Contract agreement and insurance contributions to the Social Insurance Fund

A work contract is a type of civil law contract, the parties to which are the customer and the contractor (performer).

The contractor, on the instructions of the customer, performs one-time work, the results of which the customer undertakes to accept and pay for (Clause 1, Article 702 of the Civil Code of the Russian Federation). In this case, the contractor can be either an enterprise (IP) or an individual. If the contractor is an individual, then the customer must pay insurance premiums for compulsory pension and health insurance and withhold personal income tax.

For details, see the material “Contract and insurance premiums: taxation nuances.”

At the same time, in the Social Insurance Fund, in relation to contributions in case of temporary disability and in connection with maternity, such payments are non-taxable. And in terms of contributions for injuries, remuneration is subject to contributions only if such an obligation is fixed in the contract. In this regard, FSS inspectors often enter into legal proceedings with customer companies, trying to reclassify a contract with an individual into an employment relationship in order to collect arrears on insurance premiums, as well as penalties and fines.

Thus, payments under the contract are not reflected in 4-FSS. They need to be recorded in the report only if this is provided for in the GPC agreement.

Payments under what other civil contracts may be subject to contributions for injuries, find out in ConsultantPlus. Trial access to the legal system is free.

How to draw up a contract correctly and avoid claims from inspectors, read here.

Reflection of accruals under GPC agreements in regulated reports

Published 08/18/2019 16:43 Author: Administrator Many organizations are faced with the need to hire individuals for a short period of time in order to perform a certain function. Registration of such services most often occurs using a civil law agreement or, as it is otherwise called, a work contract. In this article, we will consider some legal aspects of this issue, as well as the procedure for reflecting accruals under GPC agreements in 1C: Accounting and regulated reports.

Let us turn to the legal regulation of this issue. The principles regulating the relationship between an organization and an individual in this situation are set out in Chapters 37 and 39 of the Civil Code of the Russian Federation. The main difference between a contract and an employment contract is that the employer is the customer, and the employee is the contractor. In this case, labor legislation does not affect the rights and obligations of the parties.

The contractor under the GPC agreement does not have the right to vacation and sick leave, and the company does not pay contributions to the Social Insurance Fund on the amounts of his remuneration. The remaining contributions, the basis of which is wages, are paid in the standard manner.

Personal income tax is withheld at a rate of 13%, an individual has the right to take advantage of standard tax deductions.

This was a brief description of the theoretical foundations of contracting services. Now let’s look at how to reflect this in the software product 1C: Enterprise Accounting 8 edition 3. Unfortunately, this program does not have automated accounting of contract agreements, so entering such accruals is not very convenient. To begin with, you need to select the “Individuals” directory in the “Salaries and Personnel” section panel:

Fill in the fields with data as shown in the figure below:

The result of work with the contractor is documented in a Certificate of Work Completed/Services Rendered. After it is received and signed by the parties, we proceed to the formation of entries for accrual of remuneration. To do this, click on the “Operations” section and select “Operations entered manually.” Click on the “Create” button and select “Operation” from the drop-down menu:

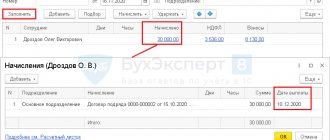

Next, you need to create accounting entries for the calculation of remuneration and insurance premiums, as well as for the withholding of income tax. Filling out a manually entered operation is shown in the figure below:

It is important that when entering this operation, tax register records are not generated, which are so important when filling out regulated reporting. Therefore, we go to the section “Salaries and Personnel” - “Personal Income Tax” - “All Documents on Personal Income Tax” and create the document “Personal Income Tax Accounting Operation”.

It is necessary to fill out the tabs of this document, indicating information about the amount of income, tax deductions and the date of tax withholding. The income code is usually selected as 2010 – “Payments under GPC agreements”. The date of personal income tax withholding is the day of payment of remuneration. The deadline for tax remittance is the day following the day the individual receives income.

We fill out the insurance premium registers in the same way. Section “Salaries and Personnel” - “Insurance Contributions” - “Contribution Accounting Operations”. In the created document, you must enter information on the “Contributions Accrued” and “Income Information” tabs.

Payments of remuneration, income tax and insurance premiums are processed using standard payment documents that form the following transactions:

Dt 76.10 Kt 51 for the amount of remuneration, minus personal income tax

Dt 68.01 Kt 51 for the amount of personal income tax

Dt 69.02.7 Kt 51 for the amount of insurance premiums for pension insurance

Dt 69.03.1 Kt 51 for the amount of insurance premiums for health insurance

After the operations are completed, the data on the contract will be included in the reporting on personal income tax and insurance premiums. Let's consider it sequentially. To do this, let’s go to the “Reports” - “Regulated reporting” section and one by one we will generate the necessary declarations.

The figure below shows the SZV-M report form. This form usually does not cause any difficulties. It is enough to indicate the insured person in the months in which he performed the work. When sending a report, if the mercenary is not an employee of the organization, a warning message may appear stating that the report contains an unhired person. This warning should not confuse you; contractors working under GPC contracts must be indicated in the SZV-M report to reflect their length of service.

Let's move on to the SZV-STAZH report: in addition to filling out the standard data of an individual, you also need to fill out column 11 “Additional information”. It indicates the code: “AGREEMENT”. Section 3 of this report is presented in the figure:

Next, we will check the completion of the Calculation of Insurance Premiums. Let's start with the third section - personalized accounting: lines 160 and 170 should contain “1”, and 180 – “2”. In subsection 3.2.1, the amount of remuneration must be indicated in columns 210, 220 and 230.

Section 1 of the report must contain the amounts payable for insurance premiums for compulsory pension insurance and compulsory health insurance. Social insurance contributions are not filled in because they were not calculated.

Subsections 1.1 and 1.2 are presented in the figure:

It remains to consider personal income tax reporting. We will generate 2-NDFL for transfer to the Federal Tax Service for 2022. Let's check the filling according to the picture:

Let's move on to quarterly income tax reporting - form 6-NDFL. Section 1 indicates the amounts of accrued income and the amount of calculated and withheld personal income tax.

Section 2 reflects the deadline for transferring tax, based on the date of actual receipt of income and withholding of personal income tax.

I hope this article will help you correctly reflect in accounting and regulated reporting mutual settlements with the contractor under the contract.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Alina Kalendzhan 10.16.2019 13:43 I quote Lana Di:

I quote Alina Kalendzhan: I quote Lana Di: I quote Alina Kalendzhan: Good afternoon, the accrual of amounts under a GPC agreement for a person who is your employee will not be any different.

The cost item will differ.

In one case it will be remuneration (clause 21 of article 255 of the Tax Code of the Russian Federation), and in the other other expenses. I wrote that accounting for a GPC agreement with an employee will be no different from the example that I looked at in the article, and not from accounting for wages at an enterprise. How could it not be, if in your DT on the 26th account when calculating remuneration under a GPC agreement, in one case (if the agreement is not with an employee) there will be an item “Remuneration”, and in the other (if the agreement is with an employee) - “Other” expenses". This also affects tax registers. I thank you for your comments, attentiveness and interest in my article. You are absolutely right when talking about cost items. And this does not contradict my text, since I did not write anywhere that you only need to choose a certain cost item. And she answered the question with the immutability of the algorithm in mind. Quote 0 Lana Di 10.15.2019 16:12 Quote Alina Kalendzhan:

I quote Lana Di: I quote Alina Kalendzhan: Good afternoon, the accrual of amounts under a GPC agreement to a person who is your employee will not be any different.

The cost item will differ.

In one case it will be remuneration (clause 21 of article 255 of the Tax Code of the Russian Federation), and in the other other expenses. I wrote that accounting for a GPC agreement with an employee will be no different from the example that I looked at in the article, and not from accounting for wages at an enterprise. How could it not be, if in your DT on the 26th account when calculating remuneration under a GPC agreement, in one case (if the agreement is not with an employee) there will be an item “Remuneration”, and in the other (if the agreement is with an employee) - “Other” expenses". This also affects tax registers. Quote 0 Alina Kalendzhan 10.15.2019 13:08 Quote Lana Di:

I quote Alina Kalendzhan: Good afternoon, the accrual of amounts under a GPC agreement to a person who is your employee will not be any different.

The cost item will differ.

In one case it will be remuneration (clause 21 of article 255 of the Tax Code of the Russian Federation), and in the other other expenses. I wrote that accounting for a GPC agreement with an employee will be no different from the example that I looked at in the article, and not from accounting for wages at an enterprise. Quote 0 Lana Di 10/15/2019 03:18 Quoting Alina Kalendzhan:

Good afternoon, the accrual of amounts under a GPC agreement to a person who is your employee will not be any different.

The cost item will differ.

In one case it will be remuneration (clause 21 of article 255 of the Tax Code of the Russian Federation), and in the other other expenses. Quote 0 Lana Di 10/15/2019 03:12 Good afternoon, in accordance with clause 21 of Art. 255 of the Tax Code of the Russian Federation, expenses for remuneration of workers who are not on the staff of the tax-paying organization for their performance of work under concluded civil law contracts (including contract agreements), with the exception of remuneration under civil law contracts concluded with individual entrepreneurs are recognized as Labor costs. But the GPC agreement with the employee is just “Other expenses” (as in your instructions).

Quote

+2 Alina Kalendzhan 08/21/2019 21:30 Good afternoon, the accrual of amounts under a GPC agreement to a person who is your employee will not be any different. In the 1C: Accounting 8.3 program, on the “Salaries and Personnel” tab, there is no option to create accruals under contract agreements. You are probably confusing it with the 1C:ZUP software product.

Quote

+4 Alina Kalendzhan 08/21/2019 15:35 Good afternoon, recognition of expenses under the simplified tax system is reflected not by the accrual of expenses, but by their payment. When generating a “Write-off from a current account” or “Cash withdrawal”, you need to fill out the line “STS expenses”.

Quote

+4 Vera 08/21/2019 11:23 Thank you, but there are still questions: - GPC agreement with the main employee; -but on the Salaries tab there is an accrual under the GPC agreement, why do we make calculations through operations

Quote

+5 Sukhitskaya Anastasia 08/20/2019 16:47 Thank you. How can we ensure that these amounts are included in the book of income and expenses under the simplified tax system?

Quote

Update list of comments

JComments

Contract agreement based on 4-FSS

Form 4-FSS, currently in force, was approved by FSS Order No. 381 dated September 26, 2016. For the reporting periods 2022-2022, the same form must be submitted, but taking into account the nuances associated with the transition to direct payments of FSS benefits. We talked about them here.

You can see a sample of filling out Form 4-FSS for the 4th quarter of 2022 in ConsultantPlus. If you do not have access to this legal system, trial access can be obtained online for free.

In the calculation of the Social Insurance Fund, the contract with an individual is displayed in the table. 1, 2 and 5 (provided that the accident contributions are paid by the customer).

Filling out table 1

If the GPC agreement does not provide for the calculation of insurance premiums against accidents, payments under the GPC agreement do not need to be included in line 1 (amount of payments and remunerations) and line 2 (payments not subject to contributions).

Example.

Smiley LLC entered into a GPD agreement with the individual Artemenko A.Yu. for office renovation work. The amount of remuneration under the agreement is 30,000 rubles. Contributions for injuries according to the GPC agreement are not accrued.

When submitting Form 4-FSS, the accountant, having studied our article, came to the conclusion that information about Artemenko’s income does not need to be included in Table 1.

Let's change the conditions of the previous example and assume that, according to the GPC agreement, Smiley LLC pays insurance premiums from Artemenko's remuneration against accidents. Then information about Artemenko’s income should be included in tables 1, 2 and 5

In table 1 contract fees must be added to wage accruals and the total recorded on page 1 gr. 3, as well as in gr. 4–6 by three reporting months. The amount is fixed in the month when the work was accepted by the customer according to the acceptance certificate.

Filling out table 2

As already noted, contributions for injuries are charged by the customer only on the condition that this is fixed in the contract (clause 1 of article 20.1, clause 1 of article 5 of the law “On compulsory social insurance against industrial accidents and occupational diseases” dated July 24, 1998 No. 125 -FZ).

If there is no such obligation, then reflect it in the 2nd table. do not need anything.

If the obligation to pay such contributions is assigned to the customer, the contractor’s remuneration is recorded on page 2 of table. 2 in the appropriate columns.

Nuances of calculus

In addition to the customer fulfilling its obligations to pay the appropriate remuneration to the contractor, there is also an obligation to calculate the amounts of insurance contributions to extra-budgetary funds for pension and health insurance. Calculation of contributions must be made in the period when the parties signed the acceptance certificate for work performed and services provided. It is worth noting that if the terms of the contract provide for the transfer of an advance to an individual, it will be subject to insurance premiums, since the above act is not signed by the parties.

The GPC agreement does not provide for payments for sick leave in connection with the illness of the performer, which means there is no need to transfer the corresponding contributions to the Social Insurance Fund to the Social Insurance Fund. In some cases, the contract may provide for contributions from accidents; these points are discussed in detail in the law of July 24, 1998 No. 125-FZ.

As for income tax, all income of an individual is used to calculate it , including within the framework of a civil law agreement.

Results

The amounts of remuneration and contributions to Social Insurance under the contract are not displayed in the 4-FSS calculation. Contributions for injuries are accrued only if this condition is fixed in the contract. If there is such a reservation, the report will be filled out in the general manner. Information on the remuneration of an individual working under a GPC agreement is included in tables 1, 2 and 5

Sources:

- Civil Code of the Russian Federation

- Order of the FSS of the Russian Federation dated September 26, 2016 No. 381

- Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Justifications for insurance premiums

The Ministry of Finance published letter No. 03-15-06/12725 dated February 21, 2020, which brings together the requirements of the Tax Code of the Russian Federation for such transactions. The remuneration that the customer accrues and pays to the contractor based on the results of the latter’s fulfillment of contractual obligations must be included in the base for calculating the amount of contributions paid to extra-budgetary funds (Article 420 of the Tax Code of the Russian Federation). As noted above, there is no need to transfer contributions to the Social Insurance Fund.

Consequently, the organization must take into account the amount of remuneration under the GPC in order to determine the basis for calculating contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund . The organization must maintain special cards in which, for each individual, information is kept on the income received and the amount of calculated contributions, including under GPC agreements. The month of recognition of income under such an agreement corresponds to the date of the acceptance certificate for work and services.

The obligation of the organization to maintain personal cards for recording the amounts of remuneration and insurance premiums is enshrined in Art. 431 Tax Code of the Russian Federation.

The deadline for transferring the amount of contributions should not be later than the 15th day of the month following the one in which the accruals were made (clause 3 of Article 431 of the Tax Code of the Russian Federation).

In letter dated June 23, 2022 No. 03-04-05/54027, the Ministry of Finance once again emphasized the above provisions of the Tax Code of the Russian Federation, which only emphasized their relevance. Also, the similarity of the positions of the June letter with the February letter indicates the unchanged position of the ministry on this issue.

The customer organization must accrue contributions for compulsory health insurance and compulsory medical insurance to the relevant extra-budgetary funds only on the basis of an act signed by the parties.

Let's look at examples:

- In accordance with the terms of the contract, the customer must pay the contractor a twenty percent remuneration from the moment the contract is signed; the calculation of insurance premiums in this case is not required.

- Based on the concluded GPC, the organization owes a twenty percent remuneration from the moment of signing the acceptance certificate, in this case, insurance premiums are accrued in the month corresponding to the date of signing.

Salary taxes according to GPA

Personal income tax.

If an organization (IP) has entered into an agreement to perform work or provide services with an ordinary individual (not an entrepreneur), then personal income tax must be calculated, withheld and paid from the remuneration under this agreement (clauses 1, 2, 4, 6 of Article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated July 21, 2017 No. 03-04-06/46733). This must be done even if the contract contains a clause stating that the responsibility for calculating and paying personal income tax lies with the employee. That is, the tax agent for personal income tax will still be the organization or individual entrepreneur that has entered into an agreement with the employee (letter of the Ministry of Finance dated 03/09/2016 No. 03-04-05/12891).

Insurance premiums.

According to the GPA, for the performance of work and provision of services, we pay insurance premiums for two types of insurance: mandatory insurance and compulsory medical insurance (clause 1 of article 420 of the Tax Code of the Russian Federation). Accordingly, such contracts are included in the calculation of insurance premiums, which we submit to the Federal Tax Service.

The remuneration will appear in Form 4-FSS if the parties have prescribed the opportunity to insure the GPC employee in case of injury. By default, social security contributions for injuries are not paid to GPA workers.

Civil contracts stand apart, the subject of which is the transfer of ownership or other proprietary rights to property, the transfer of property for use. Contributions are not accrued under such “real” agreements (clause 4 of Article 420 of the Tax Code of the Russian Federation). Example: sales and purchase agreements, leases, loans, etc.

Let's say an employee provided a loan to an organization. This means that no insurance premiums will have to be charged on the amount of interest paid to the employee.