question of what EBITDA is, in simple terms. It is generally customary to pronounce the word with an emphasis on “and”, that is, “ebItda”. In any case, experts from the financial sector most often say this way, although there are those who consider other options correct.

The term EBITDA came into use around the 80s of the twentieth century, and, in fact, it determined the ability of an enterprise to repay debts. Today, everyone who in one way or another comes into contact with the company’s reports (management, shareholders, employees) uses this indicator. Based on EBITDA, for example, potential investors draw conclusions about the profitability of the enterprise, the feasibility of investments and the expected profit from them.

Using EBITDA, you can evaluate the financial position of competing companies engaged in similar activities, and draw a picture of their solvency and repayment of debts (if any).

This indicator shows how suitable the company is for acquisition or lending. EBITDA as an analytical tool is very effective in cases of property redistribution. With its help, you can find out whether the new owner will be able to act effectively enough and reduce the company’s lending rates on loans.

EBITDA is quite easy to calculate.

What does EBITDA mean, if explained simply? This is the volume of total profit before all possible deductions (for taxes and other payments). The amount of income and net profit for this indicator is not visible. Essentially, it is the overall profitability of a business, demonstrating how successfully the company is running its operations.

This indicator is taken into account by potential investors and analysts to assess the company’s performance and their solvency. Plus, based on EBITDA, it is possible to conduct a comparative analysis for companies operating in the same industry, but in different countries.

EBITDA

— a valuable indicator for investors when they need to make an initial assessment of a company and understand the degree of its attractiveness for investment.

If we talk about Russian companies, only a few of them calculate and publish this indicator. Namely, those whose shares have fairly high prices on the stock exchange. Or companies interested in foreign investors or wanting to issue shares.

The EBITDA indicator is only important for an initial acquaintance with the company's activities, when you need to make a quick assessment. According to accounting, this figure does not appear anywhere and is not established by any standards. That is, there is no law obliging the calculation of this coefficient. Therefore, to summarize, we can say that EBITDA is a useful indicator, but we should not forget about others that characterize the company’s activities.

Example 2. Calculation of EP for the year based on information from the financial statements of the Rosfrezer enterprise

The Rosfrezer manufacturing enterprise produces drills for machine tools. It is necessary to calculate the OP indicator for the year using the VP value and information on expenses made during the specified period. The data used in the calculation is conditional. The calculation is made using the general formula (VP–OT).

| Indicator name | Line in finance. report | Annual data |

| VP | 2100 | 90 000 |

| Commercial expenses (CT) | 2210 | 6 000 |

| Management expenses (UT) | 2220 | 20 000 |

In the proposed example, OP = 90,000 – 6,000 – 20,000 = 64,000.

What does the term "operational analysis" mean?

There is such a thing as “operational analysis”. What is noteworthy is that this type of analysis is considered a trade secret and is not disclosed to third parties. This method is based on calculation and the study of several basic indicators and is used in management accounting. In particular, the following are subject to study:

- profitability threshold or break-even point or critical volume of production, sales (revenue received by the enterprise, which covers all expenses with zero profit), i.e. the enterprise in this situation has neither profit nor damage;

- operating leverage or production, operating leverage (the ratio of variable and fixed expenses, which influences the OP in a certain way, reflects the excess of the growth rate of profit over revenue);

- margin of financial strength, an indicator of financial stability (the excess of revenue received from the sale of goods over the profitability threshold shows to what extent production can be reduced so as not to incur losses).

In addition, in the process of operational analysis, gross margin ratios (GMR) and changes in gross sales (CGSP) are calculated. The first indicator (KVM) shows how capable the enterprise is of covering its own fixed expenses and, accordingly, receiving OP, i.e., sales profitability. The second (CIVP) allows you to analyze the dynamics of change. It can be used to characterize changes in the volume of gross sales that occurred in the current and previous periods.

Operational analysis is used in planning and forecasting the operation of enterprises. With its help, you can find out the most acceptable prices for products, the most profitable, cost-effective and most unprofitable products, the most significant spending lines and ways to influence them, etc. This is a kind of search for the most optimal suitable combinations between variable expenses, cost and sales volumes.

The OP indicator is used as one of the important components of this analysis. With his participation, they also determine the profitability of products by type, the influence of cost on pricing, the margin of financial strength of the enterprise, the minimum permissible volume of production (sales) corresponding to the break-even point, the influence of production volumes on expenses, etc.

Operational analysis is often called break-even analysis. This name speaks for itself. With its help, you can calculate the required number of sales at which the company will have neither loss nor profit. To survive in the current financial situation, the company needs to overcome and exceed this break-even point.

General formulas for calculating profit from sales

To know how to calculate profit from sales, you need to start, for example, with revenue indicators. We determine it by multiplying the unit price of the product by the quantity of goods sold.

Each type of profit can be calculated from primary income indicators.

1. Revenue is calculated as follows: TR = P × Q, where:

- TR (total revenue) – total revenue in rubles;

- P (price) – price of a unit of goods in rubles;

- Q (quantity) – quantity of goods in rubles.

2. Marginal profit is calculated: MP = TR - VC, where:

- MP (marginal profit) – marginal profit in rubles;

- TR (total revenue) – total revenue in rubles;

- VC is the ratio of variable costs to the volume of products sold in rubles.

3. Gross profit is calculated: GP = TR - TCtechn, where:

- GP (gross profit) – gross profit in rubles;

- TR (total revenue) – total revenue in rubles;

- TCtechn (total cost) – cost of goods taking into account production technology in rubles.

4. The profit received from sales is calculated: RP = TR - TC, where:

- RP (realization profit) – profit received in rubles;

- TR (total revenue) – total revenue in rubles;

- TC (totalcost) – cost of goods in rubles.

5. Balance sheet profit is calculated: BP = RP - OE + OR, where:

- BP (balanced profit) – balance sheet profit in rubles;

- RP (realization profit) – profit received from sales in rubles;

- OR (other revenue) – remaining income in rubles;

- OE (other expenses) – other expenses in rubles.

6. Operating profit is calculated: OP = GP - AE - BE, where:

- GP (gross profit) – gross profit in rubles;

- AE (administrative expenses) – administrative expenses in rubles;

- BE (business expenses) – business expenses in rubles.

We recommend

“Analysis of sales profit: we understand the calculation methods” Read more

7. Net profit is calculated: NP = BP - T, where

- NP (net profit) – net profit in rubles;

- BP (balanced profit) – balance sheet profit in rubles;

- T (taxes) – tax payments in rubles.

Thanks to these indicators, you can calculate the profit from sales using established formulas.

What mistakes should be avoided when determining the OP indicator

The OP indicator is not very often found in practice. Some generally believe that it is not typical for Russian booze. accounting, because it is not displayed in accounting. balance. It is often mixed up and confused with other economic indicators. But, since this is still profit, more precisely, one of the types of profit that shows and characterizes the financial result of the enterprise, it is not appropriate to ignore it. And in order to avoid mistakes, you should take note of the following facts.

Fact one. Revenue is often identified or confused with profit. These are two completely different concepts. Revenue is all the cash receipts that an enterprise receives from various available sources (sale of goods, services). Profit is the economic benefit of an enterprise, which involves a reduction in revenue received for certain expenses.

For example, if you subtract the cost of a product from revenue (that is, all the expenses that went into its production), you will get gross profit. Further, if the cost of production, as well as commercial and administrative expenses are subtracted from the revenue, the result will be operating profit.

Fact two. All economists are familiar with net profit, but even it is sometimes identified with operating profit. An emergency is always the final financial result of an enterprise. This is the part of the profit remaining after payment of all mandatory budget payments and which can be distributed (to dividends, funds). It is significantly influenced by the volume of VP and tax amounts. OP is profit only from operating, core activities. The OP does not take into account expenses and income that are not related to the named activity, as well as taxes with financing (see the definition and characteristics of this indicator above).

Net operating profit: definition and calculation

To increase the objectivity and visibility of the financial performance indicator, the operating profit amount is adjusted to the amount of tax payments made. This allows you to determine what part of the income will remain for the company to dispose of after a full range of expenses for production needs and repayment of tax obligations. To implement this task, net operating profit is derived; the formula for calculating it involves reducing operating profit by the amount of transferred income tax.

If an investor is faced with a choice between several projects in different regions or countries, this indicator will help him determine:

- which business will be more profitable;

- which territories have the most favorable conditions for the implementation of commercial ideas;

- How will the fiscal burden affect the dividends received?

Answers to frequently asked questions

Question #1: What are variable and fixed expenses?

Variable expenses are those whose size directly depends on the volume of products produced. For example, spending on materials or fuel. They are usually contrasted with constant spending, independent of the volume of output. These are, for example, depreciation transfers and rent. For your information, if you add up both of them, you get total expenses.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Differences between EBITDA and EBIT from operating profit

EBIT/EBITDA and operating profit are not the same thing. The difference is that EBIT/EBITDA includes all operating and non-operating income and expenses, excluding taxes, interest and amortization. And non-operating income and expenses are not reflected in operating profit.

Non-operating expenses are understood as non-permanent (possibly one-time) types of income and expenses that do not in any way relate to the main work of the company. This could be income from investments (when investing is not the main type of income), from any single transactions (occurring from time to time). Or expenses that are not at all related to the work of the company (depending on changes in exchange rates, suspension of some work, etc.). But operating income (or expenses) includes profit from the sale of fixed assets, their possible depreciation, some doubtful debts and most other expenses.

Useful materials to increase sales from your website!

Many companies have gone online and competition has increased significantly. Since everyone’s budgets are limited, now it is especially important that more site visitors buy and leave orders, rather than go to competitors.

Therefore, we have prepared specific instructions, by implementing which you will increase the number of applications from the site more than 2 times without increasing advertising budgets!

Vladimir Surgai

Founder of the Internet marketing agency TFA, author of the course “Hacking Conversion”

- 5 cases when it is necessary to indicate the price on the website When and how to indicate the price so as not to scare off a potential client

- 10 sources of clients for beginners How to quickly get your first clients without large investments

- 11 blocks that build trust Specific examples: how to attract a client not at the expense of a low price

- Plan for creating a lead magnet with a conversion rate of 69% Checklist with examples for choosing and designing a selling lead magnet

Operating income is already part of another non-GAAP indicator called OIBDA. This stands for operating income before depreciation and amortization (operating profit before depreciation of fixed assets and intangible assets). It is clear from their names that OIBDA and EBITDA differ in the composition of the profit included in them. OIBDA is an indicator only of the volume of operating income (non-operating income is not taken into account here).