What is a property tax deduction?

According to the legislation of the Russian Federation, when purchasing an apartment, house or land, you can return part of the money in the amount of personal income tax paid in the past.

The tax deduction is described in Art. 220 Tax Code of the Russian Federation. The benefit is aimed at providing citizens with the opportunity to purchase or improve housing conditions. If you officially work, pay personal income tax and purchased an apartment or house, you have the right to return up to 13% of the cost of housing. In addition, you can also get back up to 13% on mortgage interest and some other costs.

In what cases can you get a property deduction?

By taking advantage of the property deduction, you can return part of the expenses for:

- acquisition and construction of housing (apartment, private house, room, their shares);

- acquisition of a land plot with a residential building located on it or for the construction of a residential building;

- interest on targeted loans ( mortgage loans ) for the construction or purchase of housing;

- finishing of housing, if it was purchased from the developer without finishing.

Deduction is NOT provided :

- when purchasing real estate from dependent persons: spouse, children, parents, brothers/sisters, employer, etc.;

- if a person has already exhausted his right to property deduction (see One-time deduction).

What can you get a tax deduction for when building a house?

Property deduction for house construction includes:

- acquisition of land for construction;

- purchase of an unfinished construction project (residential building);

- payment of design and estimate documents;

- connection to general engineering networks and communications: electricity supply, water supply, sewerage, gas supply;

- construction of autonomous networks and communications;

- construction/finishing materials;

- construction/finishing works.

The deduction does not include the installation of plumbing and shower cabins, installation of gas and any other equipment. The rule also applies to adjacent buildings - a barn, a fence, a garage, a bathhouse, a swimming pool.

Tax deduction amount

The amount of tax you can get back is determined by two main parameters: your expenses when buying a home and the income tax you paid.

- In the total amount, you can return up to 13% of the cost of housing or land, but the maximum amount for deduction should not exceed 2 million rubles (that is, you can return a maximum of 2 million rubles x 13% = 260 thousand rubles). Note: for housing purchased before 2008, the maximum deduction amount is 1 million rubles.

- For each year, you can return no more than you transferred to the personal income tax budget (about 13% of the official salary). At the same time, you can return the tax over several years until you return the entire amount (see When and for what period can you get a tax deduction?)

- In case of purchasing housing with a mortgage before January 1, 2014, income tax on expenses for paying mortgage interest is refunded in full without restrictions.

- If the housing was purchased with mortgage funds after January 1, 2014, then the interest deduction is limited to 3 million rubles (that is, you can return a maximum of 3 million rubles from mortgage interest x 13% = 390 thousand rubles. ).

When purchasing expensive housing, there are situations when the amount returned on mortgage interest exceeds the return on the direct purchase of housing. Please note: the limit on the amount of return for the main property deduction for one person is 260 thousand rubles, the deduction for credit interest is 390 thousand rubles. If an apartment was purchased after 01/01/2014 by married spouses, each spouse can receive a property deduction in the amount of these limits. You can find out more about this information in the article: Peculiarities of obtaining a property deduction when buying a home by spouses.

Example 1: In 2022, Ivanov A.A. I bought an apartment for 2.5 million rubles. At the same time, in 2022 he earned 500 thousand rubles and paid 65 thousand rubles in personal income tax. In this case, the maximum amount that Ivanov A.A. will be able to return it is 2 million x 13% = 260 thousand rubles. But directly for 2022, he will be able to receive only 65 thousand rubles, and 195 thousand will remain for return in subsequent years.

Example 2: In 2022 Vasiliev V.G. bought an apartment for 1 million rubles. In 2022 Vasiliev V.G. I learned about the possibility of a tax deduction and decided to apply for it. In total, Vasiliev can return 1 million rubles. x 13% = 130 thousand rubles. If we consider that Vasiliev earned 400 thousand rubles annually in 2018-2020 and paid 52 thousand rubles in personal income tax, then in 2022 he will be able to return: 52 thousand rubles. for 2022, 52 thousand rubles. for 2022 and 26 thousand rubles. (balance of 130 thousand) for 2022.

Additional and more complex (mortgage interest, shares, etc.) examples of deduction calculations can be found here: Examples of calculating property tax deductions.

Income tax refund when purchasing land

Article 220 of the Tax Code provides for this right. Mandatory condition (at least one must be met):

- The presence of a residential building on the land plot.

- The intended purpose is individual housing construction, and the house was built later and registered as property.

Therefore, the deduction is provided not for a plot, but for a residential property, although the amount of the refundable tax includes both the construction (purchase) and the purchase of land.

Is it possible to return personal income tax?

The acquisition of a plot for individual construction or the purchase of land with housing is the basis for the return of part of the amount paid.

IMPORTANT: the opportunity for a tax break appears immediately after making entries in the real estate register about the ownership of a residential building. You can submit an application to the tax office only one year after the purchase (construction).

It must be remembered that persons paying personal income tax have the right to return. Pensioners whose income comes from a payment from the state and students receiving a scholarship will not receive a tax refund when constructing a residential building.

Due to the fact that this possibility itself was introduced in 2010, the right of return arises when purchasing a plot with a house or constructing it after the norm comes into force.

How to return

There are two procedures for returning personal income tax:

- through the federal tax service;

- through the employer.

The law provides the right to reimbursement of part of the costs of repaying a loan under a loan agreement taken out to purchase land and purchase (build) a house on it.

What is the amount of tax deduction

The amount of the refundable portion of personal income tax in accordance with Art. 220 of the law cannot exceed 2 million rubles during the tax period.

IMPORTANT: It must be remembered that the refund is carried out in proportion to the 13% tax paid.

So, in order to receive a deduction of 2 million, you need to purchase one or more plots in an amount exceeding 15 million rubles. When repaying the amount paid on the loan, the maximum amount increases to 3 million rubles.

The article also indicates what expenses can be reimbursed:

- Development of documentation (projects, estimates).

- Purchase of materials (construction, finishing).

- Amounts for the purchase of constructed housing or its share.

- Payment for services rendered and work performed during construction and finishing.

- Payment for connection or creation of autonomous sources of supply (gas, water, electricity, sewerage).

Deadlines for receiving the deduction

The period depends on the place of application of the citizen.

When submitting an application to the Federal Tax Service, the deadlines are longer:

- 3 months to verify submitted documents;

- 1 month to accrue the amount.

IMPORTANT: an application to the Federal Tax Service can only be submitted at the end of the tax period, i.e. in December of the year the purchase was made.

The advantage of contacting the inspectorate is that the entire amount is transferred immediately to the taxpayer’s account.

When contacting an employer, the deadlines are different:

- The application to the Federal Tax Service is considered for 1 month to issue a notification.

- Upon receipt of a notification with a package of documents, the employer is obliged to transfer wages without charging personal income tax until the deductible amount is exhausted.

A significant disadvantage of the second method is the long payment period, because for large amounts (for example, 500,000 rubles) and low salaries, the calculation continues for several years.

One-time right to deduction

The Tax Code limits the possibility of multiple use of deductions when purchasing a home. At the same time, the restrictions were changed from January 1, 2014 (the changes are described in detail in our article Changes in the property deduction when purchasing a home in 2014).

Currently the restrictions apply as follows:

For housing purchased before January 1, 2014 , you can use the property deduction only once in your life (paragraph 27, paragraph 2, paragraph 1, article 220 of the Tax Code of the Russian Federation). In this case, the purchase price does not matter. Even if you took advantage of a deduction of 10 thousand rubles, you will never be able to receive a larger property deduction when purchasing a home.

Example: in 2013 Sakharov A.T. purchased an apartment for 1.5 million rubles and took advantage of the tax deduction after the purchase. In 2022 Sakharov A.T. bought an apartment again for 2 million rubles. He will not be able to receive a deduction of 500 thousand rubles up to 2 million.

When purchasing a home after January 1, 2014 (unless you took advantage of the deduction earlier), the property deduction can be used several times, but the maximum amount of the deduction that you can receive for your entire life (excluding mortgage interest) even in this case is strictly limited to 2 million rubles (260 thousand rubles to be returned).

Example: at the beginning of 2022 Gusev A.K. bought an apartment for 1.7 million rubles. In September 2022, he also purchased a room for 500 thousand rubles. At the end of 2022 (in 2022) Gusev A.K. will be able to apply for a deduction of 2 million rubles: 1.7 million rubles for an apartment and get 300 thousand rubles for a room.

Please note: If you received only a basic deduction for housing purchased before January 1, 2014, then you can receive a tax deduction on interest when purchasing a new home with a mortgage. You can read more about this opportunity in our article Repeated property deduction for mortgage interest

You can find out more information about the restrictions on receiving a property deduction in the article: One-time property deduction when purchasing an apartment/house.

What documents are needed?

To apply for a tax deduction you will need:

- identification document;

- declaration 3-NDFL and application for tax refund;

- documents confirming your expenses;

- documents confirming the paid income tax (certificate 2-NDFL).

You can find a detailed list of documents here: Documents for property tax deduction.

When do I need to submit documents and for what period can I get a tax refund?

You can return the money under the property deduction starting from the year in which you have in your hands:

- payment documents confirming expenses incurred for the purchase of an apartment/house/plot;

- documents confirming the ownership of housing : an extract from the Unified State Register of Real Estate (certificate of registration of ownership) when purchasing an apartment under a sale and purchase agreement or an Acceptance and Transfer Certificate when purchasing housing under an equity participation agreement.

If you bought an apartment in the past and did not apply for the deduction immediately, you can do it now (there are no restrictions on the timing of receiving the deduction). The only thing is that you can return income tax for no more than the last three years. For example, if you bought an apartment in 2022, and decided to apply for a deduction in 2022, you will be able to get your tax back for 2022, 2022 and 2022 (detailed information about when and for which years you can get your tax back can be found in our article : When and for what years should I apply for a property deduction when buying a home?

The entire balance of the property deduction is carried over to the next year. That is, you can return personal income tax over several years until you exhaust the entire amount (see Amount of tax deduction).

The entire procedure for obtaining a deduction usually takes from two to four months (most of the time is spent checking your documents by the tax office).

If you have not yet purchased a home, we recommend our partner’s site-guide, APARTMENT-Bez-AGENTA.ru. This is an educational site for those who want to understand the rules for buying and selling apartments.

How to get back 13% of the property value

To use the tax deduction when buying a house with land and get back 13 percent of the cost, you have to:

I'm ready to give you a free consultation over the phone.

The call is free for all regions of the Russian Federation

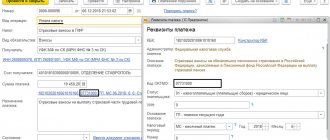

Step 1 - Fill out your tax return

First, you need to get a 2-NDFL income certificate from the accounting department at your place of work. Then, based on the data received from 2-NDFL, print and fill out a tax return in form 3-NDFL, or fill out the 3-NDFL declaration electronically.

Step 2 - prepare documents

To legally claim an income tax refund, you will need the following documents:

- Make a copy of your passport certified by the accounting department. You need to copy pages with basic information and registration;

- Prepare originals and copies of documents evidencing payments: payment orders, receipts, checks, receipts, etc.;

- If at the time of purchase of the plot the taxpayer was legally married, then a copy of the marriage certificate will be required;

- If a citizen has minor children for whom he has already received a standard deduction, copies of birth certificates will be required;

- Order an extract from the Unified State Register of Real Estate for your house and land.

Please note that RosReestr sends extracts from the Unified State Register within 3 days (there may be delays). If you want to receive information faster, I recommend ordering statements directly through the RosReestr API - this way you will receive the document within a day. The cost is the same - 250 rubles, the official data is from the Unified State Register of RosReestr and is confirmed by the registrar’s electronic digital signature (EDS).

Extract from the Unified State Register of Real Estate, which I recently ordered through the RosReestr API

Step 3 - submit documents to the tax office

Next, you need to fill out an application to the tax office at your place of registration with a request to receive a tax deduction in accordance with the costs incurred for the purchase of a house and land (you will receive the form on the spot). Here, in the application, the personal data of the taxpayer is indicated - full name, home address and registration address, if they do not match, contact telephone number, INN. The address of the house and a list of documents attached to the application are also indicated.

After reviewing the application (10-90 days depending on workload), the tax office makes a decision to satisfy the request, refuse or suspend consideration due to incorrect provision of data or billing period (submitted a year earlier than required). You can also receive a refusal during a desk audit.

At the discretion of the taxpayer, an application can be made to redistribute the deduction between husband and wife. This document is drawn up only for legal spouses and is not classified as mandatory.